August 2024

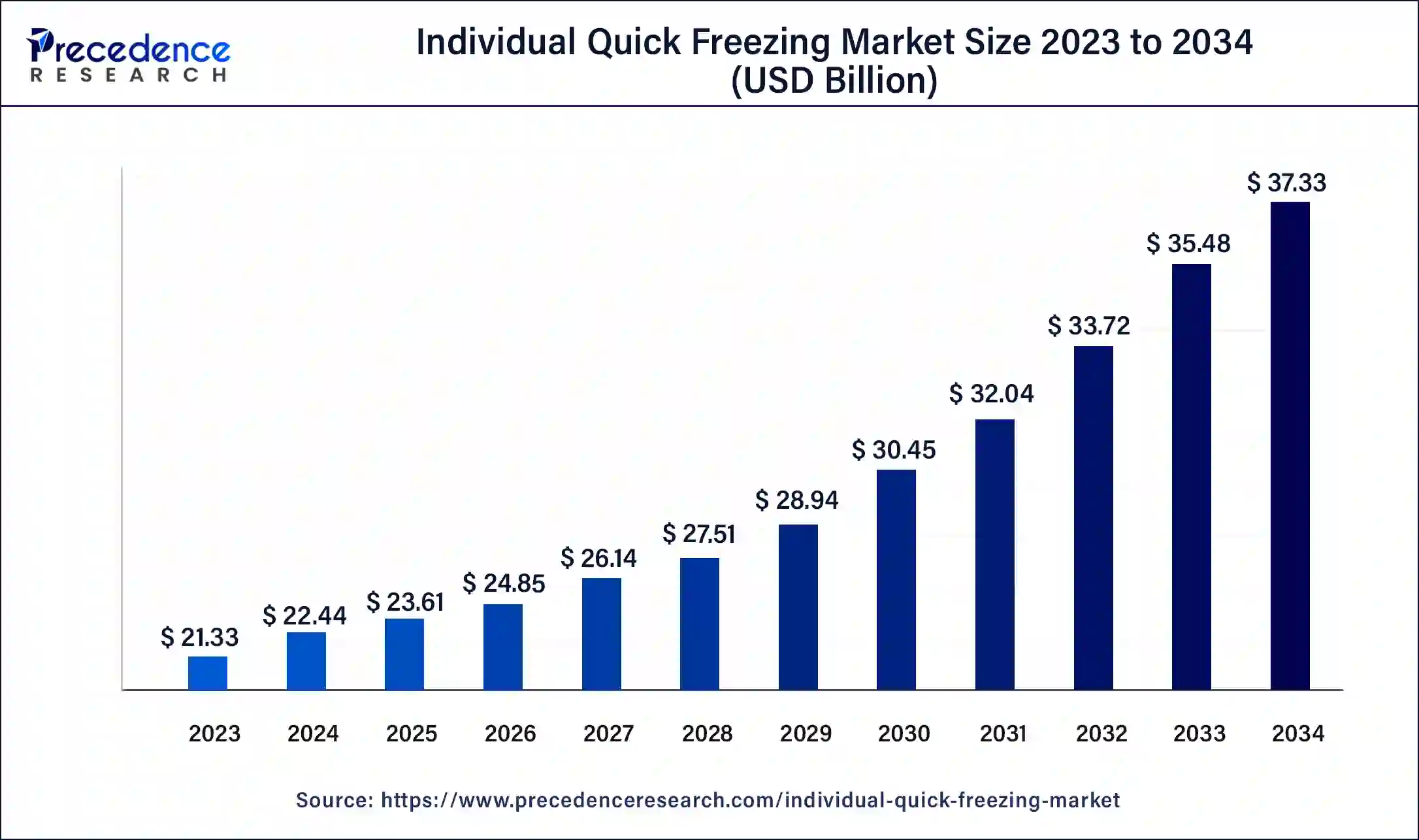

The global individual quick freezing market size was USD 21.33 billion in 2023, calculated at USD 22.44 billion in 2024 and is expected to be worth around USD 37.33 billion by 2034. The market is slated to expand at 5.22% CAGR from 2024 to 2034.

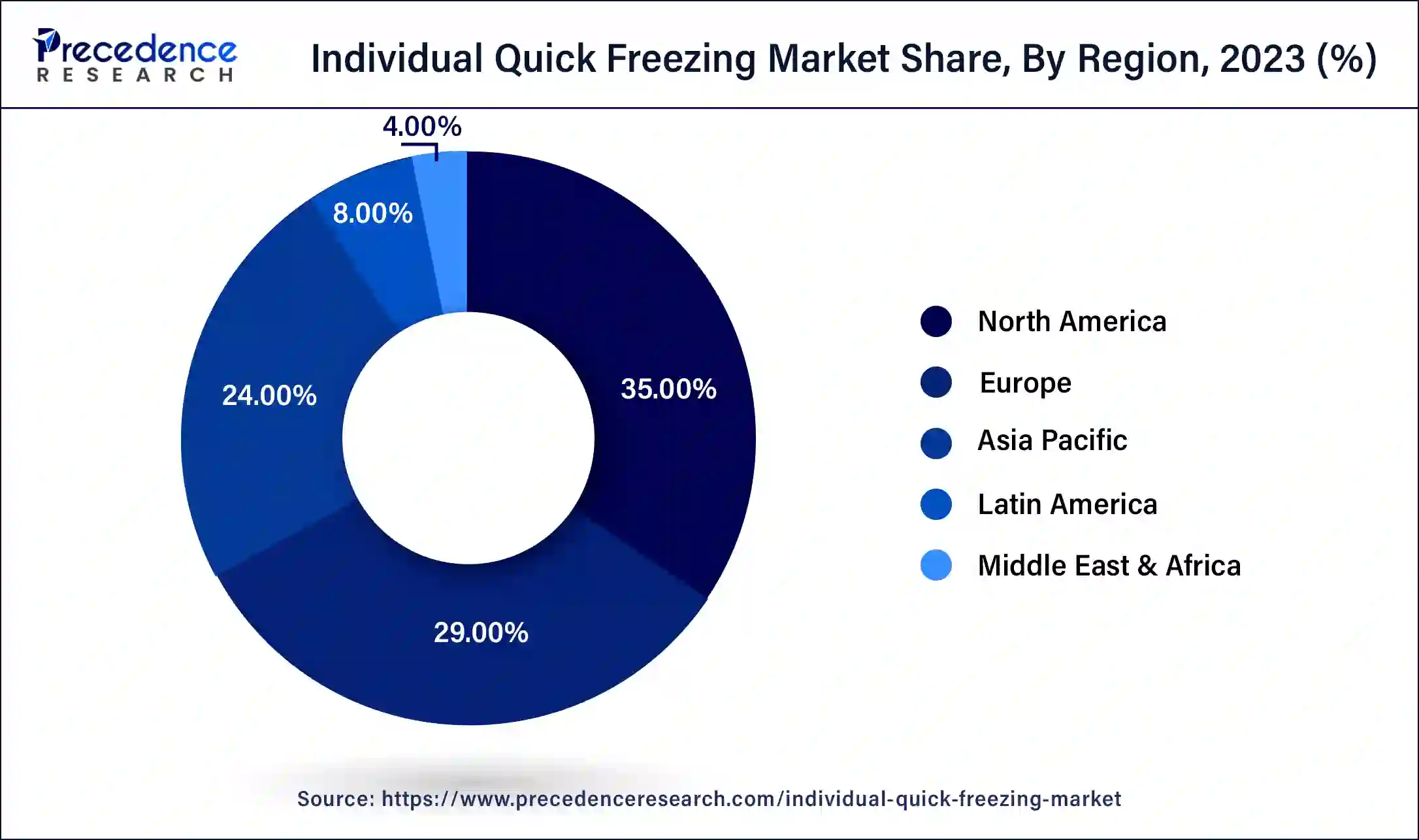

The global individual quick freezing market size is worth around USD 22.44 billion in 2024 and is anticipated to reach around USD 37.33 billion by 2034, growing at a CAGR of 5.22% over the forecast period 2024 to 2034. The North America individual quick freezing market size reached USD 7.47 billion in 2023.

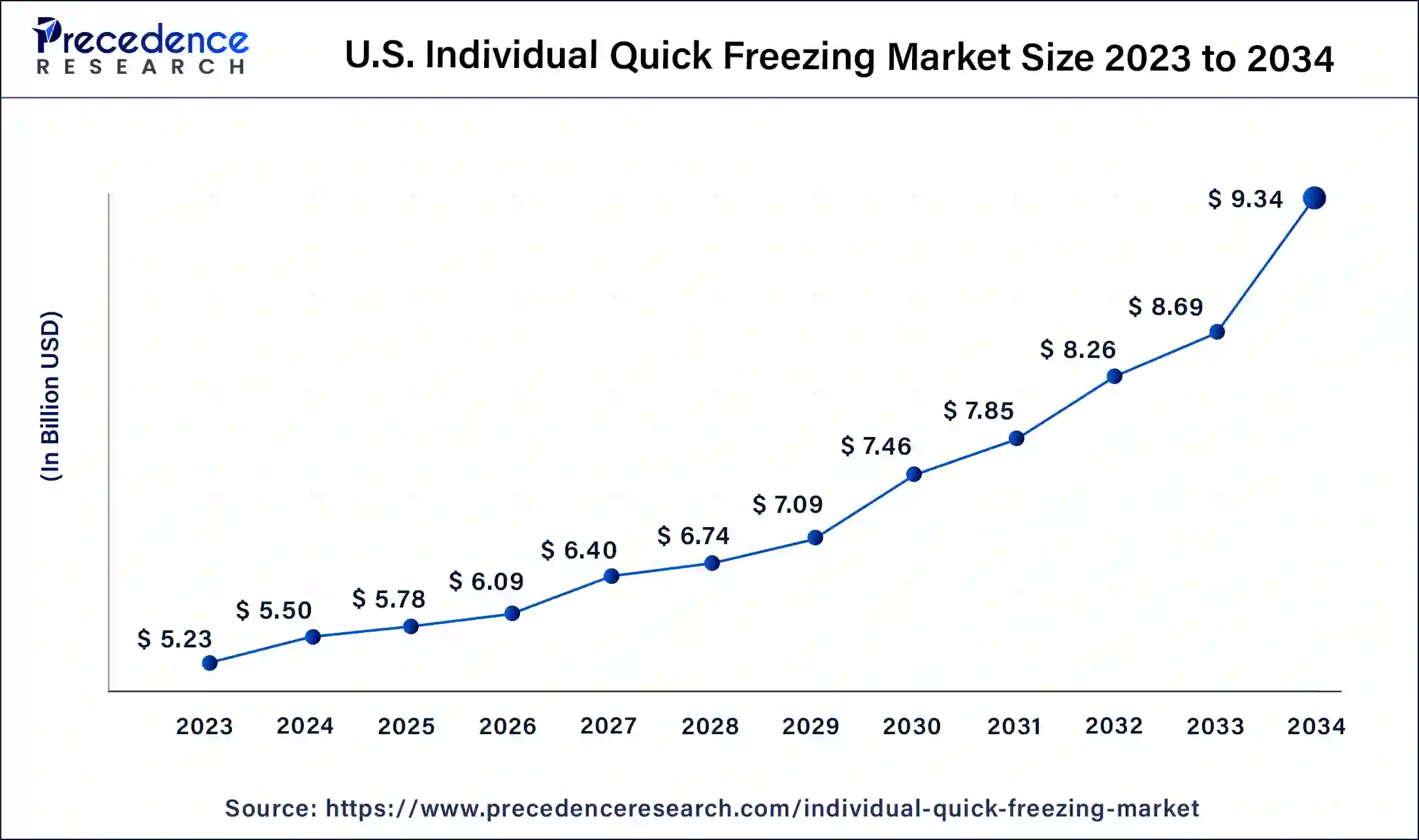

The U.S. individual quick freezing market size was exhibited at USD 5.23 billion in 2023 and is projected to be worth around USD 9.34 billion by 2034, poised to grow at a CAGR of 5.41% from 2024 to 2034.

North America held the largest share of the individual quick freezing market in 2023. The region’s growth is attributed to the presence of a large number of IQF equipment manufacturers, rising demand for frozen products, rising investments in various food processing technologies, a rise in disposable income, and stringent food safety regulations.

The rapid expansion of food & beverages due to changing lifestyles in countries such as the United States, Canada, and Mexico is likely to boost the individual quick freezing market growth. Additionally, a rise in consumer preference for frozen food products owing to their convenience and longer shelf life is expected to fuel the market’s growth. Furthermore, the rapidly advanced food processing industry and the presence of well-established retail chains are expected to boost the distribution and availability of IQF products.

Europe is anticipated to grow at the fastest rate in the individual quick freezing market during the forecast period. The region has a high consumption of frozen food products, including fish, meat, fruits, vegetables, and dairy products. Food producers and logistics firms in the region are increasingly using IQF technology to freeze food goods as a result of the rise in health-conscious consumers.

Moreover, technological innovation is associated with IQF technology, accelerating the expansion of the individual quick freezing market in the coming years. European countries such as Spain, the U.K., France, Germany, and Russia witnessed the rising consumer demand for packed frozen food & beverages.

Individual quick freezing (IQF) is a specialized freezing method that involves individually quick-freezing small pieces of food products, even if multiple product types are frozen in the same area. Individual quick freezing is generally performed using blast freezers and used for products such as chicken, fish, berries, shrimp, peaches, salmon, peas, corn, french fries, dairy products, and others. This method is highly preferred to preserve the texture, flavor, and nutrients of fresh produce.

Government initiatives observed in the individual quick freezing market

The U.S. Food and Drug Administration (FDA) regulations for frozen food packaging ensure that materials are non-toxic and safe. Labels provide accurate nutritional and ingredient information, storage and handling instructions are clear, and tamper-evident measures are in place to protect product integrity.

EU policies ensure the quality and safety of food across Europe, from health and hygiene standards to animal tracing.

Canada's Department of Health is responsible for setting standards and providing advice and information on the safety and nutritional value of food. The Canadian Food Inspection Agency enforces the food safety and nutritional quality standards established by Health Canada.

How is AI Integration Impacting the Individual Quick Freezing Market?

With continuous technological progress over the years, artificial intelligence (AI) plays a critical role in the individual quick freezing market by automatically collecting information during freezing and improving freezing efficiency. The incorporation of data analytics and smart technology into the supply chain is reshaping the frozen food sector. The smart technology also includes fully GPS-tracked vehicles, which would optimize the routes taken by drivers and track real-time data on product temperature, assisting the frozen food industry from both sensory and food safety viewpoints.

Smart technologies, such as sensors and IoT devices, provide real-time tracking and monitoring of frozen food products throughout the supply chain process of the individual quick freezing market. This improved visibility enables firms to regularly monitor humidity, temperature, and other important conditions that ensure the products are kept at the best optimal conditions starting from production to delivery. Advanced freezing technology preserves the quality and freshness of food as well as ensures that end consumers receive products with high nutritional value.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.33 Billion |

| Market Size in 2024 | USD 22.44 Billion |

| arket Growth Rate from 2024 to 2034 | CAGR of 5.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment Type, Technology, Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for frozen foods

The rising demand for frozen foods is expected to boost the growth of the individual quick freezing market during the forecast period. Frozen food preserves the quality and freshness of food products. IQF is a popular freezing method used in the food processing industry. Ready-to-eat and IQF methods have taken frozen products to a higher, top-quality level. IQF method ensures food safety and quality, reduces wastage, and extends its shelf life.

The market has witnessed a large customer base of frozen food products globally, which has led to a rising number of manufacturers' interest in producing frozen food products. Frozen food is available throughout the year irrespective of any season and is less prone to spoil while being stored. These products also help to tackle food waste. A lot of this waste occurs due to the expiry of fresh food before people have a chance to eat it. Freezing of food products can help to extend their shelf life. Thereby reducing food waste.

High initial investment

The high initial investment and maintenance cost associated with individual quick freezing equipment is anticipated to hamper the growth of the individual quick freezing market. Implementation of IQF technology requires significant investment in facilities, tools, equipment, and skilled professionals. Several potential small and middle-sized companies are discouraged from entering the individual quick freezing market due to budget constraints.

Rapid growth of the e-commerce sector

The rapid growth of the e-commerce industry is projected to create significant growth opportunities for the growth of the individual quick freezing market during the forecast period. The rising penetration of e-commerce has positively boosted online delivery services. Several eateries and restaurants around the world are increasingly relying on individual quick-freezing meat and poultry to meet the ongoing demand for exotic dishes.

Consumers are increasingly opting for online delivery services for various food categories, including poultry fruits, vegetables, meat, seafood, dairy products, and others, driving the demand for IQF technology. Additionally, Government authorities, including the U.S. FDA and the European Union, are implementing stringent regulations on the quality and safety of frozen food products.

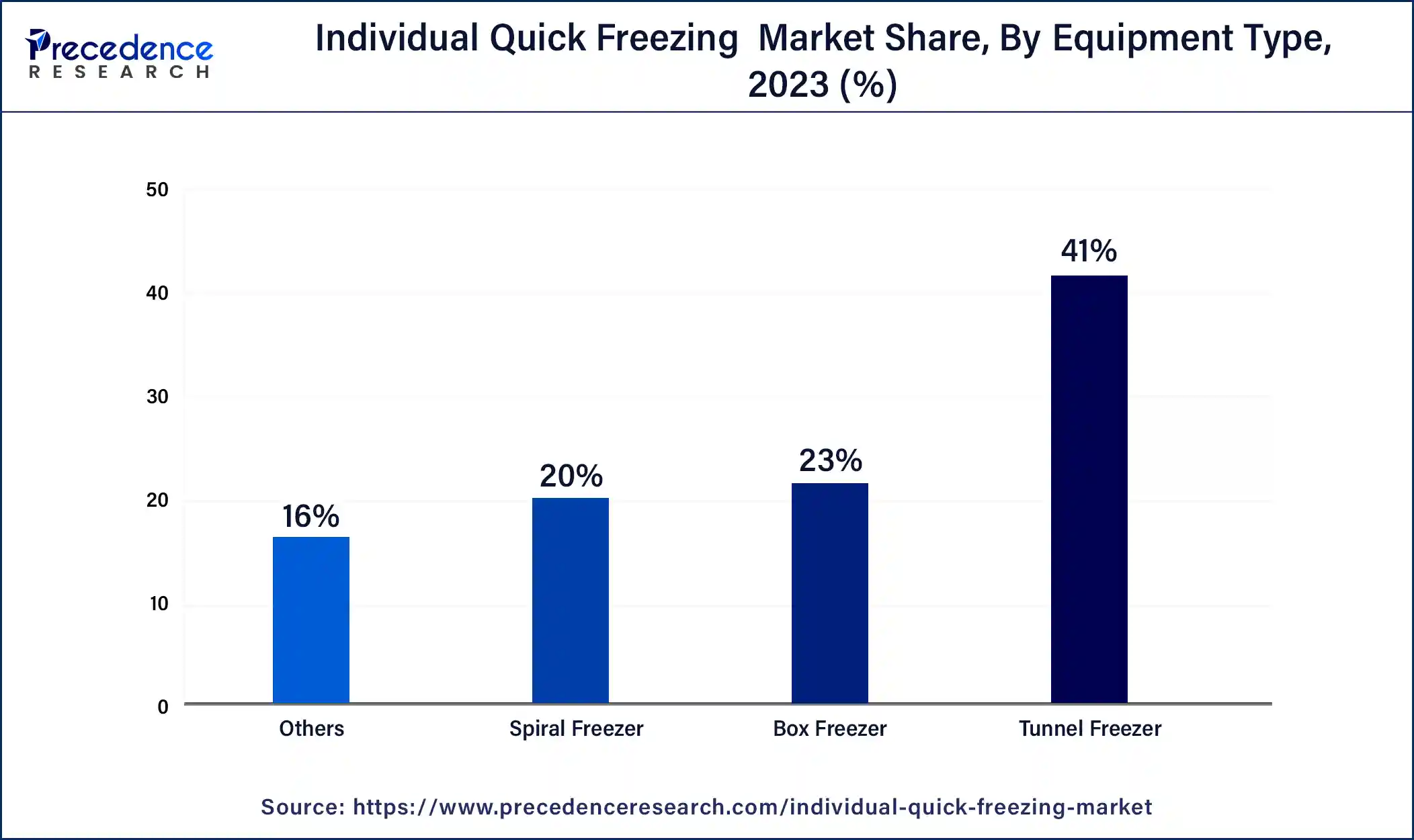

The tunnel freezer segment accounted for the dominating share of the individual quick freezing market in 2023. Tunnel freezers are cooled with carbon dioxide or liquid nitrogen, and the choice of one of these two refrigerants depends on the product to be cooled. A tunnel freezer is extensively used for freezing a variety of food items such as seafood, meat, vegetables, and fruits. Products required to be frozen are sent through a tunnel by an overhead conveyor or on a belt. The tunnel freezer allows rapid freezing and maintains the quality and freshness of the food products.

The spiral freezer segment is expected to witness significant growth in the individual quick freezing market during the forecast period. An individual quick-freezing spiral freezer operates by transporting the products around a rotating drum on a conveyor belt with a rapid linear airflow, which ensures quick freezing results in better food quality, minimizes dehydration, and maximizes yield. IQF spiral freezers are suitable for freezing or chilling food items, such as shrimp, fish, meat, berries, fruits, poultry, vegetables, pasta, grains, cheese, baked goods, and others.

The cryogenic IQF segment held a dominant presence in the individual quick freezing market in 2023. Cryogenic IQF freezer uses liquid nitrogen and Carbon dioxide to flash-freeze the food products. Cryogenic freezing is the fastest IQF freezing method. In cryofreezing, at extremely low temperatures, the food products are immersed directly in liquid nitrogen or CO2 while being moved continuously to ensure they remain separated. Cryogenic IQF ensures quick freezing at very low temperatures, preserving the texture and taste without losing the nutritional value of foods, making it preferable for sensitive products like delicate fruits and seafood. These systems are widely used by manufacturers with small spaces in their production or companies with products at the beginning of a product life cycle. The investment required in a cryogenic freezing solution is significantly lower than in a mechanical solution.

The mechanical IQF segment will witness considerable growth in the individual quick freezing market over the forecast period. Mechanical freezers are more capital-intensive than cryogenic freezers. Mechanical IQF freezing is highly recommended for large-scale and high-volume productions of both raw and finished goods. This system uses a recirculating refrigerant with an air cooler that exchanges heat from the air circulating within the freezer to reduce the temperature of the food items. However, the higher operating temperatures of mechanical freezers often result in longer freezing times and may also result in product dehydration and loss of product quality, owing to more ice crystal formation.

The fruits & vegetables segment registered its dominance over the global individual quick freezing market in 2023. IQF is the most widely used freezing method, ensuring each piece of fruit and vegetable is frozen individually without allowing them to stick together in a blast freezer. Rapid freezing minimizes the formation of ice crystals, preserving the fruit and vegetables' nutrients, color, texture, freshness, and flavor. Since some fruits and vegetables are seasonal, IQF assists in making them available throughout the year. IQF vegetables and fruits can be stored and can extend shelf life. IQF vegetables can often be cooked from frozen with less time and effort.

The meat & poultry segment is projected to expand rapidly in the individual quick freezing market in the coming years owing to the increasing demand for meat & poultry among the large base of the non-vegetarian population. IQF freezes meat and poultry products at -30°C to -40°C temperatures, preserving them for a longer period. IQF ensures individual pieces of meat & poultry are rapidly frozen and also assists in retaining quality, taste, and safety in the modern food processing industry. Individual quick freezing is rapid and effective and reduces the amount of ice crystals in poultry and meat.

Segments Covered in the Report

By Equipment Type

By Technology

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024