October 2024

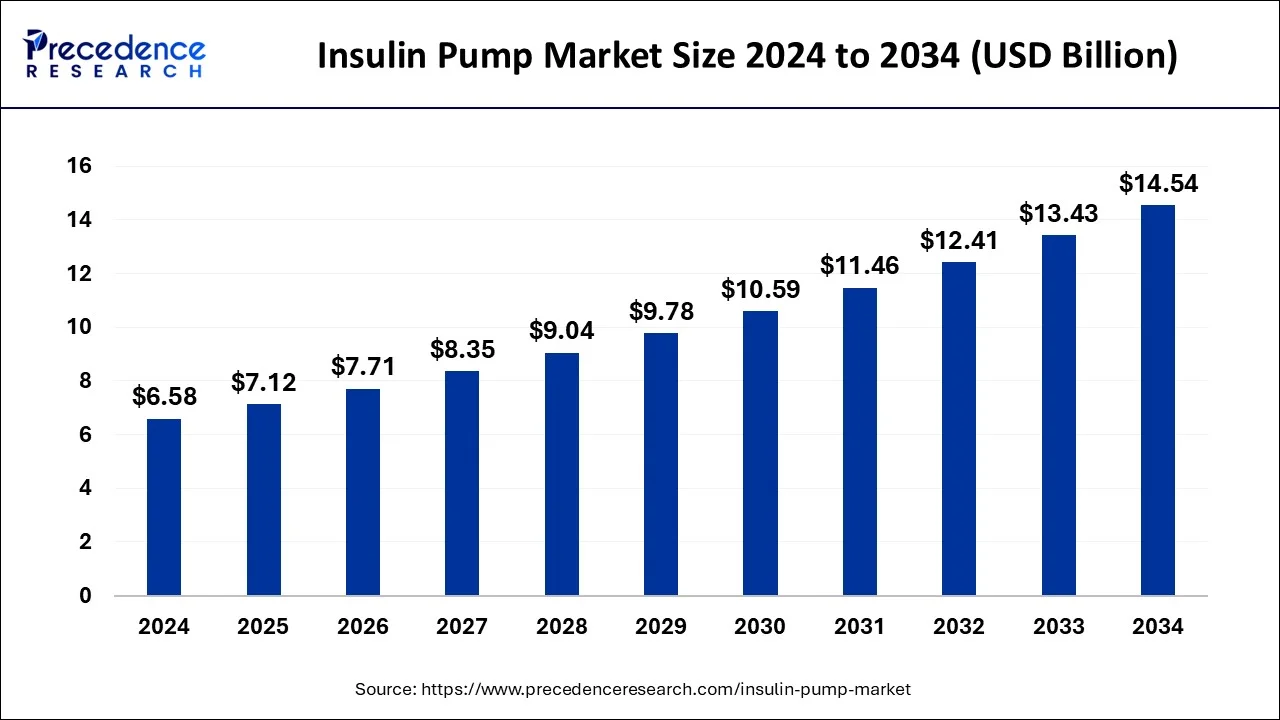

The global insulin pump market size was accounted for USD 6.58 billion in 2024, grew to USD 7.12 billion in 2025 and is predicted to surpass around USD 14.54 billion by 2034, representing a healthy CAGR of 8.25% between 2025 and 2034. The North America insulin pump market size was calculated at USD 3.03 billion in 2024 and is expected to grow at a fastest CAGR of 8.36% during the forecast year.

The global insulin pump market size was estimated at USD 6.58 billion in 2024 and is anticipated to reach around USD 14.54 billion by 2034, expanding at a CAGR of 8.25% from 2025 to 2034.

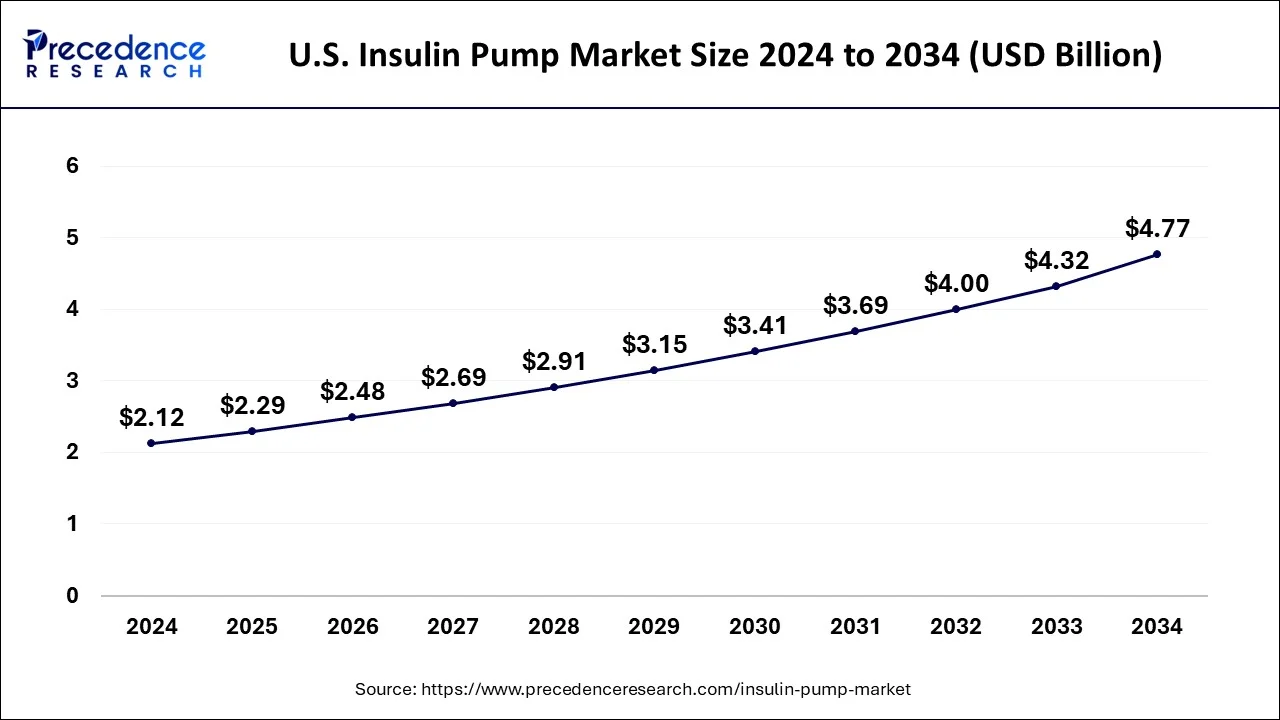

The U.S. insulin pump market size was evaluated at USD 2.12 billion in 2024 and is predicted to be worth around USD 4.77 billion by 2034, rising at a CAGR of 8.45% from 2025 to 2034.

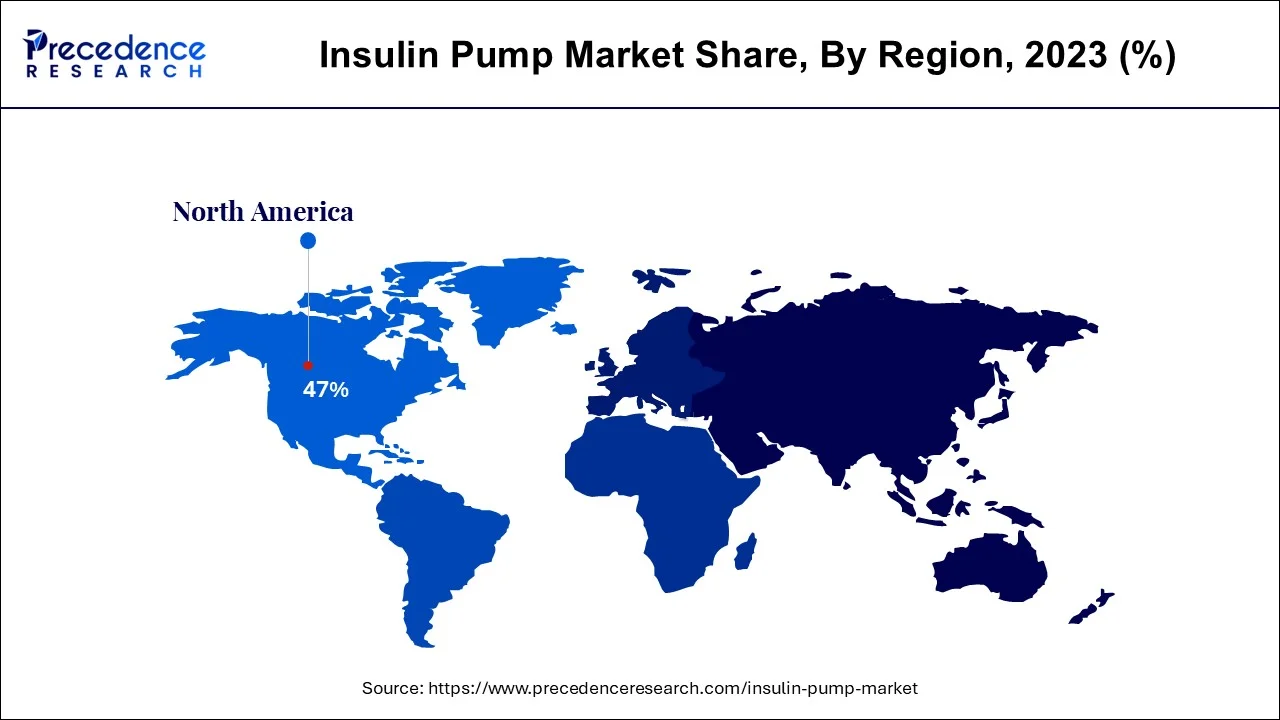

North America accounted revenue share of over 47% in 2024. The presence of numerous top market players in the region coupled with the increased prevalence of diabetes and increased demand for the innovative drug delivery devices among the population has fostered the growth of the insulin pump market in North America. The increased disposable income and increased health consciousness has triggered the adoption of the insulin pumps among the population and the region is projected to retain its dominant position throughout the forecast period.

On the other hand, Asia Pacific is estimated to be the most opportunistic segment during the forecast period. Asia Pacific is home to around 4.4 billion people and the changing consumption pattern and unhealthy food habits of the consumers is resulting in a surge in the diabetic population. Moreover, growing health awareness, rising penetration of the retail pharmacies, and rising consumer expenditure on the healthcare in the region is expected to drive the growth of the insulin pump market in Asia Pacific in the foreseeable future

Insulin pumps are compact computerized drug delivery devices that enables the delivery of the insulin doses in required amount into a diabetic patient. The increased efficiency of the insulin pumps in managing and controlling the diabetes regularly by providing consistent and timely delivery of the insulin doses to the patients has fostered the adoption of the insulin pumps across the globe. The demand for the insulin pumps is primarily driven by the growing prevalence of diabetes among the population. As per the data revealed by the International Diabetes Federation, around 552 million people across the globe are estimated to have diabetes by the year 2030. According to the World Health Organization, diabetes is a major cause of blindness, stroke, and kidney failure. The changing lifestyle of the consumers, shifting consumption pattern, and unhealthy food habits of the people is surging the cases of diabetes among the global population.

The rising awareness regarding the availability of the advanced innovative pumps and its easy availability are the major factors that drives the growth of the global insulin pump market. The rising investments by the market players in the research and innovation of the drug delivery devices has encouraged the development of the insulin pumps that primarily focuses on the convenience of the patients is fueling the market growth. Furthermore, the integration of smart technologies like artificial intelligence in the healthcare sector is propelling the adoption of the automated insulin pumps among the patients. Moreover, rising number of product approvals and various developmental strategies such as partnerships, distribution agreements, and collaborations adopted by the market players is positively influencing the growth of the global insulin pump market.

| Report Coverage | Details |

| Market Size by 2024 | USD 6.58 Billion |

| Market Size in 2025 | USD 7.12 Billion |

| Market Size in 2034 | USD 14.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Leading Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pump Type, Accessories, End User |

The tethered pump segment accounted market share of over 62% in 2024 with a CAGR of 9.4% over the forecast period. The increased adoption of the tethered insulin pumps owing to its portability and convenience that allows the patients to carry it in their pockets. Moreover, it can be connected with the handsets and allow easy control along with the monitoring of the blood glucose levels. Hence, these benefits have resulted in the increased demand for the tethered pumps.

On the other hand, the patch pump is estimated to grow at a CAGR of 10% during the forecast period. It is compact and allows remote control, which can also acts as a glues monitor. The patch pumps easy control of the doses and can be conveniently attached to the skin surface that offers convenience to the patients.

The insulin set insertion devices segment accounted largest revenue share in 2024. This can be attributed to the extensive use of the insertion devices for conveniently attaching the insulin pumps to the skin surface. It provides accurate doses and helps to efficiently manage the blood glucose levels.

On the other hand, cartridges or the reservoir is estimated 9% CAGR during the forecast period. The increasing adoption of the tethered pumps among the patients is fostering the demand for the reservoirs. The reservoirs have a capacity to hold around 300 doses of insulin and it can last up to 3 days. Thus, the segment is expected to grow rapidly in the forthcoming years.

The hospitals segment dominated the market in 2024. This is simply attributed to the increased penetration of hospitals across the globe. The skilled healthcare professionals that can provide assistance to the diabetic patients in effectively curing diabetes has fueled the growth of the segment. The rising government and corporate investments in the advancements of the hospitals is expected to further fuel the growth of the hospitals segment in the near future.

On the other hand, the homecare is estimated to grow at a CAGR of 9.2% during the forecast period. The rising healthcare expenditure, increased awareness regarding the availability of the insulin pumps, and easy availability of the insulin pumps through the online and offline retail pharmacies is fostering the growth of the homecare segment significantly.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In September 2020, Medtronic acquired the FDA approval for its insulin product MiniMed 770G, installed with the Medtronic’s SmartGuard Technology. It can be easily connected to a smartphone and can be modulated to serve children too.

The various developmental strategies like new product launches, acquisition, partnerships, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

By Pump Type

By Product

By Application

By Disease Indication

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024