January 2025

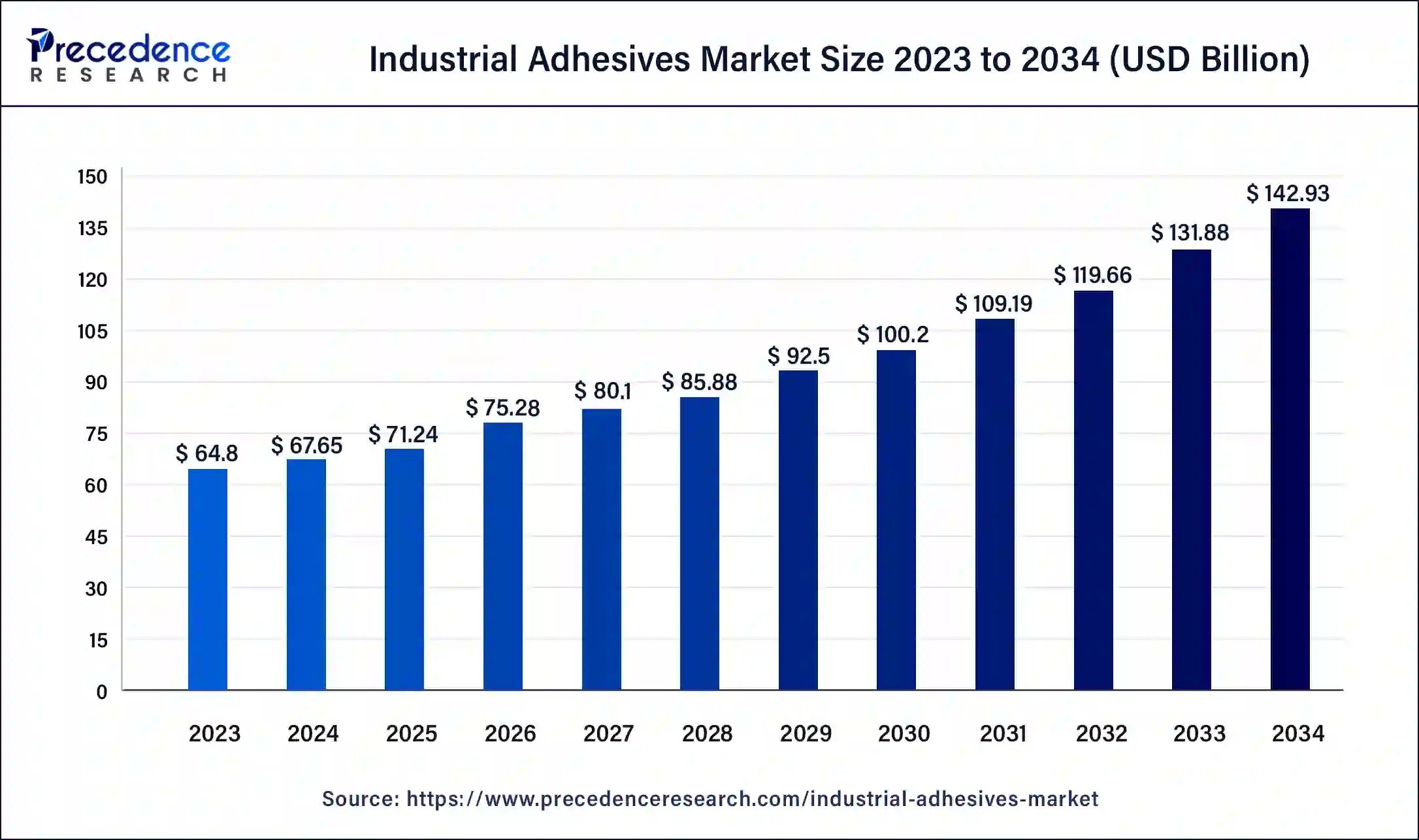

The global industrial adhesives market size was USD 64.8 billion in 2023, calculated at USD 67.65 billion in 2024 and is projected to surpass around USD 142.93 billion by 2034, expanding at a CAGR of 7.7% from 2024 to 2034.

The global industrial adhesives market size accounted for USD 67.65 billion in 2024 and is expected to be worth around USD 142.93 billion by 2034, at a CAGR of 7.7% from 2024 to 2034.

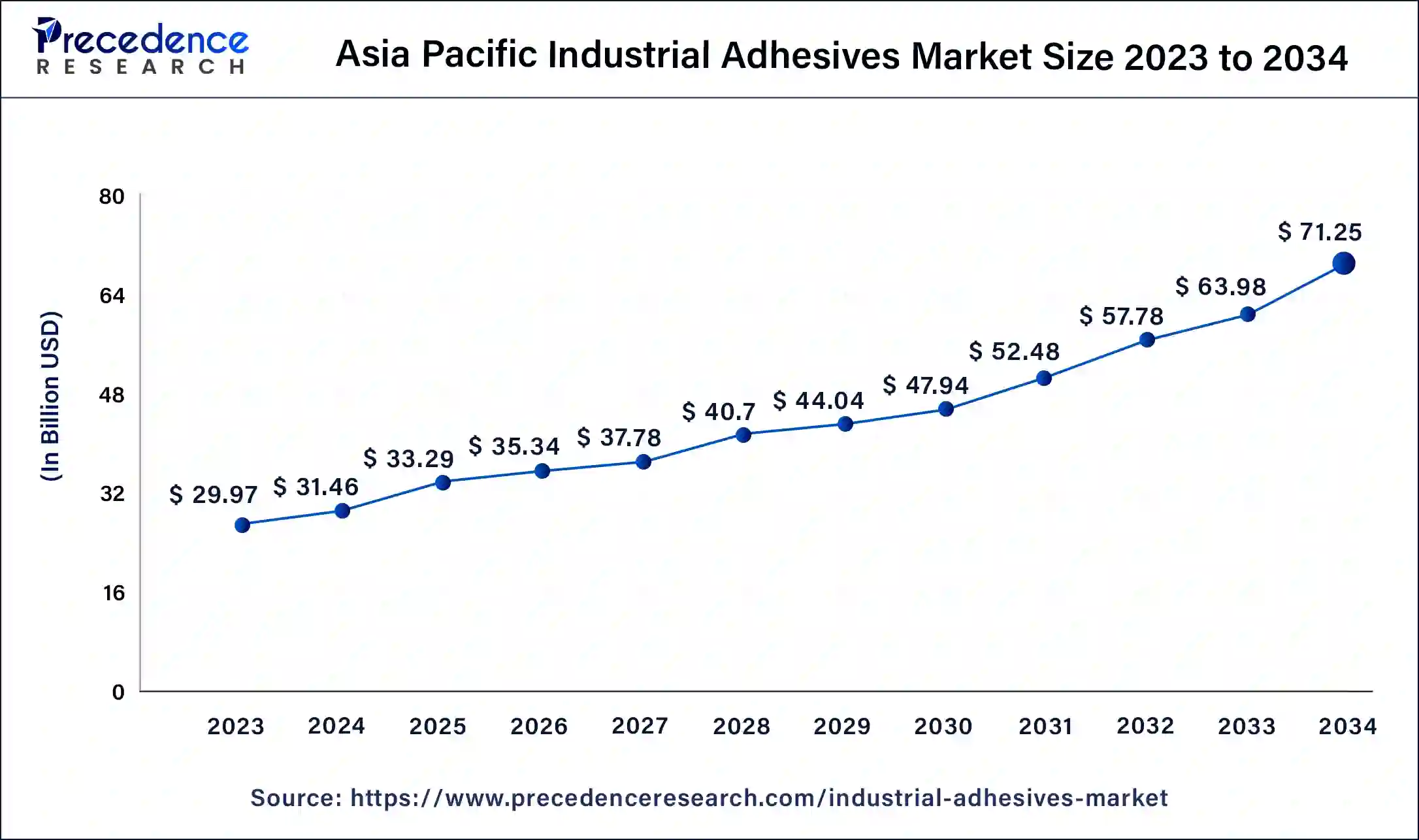

The Asia Pacific industrial adhesives market size was estimated at USD 29.97 billion in 2023 and is predicted to be worth around USD 71.25 billion by 2034, at a CAGR of 8.52% from 2024 to 2034.

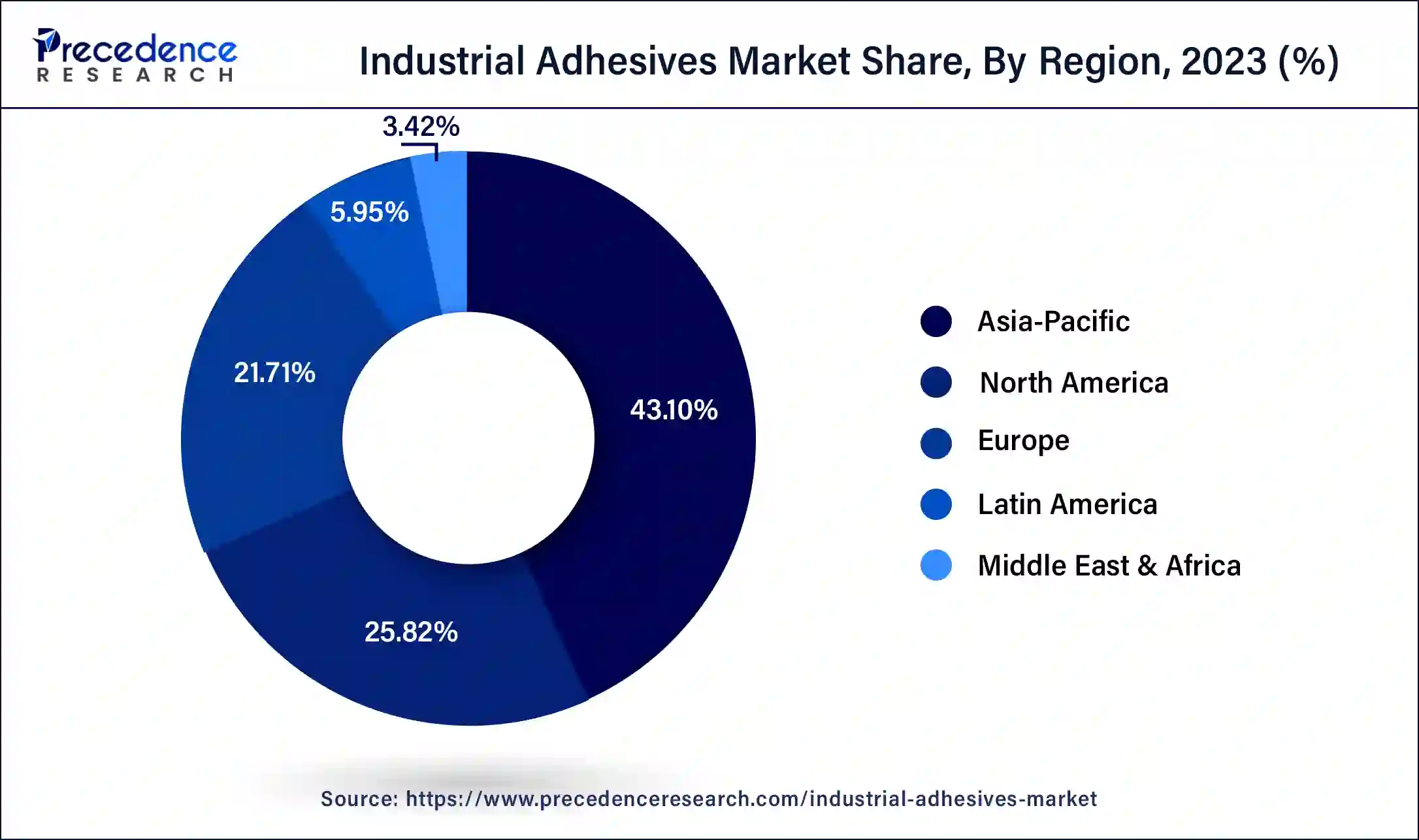

The Asia Pacific is the most opportunistic region in the global industrial adhesives market. The region captured the largest market value share accounting for nearly half of the global market in the year 2023 and the trend anticipated to continue during the analysis period. The prime factor attributed to the profound growth of the region is shifting manufacturing bases of automotive manufacturers in China, Thailand, India, Vietnam, and other Asian countries.

In addition, the region, witnessed accelerating growth in the packaging industry owing to rising demand for packed foods. The above all factors hence contribute prominently in the market growth in the Asia Pacific region.

Significant growth in the automobile sector along with rising demand from packaging industries are some of the prominent factors that drives the market for industrial adhesives. Its increasing application in automotive industry is mainly because of its favorable properties that includes flexibility, lower costs, solvent-free, high fatigue & thermal shock tolerance, less vibration, reduced waste, and high productivity. Industrial adhesives are an excellent replacement for conventional bonding materials such as hoods, fasteners used indoors, deck lid flanges, dashboards, roof panels, and other automotive components.

In addition, advanced bonding technologies help o reduce time as well as cost of the overall manufacturing process that increases the profit margin in an industry. This advantage is mainly gasped by the automotive manufacturers in order to gain maximum rate of profit in less time. Further, the new bonding technology also reduces the overall weight of a vehicle that ultimately enhances its fuel efficiency. This is a major trend accepted worldwide by several automotive manufacturers particularly in the electric vehicles and autonomous vehicles manufacturing process. Increasing government regulation for reducing carbon emission further complement the growing adoption of industrial adhesives in automotive sector.

| Report Highlights | Details |

| Market Size in 2023 | USD 64.8 Billion |

| Market Size in 2024 | USD 67.65 Billion |

| Market Size by 2034 | USD 142.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.7% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

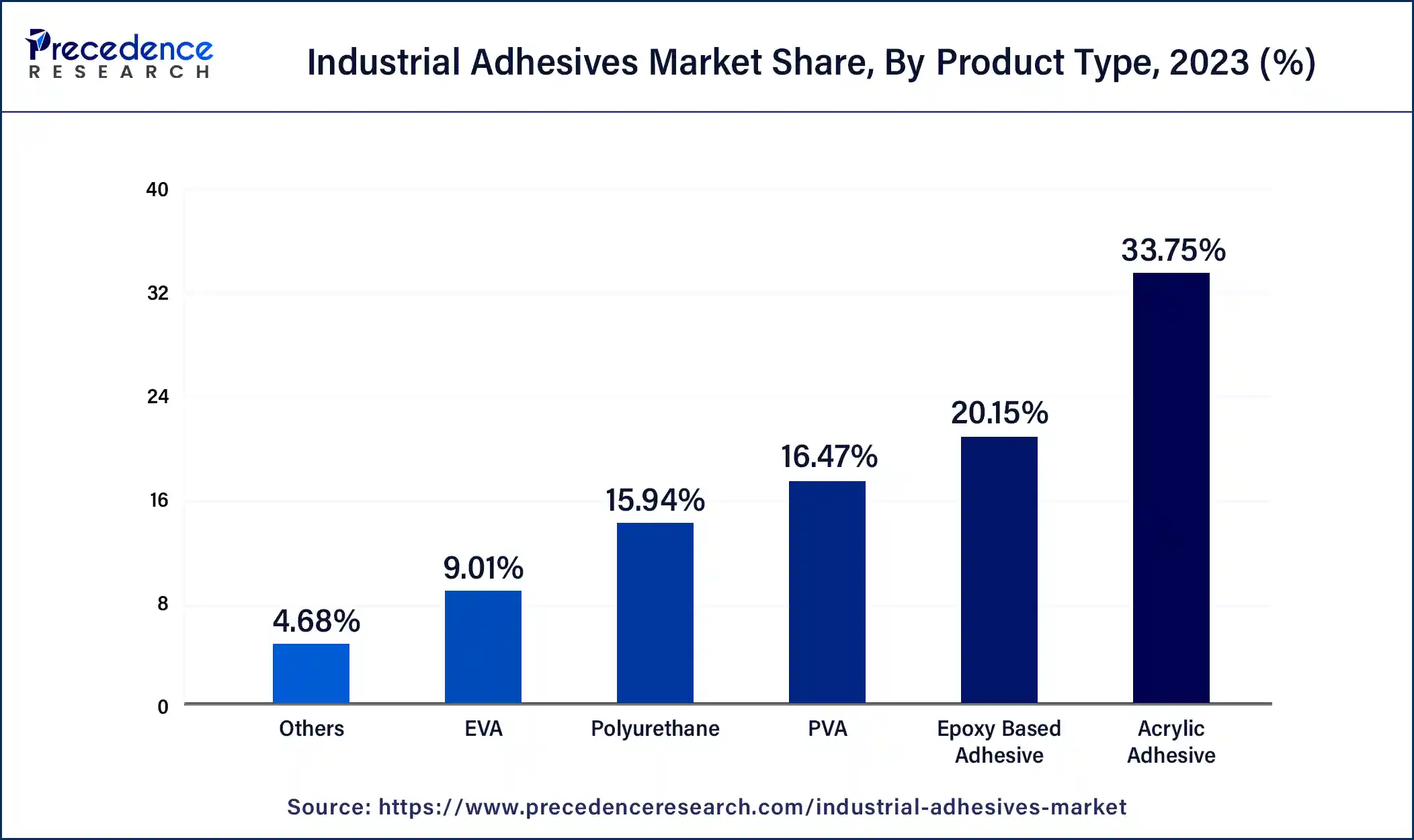

Acrylic adhesives lead the global industrial adhesives market and accounted for a volume share of around 33.75% in the year 2023. They are largely used to improve bonding strength and enhance the aesthetic appeal of metals. Their properties such as acid & solvent resistance and fast curing make them suitable for application in various end-use industries including medical devices, packaging, and furniture. Whereas, polyvinyl acetate is expected to register an average growth due to its properties such as temperature resistance and high boiling. It is significantly used in the packaging and furniture industry because of its superior bond strength and improved creep resistance.

However, the epoxy product segment found its excellent application in the automotive industry because of its oil absorption capacity, durability, high strength, and good wash-out resistance across a wide temperature range. They are mostly used in car bodies due to their high mechanical strength, heat & corrosion resistance, and adhesion to metals. The above-mentioned advantages of epoxy adhesives are likely to thrive the market growth over the upcoming years.

By application, the packaging industry witnessed the highest market penetration of industrial adhesives owing to the rising trend for packed frozen foods. In addition, the increasing application of industrial adhesives for carton sealing, labeling, and corrugated box manufacturing is the other prime factor that contributes significantly to the profound market growth of the packaging segment. Moreover, increasing demand for industrial adhesives for packaging applications particularly from the food & beverage industry anticipated to offer alluring opportunities in the near future.

On the other hand, the footwear segment exhibits the fastest growth in terms of revenue during the forecast period. The growth of the segment is mainly attributed to the increasing application of polyurethane because of its high cohesion and adhesion strength. Solvent-based polyurethane and various other adhesives are significantly used in the manufacturing process of footwear. In addition, the increased impact of Western lifestyle and changing consumer preferences are likely to drive the demand for sports and designer footwear that in turn accelerate the growth of industrial adhesive in footwear applications.

Key players in the global industrial adhesives market adopt various inorganic growth strategies that include merger & acquisition, long term contracts, capacity expansion, partnerships & collaboration, and many others. For example, in January 2017, H.B. Fuller announced to acquire the assets of H.E. Wisdom & Sons, Inc. along with Wisdom Adhesives Southeast, LLC, that is affiliated to the company that strengthen the presence of H.B. Fuller in north America region.

Segments Covered in the Report

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025