January 2025

Industrial Salts Market (By Source: Rock Salt, Natural Brine; By Manufacturing Process: Conventional mining, Solar evaporation, Vacuum evaporation; By Application: Agriculture, Chemical processing, Food processing, Water treatment, Deicing, Oil and gas, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2022-2030

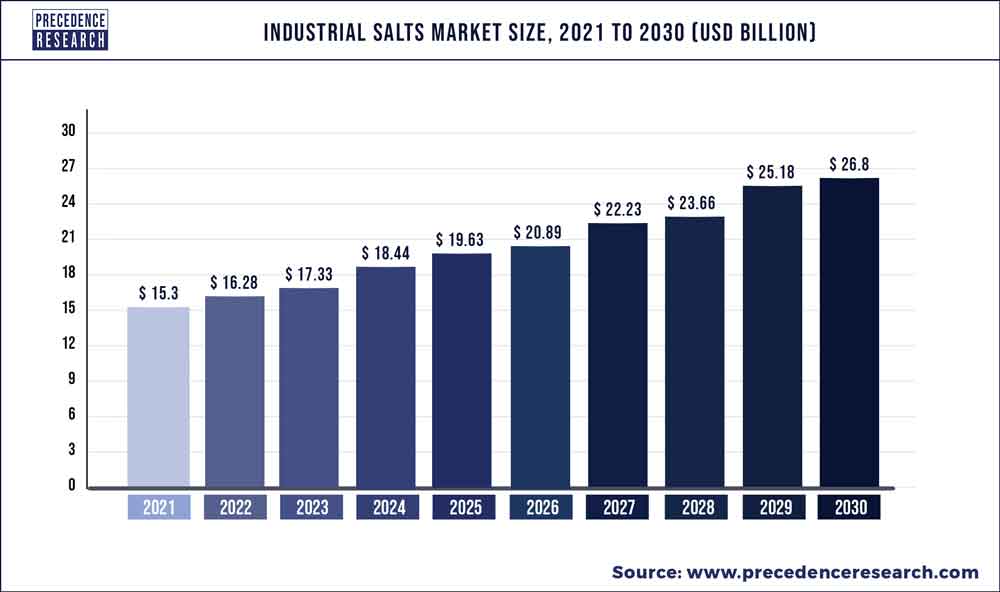

The global industrial salts market size was estimated at USD 15.3 billion in 2021 and it is expected to reach around USD 26.8 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 6.43% over the forecast period 2022 to 2030.

Sodium chloride is derived by using seawater and rock salt for its extraction. This industrial salt is used in agriculture, water treatment, de-icing, chemical processing. When it comes to the usage of industrial sales for the chemical industry it is used in the production of chlorine caustic soda and ash soda. Caustic soda is used in the production of paper and pulp, detergents and soap, chemical products and petroleum products.

For manufacturing glass soda ash is produced across the world and it is also used in the production of soaps detergent in the powdered form and the rechargeable batteries soda ash is also used in the food industry metallurgical processes, pharmaceutical and cosmetic industries. All of these factors or the applications of industrial salts will help in the growth of the market in the coming years.

The demand for industrial salt is expected to grow in the coming years due to the manufacturing of caustic soda and chlorine on a large scale. The demand for the product is expected to grow in the coming years as it is used in many industries. Agriculture chemical processing and water treatment are the major applications of industrial salts. For the production of chlorine and caustic soda industrial salts are used maximum in chemical industries across the world. The industrial salts market is expected to grow well in the coming years as there is no other alternative which is cost effective.

The other products that are available in the market are expensive hence they are not preferred by many industries. There are many local manufacturers and global manufacturers of industrial salts that manufacturer industrial salts in various forms and these salts are provided to various industries. As the raw material which is used in the manufacturing of the industrial salts is derived from the natural resource this market is extremely price sensitive and the amount of profits earned by the organizations are also less.

| Report Coverage | Details |

| Market Size in 2022 |

USD 16.28 Billion |

| Market Size by 2030 |

USD 26.8 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 6.43% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Source, Manufacturing Process, Application, and Geography |

| Companies Mentioned |

Cargill, Inc., INEOS, K+S AG, Mitsui & Co. Ltd., Nouryon, Rio Tinto Group, Compass Minerals America Inc., China National Salt Industry Co., Dominion Salt Ltd, Tata Chemicals Ltd. |

What are the drivers of the industrial salts market?

What are the challenges in the industrial salts market?

What are the opportunities in the industrial salts market?

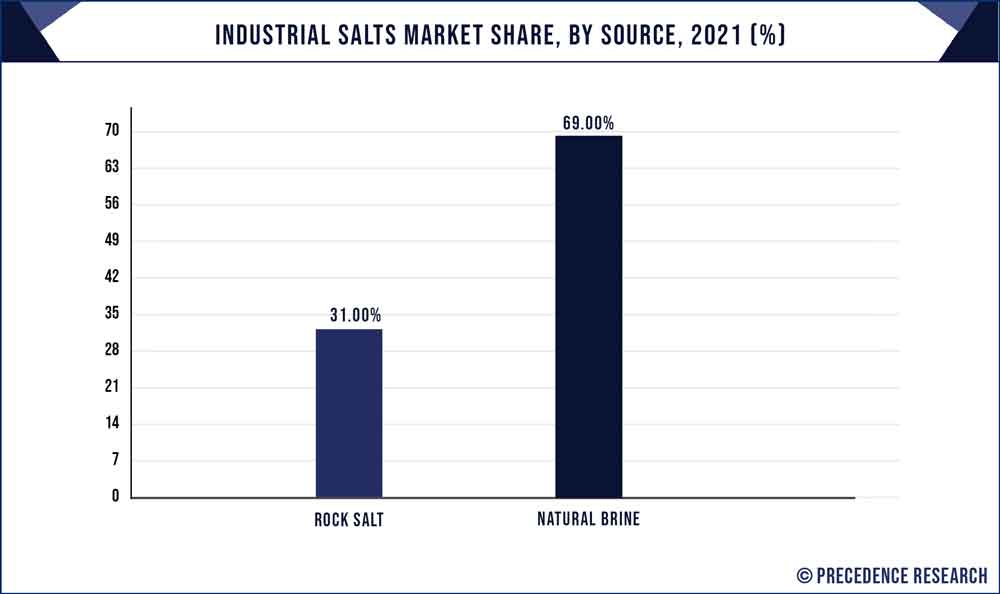

On the basis of the source, the natural brine segment is expected to have the largest market share in the coming years period this segment has dominated the market in the past due to urbanization and industrialization throughout the world. For manufacturing PVC industrial salts are used on a large scale and it is also used in the manufacturing of inorganic chemicals. Highly concentrated constituents like molecules elements and oils which are present in natural brine makes them a better option for manufacturing the industrial salts.

Brains are extremely saline as a large amount of dissolved materials are present in brines. It is used for the water purification procedure and it is also used in softening of water. the need for detergents and other chemicals used in laundry are growing in the North American market. And the increased use of such products will help in the growth of the market in the coming years.

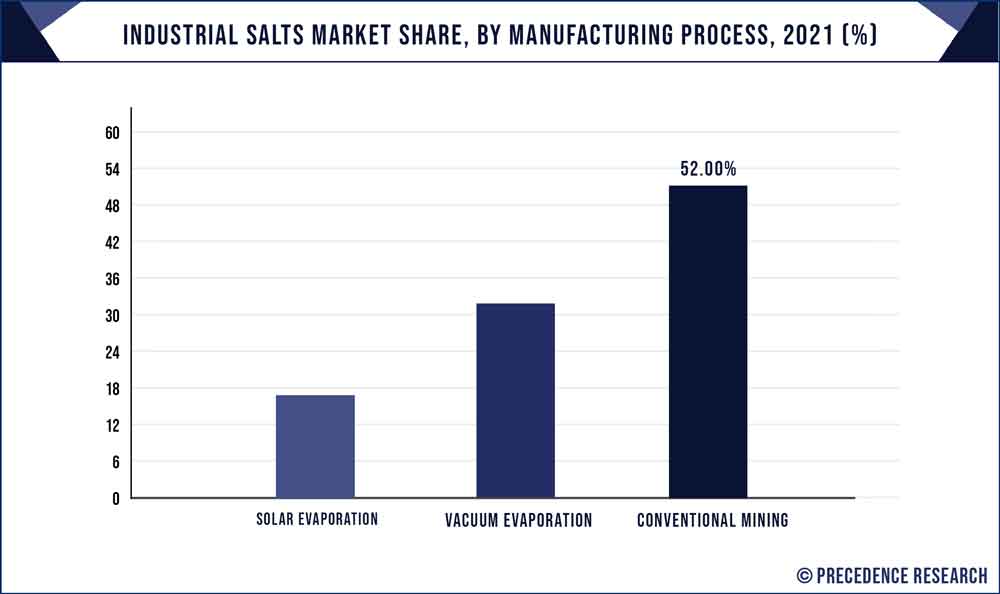

On the basis of the manufacturing process, the conventional mining segment is expected to have the largest market share in the coming years. As plenty salt mines are available throughout the world this segment is expected to grow well in the coming years. In this procedure underground salt deposits are extracted through mining.

Evaporation is the procedure used for extraction of the salt. Cheap resources and cost-effective resources will be instrumental in the growth of the market. As the number of innovations in the market have increased for the production of the pesticides and other products used in agriculture there shall be an increased need for the industrial salts.

On the basis of application, the chemical processing segment is expected to have the largest market share in the coming years as it has dominated the market even in the past. Manufacturing of soda ash and caustic soda is done with the help of industrial salts in chemical industries. As the need four different types of petroleum products has increased due to rapid urbanization the demand for industrial salts is expected to grow in the coming years. Glass is used in a lot of modern constructions and it is also used in the display of electronic products these two applications will also increase the demand for industrial salts in the coming years.

The demand for the cosmetic products and the pharmaceutical products has also increased to a great extent in the recent years especially after the outbreak of the COVID-19 pandemic and the use of industrial salts in the manufacturing of these products will help in the growth of the market during the forecast period. The extensive use of industrial salts in various industries will drive the market growth during the forecast. Most of the products which are used in the manufacturing of the end products are making use of industrial salts as there are no other alternatives available that are cost effective.

Industrial Salts Market Share, By Region, 2021 (%)

| Regions | Revenue Share in 2021 (%) |

| North America | 21.60% |

| Asia Pacific | 39.40% |

| Europe | 27% |

| Latin America | 7% |

| MEA | 5% |

Why Asia Pacific region is dominating in the industrial salt market?

Asia Pacific region has dominated the industrial salt market in the past with the largest market share in terms of revenue and it will continue to grow in the coming years. Rapid industrialization and urbanization are two main factors that have resulted in the growth of the market in the Asia Pacific region.

Increased need for cleanliness and health care has created more demand for various products that are used as cleansing agents and these cleansing agents are manufactured with the help of industrial salts hence the market is expected to grow well in the coming years for the Asia Pacific region.

The demand for the disinfection products and laundry detergents has grown to a great extent. As the population of various nations in the Asia Pacific region like China and India is huge the demand for different types of food products will also help in the growth of the market in the coming years.

Industrial salts are used in the agricultural sector and they increased use of this product to meet the growing demands of food in the various nations of Asia Pacific region will help in the growth of the market in the coming years period industrial salts are used in the manufacturing of herbicides and pesticides. The government of various regions are making investments which will help in the growth of the market in the coming years.

The market in China is growing at the largest pace and the amount of salt produced in China is maximum as compared to any other nations in the Asia Pacific region. Out of the total salt production across the globe 8.8% of it is manufactured in India.

Segments covered in the report

By Source

By Manufacturing Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

September 2024

October 2024