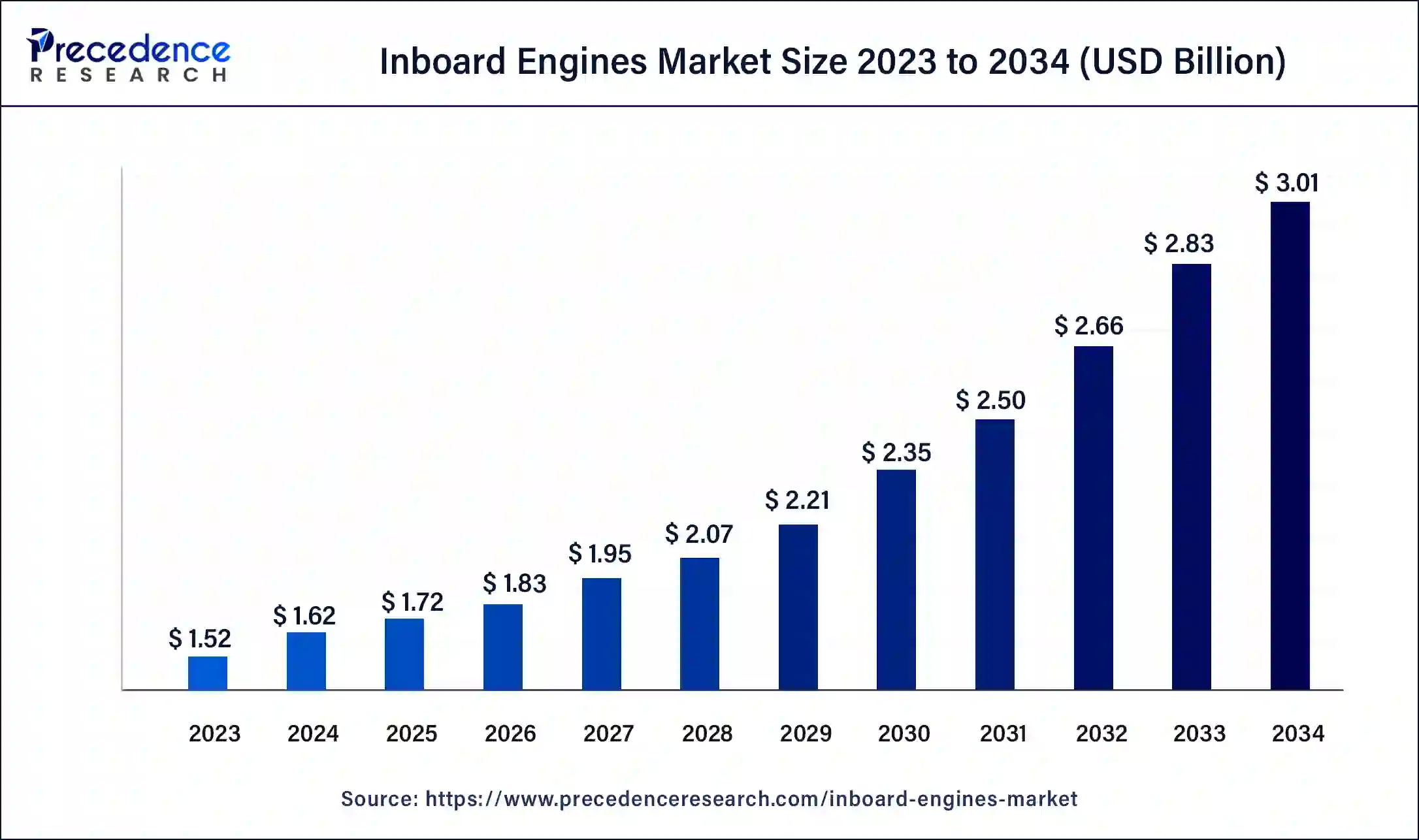

The global inboard engines market size surpassed USD 1.52 billion in 2023 and is estimated to increase from USD 1.62 billion in 2024 to approximately USD 3.01 billion by 2034. It is projected to grow at a CAGR of 6.42% from 2024 to 2034.

The global inboard engines market size is projected to be worth around USD 3.01 billion by 2034 from USD 1.62 billion in 2024, at a CAGR of 6.42% from 2024 to 2034. Increasing demand due to technological developments, increasing environmental regulations, economic growth, and growing recreational boating are the key drivers of the inboard engines market.

Inboard engines are internal engines mounted in the center of the boat. In general, inboard engines are four-stroke engines similar to automobile engines. Inboards are preferred when it comes to sailboats, motorboats, commercial boat workboats, and marine boats for tours since they are usually of higher displacement and offer a broader power range. Inboard engines are very popular with boaters who enjoy water sports. It must be said that they give great wake for water skiing and wakeboarding.

How is AI Changing the Inboard Engines Market?

The use of artificial intelligence (AI) is making significant advancements in the inboard engines market. The ship engine is a crucial and intricate part of a ship's engineering system, integrated into various systems and auxiliary subsystems. AI has the capability to predict when ships and equipment will require maintenance, which can reduce downtime and cut costs. By analyzing sensor data from ship engines, AI can detect patterns that indicate when maintenance is necessary, enabling proactive repairs that prevent unexpected breakdowns.

Traditional maintenance methods have led to longer turnaround times for repairing or replacing engine components and restoring normal operations. An AI-based condition monitoring system can continuously monitor engine health and help estimate maintenance timing, ultimately reducing maintenance costs and enhancing ship safety.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.01 Billion |

| Market Size in 2023 | USD 1.52 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.42% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Power, Ignition, Engine, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing trend towards recreational water sport activities

Increasing demand for recreational water sports activities is expected to drive growth in the inboard engines market. Some water recreational activities include Jet skiing, rowing, rafting, kayaking, canoeing, sailing, power boating, yachting, boat racing, and many more. Recreation boating facilities are being developed all over the world due to increased concern about water sports and the fact that more people are using water sports.

Environmental issues & rising legal requirements

People spend increasing amounts of time and effort studying the issue of environmental pollution, and the demands on the ecological environment are rising. This affects the dynamics of the inboard engines market. The demands for controlling the harmful gas emissions of engines are growing higher and higher, and each country has set a set of measures for emission control of transportation tools, and emissions standards are becoming higher and higher.

As for the advancement of the shipping business, the emissions of exhaust power on ships have been very detrimental to the quality of the atmosphere for a long time. A medium-speed, high-power diesel engine operates 4000 hours yearly, and it emits approximately 1500 tonnes of NOx. People around the globe have paid much attention to the emission of marine engine exhaust gas, and the dangers of marine diesel engine exhaust emissions to the atmosphere have been considered serious by most government bodies in different countries.

International Maritime Organisation (IMO) is one of the affiliated firms of the United Nations which has been established to enhance maritime safety.

Marine tourism

The maritime tourism market is expected to expand due to the increasing government support for the tourism industry. An increase in the number of travelers and tourists, favorable legislation performing a push factor for leisure travels, and increased investment in tourism coupled with growth in infrastructure development can promote the inboard engines market. Social media appeal by Gen-Z and millennials is supplementing leisure travel since the market has expanded its penetrations. However, knowledge and understanding of the culture of the other destinations continue to play a significant role while selecting the destination.

The diesel segment accounted for the biggest share of the inboard engines market in 2023. This is because diesel engines provide better power, torque, acceleration, towing, and also hauling capacity than gasoline engines. In a diesel engine, the air is compressed at a faster rate to deliver higher power for doing work. They also tend to have higher durability and may also last longer than gas engines. Furthermore, diesel fuel can be easily acquired at most marinas and ports, hence providing convenience for boat owners and operators alike. They are also preferred in marine applications since they are more reliable and durable and thus do not need frequent replacements within their life cycle.

The gasoline segment is expected to witness significant growth in the inboard engines market during the forecast period. Gasomatic engines are relatively cheaper than diesel ones, and they emit less. These are also more flexible, efficient in terms of refueling, and less noisy and vibrative than those of diesel power. The use of gasoline engines easily starts in cold weather because these fuels are more volatile as compared to diesel.

The medium segment is expected to grow significantly in the inboard engines market during the forecast period. Medium-speed engines operate at speeds that lie between 300 and 900 rpm. It is most common in small boats and power stations driving electrical generators. Medium-speed engines are the most common type of engine. These high revolutions, for instance, buses, yachts, and other powerful means of transport require such high revolutions.

The electric segment holds the largest share of the inboard engines market in 2023. The electric inboard boat motors are ideal for new boats and e.g., retrofitting of existing boats. The electric sailboat motors remain center stage and the most popular products in the seaborne market. These motors run very quietly, which enriches the sailing experience.

The IC engine segment dominated the global inboard engines market in 2023. An I.C. engine, also known as a combustion engine, is defined as an internal combustion heat engine that makes use of energy in the fuels, such as gasoline, through the process of combustion to generate mechanical energy. It is widely employed in automobiles, power generators, and numerous other similar industrial uses. IC engines vary from one another by their kind, for example, gasoline or diesel engines, which occur due to differences in combustion methods employed in them.

The recreational boats segment dominated the inboard engines market in 2023. Recreational boat means any vessel manufactured or used for recreational and not commercial purposes or a vessel that is being leased, rented, or chartered to another for recreational and not commercial purposes. Boating is a recreational activity whereby an individual travels or has an enjoyable time using a boat, power boat, sailing boat, rowing boat, or paddling boat. The factors that have led to the growth of this market include rising tourism, economic development, demands for boating, development of boat engines, and increased disposable income. Also, rising water sports events and rising import of boats in emerging regional markets.

The commercial boats segment is set to show notable growth in the inboard engines market during the forecast period. The growth in international trade and sea transportation is creating more opportunities in the market for commercial ships, which necessarily incorporate inboard engines. Innovations in engine technologies, such as better fuel economy and less pollution, are making these engines more suitable for commercial applications. The general capacity and reliability of the inboard engine also play a part in the applicability of inboard systems to the commercial business. With the increase in sectors like tourism, fisheries, cargo transport, etc., the demand for improved models of inboard engines in commercial boats is believed to increase greatly.

Asia Pacific led the global inboard engines market in 2023. The revolution of various countries such as China, India, and Japan, with fast and growing industrialization and economic growth, increased the demand for inboard engines. Further, the commercial and recreational boating industry in the region is experiencing growth, and massive investment in the maritime industry is increasing the demand for energy-effective and highly-performing inboard propulsion.

North America is anticipated to grow notably in the inboard engines market during the forecast period. The developed maritime structures and strong markets for commercial boating, including fishing, cargo transport, and commercial leisure boating, in turn, affect the demand for inboard engines.

The North American inboard engines market is characterized by relatively higher levels of technological advancement and high requirements of engine performance and efficiency. North America is one of the major drivers of the inboard engine industry due to the technological development, favorable regulations, and high demand in this region.

Segments Covered in the Report

By Product Type

By Power

By Ignition

By Engine

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client