October 2024

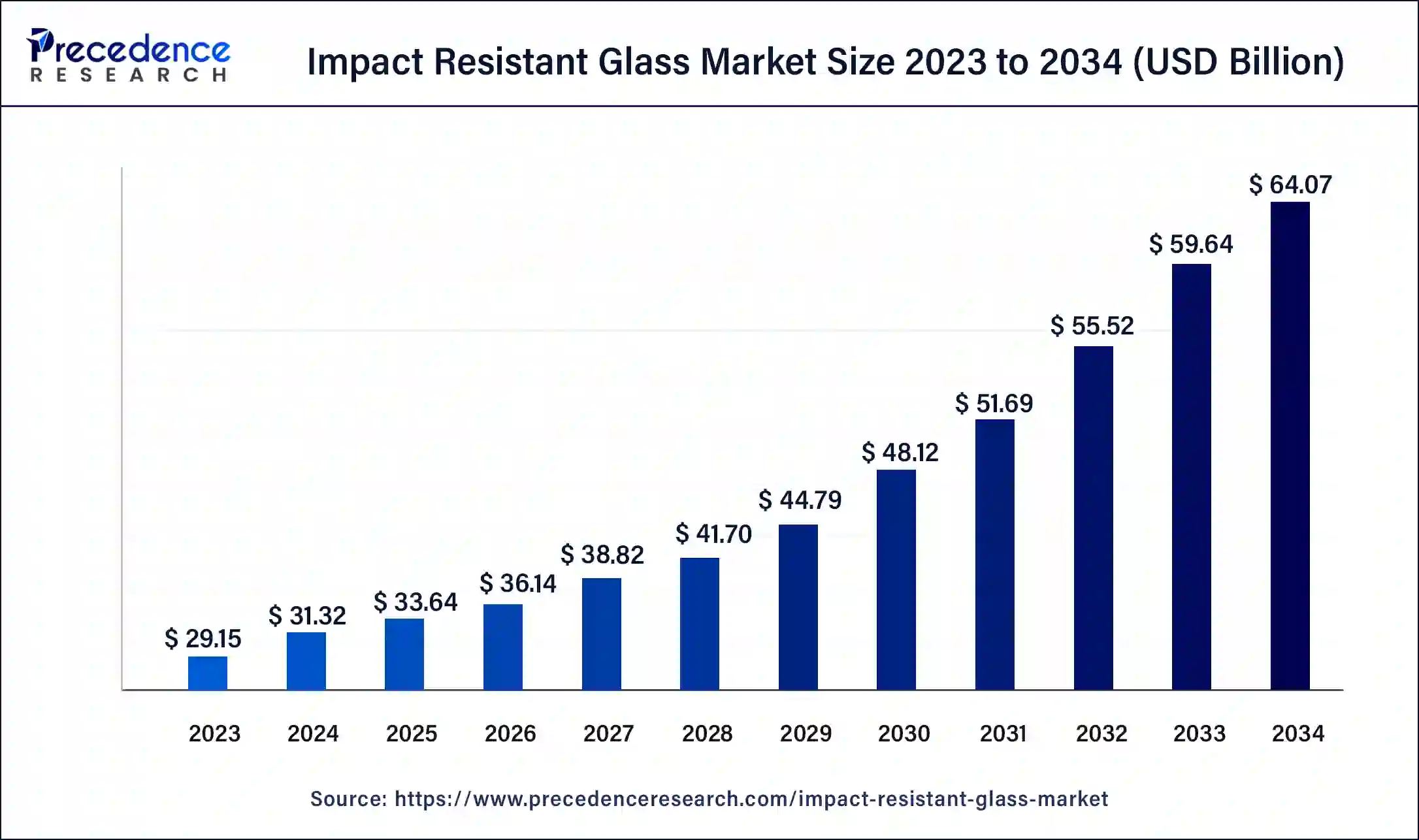

The global impact resistant glass market size was USD 29.15 billion in 2023, calculated at USD 31.32 billion in 2024 and is expected to be worth around USD 64.07 billion by 2034. The market is slated to expand at 7.42% CAGR from 2024 to 2034.

The global impact resistant glass market size is projected to be worth around USD 64.07 billion by 2034 from USD 31.32 billion in 2024, at a CAGR of 7.42% from 2024 to 2034. The increasing demand for protective glasses around the world has driven the growth of the impact resistant glass market.

The impact resistant glass market is an important specialty glass sector industry. This industry deals with the manufacturing and distribution of impact-resistant glass to numerous industries around the world. These glasses are designed to withstand high-speed hurricanes and provide scratch resistance. This industry is generally driven by rising demand for UV-protected glasses along with the rising use of double-glazing glasses. Impact-resistant glasses are manufactured using various types of interlayers such as polyvinyl butyral, lonoplast polymer, ethylene vinyl acetate, and others. These glasses are used in several end-user industries, including construction and infrastructure, automotive & transportation, and some others. This industry is expected to grow significantly with the rise in the advanced materials industry.

What is the role of AI in the Impact Resistant Glass Industry?

There are various advancements taking place in the AI technologies. Currently, most manufacturing companies have started integrating AI into the production process to increase overall output. Impact-resistant glass manufacturers are using AI to analyze and detect loopholes in finished products. Also, the integration of artificial intelligence (AI) in the glass industry enhances the batching and melting processes that are crucial for manufacturing high-quality, impact-resistant glasses. Thus, the integration of AI by glass manufacturers is playing a vital role in shaping the industry in a positive direction.

Top 10 Sunroof Manufacturers

| Report Coverage | Details |

| Market Size by 2034 | USD 64.07 Billion |

| Market Size in 2023 | USD 29.15 Billion |

| Market Size in 2024 | USD 31.32 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.42% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Interlayer, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

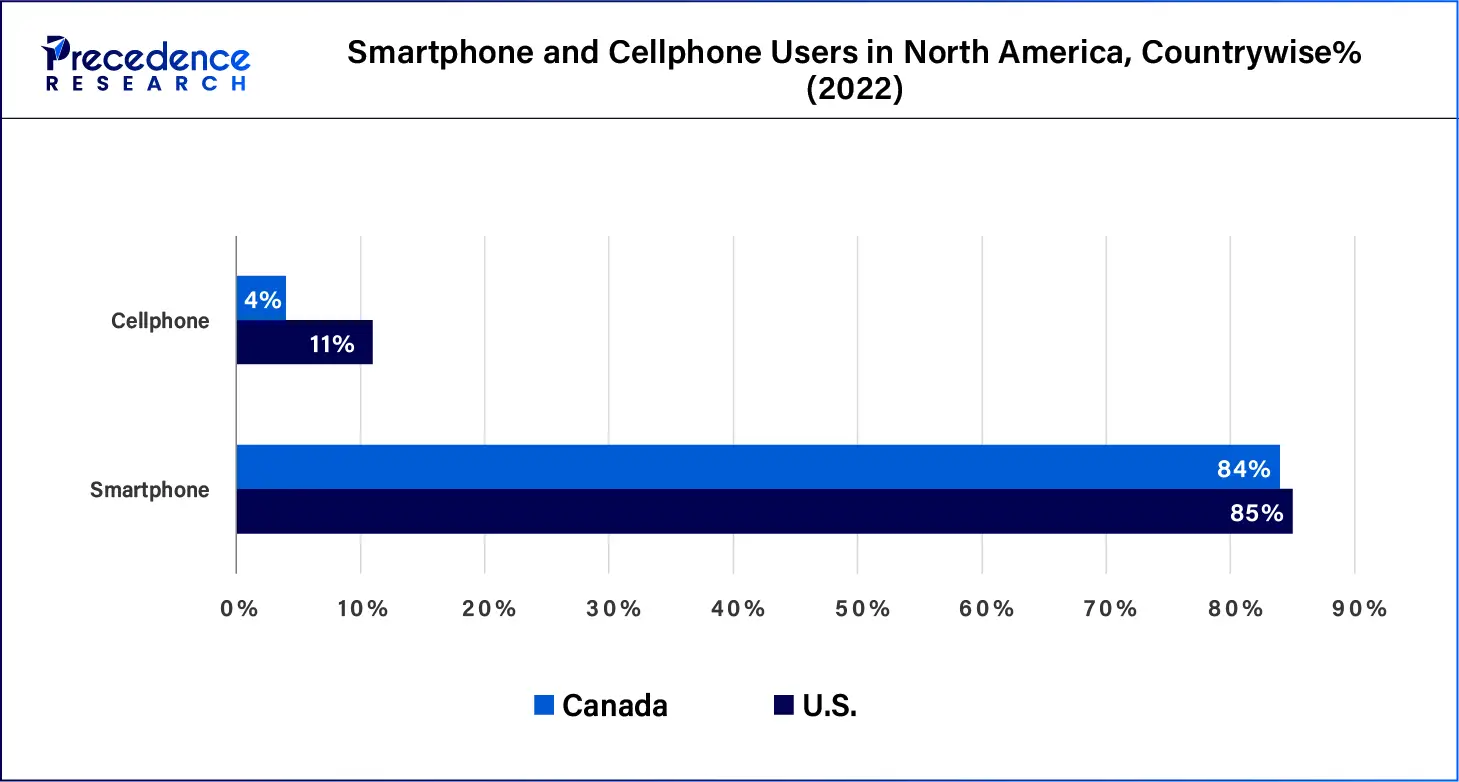

Rising demand for advanced smartphones around the world

The smartphone industry has been growing rapidly with the developments in telecom infrastructure across the world. The demand for smartphones has increased drastically with the rising trend of online gaming, video editing, social media applications, knowledge gaining, and some others among the people of the world. With the rising application of smartphones, the demand for non-breakable glasses in manufacturing smartphone displays has increased rapidly. Thus, the increasing demand for advanced smartphones around the world is expected to drive the growth of the impact resistant glass market during the forecast period.

Increasing prices of raw materials along with unskilled workforce

The impact-resistant glass industry has undergone several problems in the past, and numerous problems are arising in current times. The prices of raw materials such as polyvinyl butyral, ethylene vinyl acetate, and others that are used in manufacturing impact-resistant glasses have increased rapidly, which hampers industrial growth. Also, the lack of skilled workers in the glass industry is another factor that restrains the impact resistant glass market growth.

Advancements in self-healing glasses

Research and development activities associated with self-healing glasses have gained traction at present. Researchers and scientists are conducting numerous experiments to develop self-healing glasses from peptides and water molecules. Also, the rising emphasis on manufacturing self-healing glass from chalcogenide is an ongoing practice in the impact resistant glass industry. Thus, the advancements in self-healing glasses are expected to create ample growth opportunities for the market players in the years to come.

The polyvinyl butyral segment dominated the impact resistant glass market in 2023. The demand for polyvinyl butyral interlayers has increased in the automotive industry for windshield manufacturing, which has driven market growth. Also, the rising application of PVB interlayer in side door windows and architectural glasses is boosting the market growth. Moreover, the growing demand for PVB interlayer due to several characteristics such as sound insulation, impact resistance, optical clarity, elasticity, and others propels market growth to some extent. Furthermore, the growing demand for safety glasses from commercial and industrial sectors has fostered the growth of the impact resistant glass market during the forecast period.

The ethylene vinyl acetate segment is expected to exhibit a notable growth rate during the forecast period. The rising demand for high-adhesion and transparent glass in the military sector has driven market growth. Also, the upsurge in demand for weather-resistant glass from the residential sector is likely to propel the market growth. Moreover, the advantages of EVA interlayer, such as UV protection, superior transparency, design flexibility, and some others, contribute positively to industrial growth. Furthermore, the growing application of EVA interlayer in manufacturing safety glasses due to high water resistance capability is expected to boost the growth of the impact resistant glass market during the forecast period.

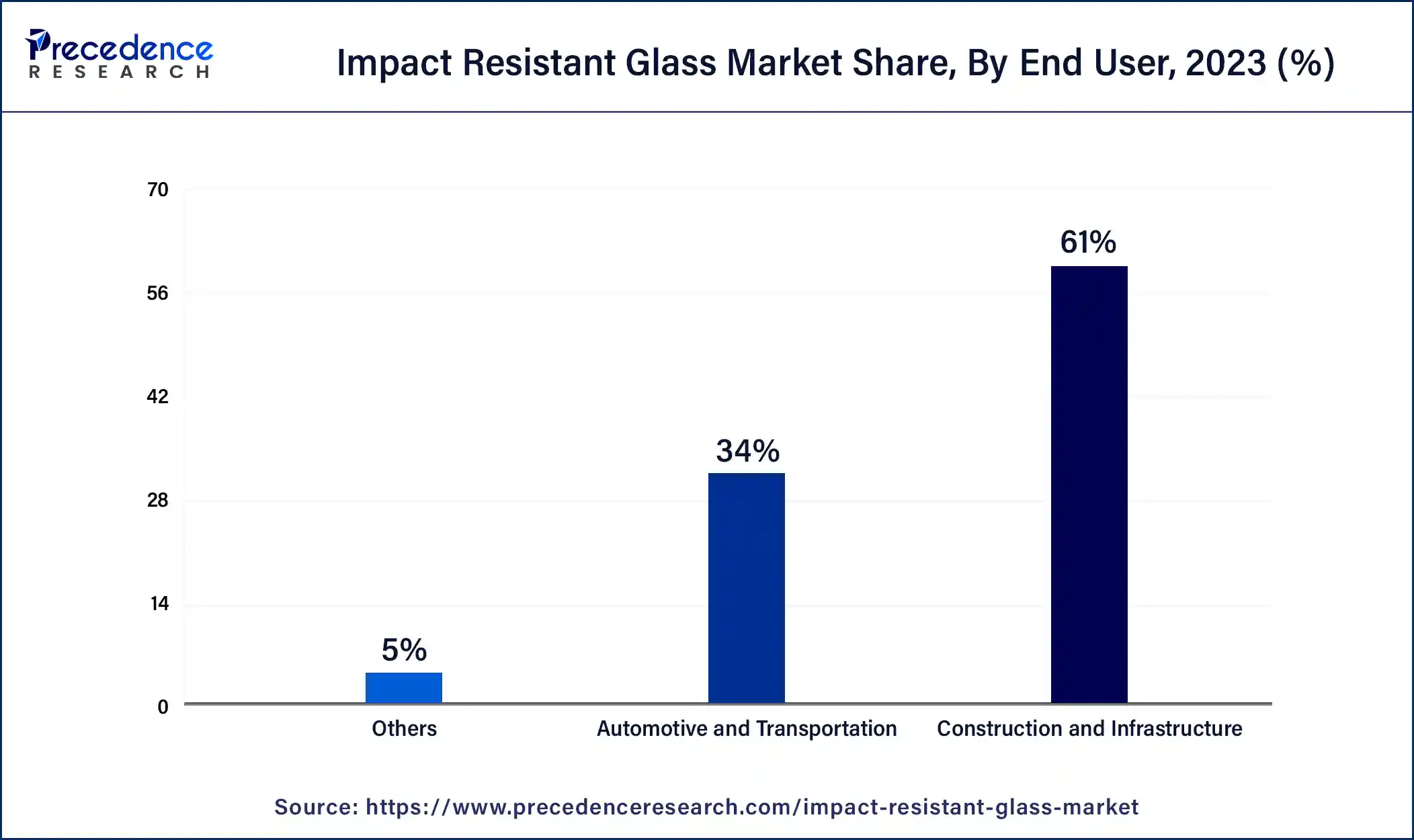

The construction and infrastructure segment held a dominant share of the impact resistant glass market in 2023. The rising demand for advanced impact resistant glasses in government buildings has driven the market growth. Also, the increase in the number of residential buildings has increased the demand for window and door glasses, which in turn increased the demand for impact-resistant glasses, thereby driving the market growth. Moreover, the ongoing development of impact resistant glass for commercial purposes with enhanced safety and durability has propelled the market growth. Furthermore, the upsurge in demand for hurricane-resistant glasses and impact-resistant windows to conserve energy is expected to foster the growth of the impact resistant glass market during the forecast period.

The automotive and transportation segment is expected to grow at the fastest growth rate during the forecast period. The growing developments in the automotive industry around the world have boosted the impact resistant glass market growth. Also, the rising application of tempered glass in automotive windows is likely to propel the market growth. Moreover, the upsurge in demand for PVB interlayer glasses in the automotive industry to manufacture strong windshields has fostered market growth. Furthermore, the increasing demand for automotive displays and sunroofs in modern vehicles has shaped the growth of the resistant glass industry in a positive manner.

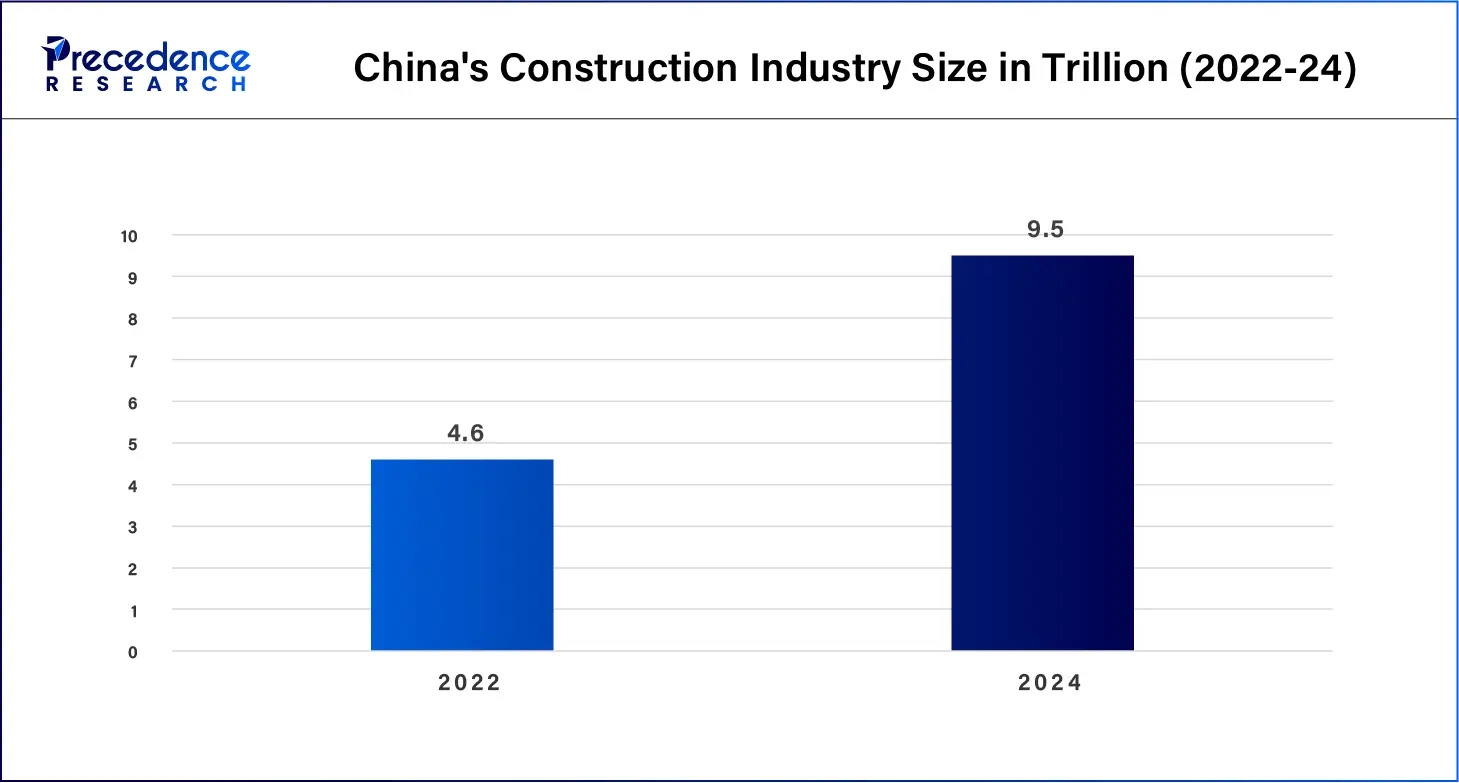

Asia Pacific held the largest share of the impact resistant glass market in 2023. The growing development of the construction industry in countries such as India, Japan, Singapore, China, South Korea, and others has boosted market growth. Also, the rise in the number of office buildings and financial institutions in India and South Korea has propelled industrial growth.

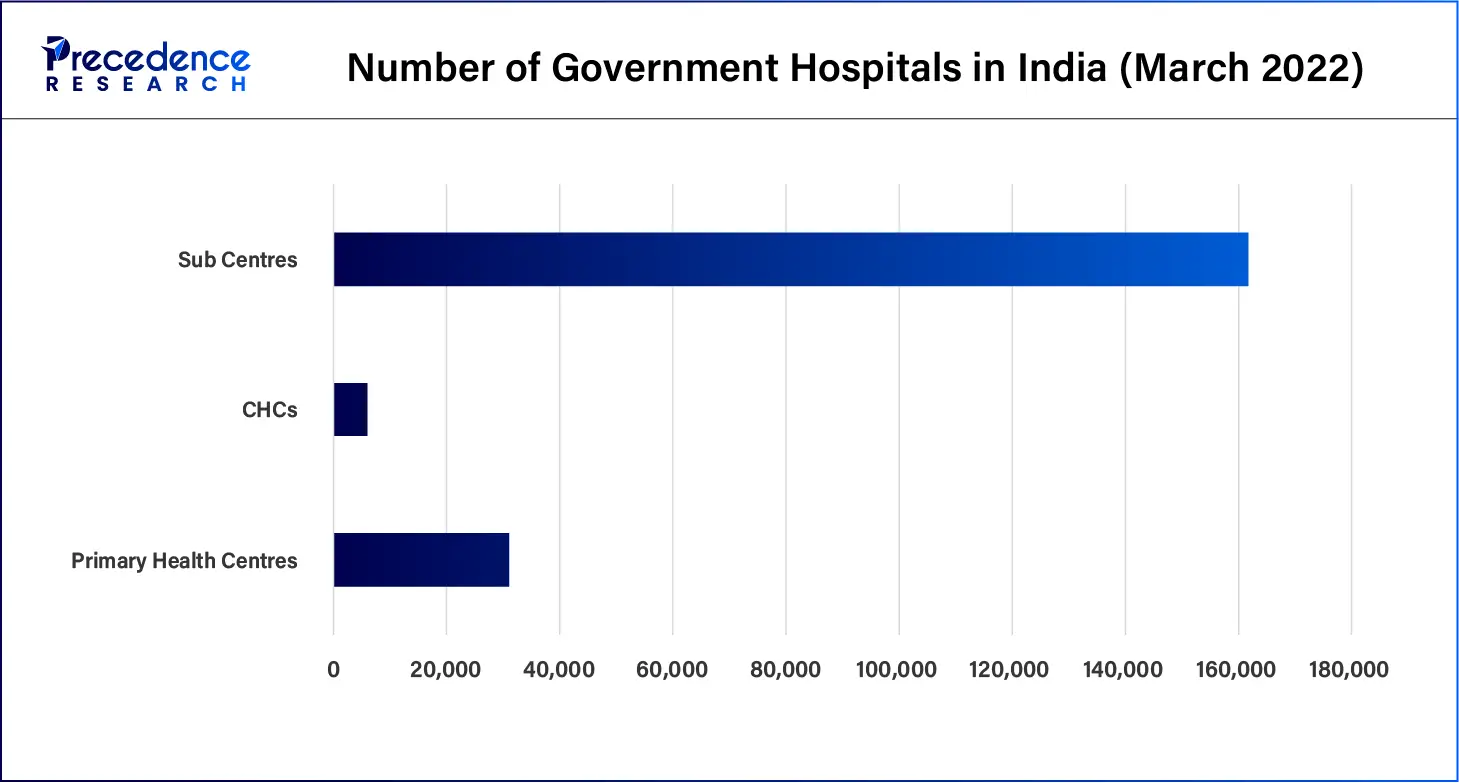

The electronics industry in China is well-established, with several market giants such as Huawei, BYD Electronic, Lenovo, Hisense, Goertek, Xiaomi, and others manufacturing various electronic products that require high-quality glasses, which in turn is likely to propel the market growth. Moreover, the rise in the number of private and government hospitals has increased the demand for impact-resistant glasses, thereby positively boosting the industry.

This region comprises several local manufacturers of impact-resistant glass, such as AGC, Nippon Sheet Glass, Qingdao Kangdeli Industrial, Fuyao Glass Industry Group, and some others are constantly developing numerous varieties of high-quality impact-resistant glass for different industries in the Asia Pacific region, which in turn is expected to drive the growth of the impact resistant glass market.

North America is estimated to be the fastest-growing region during the forecast period. The aerospace and defense industry in this region is well-established, with numerous market players such as Lockheed Martin, Northrop Grumman, Raytheon, L3Harris, Boeing, and some others increasing the demand for impact-resistant glasses.

The automotive industry in North America is highly developed due to the presence of automotive giants such as Ford, Tesla, Rivian, Tesla General Motors, and some others that are engaged in manufacturing different classes of vehicles, which increases the demand for impact-resistant glasses. Also, the demand for sunroof-equipped vehicles has increased the application of impact-resistant glasses, thereby driving impact resistant glass market growth.

This region consists of local market players of impact-resistant glass such as Corning, Cardinal Glass, Guardian Industries, and some others that are constantly engaged in manufacturing superior-grade impact-resistant glass for various applications and adopting several strategies, which in turn drives the growth of the impact resistant glass market in this region.

Segments Covered in the Report

By Interlayer

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

December 2024