February 2025

Influenza Vaccine Market (By Vaccine Type: Quadrivalent, Trivalent; By Technology: Egg-based, Cell culture; By Age Group: Pediatric, Adult; By Route of Administration: Injection, Nasal Spray) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

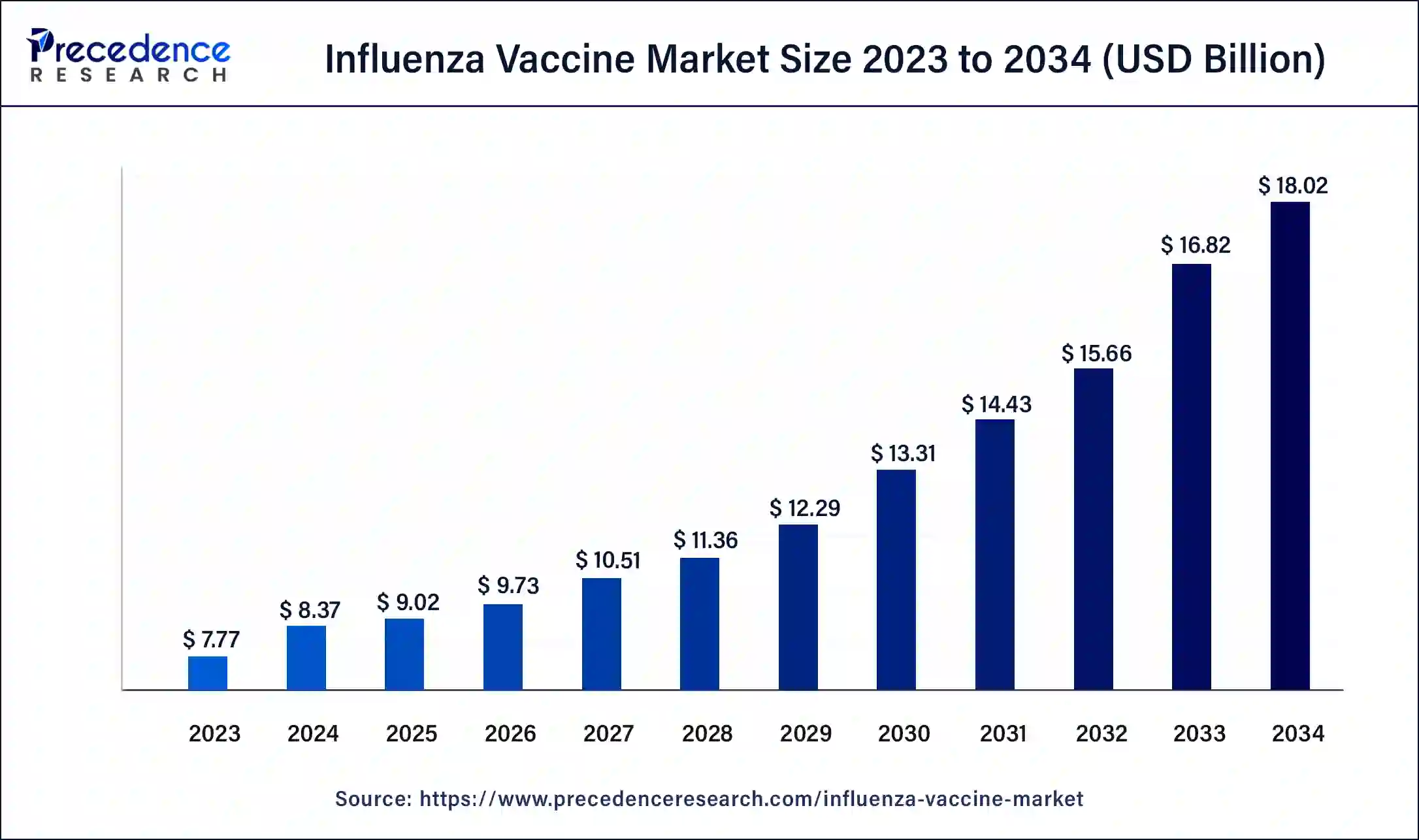

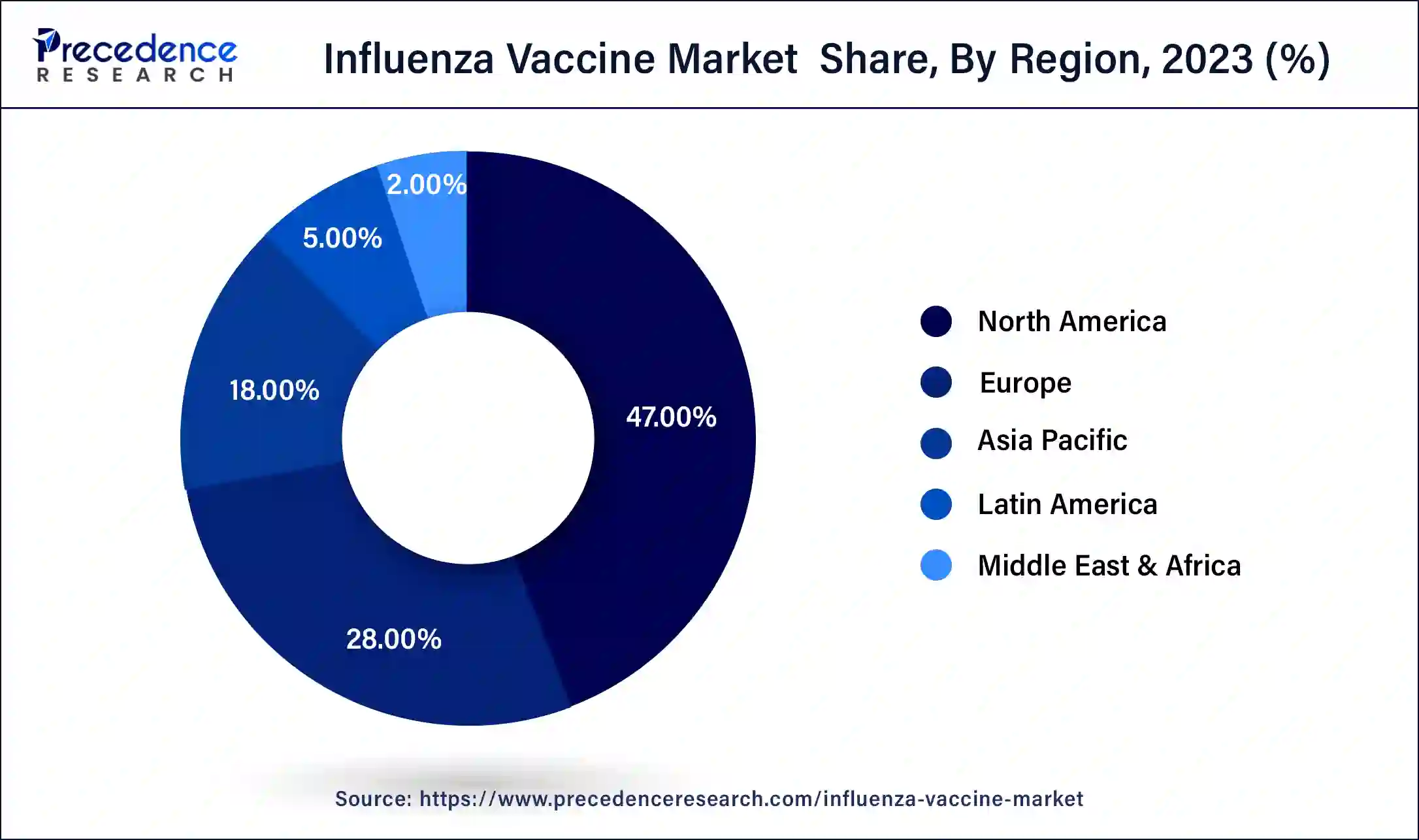

The global influenza vaccine market size was USD 7.77 billion in 2023, calculated at USD 8.37 billion in 2024, and is expected to reach around USD 18.02 billion by 2034, expanding at a CAGR of 8% from 2024 to 2034. The North America influenza vaccine market size reached USD 3.65 billion in 2023.

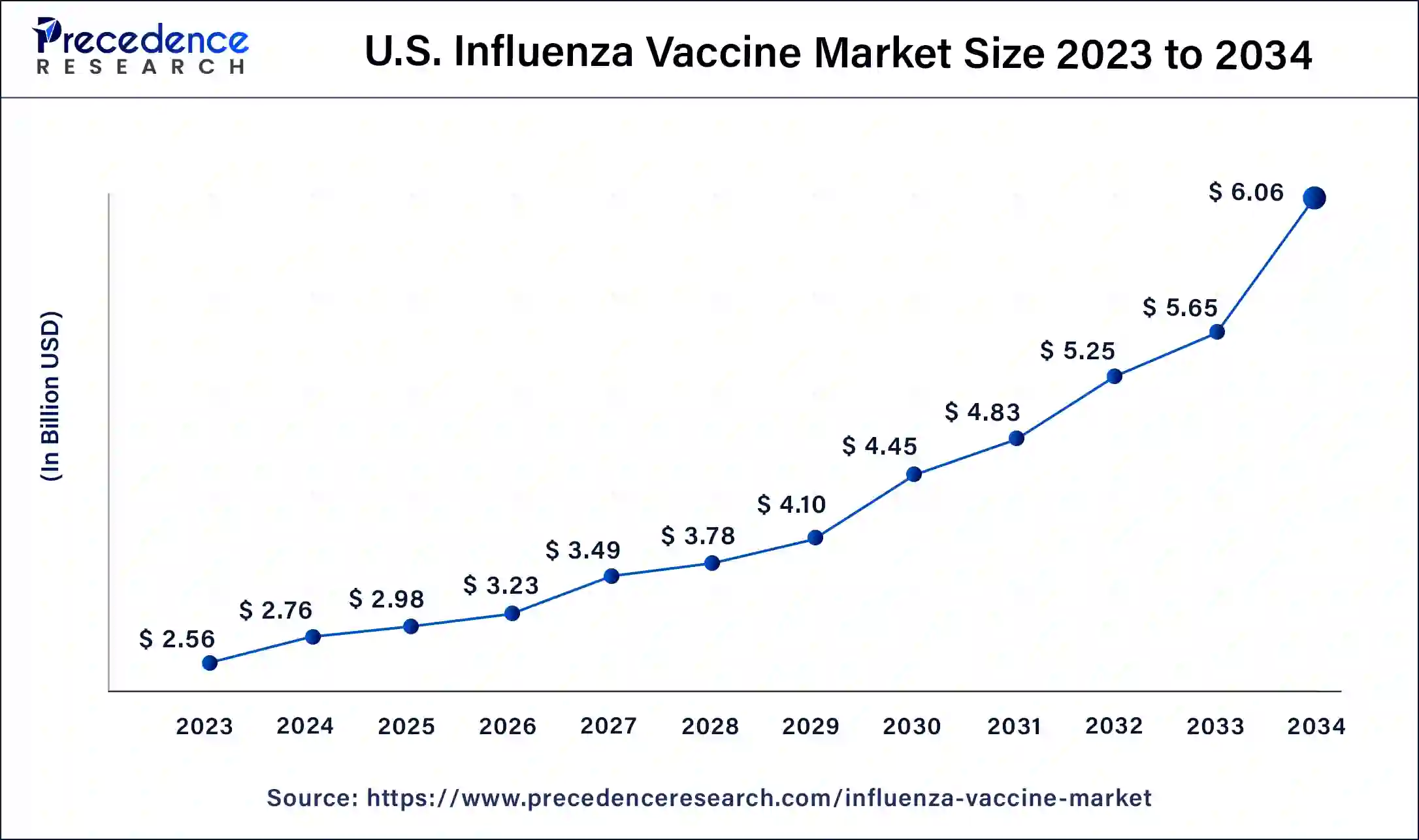

The U.S. influenza vaccine market size was valued at USD 2.56 billion in 2023 and is expected to reach USD 6.06 billion by 2034, growing at a CAGR of 8.17% from 2024 to 2034.

North America has held the largest revenue share at 47% in 2023. In North America, a well-established healthcare infrastructure drives advanced trends in the influenza vaccine market. Strong government support and immunization programs, coupled with heightened public awareness, contribute to consistent demand. Technological innovations, such as digital vaccination monitoring, are on the rise. Additionally, strategic partnerships between pharmaceutical companies and research institutions foster the development of next-generation influenza vaccines, aligning with the region's commitment to public health excellence.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific influenza vaccine market experiences dynamic trends shaped by increasing healthcare awareness and expanding immunization initiatives. Growing populations in emerging economies drive demand, prompting investments in vaccine production and distribution infrastructure. The region sees a surge in collaborations for technology transfer and localized vaccine manufacturing. Tailored vaccination strategies, public health campaigns, and governmental efforts contribute to a proactive approach to addressing influenza, reflecting the region's evolving healthcare landscape.

In the European influenza vaccine market, advanced healthcare systems and a commitment to public health underscore trends. The region emphasizes universal access to influenza vaccines through government-led programs and collaborations. Ongoing research into vaccine effectiveness and the development of innovative formulations align with Europe's dedication to healthcare excellence. Stringent regulatory standards guide product development, ensuring safety and efficacy in influenza prevention strategies.

The influenza vaccine market revolves around the production and distribution of vaccines designed to protect against influenza viruses. Driven by global health initiatives, seasonal outbreaks, and the need for preventive healthcare, the market experiences consistent demand. Key players focus on vaccine development, production innovations, and distribution networks to meet increasing global vaccination needs. The market's growth is influenced by factors such as government immunization programs, rising awareness, and efforts to mitigate the impact of influenza-related illnesses. Ongoing research and development contribute to the market's dynamism, ensuring the availability of effective vaccines against evolving influenza strains.

In addition to seasonal demand, the influenza vaccine market is shaped by advancements in vaccine technologies and international collaboration for pandemic preparedness. Strategic partnerships, public health campaigns, and improved distribution infrastructure further enhance the accessibility and effectiveness of influenza vaccines, contributing to the market's resilience and adaptability.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.02 Billion |

| Market Size in 2023 | USD 7.77 Billion |

| Market Size in 2024 | USD 8.37 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vaccine Type, Technology, Age Group, Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pandemic preparedness and advancements in vaccine technologies

Pandemic preparedness and advancements in vaccine technologies synergistically surge the market demand for influenza vaccines. The ever-present threat of influenza pandemics, underscored by historical events like H1N1 and H5N1, compels governments, organizations, and pharmaceutical companies to invest significantly in research and development. The collaborative emphasis on preparedness not only guarantees a swift reaction to emerging viral strains but also fortifies the market's adaptability to evolving threats. This collective effort establishes a resilient market, fostering a continuous demand for influenza vaccines.

Moreover, advancements in vaccine technologies play a pivotal role in meeting this demand. Continuous research leads to innovations in vaccine formulations, production processes, and delivery systems, enhancing the efficacy and accessibility of influenza vaccines. Cutting-edge technologies enable the development of vaccines with broader coverage and improved effectiveness against a spectrum of influenza strains, contributing to the market's growth and its critical role in global health initiatives.

Vaccine manufacturing complexity and seasonal nature of demand

The influenza vaccine market faces challenges stemming from the intricate manufacturing processes and the seasonal nature of demand. Vaccine manufacturing involves a complex and time-consuming production cycle, requiring precise formulation and testing to ensure efficacy and safety. The intricate nature of this process, coupled with stringent regulatory requirements, contributes to manufacturing complexities, limiting the rapid scaling of production in response to sudden spikes in demand during pandemics.

Moreover, the seasonal nature of influenza, with distinct strains prevalent in different seasons, poses a restraint on year-round demand. Manufacturers must anticipate and produce vaccines tailored to specific strains, leading to periodic fluctuations in market demand. These constraints hinder the market's ability to swiftly adapt to evolving influenza threats, emphasizing the importance of continuous research into streamlining manufacturing processes and developing more adaptable, year-round vaccination strategies.

Global immunization initiatives and universal influenza vaccines

Global immunization initiatives play a pivotal role in surging demand for the influenza vaccine market by fostering widespread awareness and accessibility. Collaborative efforts between governments, international organizations, and pharmaceutical companies ensure that immunization programs are prioritized and implemented globally. As these initiatives aim to reach diverse populations, particularly in developing regions, the demand for influenza vaccines increases, propelling market growth.

The pursuit of universal influenza vaccines further amplifies market demand by addressing the challenges of evolving viral strains. With the potential to provide broad-spectrum protection against multiple influenza variants, universal vaccines appeal to a global audience concerned about the constant threat of seasonal and pandemic outbreaks. As research and development in this direction progress, the promise of more comprehensive and long-lasting immunity fuels heightened interest and investment in influenza vaccination, driving the market's evolution and expansion.

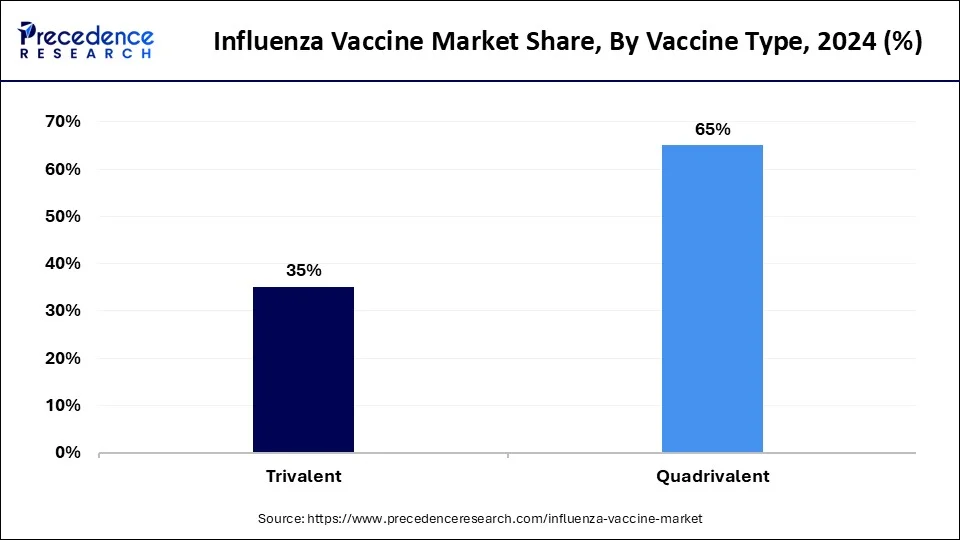

The quadrivalent segment has held a 65% revenue share in 2023. Quadrivalent vaccines protect against four influenza virus strains, including two influenza A strains and two influenza B strains. They have become a standard in influenza vaccination, offering broader coverage against circulating viral variants. Market trends indicate a growing preference for quadrivalent vaccines due to their enhanced protection against both influenza B lineages, aligning with the evolving nature of the virus and providing a more comprehensive defense against seasonal outbreaks.

The trivalent segment is anticipated to expand at a significant CAGR of 10.1% during the projected period. Trivalent vaccines safeguard against three influenza virus strains—two influenza A strains and one influenza B strain. Although traditional, trends suggest a gradual shift toward quadrivalent formulations for more extensive coverage. Trivalent vaccines remain relevant, especially in regions where they effectively match prevalent strains. However, the influenza vaccine market increasingly leans towards quadrivalent options, reflecting the industry's commitment to adapting to the dynamic nature of influenza viruses.

The egg-based segment held the largest market share of 69% in 2023. Egg-based influenza vaccine production involves cultivating virus strains in fertilized chicken eggs. Although a traditional method, it faces challenges such as longer production timelines and limitations in scalability. However, advancements aim to improve efficiency and address concerns related to egg allergies. Trends include ongoing research to enhance yield, reduce production time, and explore alternative platforms, ensuring egg-based technology remains a viable contributor to influenza vaccine manufacturing.

The cell culture segment is projected to grow at the fastest rate over the projected period. Cell culture technology involves using mammalian cells to propagate influenza virus strains, offering a more flexible and scalable alternative to egg-based methods. Trends indicate a shift towards cell culture due to its potential for faster production, reduced risk of egg-related allergens, and adaptability for pandemic response. Continuous efforts in optimizing cell culture systems and increasing capacities underscore the technology's increasing prominence in the influenza vaccine market.

The pediatric segment held the highest market share of 59%in 2023 based on the end user. Pediatric influenza vaccine market caters to children, offering preventive measures against influenza viruses. Trends include the development of child-friendly vaccine formulations, such as nasal sprays, to enhance administration. Educational campaigns emphasizing the importance of pediatric influenza vaccination contribute to increased awareness among parents and healthcare providers, driving market growth. Moreover, expanding government immunization programs for children further stimulates demand, ensuring widespread coverage and protection.

The adult segment is anticipated to expand at the fastest rate over the projected period. The adult influenza vaccine market targets the broader population, focusing on individuals beyond childhood. Trends encompass the development of high-dose vaccines for the elderly to address age-related immune decline. Growing awareness campaigns, workplace vaccination programs, and the integration of vaccination into routine healthcare check-ups contribute to increased adult vaccination rates. As governments worldwide emphasize adult immunization, the market experiences sustained demand, with a focus on addressing diverse age groups and healthcare needs.

The nasal spray segment held the highest market share of 53%in 2023 based on the end user. Nasal spray influenza vaccines offer an alternative to injections, providing a non-invasive and needle-free administration option. This route introduces the vaccine through the nasal mucosa, stimulating a mucosal immune response. Nasal spray vaccines, while not as prevalent as injections, cater to individuals averse to needles, particularly children. Trends in this segment include ongoing research into improved formulations, broader age group eligibility, and increased adoption as technology continues to refine the nasal spray delivery method.

The injection segment is anticipated to expand at the fastest rate over the projected period. In the influenza vaccine market, injections are a traditional and widely used route of administration. Injectable influenza vaccines, typically administered intramuscularly, have been the primary choice for decades, ensuring reliable and efficient delivery of the vaccine. Recent trends indicate ongoing advancements in injection technologies, including the development of microneedle patches, enhancing ease of administration and potentially increasing patient compliance.

Segments Covered in the Report

By Vaccine Type

By Technology

By Age Group

By Route of Administration

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024

December 2024

September 2024