February 2025

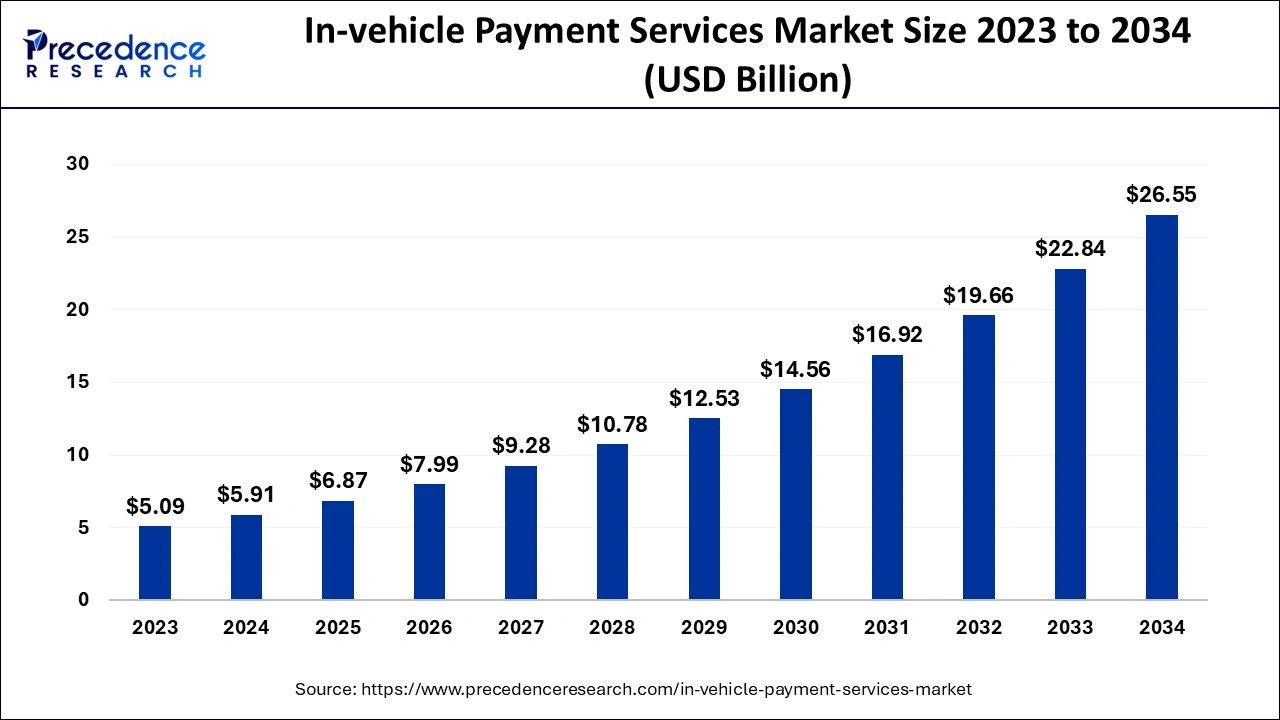

The global in-vehicle payment services market size accounted for USD 5.91 billion in 2024, grew to USD 6.87 billion in 2025 and is predicted to surpass around USD 26.55 billion by 2034, representing a healthy CAGR of 16.20% between 2024 and 2034. The North America in-vehicle payment services market size is calculated at USD 2.36 billion in 2024 and is expected to grow at a fastest CAGR of 16.31% during the forecast year.

The global in-vehicle payment services market size is estimated at USD 5.91 billion in 2024 and is anticipated to reach around USD 26.55 billion by 2034, expanding at a CAGR of 16.20% from 2024 to 2034.

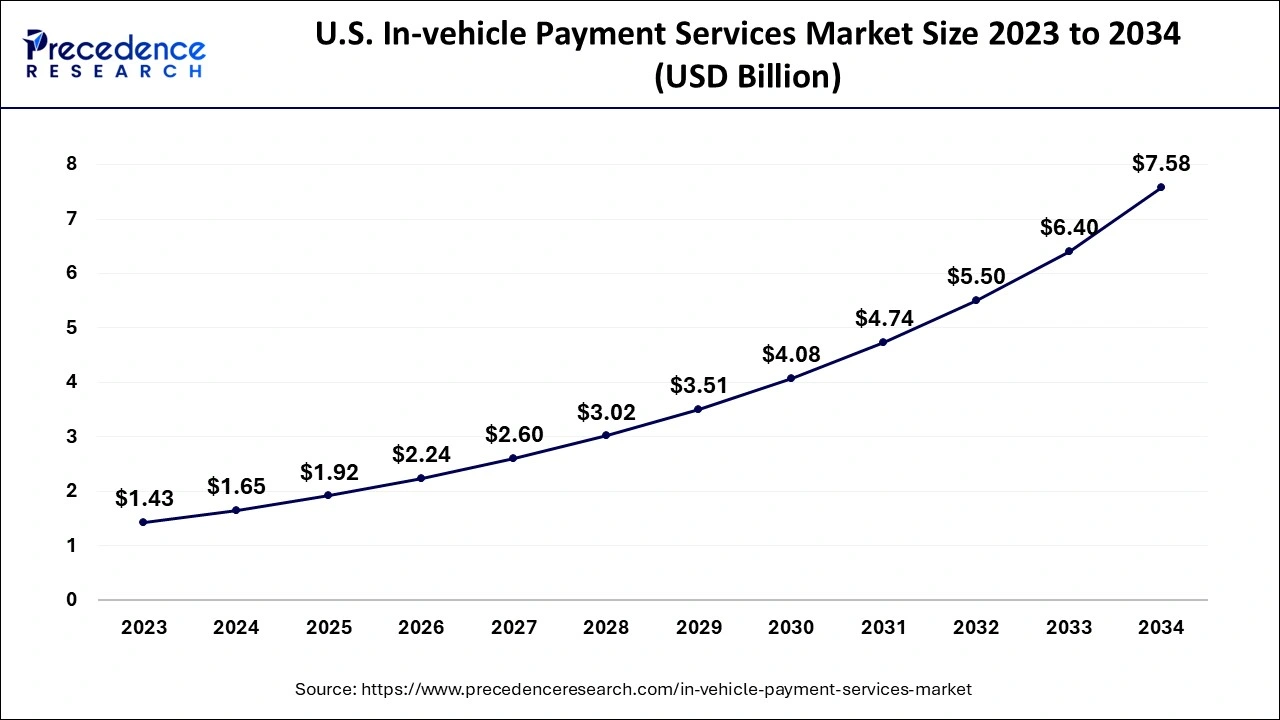

The U.S. in-vehicle payment services market size is evaluated at USD 1.65 billion in 2024 and is predicted to be worth around USD 7.58 billion by 2034, rising at a CAGR of 16.37% from 2024 to 2034.

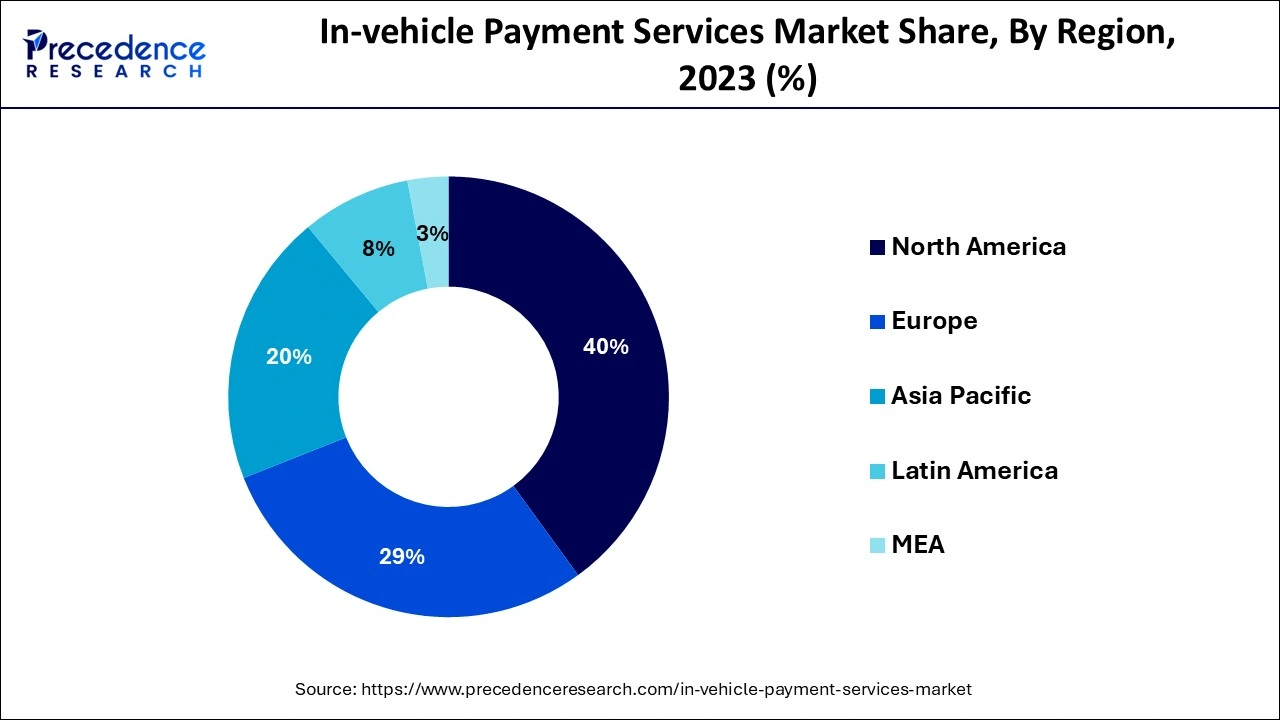

North American region has dominated the market in the past and it is expected to have the largest market share in 2023. Due to the growth in the adoption of connected cars the demand for these services are expected to grow in the coming years. As the population in the Asia Pacific region is expected to grow the demand will continue to grow in this region. There has also been an increase in the disposable income of the people staying in these regions. Constant research and development activities have provided advanced technology and innovative products for making the payments and these shall play an instrumental role in the growth of the market in the coming years.

The North American region is expected to have a larger adoption of in vehicle payment services during the forecast period as the government in these regions are increasing the amounts invested in the infrastructure of the road as well as the telecom industry. Increased investments in these two sectors will be helpful in increasing the connectivity and communication in the car. It will be able to establish the automotive market in a positive manner. Major companies across the globe are increasing their focus on partnerships as they shall be instrumental in improving the market presence and the product portfolio of these companies.

The demand for the in-vehicle payment services is expected to grow in the coming years as it is helpful in ordering and making payments for foods and beverages as well as groceries and gasoline for the drivers without having to come out of the call and it is also helpful in making payments for the parking as well as the tolls. Increased use of IoT technology in the vehicles by the manufacturers will be driving the market growth in the coming years.

Constant research and development in the manufacturing of the cars has led to an integration of advanced and better solutions in terms of infotainment which have provided such features and these features are expected to drive the market growth in the forecast period. These payment processes are provided by different people across the globe like PayPal, visa MasterCard as they have partnered with the vehicle manufacturers. Partnership between MasterCard and General Motors was beneficial in developing these solutions in the year 2017. Similar collaborations with different payment providers with the manufacturers will drive the market growth during the forecast period. Major car manufacturers like Honda, Volkswagen and Ford have incorporated the in-vehicle payment solution. There's a growing demand for these built-in systems in the automobiles which are expected to drive the market growth in the coming years. In order to improve the road safety for the drivers as well as the passengers the market for in vehicle payment services is expected to grow well during the forecast period.

During the COVID-19 pandemic the demand for in vehicle payment services had affected to a great extent. Disrupted supply chains had negatively impacted the manufacturing processes of the major companies. add the manufacturing activities had come to a standstill during the pandemic the companies incurred losses. Due to the various restrictions that were imposed by the governments and social distancing policies laid down by the government during the pandemic had negatively impacted the market. However, as this service is helpful in providing contactless payments there was an increased preference for this payment method even during the pandemic.

Increase in the demand for the driver support systems in the vehicles is expected to drive the market growth in the coming years. There is a growing demand for the in-vehicle payment services and it is adopted by major manufacturers. As the service is extremely beneficial for the drivers as it is helpful in making instant purchases and provides the benefits of easy parking without making use of any card payments or the use of any other device the market is expected to grow well in the coming years. As the service comes with the voice enabled controls it has a greater potential for driving the market growth in the coming years as it does not compromise with any of the safety norms of driving on the roads.

The advancements in the technology is used in the automobiles have led to the introduction of self-driven cars with the facilities of connectivity and this is expected to be an extremely beneficial technology we shall drive the market growth in the coming years. Due to an increased adoption of this facility in the hospitality and travel segments which helps by providing many benefits the market is expected to grow well. As the time required for the various activities is reduced to a great extent and the service is extremely convenient the market will grow well. As the service is extremely beneficial in increasing the speed of the transaction of money for the service is taken by the person and it is also beneficial as it has application in many different purchases The market is expected to grow well.

Increased connectivity in the vehicles and the use of high-speed Internet especially at the fuel stations bill generate more revenue for this market. Availability of Internet add the all boots and fuel stations as well as the parking lots will be instrumental in the growth of the market in the coming years period increased use of the smartphones and lesser time needed for making the payments has created more demand for the payment devices of the variable type. And they shall accelerate the market growth in the coming years. As the developing and the developed nations are increasing the amount of investments made in order to help the growth of the automobile industry the market for these services is also expected to grow. Increased number of initiatives taken by the government to promote digital payment options across the developed as well as the developing economies will lead to a growth in the market in the coming years.

During the pandemic the demand for these services had gained importance due to the feature of contactless payment. Major manufacturers like Honda, Mercedes, General Motors are concentrating on providing connected vehicles. Increased traffic congestions and the longer queues at the parking spaces, gas stations as well as the toll booths are some of the factors that will lead to the growth of the market in the coming years. There is a growing popularity of this service due to various benefits provided. There has been an increase in the development of the infrastructure required for the service and should boost the growth of the market in the coming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.91 Billion |

| Market Size by 2034 | USD 26.55 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 16.20% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Mode of Payment, Offering, Vehicle Type, Application, and Geography |

Depending upon the mode of payment, the debit card and credit card segment is expected to have the largest market share in 2023. The debit cards as well as the credit cards are used largely in the developed as well as the developing economies as it happens to be the most popular mode for payment. This payment mode is preferred by most of the consumers for the contact list as well as the contact payments. There is an increased preference for the cordless as well as card transactions at the point of sales it is expected to contribute to the growth of the market in the coming years. The debit card and the credit card payment method is preferred by the various people belonging to different age groups as it is extremely convenient to use.

On the basis of application, the demand for the in-vehicle payment services is expected to have the largest market share for the food and coffee segment. Large amount of revenue is generated through the sales of food and coffee as compared to any other purchases in the past period it is expected to hold a dominant position as these products are consumed on a large scale especially on the travels made for offices or the workplaces. Increased traffic congestion has led to a shortage of time especially when a person has to reach the office. In order to limit the time period required for waiting when buying food the demand for in vehicle payment services is expected to grow. This method of payment is extremely convenient as it helps in saving the time period there is a growing popularity for the usage of in-vehicle payment services in the developing as well as the developed nations.

Apart from the amount of revenue generated through the sales of coffee and fool a good amount of revenue will also be generated through the payments made for parking lots. The segment is expected to grow with a compound annual growth rate of 15% during the forecast period. Due to an increased sales of the commercial vehicles as well as the passenger vehicles the demand for parking is expected to grow. Growing population and increased sales of automobiles has created limited space for parking. A large number of commercial vehicles are sold in many Asia Pacific regions. The in-vehicle payment services are used in the Asia Pacific regions for the parking spaces as they are helpful in reducing the amount of time required for staying in the long queues.

By Mode of Payment

By Offering

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

December 2024

January 2025