April 2025

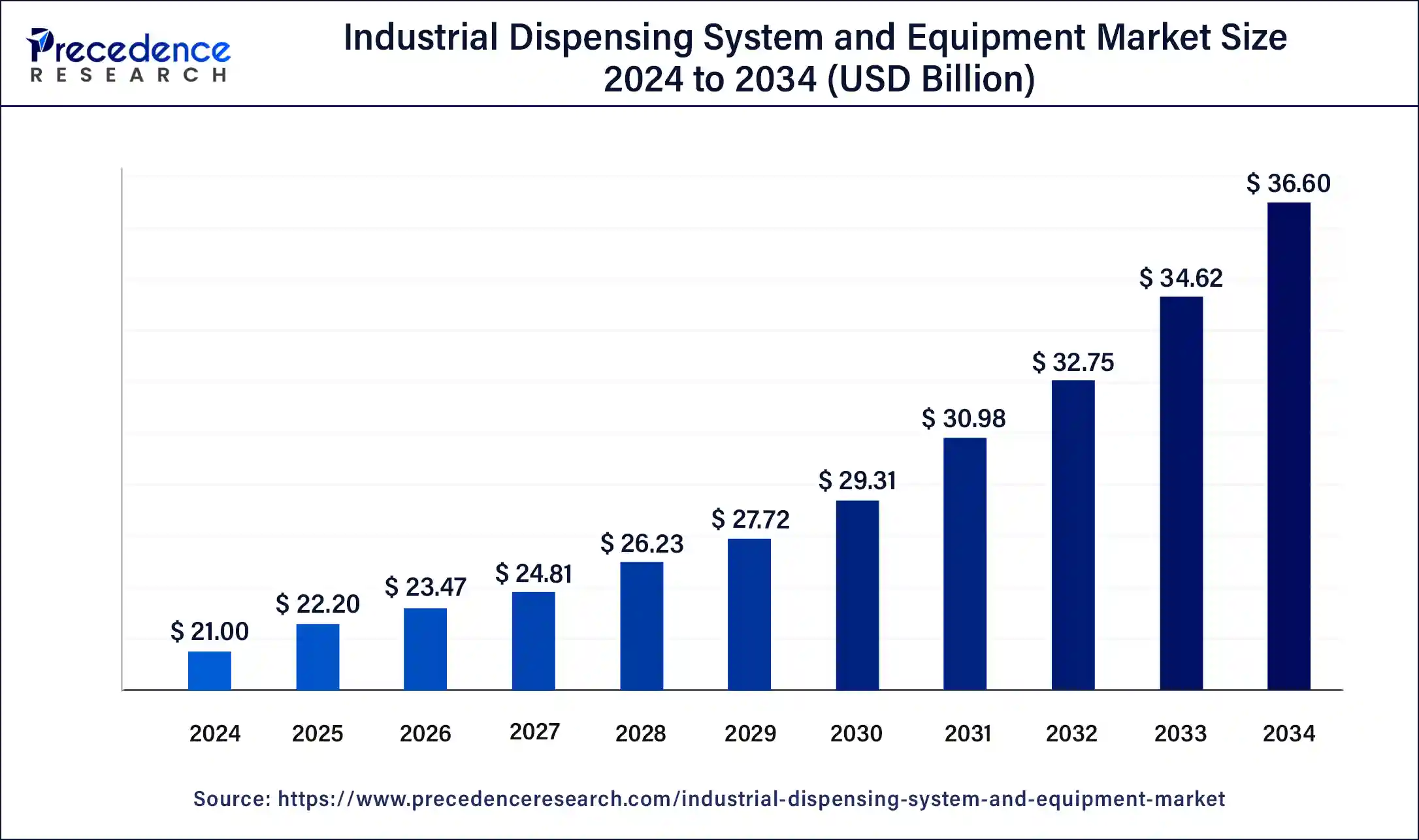

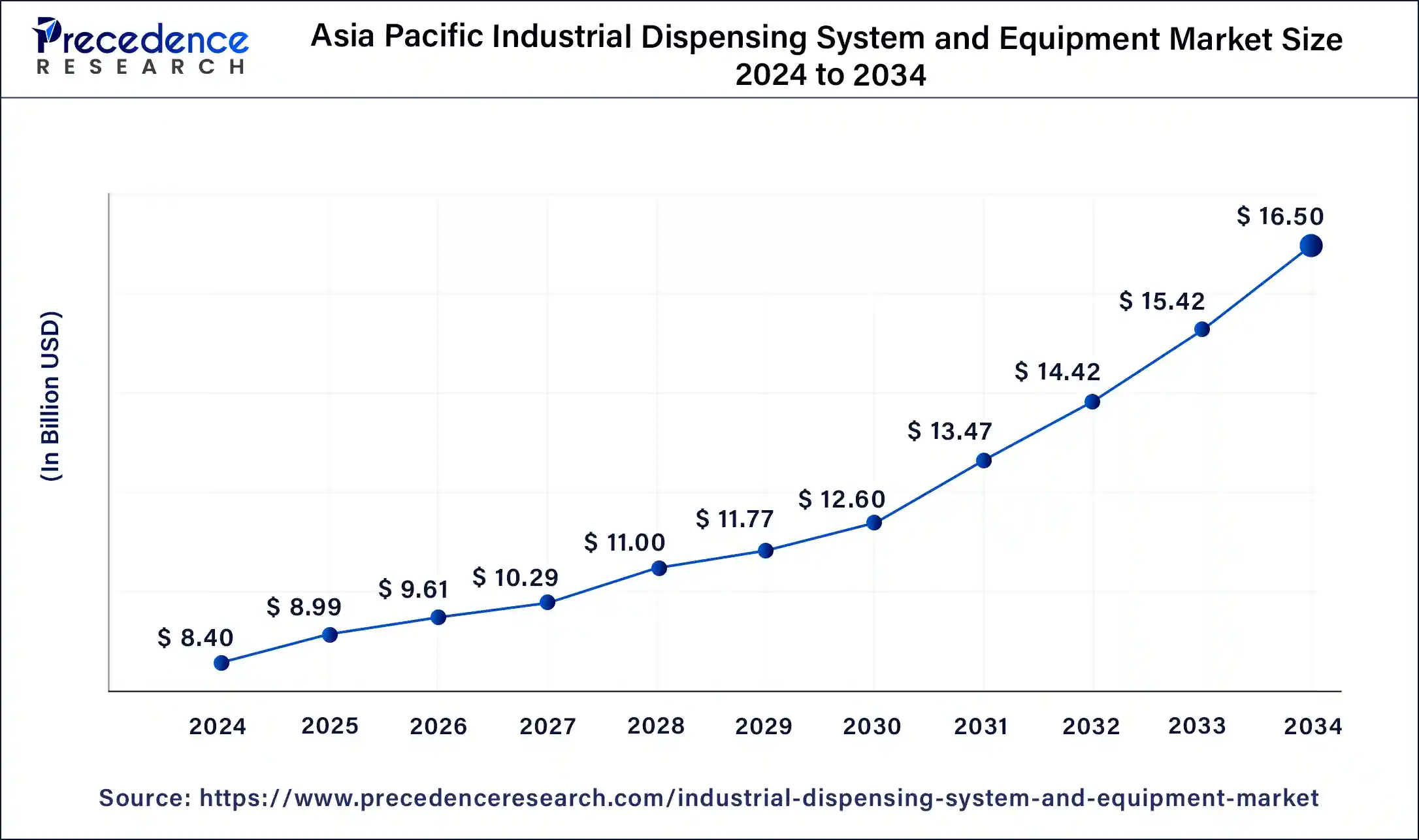

The global industrial dispensing system and equipment market size is calculated at USD 22.20 billion in 2025 and is forecasted to reach around USD 36.60 billion by 2034, accelerating at a CAGR of 5.71% from 2025 to 2034. The Asia Pacific industrial dispensing system and equipment market size surpassed USD 8.99 billion in 2025 and is expanding at a CAGR of 6.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial dispensing system and equipment market size was estimated at USD 21.00 billion in 2024 and is predicted to increase from USD 22.20 billion in 2025 to approximately USD 36.60 billion by 2034, expanding at a CAGR of 5.71% from 2025 to 2034. The rising industrialization across the countries and the machinery that provides accurate dispensing solutions drive the growth of the industrial dispensing system and equipment market.

Artificial intelligence could enhance industrial operations with greater efficiency and productivity. The adaptation of smart technologies such as AI, IoT, machine learning, sensors, and others in the industries. In many industries, AI integration into robotic dispensing systems is revolutionizing overall operations. The integration of robotics in the dispensing system enhances accuracy, streamlines the process, increases overall efficiency, reduces errors, and allows professionals to focus more on industrial operations. Accuracy and precision in operation are the major advantages of AI in robotic dispensing systems. The robotic dispensing system is equipped with advanced algorithms that meticulously measure medication dispense and minimize the risk of human errors.

The asia pacific industrial dispensing system and equipment market size was evaluated at USD 8.40 billion in 2024 and is predicted to be worth around USD 16.50 billion by 2034, rising at a CAGR of 6.98% from 2025 to 2034.

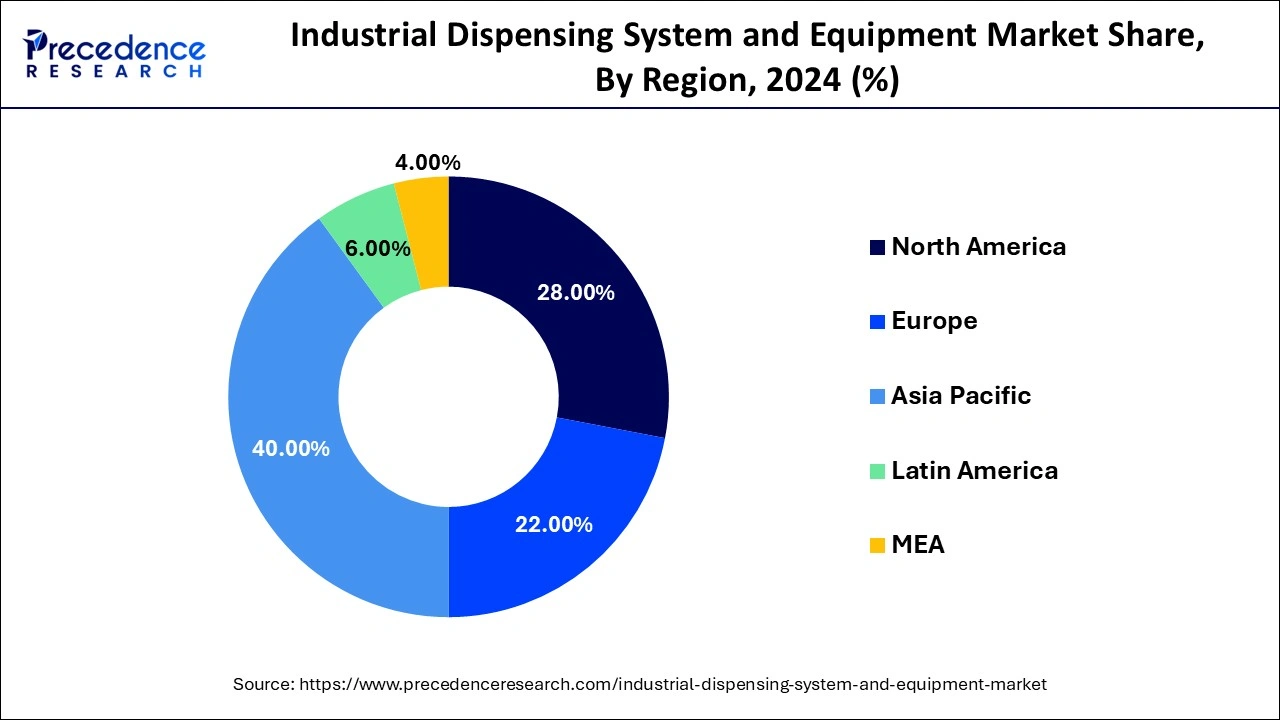

Asia Pacific led the industrial dispensing system and equipment market with the largest revenue share of 40% in 2024. The growth of this region is attributed to the growing demand from the various industries to deliver products and goods needed by the masses. Asia Pacific includes countries having largest population in the globe like India, China. The increased population is expected to generate more demand for the leading industries. The increasing acceptance of industrial machinery and equipment to operate efficiently is further bolstering the industrial dispensing system and equipment market.

North America is observed to be the fastest growing during the forecast period. The growth of this region is attributed to the increasing investment in industrialization and presence of major manufacturing industries, propelling the market's growth on a global scale. Technological advancements like metering systems for adhesive dispensing, sealing and potting provide enhanced accuracy and efficiency. From precision adhesive bonding and dispensing in electronics sector where, every system is engineered to handle unique, materials and conditions which ensures optimal functioning.

The industrial dispensing system and equipment are important parts of the industry. These types of machines or equipment are used to dispense the accurate amount of liquid, such as glues, chemicals, sealants, powder products, and liquid products. The rising industrialization, such as healthcare, pharmaceutical, automotive, consumer goods, personal care, and others, drives the demand for dispensing systems and equipment in industrial operations. The industrial dispensing system and equipment increase efficiency in the workplace. The industrial dispensing system and equipment are continuously used by the manufacturing sectors. These devices are manufactured by manual dispensing.

The global manufacturing value added per capita is expanded by $1879 in 2022 from $1646 in 2015. Northern America and Europe reached their highest with $5093 in 2022, with the manufacturing value added (MVA) per capita in the least developed countries (LDCs) reaching $159. The share of manufacturing as a proportion of GDP has increased in LDCs from 12.1 percent in 2015 to 14.0 percent in 2022. The Asian LDCs are making significant progress, while African LDCs need to change their acceleration to meet the target by 2030.

| Report Coverage | Details |

| Market Size by 2034 | USD 36.60 Billion |

| Market Size in 2025 | USD 22.20 Billion |

| Market Size in 2024 | USD 21.00 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.71% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Operation Mode, End-use, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for industrial dispensing systems and equipment by the pharmaceutical industry

The rising population and the increasing geriatric population are driving the demand for the healthcare and pharmaceutical industry. The rising adoption of dispensing machines in the pharmaceutical industry is a result of providing accurate dosages to patients. In the pharmaceutical manufacturing units, the dispensing system and equipment play an essential role in producing medication with precise and accurate formulas. In the pharmaceutical industries, vending machines are used as the dispensing system for drug and dietary supplement manufacturing plants. The dispensing machine saves the pharmaceutical industry overhead costs. This involves significant consumption of in-house storage resources. The rising investment in the development of the pharmaceutical and healthcare sector across the world is highly contributing to the expansion.

High cost of maintenance

The higher cost of the industrial dispensing system and equipment installation and maintenance of the system limit the adoption of the system by small and medium-scale industries and restrain the growth of the industrial dispensing system and equipment market.

Advancements in the industrial dispensing system and equipment

The adoption of technologies such as the Internet of Things (IoT) revolutionizes industrial dispensing systems and equipment, resulting in better operations and productivity in industries. The evaluation of smart dispensing machines uses IoT, which enables remote monitoring, real-time inventory tracking, and data analytics. With the advancement in technologies, industrial operators manage more efficiency and ensure that they are operational and stocked. Furthermore, the rising research and development activities in the expansion of industrial technologies are emerging as a potential opportunity in the growth of the industrial dispensing system and equipment market.

The fluid dispensing systems segment held the largest share of the market in 2024. The segment is expanding due to reasons like growing demand for liquid material dispensing, which includes chemicals, glues and other liquid wastes from different industries. The increasing population leads to growing rate of urbanization that are driving the sectors like healthcare, automotive, consumer goods, pharmaceutical, electronics, personal care and others, augmenting the markets demand. The liquid dispenser is an important component in leading industries. It uses a fixed amount of liquid material like coatings, paints and others which is prominently used in various types of manufacturing sectors.

The contact dispensing segment led the market in 2024. Contact dispensing is highly demanding due to high-value products having uneven surfaces, deep cavities and dense holes. The segment is expanding due to various reasons like denser droplet pitch, dynamic lines and artful shaping, which helps to create higher droplets in terms of height, less wear and tear along with compatibility for particle-filled fluids.

The fully automated dispensing systems segment held the largest share in 2024. The segment is expanding due to growing demand for industrialization and the continuous demand for products and require goods developing the adoption of various technologies within the domain. The increasing industrial development in the economically emerging along with technological advancements. Various types of dispensing tasks have been offered by a fully automatic dispensing system. It has several advantages in industries like precision, production capacity, ability to dispense correctly, sophistication to avoid wastages. Automation increases production capacity, minimizes time required for manufacturing and improves overall product quality.

The automotive and transportation segment held the largest share of the market in 2024. The dispensing system have been highly adopted by the automotive and transportation sector, augmenting the segments growth significantly dispensing machines holds significant applications such as dispersive adhesives, resins, foams sealants, varnishes and thermally conductive materials etc. While manufacturing the modern cars, there is significant amount of consumption of oil and other essential chemicals which fueling demand for precise dispensing methods in automotive and transportation industries

The offline segment led the industrial dispensing system and equipment market. The segment is growing due to growing adoption of direct sales channels particularly for industrial dispensing systems and the equipment market. Also, direct sales channels offer better discounts due to higher transparency while purchasing the product. Also, shopkeepers provide convenient options as a doorstep delivery of required products, creating opportunity to expand in the market.

The online segment is projected to grow at a rapid pace during the forecast period. The online segment is expanding due to the wide range of products with different types and sizes made available on the online portal creating huge sales through it, fueling the segments demand. The online segment is growing due to the reduction in compulsion to personally visit the store, in turn, saving time as well, which is beneficial in hectic urban lifestyle.

By Product Type

By Dispensing Method

By Automation Level

By End-use

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

December 2024