February 2025

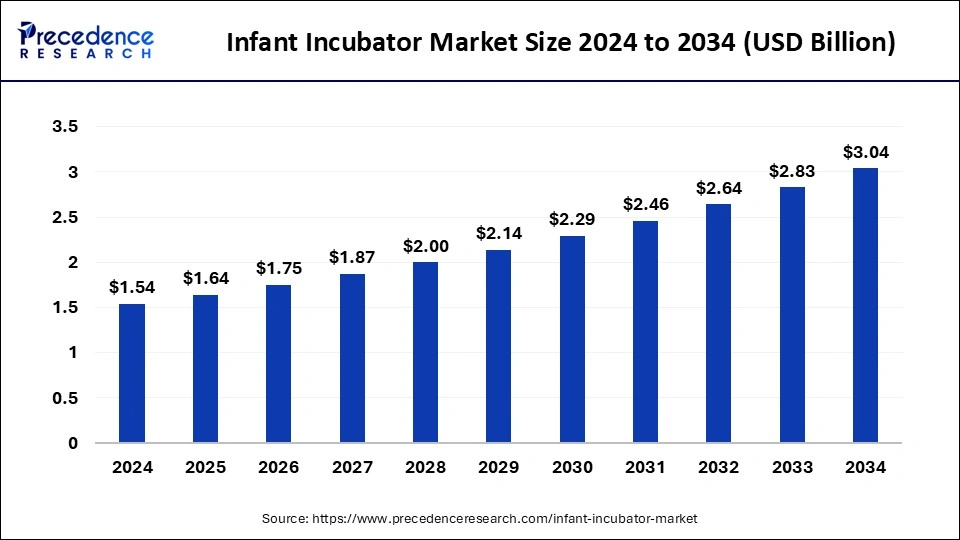

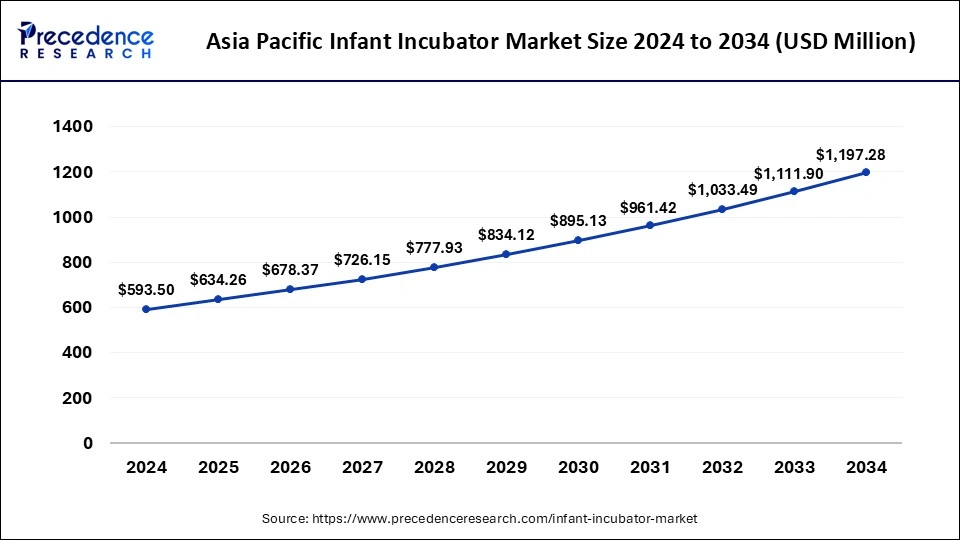

The global infant incubator market size accounted for USD 1.64 billion in 2025 and is forecasted to hit around USD 3.04 billion by 2034, representing a CAGR of 7.10% from 2025 to 2034. The Asia Pacific market size was estimated at USD 593.50 billion in 2024 and is expanding at a CAGR of 7.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global infant incubator market size accounted for USD 1.54 billion in 2024 and is predicted to increase from USD 1.64 billion in 2025 to approximately USD 3.04 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034.

The Asia Pacific animation market size was exhibited at USD 593.50 million in 2024 and is projected to be worth around USD 1,197.28 million by 2034, growing at a CAGR of 7.30% from 2025 to 2034.

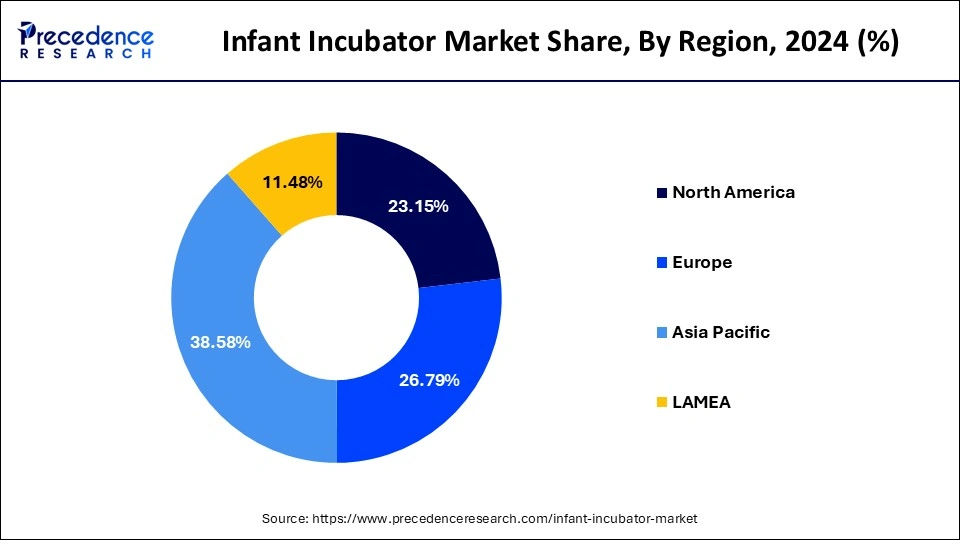

North America is anticipated to dominate the global infant incubator market between 2025 and 2034. Infant incubators are necessary for nations with dense populations due to the rise in preterm birth rates. Furthermore, technological advances in the neonatal care sector, including developing cutting-edge incubators such as double-walled incubators, microprocessor-based servo-controlled temperature systems, and incubators with thermal-neutral environments, aided market growth.

Europe is projected to grow due to various benefits that promote newborn health. The infant incubator industry is being driven by advancements in neonatal care, an increase in the birth rate of premature babies, and increased awareness. Furthermore, the increased number of NICU unit installations drives market growth over the projected period. Baby incubators improved premature baby survival and reduced neonatal hypothermia.

The infant incubators market is growing due to rising concerns about newborn health, an increase in the occurrence of chronic infections and a number of infants dying suddenly and unexpectedly in hospitals. According to the World Health Organization (WHO), an estimated 15 million premature babies are born yearly, more than one in every ten babies. Each year, approximately 1 million children die from preterm birth complications.

Many surviving babies are disabled for the rest of their lives, including learning disabilities and visual hearing impairments. Furthermore, the occurrence of numerous epidemics, as well as the looming health consequences they pose, has increased the requirement for intensive care incubators across healthcare facilities, promoting market growth. Moreover, the increasing acceptance of newborn incubators by several end users, such as hospitals and pediatric and neonatal intensive care units, will drive the market forward in the coming years.

The healthcare industry has emphasized the benefits of government bodies cooperating to advance healthcare facilities in the United States.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size by 2034 | USD 3.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

New incubators with top adjustment elements are now available

Due to various ongoing advances in neonatal care, premature infants have greater access to medical therapy than before. If the newborn requires surgery, preserving them in an incubator increases their probability of recovery because the equipment allows medical experts to prepare them in the best possible environment. Furthermore, as innovative technologies such as using webcams in NICUs allowed families to connect with their infants, this advancement has resulted in visible positive therapy outcomes in hospitals and enhanced patient satisfaction.

For instance, the Fluke Biomedical INCU II is a complete incubator/radiant warmer analyzer that, by adhering to global standards, simplifies testing while guaranteeing the proper operation and security of transport incubators, infant incubators, and as radiant warmers.

Loud noises produced by premature infant incubators may lead to hearing loss

Newborn incubators play a significant role in the healthcare sector to provide better healthcare services. Despite their dominance, incubators have limited drawbacks. The neonatal intensive care unit (NICU) requires radiant warmers and incubators to offer a thermo-neutral surroundings for preterm infants. Various hospitals in middle-income and low-income countries cannot afford the high maintenance and capital costs of presently available thermoregulation gadgets, so affordable, high-quality equipment is needed.

Furthermore, preterm infants necessitate specific care and must spend days, if not months, in neonatal units equipped with monitoring devices and incubators to help control their cardiorespiratory and temperature function. Such devices produce noise from switches, fans, and alarms. Environmental noise has been associated with a greater risk of brain development issues and disrupting activities such as recreation and sleep. The abovementioned factors may cause a decline in infant incubator demand over the following decade.

The use of neonatal intensive care units is increasing.

The natality of underweight babies and other baby abnormalities is the primary driver of market expansion. The increasing use of neonatal intensive care units for premature babies further improves the market.

According to the National Library of Medicine, 39 220 infants (12.4%) were admitted to the NICU among the live births, resulting in a mean of 1.46 NICU patient days per birth. High GA and BW newborns reported 96% of births (307 417), admission in NICU is 69% (26 918), and 25% (118 027) of NICU patient days.

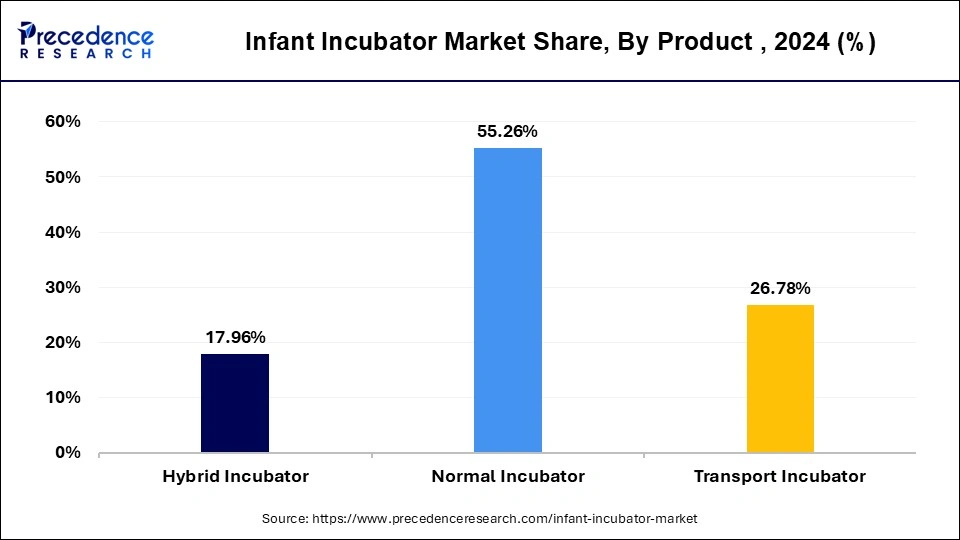

Based on the product, the infant incubator market is segmented into Transport Infant Incubators and Neonatal Intensive Care Unit Incubators. Intensive care incubators are anticipated to increase, registering the fastest-growing CAGR over the projected period. Pathogens, dangerous light levels, climate control and defense against allergens, and loud noise are among the features of an intensive care incubator.

This incubator's ability to control humidity protects a baby's skin from brittleness or cracking and extreme water loss. As a result, intensive care incubators will grow rapidly during the anticipated period. For instance, in December 2021, the US Food and Drug Administration (FDA) approved 510(k) authorization to Medtronic plc., a world leader in healthcare technology, for its INVOS 7100 cerebral/somatic oximetry system for children aged newborn to 18.

In 2022, the transport infant incubator segment was the largest An infant incubator called a neonatal transport incubator offers medical attention and transportation for premature or ill neonates. Neonatal transport incubators are designed to keep young children safe and secure while being transported, as well as to keep an eye on their vital signs and administer life support as necessary. The device is designed with special care to be quite compact, which makes movement easier.

A baby tray is on a trolley covered by a fiberglass or acrylic structure to provide the baby with a closed environment. Openings allow medical personnel to access the baby as needed, and separate openings are provided to insert oxygen tubes, etc. For instance, the TI-2000 transport incubator is designed for the short-distance transportation of preterm births.

It offers a more convenient transport operation process and establishes a comfortable transfer environment by keeping comfort and convenience as the primary design concepts while maintaining a constant temperature.

Infant Incubator Market, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Hybrid Incubator | 244.42 | 259.75 | 276.26 |

| Normal Incubator | 755.12 | 800.86 | 850.05 |

| Transport Incubator | 356.00 | 382.82 | 411.93 |

Based on the end-user, the infant incubator market is segmented into hospitals, pediatric and neonatal intensive care units, and others. Hospitals had the largest market share in 2022. This segment growth has been driven by the rising prevalence of chronic and infectious diseases in infants and an increase in the number of preterm births, propelling the sales of infant incubators worldwide.

On the other hand, the pediatric and neonatal intensive care unit is the fastest-growing segment over the forecast timeframe. The NICU incubator has a water bath to add humidity, a heating element, an oxygen inlet, a fan for forced convection, and an access port for nursing care.

The sector is anticipated to be influenced by the high prevalence of neonatal jaundice, a growing proportion of preterm births, and the development of new products for use in Neonatal Intensive Care Units (NICU).

The global infant incubator market is segmented into neonatal hypothermia, lower birth weight, genetic defects, and others. The neonatal hypothermia sector is predicted to lead the worldwide infant incubator industry.

The market is expanding due to a rise in the incidence of preterm birth, which causes low body temperature, particularly in the delivery room, due to a lack of stored body fat. Neonates suffering from cold stress or hypothermia require a thermostable environment to maintain their body temperatures. According to the World Health Organization, hypothermia is a leading cause of infant illness and mortality.

Furthermore, the lower birth weight segment is estimated to grow the fastest. Intrauterine growth restriction, prematurity, or both cause low birth weight. It contributes to various adverse health outcomes, including fetal and neonatal mortality and morbidity, impaired growth and cognitive development, and later NCDs. Infants with low birth weight are approximately 20 times more likely to die than heavier infants. WHO defines low birth weight as a birth weight of fewer than 2500 grams (5.5 pounds).

Infant Incubator Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Neonatal Hypothermia & Low Birth Weight | 754.12 | 804.62 | 804.62 |

| Jaundice | 417.06 | 443.66 | 443.66 |

| Others | 184.35 | 195.14 | 195.14 |

By Product

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024