September 2024

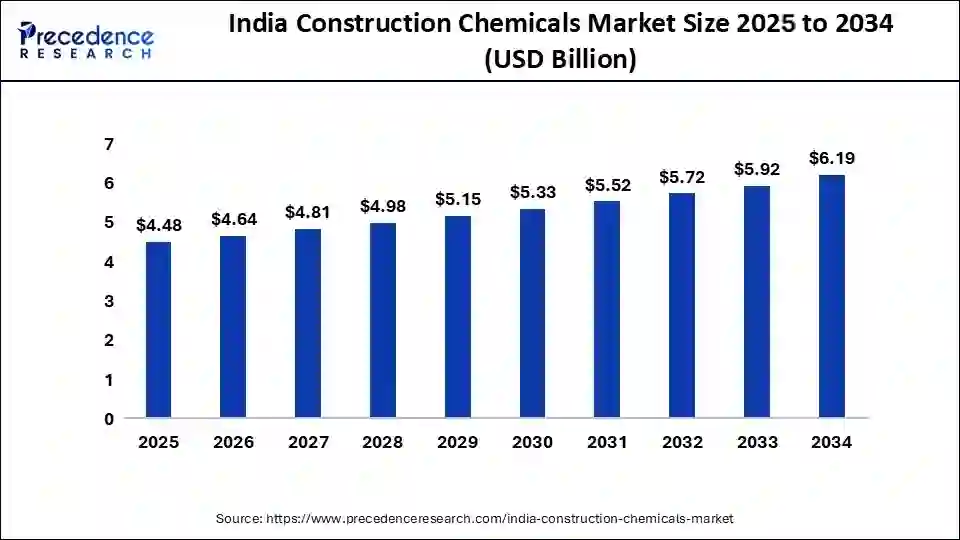

The India construction chemicals market size is calculated at USD 4.48 billion in 2025 and is forecasted to reach around USD 6.19 billion by 2034, accelerating at a CAGR of 3.63% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The India construction chemicals market size accounted for USD 4.33 billion in 2024 and is predicted to increase from USD 4.48 billion in 2025 to approximately USD 6.19 billion by 2034, expanding at a CAGR of 3.63% from 2025 to 2034. The expanding infrastructure developments are driving the market. The demand for sustainable construction practices and eco-friendly materials has increased, fueling the market expansion.

Artificial Intelligence is the extreme revolution in the India construction chemicals market. Manufacturing companies are integrating AI for predictive maintenance, process optimization, quality control, supply chain optimization, and compliance with regulatory standards. With the rising demand for efficiency, sustainability, and smart manufacturing, companies are becoming essential to adopting AI.

AI's ability to provide tailored, customized solutions, sustainable practices, and the discovery and development of new construction chemicals with advanced capabilities boost its popularity. The trend of sustainable construction and government encouragement for green buildings are transforming the Indian construction chemical industry, leading attention toward AI adoption.

Industrial leaders conducting events or discussions and investment approaches. The ICC's 18th Annual India Chemical Industry Outlook 2025 in Mumbai for AI, sustainability, and innovation is poised to shape India's USD 1 trillion chemical future. Additionally, events like India Inc. on the Move 2025, leveraging AI are important for the construction chemical industry in India.

The India construction chemicals market has witnessed transformative growth driven by government initiatives, infrastructure developments, rapid urbanization, residential and non-residential construction projects, smart house trends, and concerns for sustainable construction. India is undergoing extreme infrastructure growth, including smart cities, highways, metro rail, and real estate, raising demand for innovative construction solutions.

The India construction chemicals market witnessed rapid demand for concrete admixtures, specialized underground construction solutions, and sustainable innovations. Heavy monsoons and high humidity improve the durability, strength, and workability of concrete. Eco-friendly construction practices are emerging in the Indian construction chemicals industry. The year 2024 was marked by significant activities of the Indian government in the chemicals and petrochemicals industry, including construction chemicals. The Indian government’s implementation of "India Chem 2024" was aimed at enhancing the country's economy and reducing its dependence on imports.

Government encouragement for the adoption of construction chemicals is emerging in research and development activities in India's construction chemicals market. Government initiatives like Pradhan Mantri Awas Yojana (PMAY), the National Building Code (NBC), PM Gati Shakti, Affordable Housing for All, and the Smart Cities Projects have created a fertile ground for key vendors to provide high-performance solutions tailored to India’s evolving needs. India's growing emphasis on transportation and energy infrastructures is further contributing to the demand for specialized products.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.19 Billion |

| Market Size in 2025 | USD 4.48 Billion |

| Market Size in 2024 | USD 4.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.63% |

| Dominated Region | North India |

| Fastest Growing Market | South India |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, and Application. |

Demand for high-quality and durable construction chemicals

Rapid urbanization and industrial development such as roads, bridges, airports, and smart homes, Bridges, airports, and smart homes are contributing to high demand for high-quality and durable construction chemicals. India has witnessed growth in awareness about quality and durability to ensure the sustainability and longevity of the buildings.

Climate challenges further contribute to the need for high-strength and durable construction chemicals. The growing demand for green buildings is fueling the need for eco-friendly and sustainable construction chemicals. The India construction chemicals market growth is further driven by the government's implementation of strength quality standards for construction chemicals, leading to high-quality product demands.

Volatility in raw material prices

The raw materials of construction chemicals, such as petrochemicals and crude oil, are very volatile, making it difficult for manufacturers to maintain profit margins and stable prices. The cost associated with transportation further influences the portability of construction chemical manufacturers. The dependence on imports of raw materials further contributed to price fluctuations and availability. War material costs lead to increased production costs and reduced demand rates.

Demand for sustainable construction chemicals

India has increased demand for sustainable construction chemicals, driven by government initiatives and a focus on sustainable and high-performance building materials. The Indian government is implementing environmental regulations like the Environment Protection Act, driving the adoption of sustainable construction products.

The ongoing push for green building initiatives and sustainable construction practices is shifting countries' construction industries toward eco-friendly construction chemicals. The rising use of recyclable materials in construction chemicals and the rising popularity of water-based chemicals are contributing to market growth. The growing demand for low or zero-volatile organic compounds (VOCs) and products that improve thermal insulation and energy efficiency is expected to drive significant approaches in novel innovation and developments.

The concrete admixtures segment dominated the India construction chemicals market in 2024. Concrete admixtures improve concrete properties like workability, strength, and durability. These properties enable concrete mixtures to meet the needs of specific environmental conditions. The demand for concrete admixtures has increased in India, driven by increased residential, commercial, and infrastructure constructions. Residential construction projects are higher adopters of concrete admixtures, driven by the requirement of specialized high-performance structures in the industry. The rising Indian emphasis on sustainable construction practices and eco-friendly materials is expected to witness growth in the adoption of concrete admixtures.

The waterproofing adhesives segment is expected to grow at the fastest CAGR over the forecast period due to countries' climate challenges and an increased number of constructions. India has high humidity and heavy monsoons, which drive the need for waterproofing adhesives. The rapidly growing buildings, bridges, and tunnels are necessitating water-resistance solutions. The increasing use of waterproofing adhesives in infrastructure construction projects is leveraging the segment growth. Additionally, government initiatives and regulations like Pradhan Mantri Awas Yojana (PMAY) and the National Building Code (NBC) are encouraging the adoption of waterproofing adhesives in construction projects.

The non-residential segment led the India construction chemicals market in 2024. The non-residential construction includes commercial, industrial, institutional, and infrastructure construction projects. The increase in investments in non-residential construction projects a driving segment growth. Government initiatives, direct investments, and demand for modern office spaces are the factors contributing to the growth of non-residential construction in India. Large population bases and rapidly expanding organizations are seeking high- and better-quality structures. Additionally, the increased focus on sustainable construction and green building materials a driving the adoption of eco-friendly construction chemicals in residential construction projects.

The residential segment is estimated to grow at the fastest CAGR over the forecast period. Residential construction projects such as urbanization and housing in India have witnessed extreme demand for chemical materials like adhesives, sealants, and concrete admixtures. The growing middle-class population of India has increased the demand for modern homes and amenities with durability, safety, and quality of structures. Government initiatives like Pradhan Mantri Awas Yojana and smart city projects are driving growth in residential construction activities.

Which Factors Fuel the Market in the North Part of India?

North India dominated the Indian construction chemicals market in 2024 due to rapid urbanization, industrial construction, and high population. Cities like Delhi, Gurugram, and Noida have witnessed rapid urbanization, driving demand for construction chemicals. North India is a hub for several large-scale infrastructure projects like the Delhi- Mumbai industrial corridor and the Amritsar- Delhi- Kolkata industrial corridor. The presence of Master Builder Solutions enables access to advanced construction chemical facilities in the northern part of India. Government initiatives such as the smart city mission promote smart city development and infrastructure growth in north India.

Robust Infrastructure Developments Boosting South Indian Market

South India is expected to grow significantly in the India construction chemicals market over the forecast period. The southeast part of India, including states like Tamil Nadu, Karnataka, and Andhra Pradesh, has witnessed extreme growth in infrastructure development and the construction industry. Expanding urbanization in cities like Bangalore, Chennai, and Hyderabad has increased the demand for construction chemicals. The demand for chemicals like concrete admixtures and protective coatings is high in South India. Government initiatives and the presence of key market players are boosting the market expansion.

.webp)

By Type

By Application

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

November 2024

February 2025

November 2024