Insecticides Market Size and Forecast 2025 to 2034

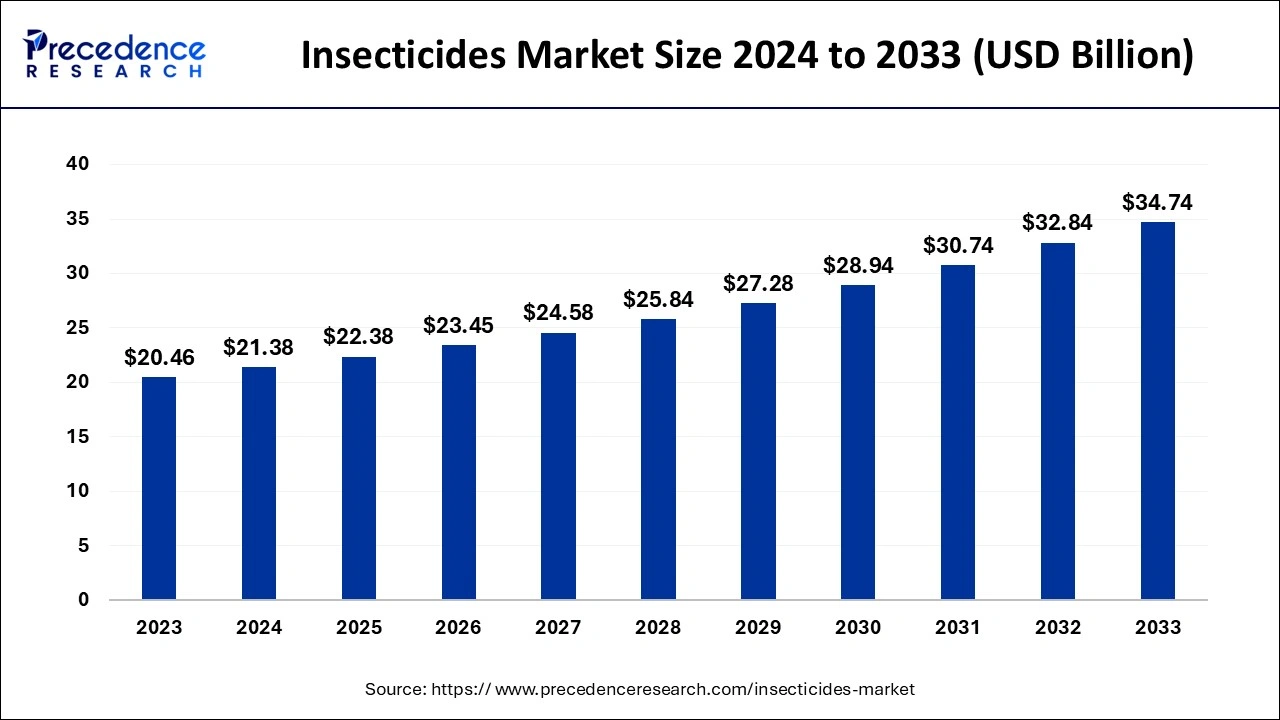

The global insecticides market size was calculated at USD 21.38 billion in 2024 and is predicted to increase from USD 22.38 billion in 2025 to approximately USD 36.43 billion by 2034, expanding at a CAGR of 5.56% from 2025 to 2034. The insecticides market is driven by expanding treatments to protect agricultural areas from insect and pest invasions.

Insecticides Market Key Takeaways

- In terms of revenue, the global insecticides market was valued at USD 21.38 billion in 2024.

- It is projected to reach USD 36.43 billion by 2034.

- The market is expected to grow at a CAGR of 5.56% from 2025 to 2034.

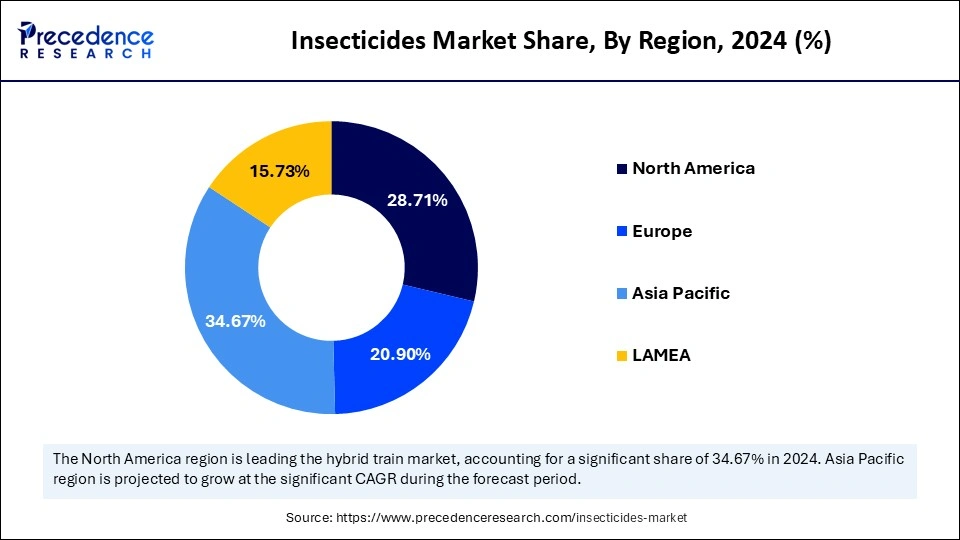

- Asia-Pacific dominated the insecticides market in 2024.

- North America shows a significant growth in the market during the forecast period.

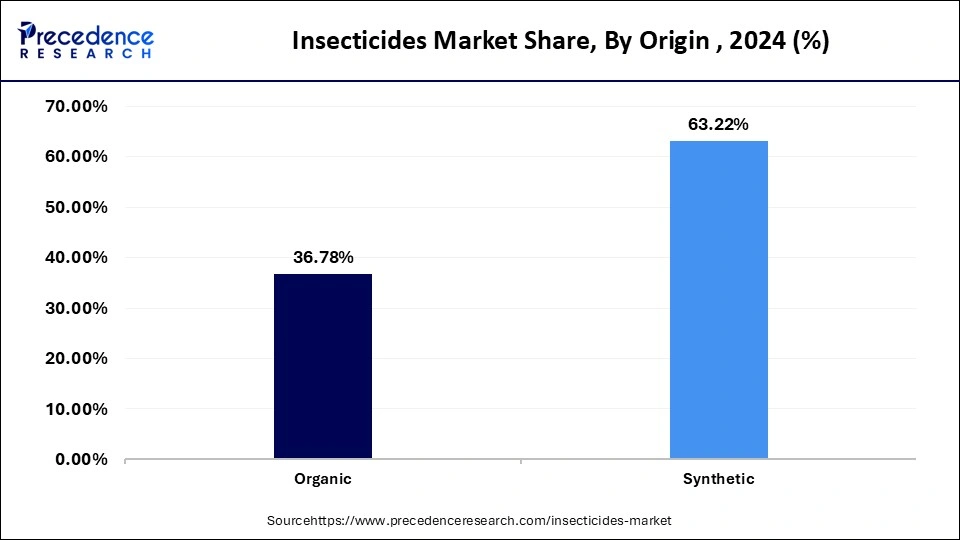

- By origin, the synthetic segment dominated the market in 2024.

- By origin, the organic segment is observed to be the fastest growing market during the forecast period.

- By type, the systematic insecticide segment dominated the insecticides market in 2024.

- By type, the contact insecticide segment is observed to be the fastest growing market during the forecast period.

- By product, the carbamates segment dominated the market in 2024.

- By product, the organochlorine segment is observed to be the fastest growing market during the forecast period.

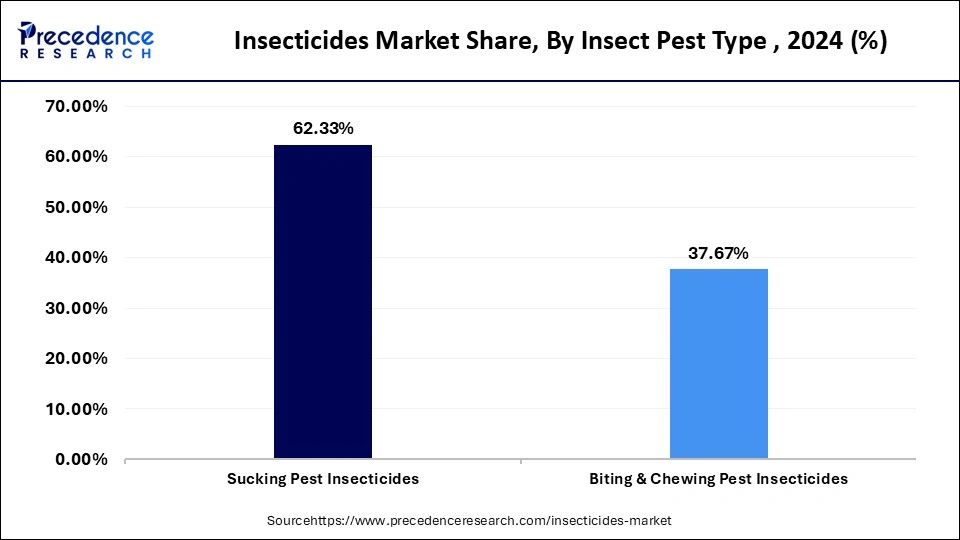

- By insect pest type, the sucking pest insecticide segment dominated the market in 2024.

- By insect pest type, the biting and chewing pest insecticide segment significantly growing market during the forecast period.

- By application, the grains and cereals segment dominated the insecticides market in 2024.

- By application, the fruit and vegetables segment show a notable growth in the market during the forecast period.

What is the Role of AI in the Insecticides Market?

Artificial intelligence (AI) has benefits including it has capacity to identify pests, predict diseases, and suggest management strategies by reducing the dependance on pesticides. AI algorithms process high amount of data like pest life cycles, weather patterns, and past outbreaks, to generate predictive models. AI based spraying systems in agriculture represents a transformative, technology-based approach to farm management. By using AI, sensors, automation, and robust data analysis, farmers can achieve accuracy in pesticide application, boost yields, protect crops, and ensure sustainability for future generations.

AI detectors are used across fields and industries by anyone who would like to check if a text may have been produced by AI. The benefits of insecticides include enhanced operational efficiency, improved safety measures, and reduced environmental impact.

Asia Pacific Insecticides Market Size and Growth 2025 to 2034

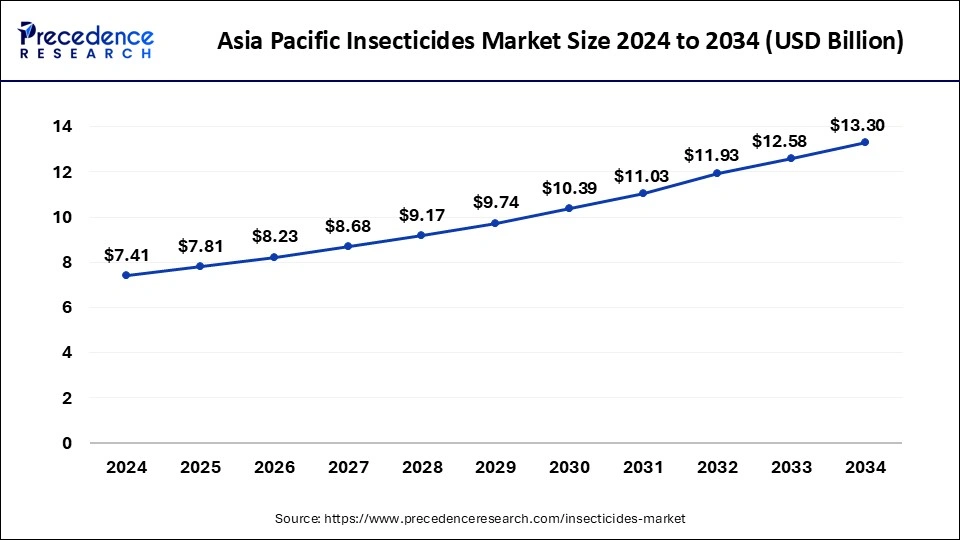

The Asia Pacific insecticides market size was evaluated at USD 7.41 billion in 2024 and is projected to be worth around USD 13.30 billion by 2034, growing at a CAGR of 6.10% from 2025 to 2034.

Asia-Pacific had the largest market share in 2024 in the insecticides market. Asia accounts for more than half of the world's pesticide usage. After China and Turkey, India is ranked third in Asia and 12th in the world for the usage of pesticides. Nearly 70% of Indians depend on agriculture for their work and means of subsistence, making it the most critical sector of the country's economy. The use of pesticides is essential to contemporary agriculture. In agriculture, insecticides, fungicides, and herbicides are frequently employed for pest management. Nonetheless, most pesticides used in India are insecticides.

North America shows a significant growth in the insecticides market during the forecast period. Since insecticides offer significant advantages like greater crop yields due to defoliation disease protection, less spoilage of stored foods, and more, insecticides like carbamates, organophosphate, nicotinoids, aldicarb, neonics, and others are commonly utilized in several applications. Pesticides are used when applying soil amendments to crops, including wheat, soybeans, rice, and others. Insecticide use is essential since it safeguards the crop against pests. The rise of the agriculture industry is fueled by factors including the rising demand for food crops, the expansion of policies to ensure food security, and the increased output of cash crops in the North American continent.

As a result, North American agriculture is producing more food, increasing the demand for pesticides, and driving the expansion of the North American insecticide industry. The output of agriculture has increased recently. However, rather than enlarging the planted area, a higher yield per unit area has been the main force behind this expansion. By 2030, there should be an increase in annual agricultural productivity yield on the same agricultural land.

Asia Pacific dominated the global insecticides market in 2024.

- In September 2021, Jinguangdadao Solution, which is an integrated solution that uses a pesticide combination developed by the company, to control pests and weeds during crucial growth period of paddy rice was launched by Sinochem Crop PROTECTION Ltd.

North America is anticipated to grow at the fastest rate in the market during the forecast period.

- In March 2025, nation's first pesticide alert system was launched by California. California's nation leading agriculture industry pumps more than 180 million pounds of pesticides into fields each year.

Market Overview

Pesticides are essential chemicals for controlling invasive and destructive pests in agriculture, the landscape, and forestry. All substances used to stop, eliminate, deter, attract, or lessen pest organisms are considered pesticides. Some well-known pesticides include insecticides, herbicides, fungicides, and rodenticides. Crop protection products are widely used in modern agriculture to increase crop yield by shielding plants from damaging pests and weeds. Agricultural productivity has also increased considerably, providing food security for the increasing population. One of the key reasons for increasing agricultural output in some economies is high pesticide usage.

Plant diseases and pests are more likely to appear and spread owing to climatic changes. Crop productivity is impacted by crop vulnerability to various diseases and pests, which are increased by climate change. As a result, any change in the climate causes farming practices to diverge, which lowers production, and this, in turn, is expected to increase the demand for pesticides. Additionally, sporadic rainfall in different areas contributed to an increase in the fungus population. These factors have increased farmers' dependence on pesticides for effective pest prevention, likely fueling the market's growth.

Key Factors Influencing Future Market Trends

- Demand for bio-based insecticides: The stricter laws and many people choosing organic food, bio-based insecticides are gaining momentum. There is an increase in the number of farmers deciding to use natural chemicals to control pests. Since these sprays are not harmful to helpful insect populations, more eco-friendly, and can be decomposed, they are kinder to the Earth.

- Rising Investment in R&D:The focus should be on creating things that are safe for unharmed beings and continue to function as required. They support farmers in managing recent pests and upholding the principles of sustainable and precision agriculture.

- Need for Increased Agriculture Productivity: By using insecticides, pests and diseases that harm crops can be controlled, which leads to increased crop yields. Companies are responding to the demand by introducing new and more effective insecticides. They aid modern farmers by killing pests with little effect on nature, contributing to safe and sustainable food.

Insecticides Market Growth Factors

- Cost-effectiveness compared to alternatives

- Wide spectrum efficiency against pests

- Rising global food demand

- Rise in agricultural output across the globe

- Rapid increase in the consumption level of insecticides

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.43 Billion |

| Market Size in 2025 | USD 22.38 Billion |

| Market Size in 2024 | USD 21.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.56% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Origin, Type, Product, Insect Pest Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increase in the global agricultural output

Agricultural output and productivity have increased drastically over recent years due to the use of modern irrigation systems, high-yielding seed types, and agricultural pesticides such as insecticides. Insecticides are beneficial in terms of both economic and labor advantages, resulting in decreased crop loss. Sustainable productivity and green practices in the agricultural industry have significantly contributed to the increasing global agricultural output.

Moreover, the agricultural industry rapidly expands worldwide to cope with fast-changing and growing food demand. Current agricultural aspects are mainly focused on providing nutritional food. Hence, the overall increase in farm output is thriving in the growth of the global insecticides market.

Moreover, the global agriculture industry has evolved into a diverse landscape, encompassing everything from small-scale peasant farms to large multinational corporations. What's truly inspiring is the collaborative spirit among various market players, private and public organizations, research institutes, NGOs, and universities. Together, they are working towards a common goal of creating a sustainable future with enhanced agricultural productivity.

Restraint

Toxicity associated with insecticides

The toxicity associated with insecticides is one of the major restraints to the growth of the global insecticides market. As insecticides are poisonous, they are hazardous to children and small pets, requiring proper handling and safety practices, restricting insecticides' acceptability for residential use. Several insecticides may cause poisoning when inhaled, swallowed, or even absorbed through the skin. The most dangerous insecticide poisonings are caused by organophosphate and carbamate insecticides. As stated by the American Association of Poison Control Centers, Organophosphates are the most often implicated class of pesticides in symptomatic disorders. Further, insecticide toxicity may lead to blurred vision, vomiting, coughing, frequent bowl, and urination.

In severe cases, it may decrease blood pressure and heart rate, which is dangerous for human health. Furthermore, the rising cases of insecticide toxicity across the globe are creating a significant hurdle for the growth of the global insecticides market.

Opportunity

Rise in the research & development of insecticides

Pests are growing more widespread in a variety of crops across the globe, and insecticide-resistant bugs are becoming more common. Insecticides are useful for controlling a wide variety of pests. However, when pests develop resistance, their potency drops over time, and a significant reduction in sensitivity to a pesticide reduces its efficacy in the field. Insecticide tolerance typically occurs due to growing dependence on insecticide-based pest management. This resistance increases fast as the temperature rises, allowing insects or lice to reproduce more rapidly. Hence, the need for constant research to create new products is creating tremendous growth opportunities in the global insecticide market.

Origin Insights

The synthetic segment held a dominant presence in the market in 2024.

The organic segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In July 2025, eco-friendly biopesticide to combat thrips infestation in cardamom was launched by ICAR-IISR.

Global Insecticides Market Revenue, By Origin 2022 to 2024 (USD Million)

| Origin | 2022 | 2023 | 2024 |

| Systemic Insecticide | 8,288.30 | 8,627.60 | 9,044.30 |

| Ingested Insecticide | 4,364.30 | 4,530.70 | 4,715.10 |

| Contact Insecticide | 7,029.90 | 7,305.60 | 7,625.30 |

Type Insights

The systematic insecticide segment accounted for a considerable share of the market in 2024.

- In May 2024, Proclaim XTRA insecticide for maize and soybean crops was launched by Crystal Crop Protection, a leading agrochemical manufacturer.

The contact insecticide segment is projected to experience the highest growth rate in the market between 2025 to 2034.

- In May 2025, an eco-friendly pesticide with just 20% paraffin oil was launched by the Spanish Agrochemical Company, Altinco, which specialized in natural crop protection solutions.

Altinco launches an eco-friendly pesticide with just 20% paraffin oil - FruitToday

Global Insecticides Market Revenue, By Type 2022 to 2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Systemic Insecticide | 8,288.30 | 8,627.60 | 9,044.30 |

| Ingested Insecticide | 4,364.30 | 4,530.70 | 4,715.10 |

| Contact Insecticide | 7,029.90 | 7,305.60 | 7,625.30 |

Product Insights

The carbamates segment dominated the insecticides market in 2024. Carbamates are insecticides made from carbamic acid. In addition to being efficient at getting rid of insects, they can quickly be detoxified from the tissues of mammals, lowering their toxicity levels in both humans and animals. Carbamates are used as baits or sprays to kill insects by affecting their nervous systems and brains. They kill aphids, ants, fleas, scales, whiteflies, and mealy bugs on crops. Some carbamates are effective mosquito repellents. Some have been found in groundwater at concerning levels.

Moreover, when appropriately used, carbamate pesticides benefit society, as they protect and increase agricultural production while protecting human and animal health from insect-vector-mediated diseases. Mosquito species are mainly developed within agricultural lands due to access to water in these areas. These mosquitoes transfer vector-borne diseases such as malaria and dengue to humans.

The organochlorine segment is observed to be the fastest growing in the insecticides market during the forecast period. Organochlorine insecticides have been successfully used to control malaria and typhus, but their use is prohibited in a few countries due to their adverse health effects. Over time, organochlorine pesticides can harm the central nervous system, kidneys, liver, bladder, and thyroid. Some evidence also suggests that organochlorine pesticides may cause cancer in humans.

Moreover, a review of pesticide use statistics reveals that most pesticides used in a few economies belong to the organochlorine class of chemicals. Organochlorine insecticides such as DDT, hexachlorocyclohexane (HCH), aldrin, and dieldrin are among the most widely used pesticides in developing Asian countries due to their low cost and need against various pests. Despite environmental regulations, the high global demand for OCPs in agricultural practice is primarily due to their excellent pest control efficacy and cost-effectiveness. Also, they are usually applied as sprays or dusts, making them easy for farmers and householders to use.

The carbamates segment led the market. The organochlorine segment is set to experience the fastest rate of market growth from 2025 to 2034.

Global Insecticides Market Revenue, By Product 2022 to 2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Organochlorine | 2,905.80 | 3,036.80 | 3,192.00 |

| Organophosphate | 2,241.20 | 2,337.00 | 2,450.70 |

| Organosulfur | 1,753.10 | 1,817.20 | 1,880.90 |

| Carbamates | 3,559.30 | 3,708.10 | 3,879.40 |

| Formamidines | 1,282.60 | 1,322.00 | 1,371.00 |

| Dinitrophenols | 1,941.40 | 2,013.60 | 2,094.70 |

| Pyrethroids | 2,566.60 | 2,672.60 | 2,799.00 |

| Neonicotinoids | 1,969.60 | 2,050.50 | 2,144.20 |

| Others | 1,463.10 | 1,506.10 | 1,572.70 |

Insect Pest Type Insights

The sucking pest insecticides segment registered its dominance over the market in 2024.

- In May 2024, a new class of insecticide, Efficon in the Indian Market was launched by BASF. Efficon has a new active ingredient Axalion in a specialized formulation and target piercing and sucking pests that cause 35-40% loss in productivity and yield to farmers.

BASF launches new class of insecticide Efficon in Indian market | Hyderabad News - Times of India

The biting and chewing pest insecticide segment is anticipated to grow with the highest CAGR in the market during the studied years.

Application Insights

The grains and serials segment dominated the market.

- In January 2024, a new insecticide for stored grains was launched by Central Life Sciences. Gravista-D is a CODEX approved for cereal grains and labeled for use in grain sorghum (milo), corn, popcorn, barley, oats, rice, rye, and wheat.

- In July 2024, an innovative plant disease solutions VELZO and COSUIT fungicides designed to protect fruits and vegetables crops from destructive fungi diseases right from the beginning of the crop cycle was launched by FMC India, an agricultural sciences company.

FMC India Launches Innovative Plant Disease Solutions for Fruits and Vegetables | FMC Ag IN

Global Insecticides Market Revenue, By Application 2022 to 2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Grains and Cereals | 6,350.50 | 6,619.40 | 6,940.90 |

| Pulses and Oilseeds | 3,928.30 | 4,067.40 | 4,237.00 |

| Commercial Crops | 3,925.00 | 4,103.90 | 4,302.20 |

| Fruits & Vegetables | 4,383.60 | 4,540.70 | 4,740.40 |

| Others | 1,095.10 | 1,132.40 | 1,164.90 |

Insecticides Market Companies

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- FMC

- Corteva Agriscience

- Nufarm Limited

Recent Developments

- In August 2025, the launch of new insecticide sparcle for paddy farmers in India in collaboration with Corteva Agriscience was announced by Insecticides India Limited (IIL). Sparcle is a broad-spectrum insecticide that aims to address brown plant hopper (BPH) and improve rice yields.

New Insecticide 'Sparcle' Launched by Insecticides India in Partnership with Corteva Agriscience for Paddy Farmers - In January 2025, a new Insecticide Centran to tackle the problem of stem borers in paddy was launched by Insecticides (India) Limited (IIL). With its action formula, Centran effectively controls stem bores and helps farmers to achieve healthier crops and better productivity.

Insecticides (India) Limited Launches New Insecticide Centran

Segments Covered in the Report

By Origin

- Organic

- Synthetic

By Type

- Systematic Insecticide

- Ingested Insecticide

- Contact Insecticide

By Product

- Organochlorine

- Organophosphate

- Organosulfur

- Carbamates

- Formamidines

- Dinitrophenols

- Pyrethroids

- Neonicotinoids

- Others

By Insect Pest Type

- Sucking Pest Insecticide

- Biting And Chewing Pest Insecticide

By Application

- Grains And Cereals

- Pulses And Oilseeds

- Commercial Crops

- Fruit and Vegetables

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting