April 2025

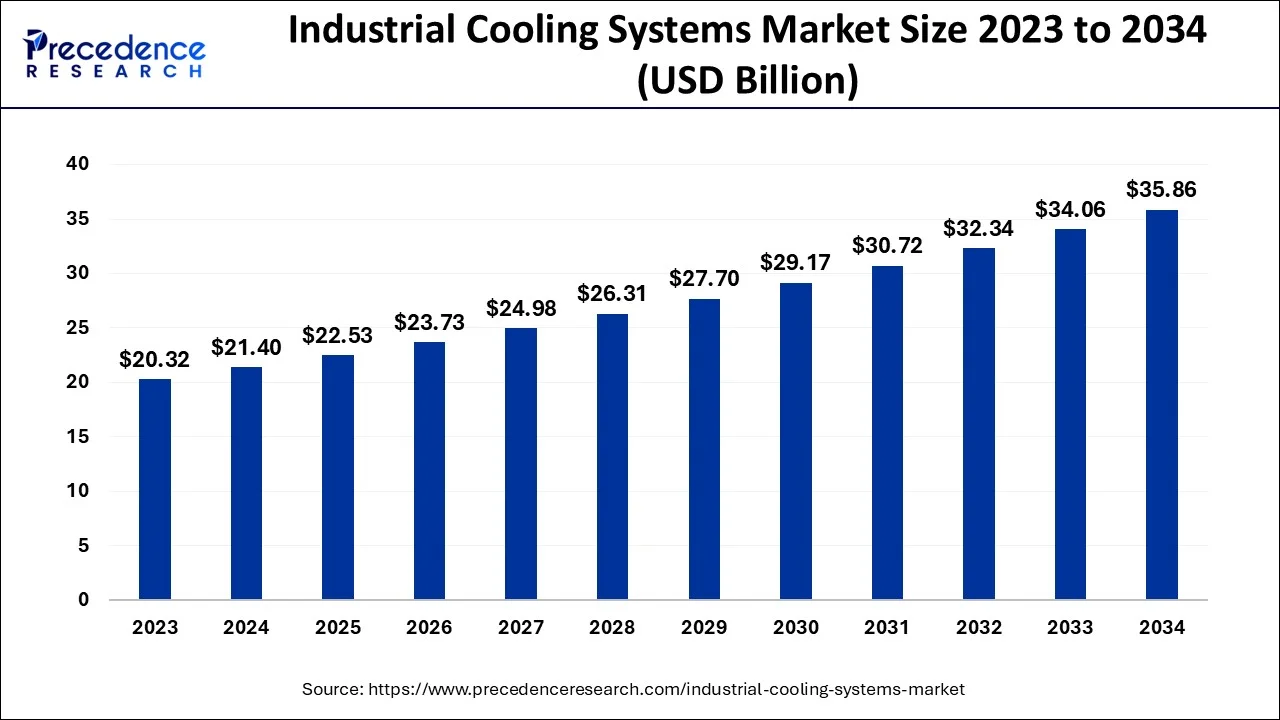

The global industrial cooling systems market size accounted for USD 21.40 billion in 2024, grew to USD 22.53 billion in 2025 and is predicted to surpass around USD 35.86 billion by 2034, representing a healthy CAGR of 5.30% between 2024 and 2034. The North America industrial cooling systems market size is calculated at USD 8.13 billion in 2024 and is expected to grow at a fastest CAGR of 5.43% during the forecast year.

The global industrial cooling systems market size is estimated at USD 21.40 billion in 2024 and is anticipated to reach around USD 35.86 billion by 2034, expanding at a CAGR of 5.30% from 2024 to 2034.

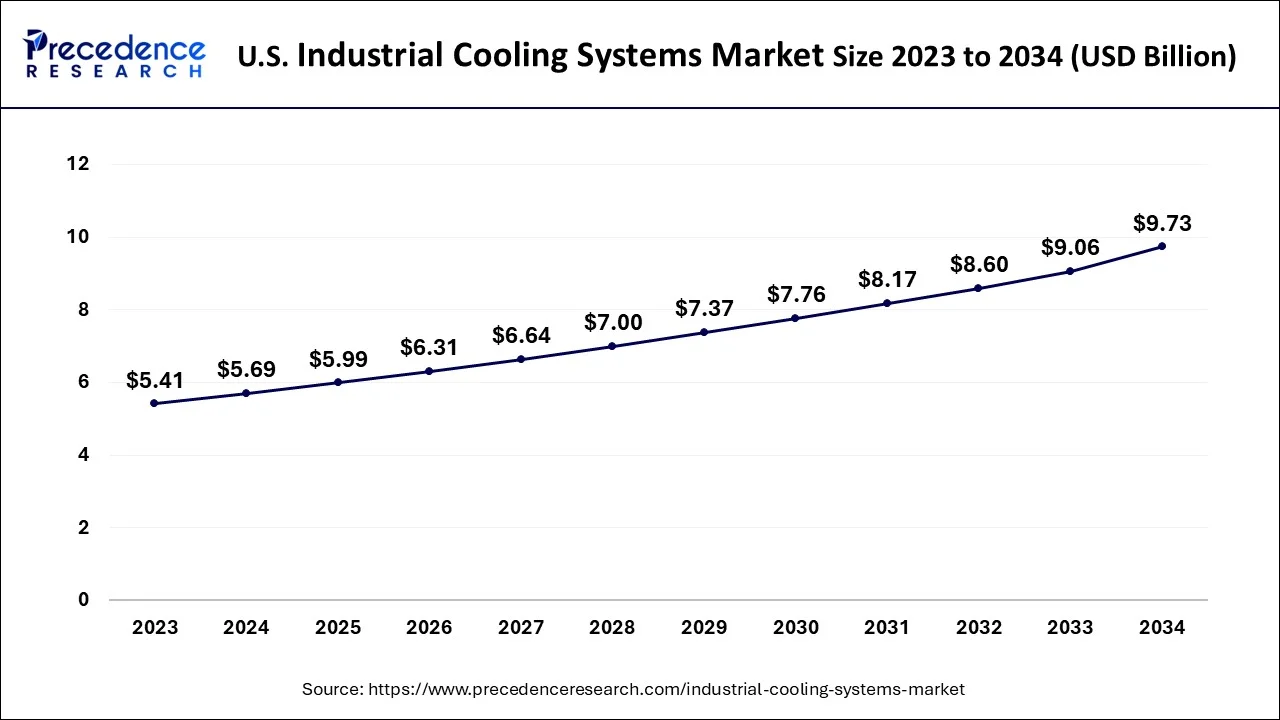

The U.S. industrial cooling systems market size is estimated at USD 5.69 billion in 2024 and is expected to be worth around USD 9.73 billion by 2034, rising at a CAGR of 5.48% from 2024 to 2034.

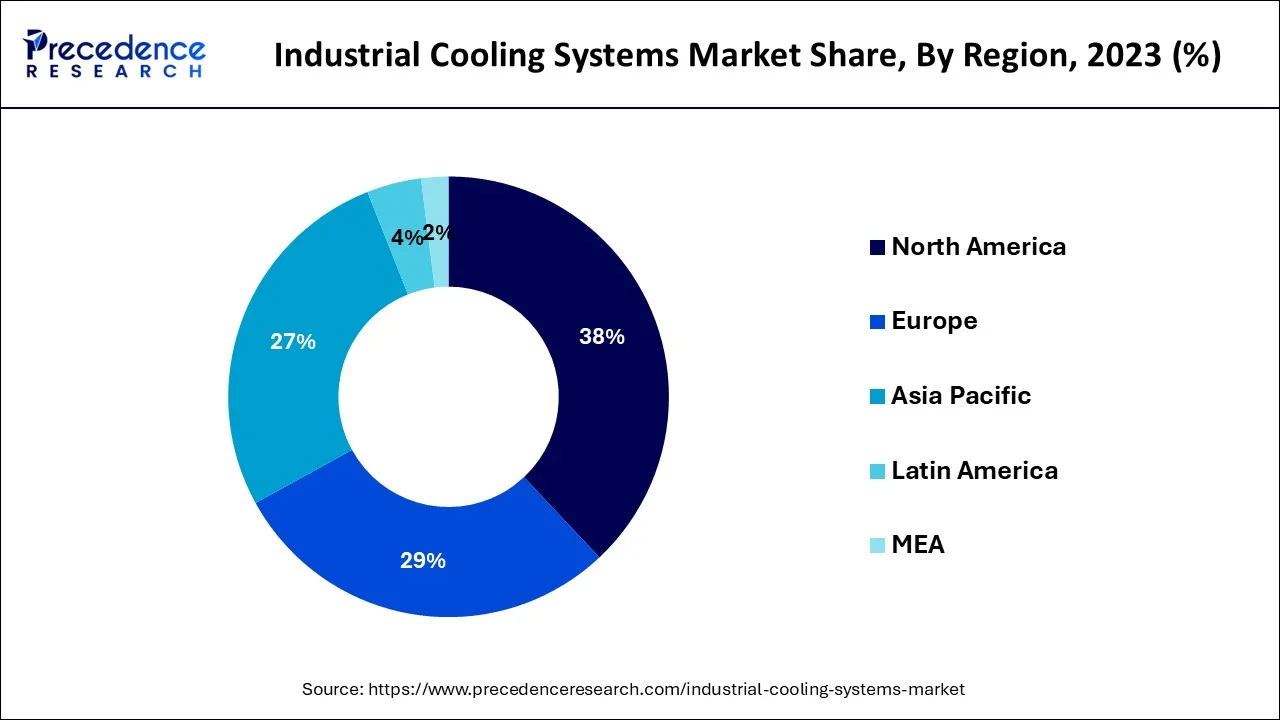

In 2023 the industrial cooling system market share was led by Asia Pacific, and it is predicted that this trend would continue over the next years. It is anticipated that the booming food and beverage industries in well-known nations including China, India, Japan, South Korea, and Indonesia would increase demand for dependable cooling systems. Food quality requirements, cost-effectiveness, and rising online food demand are all promoting the use of contemporary cooling solutions, which is anticipated to drive market expansion for industrial cooling systems over the ensuing years. A significant portion of the worldwide market belongs to North America as a result of its extensive industrialization. Due to urbanization and rising energy consumption in the area, Latin America, the Middle East, and Africa are predicted to have rapid expansion in the worldwide industrial cooling system market. During the projected period, the essential and reliable infrastructure in Europe will replace conventional chillers with cutting-edge industrial cooling systems, creating dependable demand prospects.

Industrial locations are known for their high energy needs, both for cooling and heating purposes, which are often connected to a significant amount of fossil fuel use. Using an industrial cooling system, heat from a process or factory is rejected. Because of their great efficiency, evaporative industrial cooling systems are among the most common across all industries. Industrial cooling systems are frequently utilized in sectors like metalworking, automotive, and chemical to lessen the negative effects of excessive heat produced by various industrial equipment and components. The health of employees, the effectiveness of the equipment, and the quality of finished goods or inventory items can all be negatively impacted by excessive heat in a production process. The cooling apparatus aids in preserving the necessary temperature for various machinery, industrial procedures, and components. Industrial equipment productivity may be increased, and maintenance costs for the machinery can be decreased, by preventing overheating. The chemical business has experienced tremendous expansion during the past several years. Additionally, there has been tremendous expansion in the industrial sector, which has greatly benefited the lubricants industry and contributed to the market's overall growth. Nuclear and thermal power facilities are noticing an increase in demand for cooling equipment. The need for industrial cooling systems is anticipated to rise as energy-efficient cooling systems become more in demand and as technology advances. Over the next years, the market for industrial cooling systems is anticipated to increase as a result of these factors.

Over the course of the projection period, the market is anticipated to grow due to the widespread usage of industrial cooling systems across all key end-user sectors. Over the past ten years, the market for industrial cooling systems has shown spectacular growth, and this trend is anticipated to continue. All significant emerging nations are experiencing a surge in demand for industrial cooling systems as a result of growth in the industrial manufacturing sector. Industrial cooling system sales are being further boosted by macroeconomic factors like rising urbanization and industrial activity as well as technology advancements in the HVAC sector. It is anticipated that the rising concerns about efficient and effective process flow in industrial operations would significantly raise sales of industrial cooling systems and drive the worldwide industrial cooling system market. Additionally, the industrial sector in South and East Asia is expected to develop significantly, and there are growing worries about greenhouse gas emissions, which will likely lead to a substantial market potential for industrial cooling systems worldwide.

Additionally, the better performance qualities of industrial cooling systems, such as high energy efficiency and low power consumption, are expected to increase their popularity. Industrial cooling systems are becoming much more well-known throughout all main growing countries since they significantly contribute to the more effective operation of an industrial facility.

Over the course of the projected period, it is highly predicted that all of the key impacting factors mentioned above would propel the worldwide industrial cooling system market. The main restraints on market growth during the forecast period are the sluggish replacement rate, the difficult installation procedure for industrial cooling systems, and the dominance of traditional coolers in the current industry.

| Report Coverage | Details |

| Market Size in 2024 | USD 21.40 Billion |

| Market Size by 2034 | USD 35.86 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.30% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

The expansion of the pharmaceutical industry, an increase in cold storage facilities in developing nations, and a rise in the use of environmentally friendly and energy-efficient refrigerants have all contributed to the growth of the industrial cooling system market globally. Strict laws governing the use of refrigerants and high energy costs for running and maintaining industrial refrigeration equipment, however, restrain market expansion. On the other hand, market participants are anticipated to benefit from new prospects brought on by the adoption of IoT-enabled refrigeration systems for equipment monitoring in the future.

Because of their superior economic value and efficiency than refrigerated systems, the evaporative cooling segment led the market by product type in 2022, accounting for about two-fifths of the worldwide industrial cooling system market. However, due to rising government efforts in emerging nations like India and a growth in demand for industrial air-cooling systems, the air-cooling category is anticipated to grow at the highest CAGR of 6.50% over the projection period.

Due to the expansion of the food processing sector and the need for stringent temperature control when transporting pharmaceutical and biopharmaceutical items, the transport cooling segment is anticipated to see the highest CAGR of 5.9% over the course of the projection period. However, the stationary cooling sector retained the lion's share in 2022, accounting for more than two-thirds of the worldwide industrial cooling system market. This is because middle-class populations' purchasing power has increased, and internet usage in emerging nations has increased as well. Due to the increasing need for such systems to manage the temperature of machines, components, and equipment on the manufacturing site, the automotive industry is anticipated to experience a large increase in demand for cooling equipment throughout the projection timeline. The automobile sector employs top-notch cooling equipment to build a productive production system and profit from the cost and efficiency-saving advantages. The car industry is being encouraged to replace the outmoded cooling systems with several inventive and technological developments as well as ongoing cooling system enhancements.

By Product Type

By Function

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

December 2024