January 2025

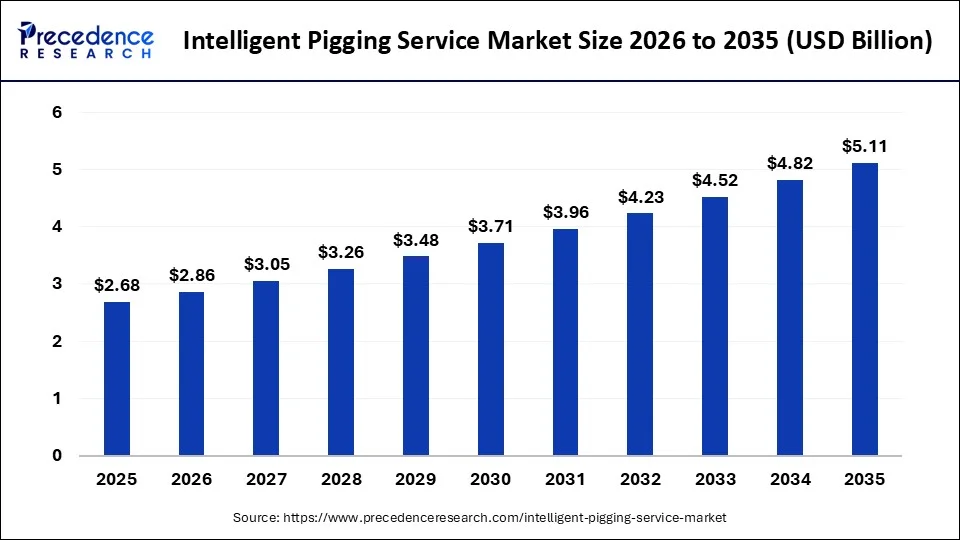

The global intelligent pigging service market size is calculated at USD 2.68 billion in 2025 and is forecasted to reach around USD 4.82 billion by 2034, accelerating at a CAGR of 6.75% from 2025 to 2034. The North America market size surpassed USD 800 million in 2024 and is expanding at a CAGR of 6.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global intelligent pigging service market size accounted for USD 2.51 billion in 2024 and is predicted to increase from USD 2.68 billion in 2025 to approximately USD 4.82 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034. The rising automation in industrial applications to improve efficiency in production with time and cost savings boosts the growth of the market.

The incorporation of artificial intelligence into industrial operations increases overall efficiency and production. AI is used by a wide range of industries in their different production, maintenance, and logistics processes. In the case of the intelligent pigging service market, the implementation of artificial intelligence provides several benefits and cost savings by automatically scheduling the pigging process with predictive analysis. Enhance safety in the field by reducing the chances of pipeline failure and leakage, which may cause severe accidents in the field, by providing early detection and prevention of anomalies. Additionally, machine learning algorithms offer maintenance operators real-time insights, which helps increase the efficiency of the operations.

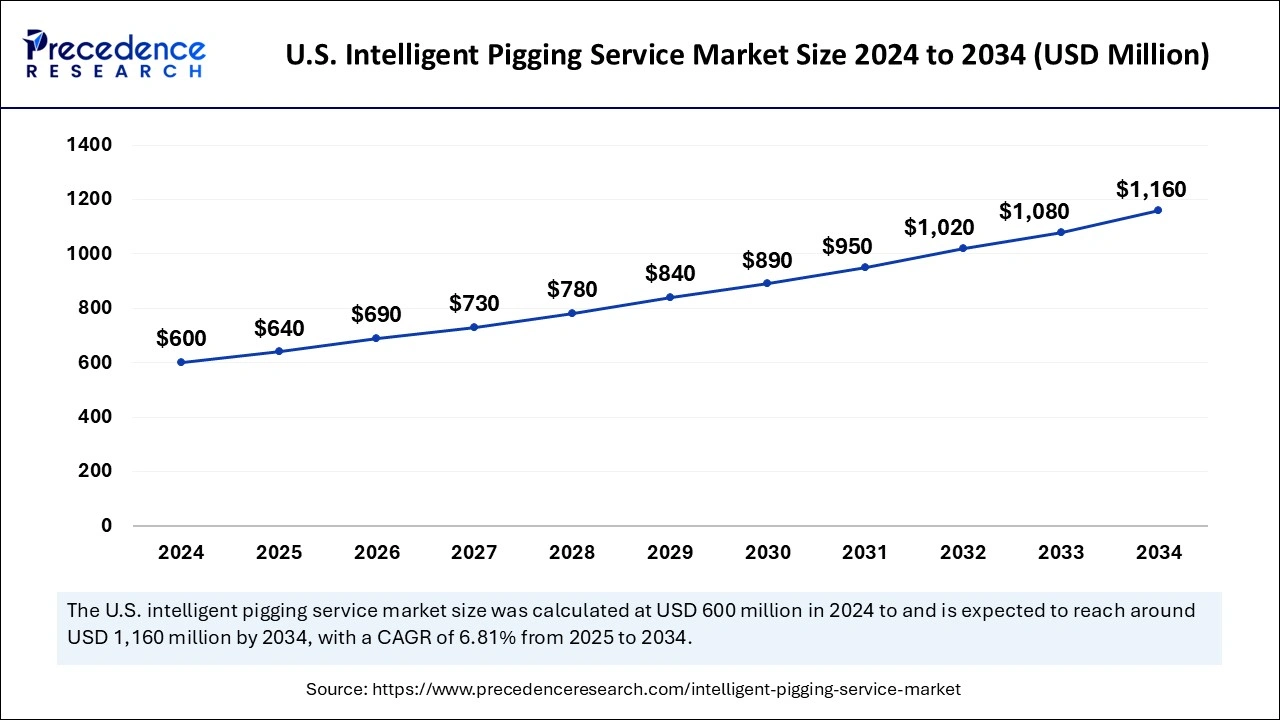

The U.S. intelligent pigging service market size was exhibited at USD 600 million in 2024 and is projected to be worth around USD 1,160 million by 2034, growing at a CAGR of 6.81% from 2025 to 2034.

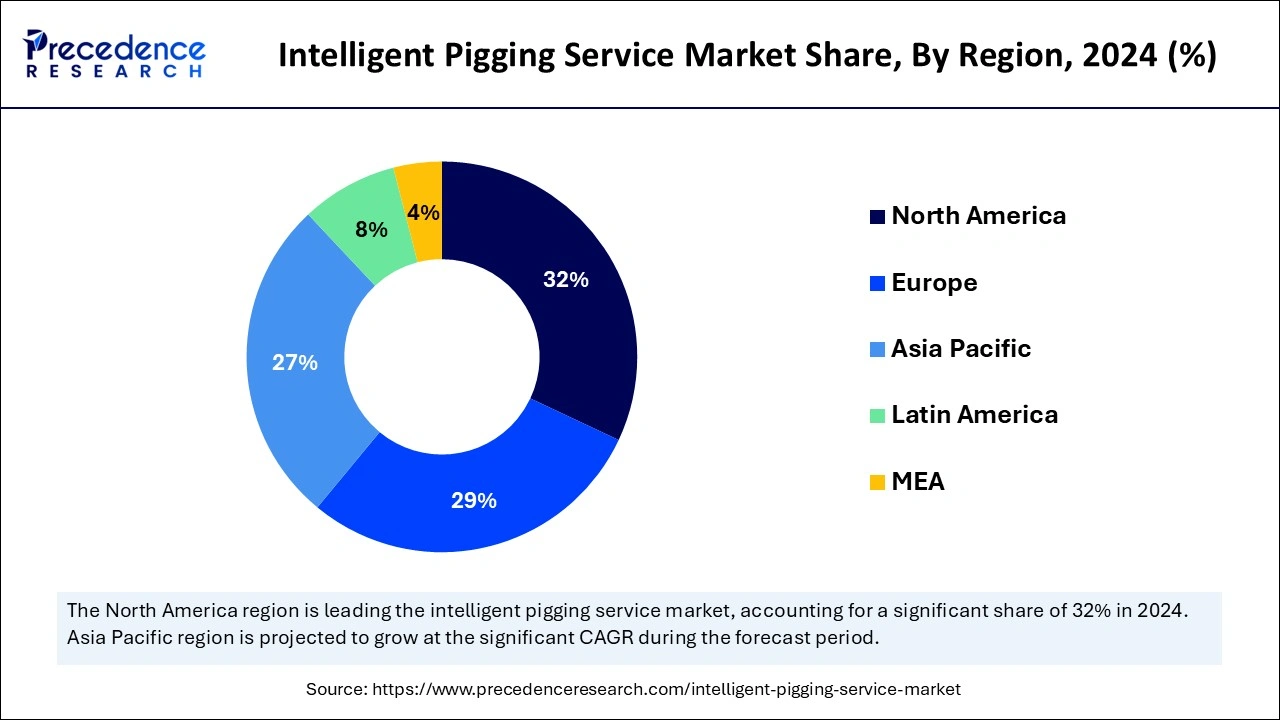

North America dominated the intelligent pigging service market in 2024. The growth of the market is attributed to the rising industrial infrastructure in regional countries like the United States and Canada, which is driving the demand for automation and smart technologies that are associated with the industries that boost the growth of the market. Additionally, the rising oil and gas industry across the region causes the demand for smart pigging services for faster and more effective production.

Europe is expecting substantial growth in the intelligent pigging service market during the predicted period. The rising awareness about waste management and industrial infrastructure boosts the demand for automated or intelligent machinery that rapidly detects and monitors anomalies in industries. The increasing presence of industrial-technological leaders is collectively contributing to the growth of the across the region.

The intelligent pigging services, which are also referred to as the smart pigging solution, help in detecting any types of defects and anomalies in the pipeline system of the industries. The intelligent pigging service market system is basically used for the inspection, maintenance, and cleaning of pipelines. The intelligent pigging system is the advanced technological integration in the pigging system, which is used to detect corrosion, cracks, metal loss, deformations, dents, etc.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.51 Billion |

| Market Size in 2025 | USD 2.68 Billion |

| Market Size by 2034 | USD 4.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.75% |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Pipeline Type, Technology, Diameter Range, End-User Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits associated with the intelligent piping service

The rising inclination towards smart or technologically advanced machinery or maintenance services would help prevent businesses from paying for the extra cost of repair, maintenance, and time for the business. The intelligent pigging service market predicts and analyzes the anomalies that may happen in the future before they can worsen. The intelligent pigging system provides easy tracking of defects en route in the piping system. The intelligent piping can detect issues in the pipeline like anomalies in welding, metal loss, temperature, bending problems, cracking through gas, corrosion, and others, which may lead to production loss.

High cost

The high cost of implementation or installation process of the intelligent pigging system due to the increased cost of software, hardware, and integrated services limits the adoption of intelligent pigging systems, which restrains the growth of the intelligent pigging service market.

Advancements in pigging technology

There is rising investment in industrial machinery and maintenance systems, such as innovations in pigging technologies like the incorporation of advanced fully automatic systems that are designed to operate automatically without any human intervention. The automated intelligent pigging service market offers the scheduling of pigging operations, real-time system health monitoring, automatic return to the launch housing, and remote monitoring and control capabilities from control rooms in the industries. Leading industries are using automated pigging technology for the efficient maintenance of pipeline systems.

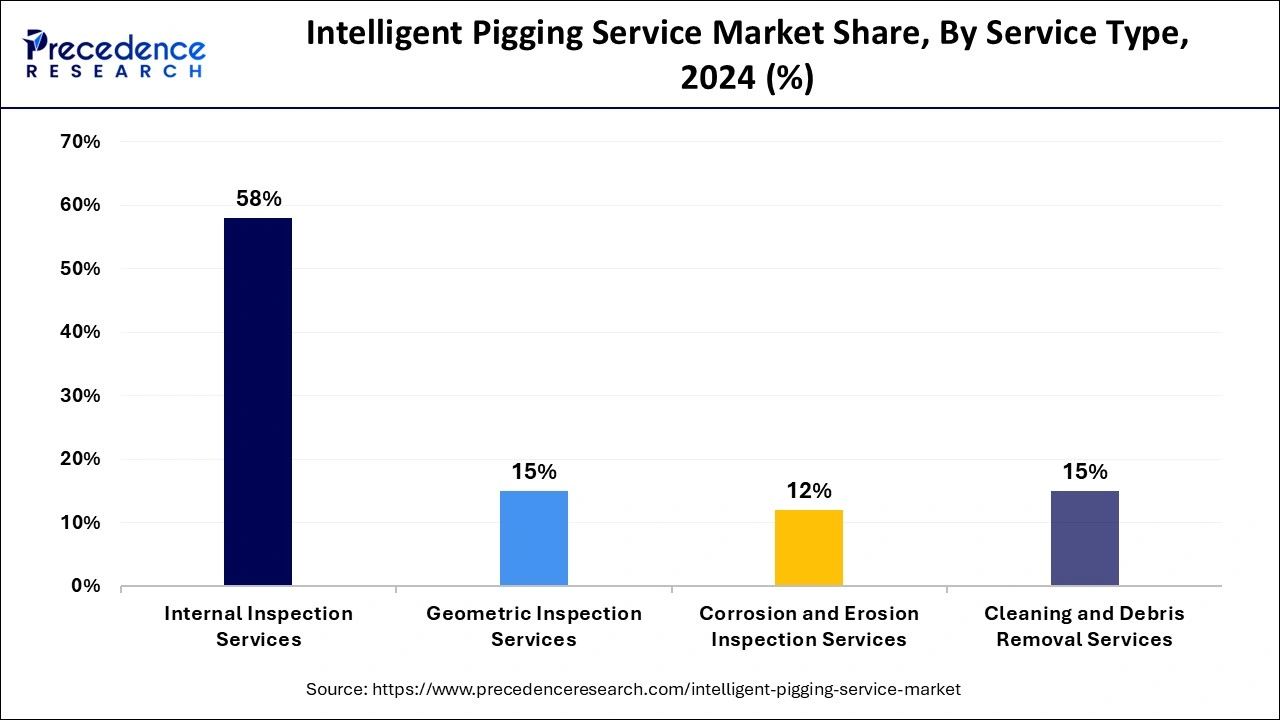

The internal inspection services segment led the global intelligent pigging service market in 2024. The internal inspection is the inspection or identification of the internal problems in the assets. Traditionally, internal inspections were done via humans, but as technology grows, robots and automatic machines are used to detect internal issues in pipelines or assets. The internal inspection is typically done via scaffolding, rope access, and remote visual inspection (RVI) tools. In which remote visual inspection is rapidly adopted by a number of industries for faster and more efficient services.

The geometric inspection services segment will show notable growth in the forecast period. The increasing demand for accurate and faster tools to detect any anomalies in the pipeline, which may become the cause of the problem in the production line, boosts the demand for geometric inspection services. The geometric inspection tools are specially designed technology or instruments that help in the pipeline's internal condition and accurate shape, which helps in finding issues in a timely manner and minimizing the expected downtime and cost in production.

The onshore pipelines segment dominated the intelligent pigging service market in 2024. The increasing demand for the time to time-pigging services from the onshore pipeline is due to various environmental and technological factors. The onshore pipeline is more prone to contaminants and debris, which may hamper the production process and cause the demand for intelligent pigging services in the onshore pipeline.

The offshore pipelines segment will witness for significant growth during the predicted period. The offshore pipelines are one of the major contributors to the efficient production process of the oil and gas industry distribution from the offshore units to the onshore line, which may be highly affected by contamination and corrosion due to temperature fluctuations that cause the increased demand for the pigging services in the offshore pipeline.

The magnetic flux leakage (MFL) inspection segment dominated the intelligent pigging service market in 2024. The Magnetic flux leakage (MFL) Inspection is the major technology used in pigging services by several leading organizations due to its higher efficiency in detecting and monitoring processes. The magnetic flux leakage uses a magnet to attract magnetized material. It is an advanced and nondestructive testing (NDT) technique used majorly in the oil and gas industries and others.

The ultrasonic inspection segment expects substantial growth during the predicted period. Ultrasonic inspection is one of the emerging technologies that is used in pigging services in various industries. The technology is used to send the ultrasonic frequency through the object. Most ultrasonic inspections are performed using pulse waves with a frequency ranging between 0.1-15 MHz, and up to 50 MHz can be used.

The medium-diameter segment led the global intelligent pigging service market in 2024. The presence of the medium-diameter pipeline in a wide range of industries, including oil and gas industries and the chemical industry for transporting crude oil, hydrocarbons, and other chemicals, boosts the adoption of intelligent pigging services in the medium-diameter pipeline.

The large-diameter and extra-large-diameter segment expect substantial growth in the market during the predicted period. The increasing demand for large-diameter and extra-large-diameter pipelines from water and wastewater management plants and several other industries drives the adaptation of intelligent pigging services in the large-diameter and extra-large-diameter pipelines.

The oil and gas industry held the largest share of the intelligent pigging service market in 2024. The oil and gas industry is one of the major contributors to the growth of the intelligent pigging services market. The oil and gas industry had a larger presence of pipelines in their production line for the distribution of chemicals, raw materials, crude oils, and other liquid materials, which may cause the increased demand for the time-to-time internal inspection of any anomalies in the pipeline, which may hamper the production process.

The rising automation in industrial operations is driving the demand for the intelligent pigging services market.

The water and wastewater industry expects substantial growth in the predicted period. The increasing awareness about the water and wastewater management process due to the rising industrial infrastructure, pollution level in water, and urbanization has boosted the development of the number of wastewater management plants globally, which causes the increased demand for efficient technology that can help in cleaning and detecting any issues in the pipeline internally that drives the growth of the market.

By Service Type

By Pipeline Type

By Technology

By Diameter Range

By End-User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025