January 2025

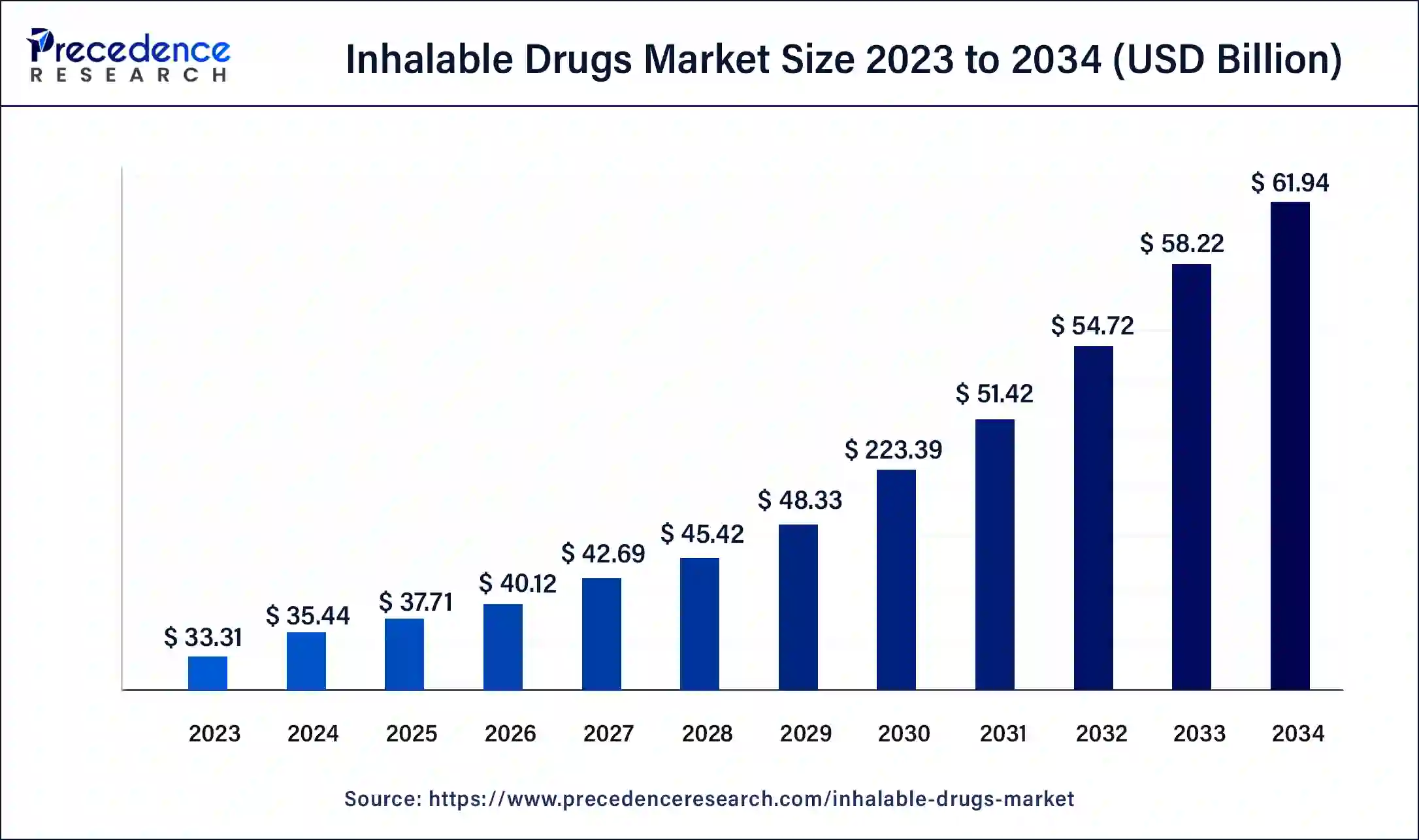

The global inhalable drugs market size was USD 33.31 billion in 2023, estimated at USD 35.44 billion in 2024 and is anticipated to reach around USD 65.51 billion by 2034, expanding at a CAGR of 6.34% from 2024 to 2034.

The global inhalable drugs market size accounted for USD 35.44 billion in 2024 and is predicted to reach around USD 65.51 billion by 2034, growing at a CAGR of 6.34% from 2024 to 2034.

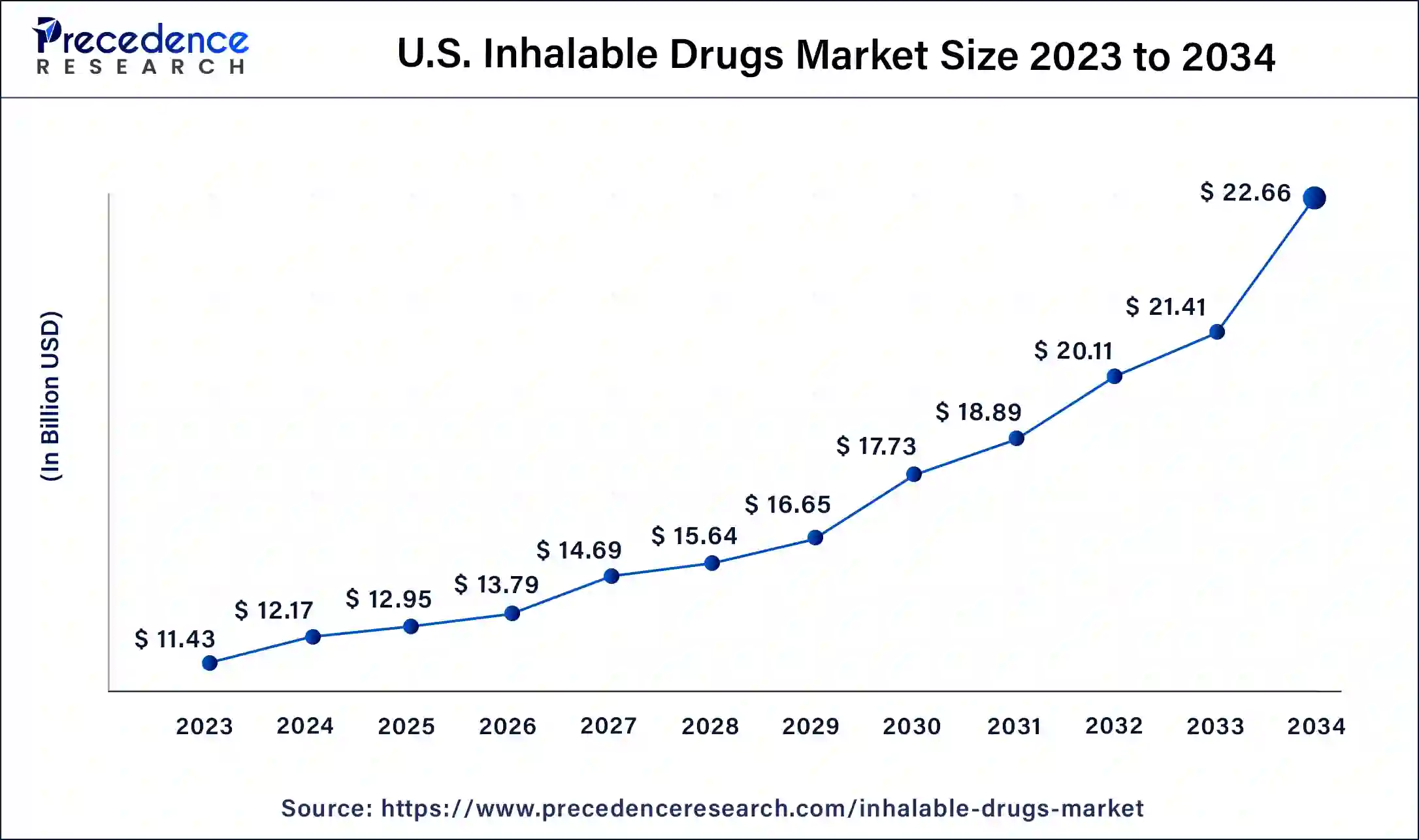

The U.S. inhalable drugs market size was valued at USD 11.43 billion in 2023 and is expected to be worth around USD 20.34 billion by 2034, at a CAGR of 6.42% from 2024 to 2034.

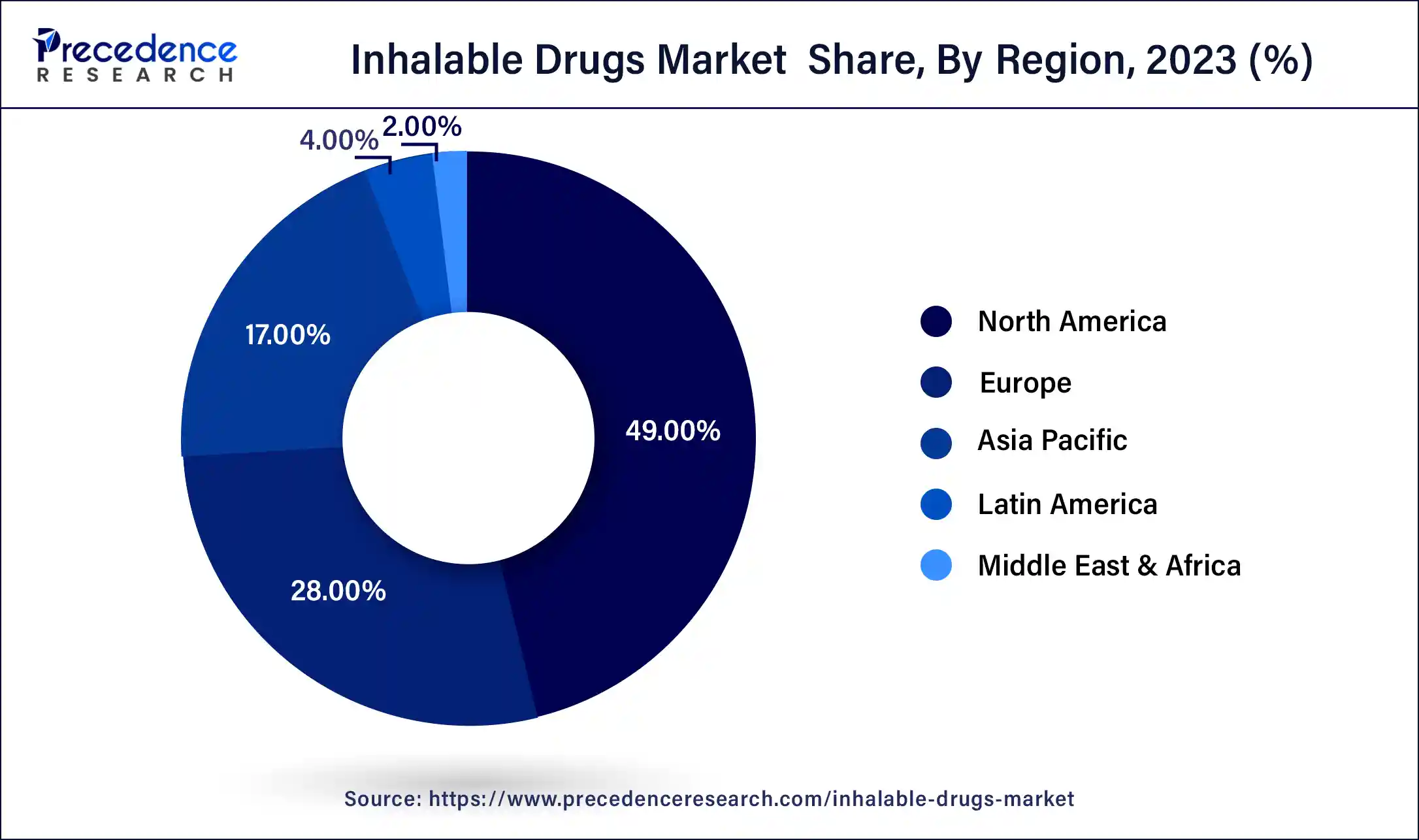

North America held the largest revenue share of 49% in 2023. North America holds a significant share in the inhalable drugs market due to advanced healthcare infrastructure, a well-established pharmaceutical industry, and high adoption of innovative medical technologies. The region benefits from a robust regulatory framework supporting the development and commercialization of inhalable drugs. Moreover, a rising prevalence of respiratory diseases, increasing healthcare expenditure, and a growing aging population contribute to the market's prominence. The presence of key pharmaceutical players and ongoing research activities further solidify North America's leadership in driving advancements and market growth within the inhalable drugs sector.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the inhalable drugs market due to several factors. The region's large population, coupled with a rising prevalence of respiratory diseases and a growing aging demographic, contributes to increased demand for inhalable therapies. Additionally, expanding healthcare infrastructure, favorable government initiatives, and a surge in pharmaceutical research and development activities in countries like China and India further propel the market. The Asia-Pacific region's robust economic growth and increasing awareness of advanced medical treatments position it as a major contributor to the inhalable drugs market.

Inhalable drugs represent pharmaceutical compounds meticulously designed for delivery through inhalation, a precise method that directs the medication straight to the respiratory system. This mode of drug administration proves especially advantageous in managing lung-related conditions like asthma, chronic obstructive pulmonary disease (COPD), and respiratory infections. The primary objective is to facilitate the efficient delivery of active drug components to lung tissues, ensuring swift absorption and localized therapeutic impact.

A diverse array of inhalation devices, including metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizers, are employed to administer these drugs. Inhalable medications offer a spectrum of advantages, encompassing rapid onset of action, minimized systemic side effects, and heightened adherence among patients. The pharmaceutical industry directs substantial efforts toward refining inhalable formulations, aiming to enhance treatment outcomes, elevate patient convenience, and effectively address respiratory complexities. The ongoing evolution of drug formulations and inhalation technologies plays a pivotal role in shaping the landscape of inhalable drugs, providing individuals with more targeted and efficient solutions for their respiratory well-being.

| Report Coverage | Details |

| Market Size by 2034 | USD 65.51 Billion |

| Market Size in 2023 | USD 33.31 Billion |

| Market Size in 2024 | USD 35.44 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.34% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Class and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancements in drug formulations and expanding applications beyond respiratory conditions

Advancements in drug formulations significantly boost the demand for inhalable drugs by fostering the development of more effective and targeted therapeutic solutions. Continuous research and development efforts focus on refining the formulation of inhalable drugs, enhancing their pharmacokinetics, and optimizing their therapeutic efficacy. These advancements contribute to improved patient outcomes, reduced side effects, and increased patient compliance, thereby driving the market demand for inhalable drugs.

Moreover, the expanding applications of inhalable drugs beyond respiratory conditions play a pivotal role in surging market demand. As these drugs demonstrate efficacy in treating ailments beyond traditional respiratory disorders, such as diabetes and pain management, the market scope widens considerably. This diversification attracts a broader patient base, encouraging pharmaceutical companies to invest in the development of inhalable drugs for multifaceted therapeutic applications. The versatility of inhalable drugs in addressing diverse health issues contributes to their growing acceptance and increased demand in the healthcare landscape.

Limited drug compatibility and insurance coverage challenges

Limited drug compatibility poses a significant restraint on the inhalable drugs market as not all medications are suitable for inhalation delivery. This limitation restricts the range of drugs that can be formulated as inhalable, potentially excluding crucial therapeutic options. Pharmaceutical companies face challenges in adapting diverse medications to inhalable formulations, hindering the development of a comprehensive portfolio of inhalable drugs.

The constraint of limited drug compatibility thus narrows the scope of inhalable drug applications and may impact the overall market demand. Insurance coverage challenges further impede the market demand for inhalable drugs. Insufficient reimbursement and insurance coverage for certain inhalable medications can limit patient accessibility, particularly in regions with less comprehensive healthcare coverage.

Patients may face higher out-of-pocket costs, deterring them from choosing inhalable drug therapies even when they are clinically advantageous. Overcoming these challenges requires collaborative efforts among stakeholders, including pharmaceutical companies, insurers, and regulatory bodies, to address reimbursement issues and ensure broader access to inhalable drug treatments.

Regulatory support for innovation and personalized medicine

Regulatory support for innovation in the inhalable drugs market is a key catalyst for opportunities. Favorable regulatory environments that encourage and facilitate the development of novel inhalable drug therapies foster innovation and streamline approval processes. This support allows pharmaceutical companies to navigate regulatory pathways more efficiently, bringing advanced inhalable drugs to market sooner. Regulatory backing not only ensures the safety and efficacy of these innovative treatments but also stimulates research and development investment, creating a conducive environment for market growth and expansion.

The trend towards personalized medicine further amplifies opportunities in the inhalable drugs market. Tailoring inhalable drug therapies to individual patient characteristics enhances treatment precision and efficacy. With advancements in diagnostics and genetic profiling, inhalable drugs can be customized to address specific patient needs, optimizing therapeutic outcomes. This personalized approach aligns with evolving healthcare trends, creating a unique market niche and positioning inhalable drugs as a forefront solution in the era of precision medicine.

In 2023, the dry powder formulations segment held the highest market share of 46% based on the drug class. Dry powder formulations represent a drug class in the inhalable drugs market, characterized by medications formulated in powder form for inhalation. This segment has witnessed a growing preference due to its convenience, stability, and ease of administration. Recent trends indicate increased research and development efforts focusing on enhancing the performance and efficacy of dry powder formulations. Advancements in inhalation device technology and innovations in particle engineering contribute to the evolving landscape of dry powder inhalable drugs, offering patients and healthcare providers efficient and patient-friendly respiratory treatments.

The spray segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The spray segment in the inhalable drugs market encompasses drugs administered through aerosolized sprays, typically delivered via metered-dose inhalers (MDIs) or nebulizers. This drug class is witnessing a growing trend with advancements in spray technology, offering precise and convenient delivery of medications to the respiratory system. Innovations in formulations and devices, such as breath-actuated inhalers, are enhancing patient compliance. The spray segment is gaining prominence due to its effectiveness in treating respiratory conditions, contributing to the overall expansion of the inhalable drugs market.

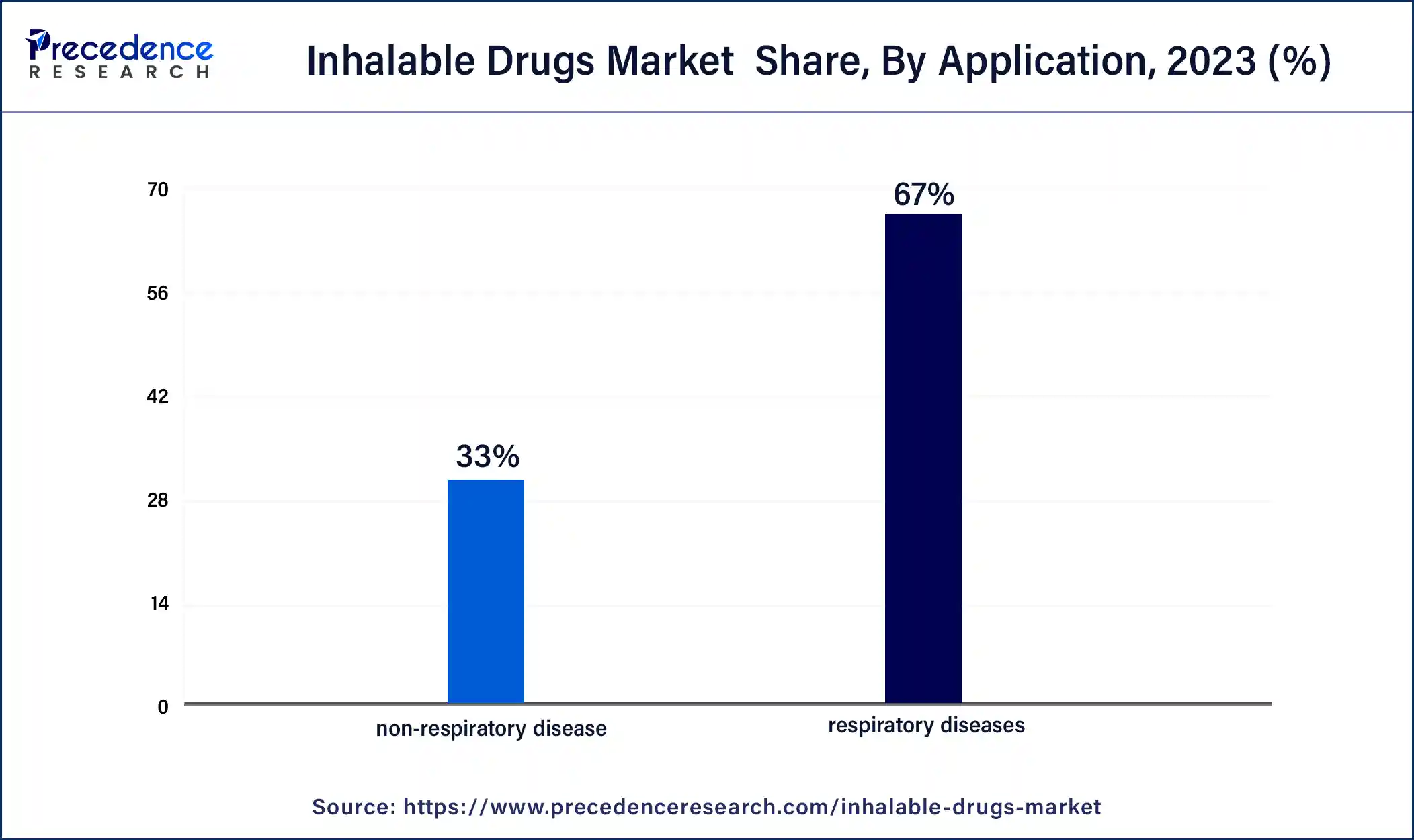

According to the application, the respiratory diseases segment held 67% revenue share in 2023. The respiratory diseases segment in the inhalable drugs market focuses on addressing conditions such as asthma, chronic obstructive pulmonary disease (COPD), and respiratory infections. This segment involves the development of inhalable drugs specifically designed to provide targeted and efficient treatment for respiratory ailments. Current trends include the continuous advancement of inhalable drug formulations and delivery devices, as well as ongoing research efforts to expand the range of respiratory diseases addressed. The segment reflects a commitment to improving patient outcomes and enhancing the management of various respiratory conditions through innovative inhalable drug therapies.

The non-respiratory disease segment is anticipated to expand fastest over the projected period. The non-respiratory disease segment in the inhalable drugs market refers to the application of inhalable formulations for treating conditions beyond the respiratory system. This includes diverse therapeutic areas such as diabetes, pain management, and systemic infections.

A notable trend in this segment involves the expansion of inhalable drugs into novel medical domains, driven by advancements in drug formulations and a growing recognition of the potential benefits of inhalation therapy for a broader spectrum of health issues. This diversification reflects a shift toward the development of inhalable drugs as versatile solutions for various non-respiratory diseases.

Segments Covered in the Report

By Drug Class

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025