February 2025

The global fertility market size is expected to reach around USD 71.24 billion by 2033, currently valued at USD 35.49 billion, the market will expand with a CAGR of 7.01% from 2024 to 2033.

The fertility market can be defined as an industry that revolves around reproductive well-being. It caters specifically to individuals facing conceiving and maintaining pregnancies with medically enhanced methods. The market provides services including but not limited to diagnosis of infertility, including medical facilities that offer treatments to aid in conceiving children. These facilities offer diagnosis, medications, intrauterine insemination, in vitro fertilization, and other assisted reproductive technology methods.

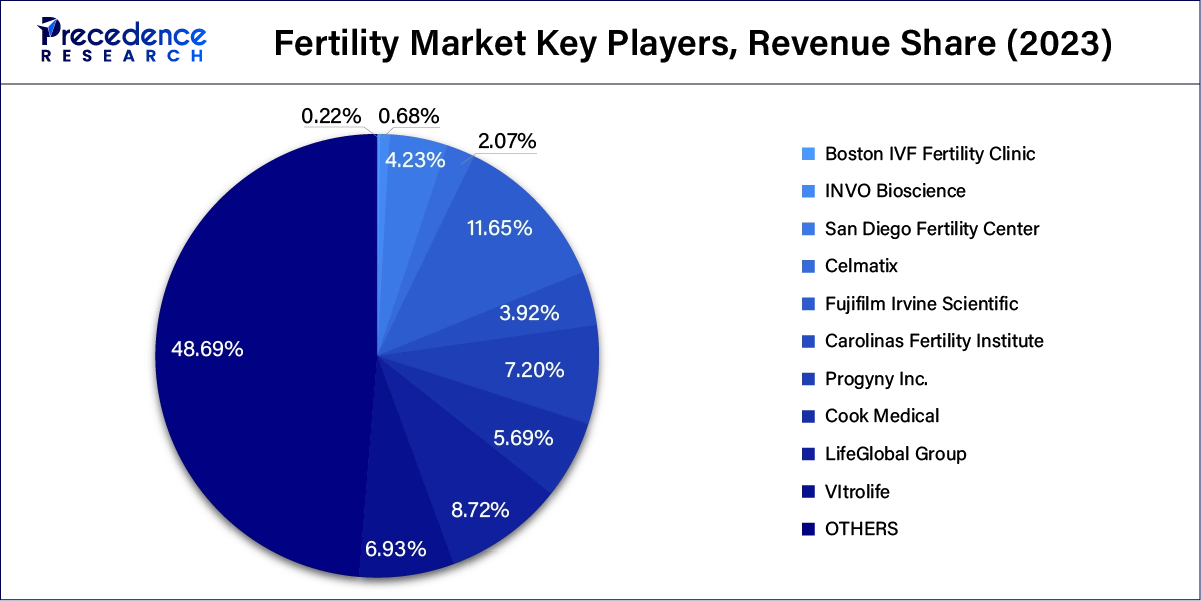

The value of any industry is majorly reliant on the contribution of its key players. In the fertility market, companies such as VItrolife, Boston IVF Fertility Clinic, San Diego Fertility Center, INVO Bioscience, Carolinas Fertility Institute, Progyny Inc., Cook Medical, Celmatix, Fujifilm Irvine Scientific, LifeGlobal Group are few among several that have made an impact on the market.

| Company | Key insights |

| Cooper Surgical (U.S.) | Being one of the most prominent players in the industry, Cooper Surgical offers advanced fertility devices for diagnostics and treatment. The company’s strategic focus over acquisition and breakthrough launch of its product SAGE IVF media have level up the grounds for fertility sector in the healthcare industry. |

| Thermo Fisher Scientific (U.S.) | Well known for laboratory technologies, the company offers fertility clinics with genetic testing tools. Company’s broad portfolio and fertility solutions are driven by AI and genetic testing innovations. |

| Vitrolife | The company is well known for its offering of embryo culture media and time-lapse incubators. Vitrolife has already established strong foot in embryology technologies where it seeks opportunities. |

Private Ventures Shaping the Fertility Landscape

The European fertility market is currently ranks third valued at USD 12.16 billion but will soon overtake the North American market with a CAGR of 7.2%. By 2034, it will be worth USD 24.46 billion. Europe is dealing with a greatly declining birth rate as a result of cultural shifts and infertility rates. In 2022, only 3.88 million live births were observed in the European Union, marking the first time lowest in over six decades.

The region's growth is attributed to the presence of key market players and their strategic initiatives to develop and commercialize new infertility medicinal products for treating patients. Also, there is an increasing disposable income and enhanced utilization of healthcare centers due to rising infertility problems among women.

Government Initiatives in Response to Evolving Demands

| Insight | Development |

| Fertility tourism | In October 2024, the Irish government announced amendments to the Assisted Human Reproduction (AHR) Act. Irish residents undergoing donor-assisted human reproduction (DAHR) or surrogacy abroad would be able to apply for a declaration of parentage for the children born. |

| Infrastructure | In July 2024, the Health and Medical Education Department, Jammu and Kashmir, India, announced their intention to establish in-vitro fertilization (IVF) centers in government medical hospitals. |

| Job security | In September 2023, the government of Malta announced its decision to provide self-employed couples undergoing IVF upto a total of 100 hours of paid-leave. The prospective mothers will be provided around 60 hours of paid absence, while their partners will be eligible for up to 40 hours. |

| Financial aid | In September 2024, the government of Madhya Pradesh, India announced an insurance of INR 10 lakh for surrogates. |

Shifts in Societal Preference and Gender Diversification: Creating New Opportunities

Changing social ideologies and structural and economic factors greatly influence the global population. In terms of reproductive rate, countries such as the U.S., Korea, and the UK face declining birth rates due to career-centric practices such as delayed marriage and parenting, lifestyle-influenced health issues, and hereditary issues. On the other end of the spectrum, developing regions face the same issues due to financial instability and other economic difficulties. The decline in birth rates is a major factor in the market development in these regions.

Besides the concerns about declining birth rates in several regions, the global fertility market has garnered attention due to state recognition of several assisted reproductive practices such as surrogacy, gamete donation and preservation facilities, and supportive insurance and reimbursement policies. Fertility drugs are often used in combination with other fertility treatments, including IUI and IVF. These practices are especially beneficial for same-sex couples, people undergoing treatments harmful to their reproductive health, etc.

The Asia Pacific clinical trials market is currently valued at USD 9.10 billion and is expected to grow at a CAGR of 10.9% over the forecast period. Delays in childbirth, lifestyle changes, and increased infertility prevalence have led to a growing demand for fertility treatments. As this happens, a greater number of couples are seeking help due to the destigmatization of infertility, increased awareness of reproductive issues, and the availability of treatments. Also, fertility treatments are being made more affordable with the help of financial assistance or subsidies from several governments for couples in the region.

In August 2024, the Goa Medical College (GMC), Bambolim, introduced their new assisted reproductive technology (ART) and intrauterine insemination (IUI). The facility will be the first in India to offer free IVF procedures under corporate social responsibility (CSR) programs.

Asia’s Consumer Demand, Investments and Initiatives: Key Elements for Fertility Market

| Key Elements | Details |

| Consumer Demand | Delayed parenthood trends, increased affordability for fertility treatments and growing middle-class population. |

| Private Investments | Major fertility clinics and startups received funds for investments in India for boosting the fertility chains. |

| Government Initiatives | Japan government funds 70% of cost coverage for fertility treatments. Whereas China has offered relaxation of one child policy. |

| Future Outlook | Rising innovation in reproductive technologies, medical tourism and advancements in cryopreservation. |

A relaxed regulatory framework with regard to reproductive health research, a plethora of skilled professionals specializing in a variety of conditions, relaxed surrogacy and ART-related policies, lower medical costs, and a growing healthcare infrastructure make Asia Pacific a prime destination for fertility tourism. Along with the rapidly rising surrogacy business in countries like India and China, the intake of patients has been significant. The region also boasts a rich history of medical techniques and a relaxing environment, which makes it a prime spot for fertility retreats for foreign couples.

Reproductive health has been a taboo topic in several predominant cultures and religions. Combined with associated side effects, this affects not only the acceptance of well-established technologies but also R&D activities. Market players place financial stakes in the market to launch new products and services. However, regulatory inhibition, religious inflexibility, and difficulties in advertisement create reluctance in new market players.

By offering, the assisted reproductive technology segment led the global fertility market with a value of USD 23.8 billion in 2023. The segment is expected to sustain this dominance by growing at a CAGR of 10%. Several regions across the world have been experiencing desensitization to taboos related to reproductive health. Combined with technological advancements, this has greatly impacted the market in the developed regions. Within the Art segment, in vitro fertilization (IVF) is the most widespread technique. In 2023 alone, it generated a revenue of around USD 15.2 billion, which is more than the combined revenue of surrogacy, artificial insemination, and other reproduction-assisting methods (USD 2.5 billion).

By offering, the fertility drugs segment is expected to grow with a considerable CAGR of 5%, owing to its lower costs and significantly reduced associated risks. Also, developed economies such as Europe, the U.S., South Korea, etc., prefer to plan their families after establishing their careers. Such couples face problems such as low gamete counts, hampered conception rates, and difficult or nonviable pregnancies. In North America alone, fertility drugs are estimated to generate a revenue of USD 3.95 billion in 2034 compared to its current USD 2.5 billion.

By end user, in 2023, the fertility clinics segment led the fertility market at USD 22.08 billion. Fertility clinics are preferred over traditional point-of-care centers as they provide specialized treatment along with privacy. The growth of this segment is further supported by growing healthcare expenditure and developing specialized infrastructure in developed economies. In North America and Europe, these specialized facilities are valued at USD 7.41 billion and USD 8.15 billion, respectively.

By distribution channel, the hospital segment is expected to have a CAGR of 6.5%, resulting in a value of USD 17.35 billion in 2034 compared to USD 8.81 billion in 2023. Historically, hospitals have been the preferred choice of medical aid for any and every healthcare need. Hospitals provide patients with access to diagnostic, therapeutic, testing, consultation, and pharmacy facilities at single location.

View Full Report@ https://www.precedenceresearch.com/fertility-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

February 2025

November 2024

November 2024

April 2024