July 2024

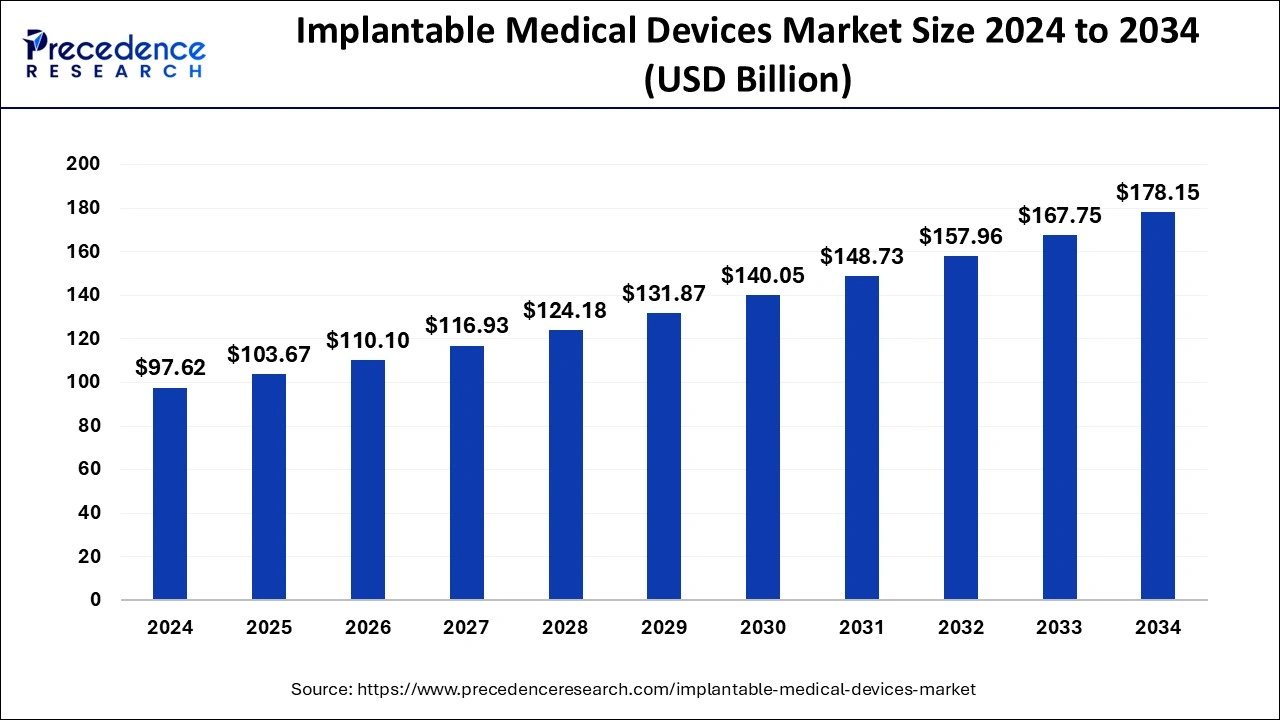

The global implantable medical devices market size is calculated at USD 103.67 billion in 2025 and is forecasted to reach around USD 178.15 billion by 2034, accelerating at a CAGR of 6.20% from 2025 to 2034. The North America implantable medical devices market size surpassed USD 42.08 billion in 2024 and is expanding at a CAGR of 6.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global implantable medical devices market size was estimated at USD 97.62 billion in 2024 and is anticipated to reach around USD 178.15 billion by 2034, expanding at a CAGR of 6.20% from 2025 to 2034.

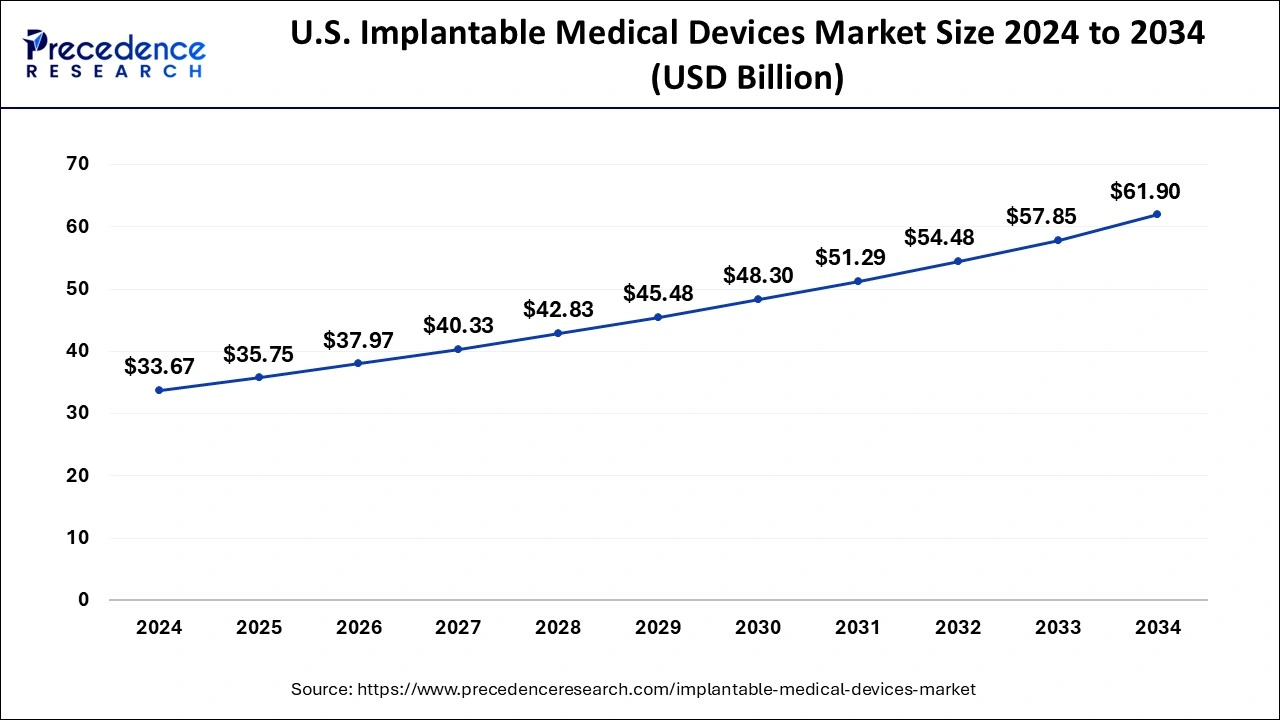

The U.S. implantable medical devices market size was evaluated at USD 33.67 billion in 2024 and is predicted to be worth around USD 61.90 billion by 2034, rising at a CAGR of 6.27% from 2025 to 2034.

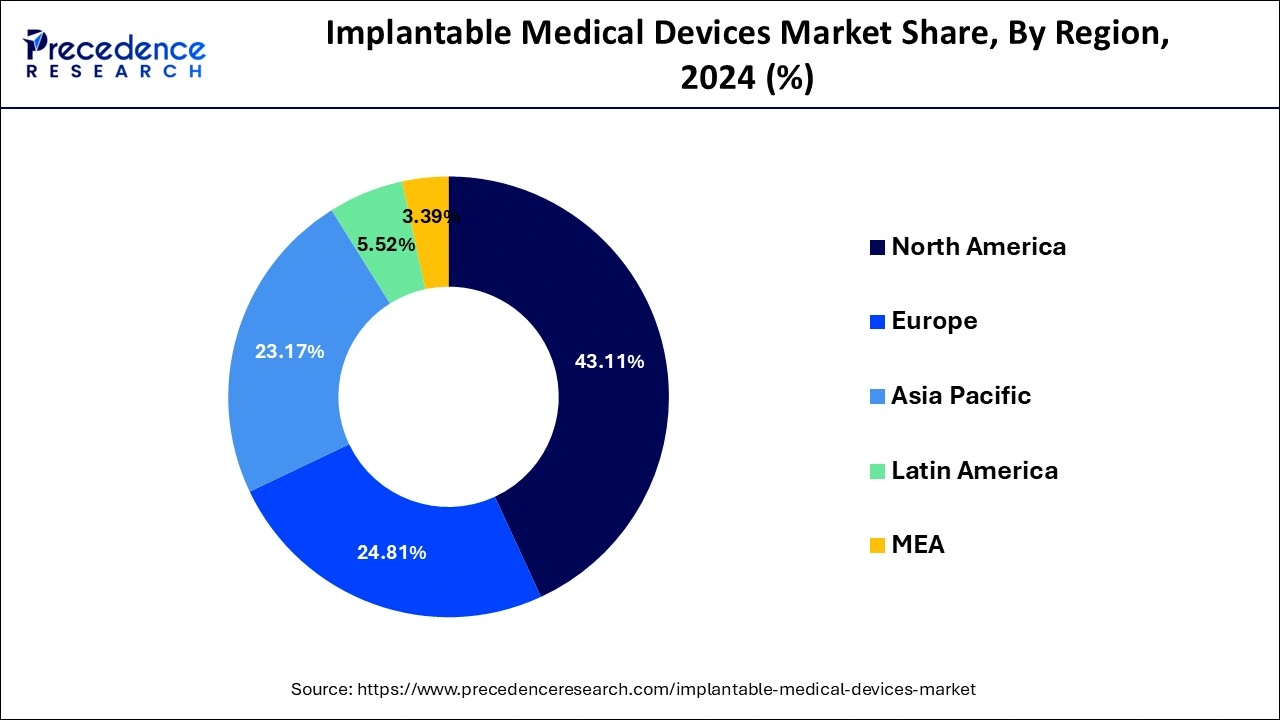

North America dominated the global implantable medical devices market and contributed the highest market share of 43.11% in 2024. North America is characterized by the increased prevalence of various chronic diseases and increasing geriatric population. Further, the increased disposable income, presence of advanced healthcare infrastructure, increasing adoption of minimally invasive surgeries, and rising consumer expenditure on healthcare are the major factors that are expected to drive the growth of the medical implants market in the region. Further, the number of medical visits in the US is rising. According to the CDC, approximately 64% of the US population of age between 18 years to 64 years, visited clinics related to their medical health in 2017. Moreover, the increased awareness among the population in North America regarding the availability of various medical implants has significantly contributed towards the market growth in the past.

On the other, Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is attributed to the rising geriatric population. According to the United Nations, around 80% of the global geriatric population is expected to be living in the low and middle income nations. Further, the rising government and corporate investments in the development of advanced healthcare infrastructure in the region is anticipated to boost the market growth in the region.

The technological advancements in the healthcare industry has allowed the people to improve their looks and enhance their beauty by implanting medical devices such as dental implants, breast implants, pectoral implants, deltoid implants, and cochlear implants. The rising concerns regarding the aesthetics and physical appearances among the population is another factor that drives the demand for the implantable medical devices. Moreover, the presence of numerous market players and various developmental strategies adopted by them plays a prominent role in influencing the market. Furthermore, the rising number of accident cases in which limbs or organs are damaged is a major factors that may drive the demand for the implantable medical devices across the globe. All these factors are expected to drive the growth of the global implantable medical devices market during the forecast period.

The increasing awareness regarding the availability of implantable medical devices, presence of advanced healthcare infrastructure, rising disposable income, and increasing consumer expenditure on healthcare are the prominent drivers that boosts the adoption of the implantable medical devices among the patients. Furthermore, the rising prevalence of chronic diseases ad growing geriatric population across the globe are the primary drivers of the global implantable medical devices market.According to the United Nations, there were around 382 million old age people, aged 60 years or above, across the globe in 2017 and this number is expected 2.1 billion by 2050. The old age people are prone to various chronic diseases such as cardiovascular diseases, endovascular diseases, orthopedic disorders, and dental disorders, which can foster the demand for the implantable medical devices across the globe. The kidney implants, joints implants, eye implants, and heart implants are some of the common implantable medical devices among the geriatric people. Moreover, availability of wider range of different implantable medical devices serves a wider need for the implants such as cardiovascular implants, orthopedic implants, and various other types of implants.

| Report Coverage | Details |

| Market Size in 2024 | USD 97.62 Billion |

| Market Size in 2025 | USD 103.67 Billion |

| Market Size by 2034 | USD 178.15 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Biomaterial, End User, and Region |

The orthopedic implants segment accounted largest revenue share in 2024. Orthopedic implants are extensively used across the globe for replacing the missing bones or joints and to support the damaged bones. The rising cases of accidents that leads to damage bones and joints is augmenting the growth of this segment. Further the rising cases of rheumatoid arthritis is giving rise to the elbow joint replacement surgeries. According to the Australia Bureau of Statistics, around 458,000 people have rheumatoid arthritis. In 2017-18. Moreover, according to the Arthritis Report UK, around 17.8 million people were living with a musculoskeletal condition in 2018. Hence, this is resulting in the increased number of orthopedic surgeries that may boost the growth of the orthopedic implants in the upcoming years.

On the other hand, the dental segment is estimated to be the most opportunistic segment during the forecast period. This is simply attributed to the rising demand for the dental implants to improve physical appearances of face. According to the American Academy of Implant Dentistry (AAID), around 3 million US people have dental implants and it is expected to grow by 500,000 per year. Hence, the rising adoption of dental implants is estimated to drive the market growth in the forthcoming years.

Based on the biomaterial, the metallic segment dominated the global implantable medical devices market in 2024, in terms of revenue. This can be attributed to the rising cases of road accidents and trauma cases across the globe coupled with the rising demand for the minimally invasive surgeries among the people. Moreover, the dominance of this segment is attributed to the increased adoption of the metal implants in the orthopedic surgeries to provide strong support to the damaged bones or joints. Hence, this segment is further expected to grow owing to the rising cases of arthritis among the global population.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

By Product Type

By Biomaterial

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

March 2025

August 2024