July 2024

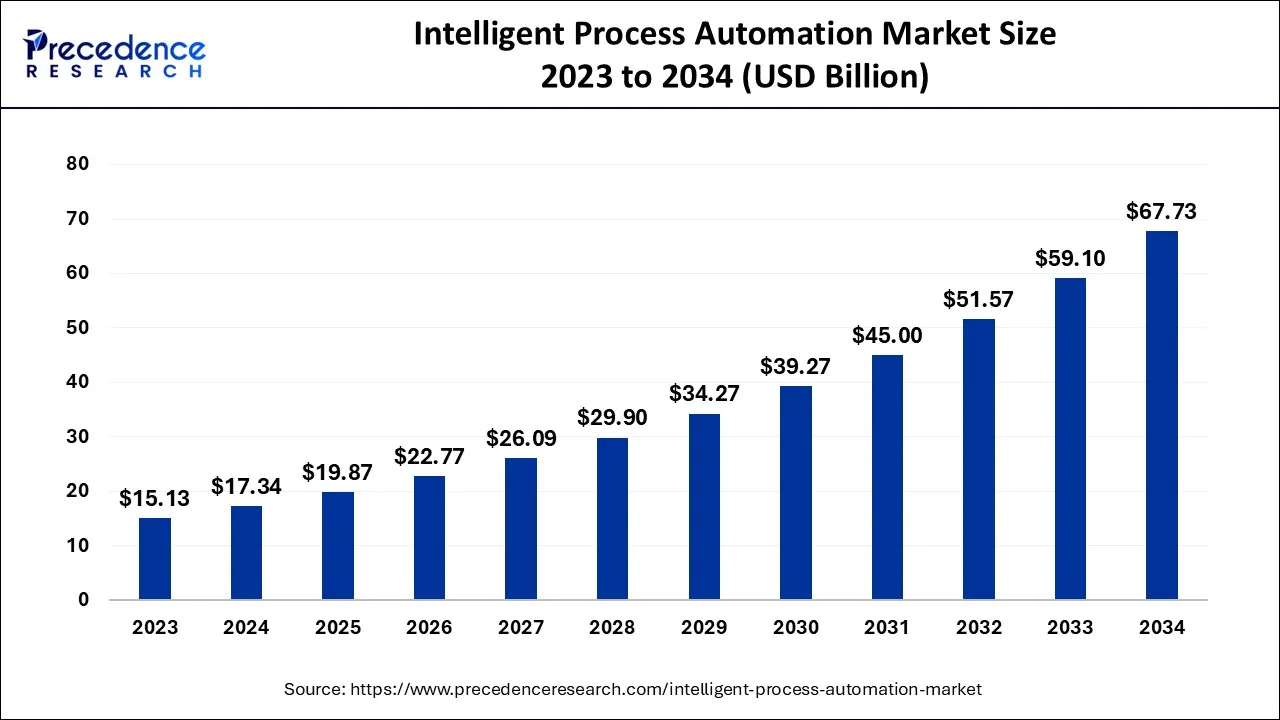

The global intelligent process automation market size accounted for USD 17.34 billion in 2024, grew to USD 19.87 billion in 2025, and is expected to be worth around USD 67.73 billion by 2034, poised to grow at a CAGR of 14.6% between 2024 and 2034.

The global intelligent process automation market size is expected to be valued at USD 17.34 billion in 2024 and is anticipated to reach around USD 67.73 billion by 2034, expanding at a CAGR of 14.6% over the forecast period from 2024 to 2034.

Intelligent process automation (IPA) is the implementation of artificial intelligence and linked new technologies to robotic process automation, such as computer vision, cognitive automation, and machine learning. Intelligent automation offers humans extensive advanced technologies and flexible processes, allowing them to make faster and more intelligent decisions. It offers benefits such as increasing process efficiency, improving the consumer experience, optimizing back-office operations, optimizing workforce productivity, reducing costs and risks, product and service innovation, and effective monitoring and fraud detection.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.34 Billion |

| Market Size by 2034 | USD 67.73 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Offering, Technology, Organization Size, Application, Deployment Mode, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing adoption of RPA

RPA technology automates enterprise routine tasks such as data extraction and cleaning through existing user interfaces, eradicating the need for human effort. Al uses neural nets with self-learning networks that take in information and make intelligent decisions by evaluating past data models and learning from them. ML, Al, cognitive learning, and RPA make up IPA workflow. Therefore, the increase in RPA leads up to growing demand for IPA. RPA offers efficiency and speed.

Executing robots that simulate human actions helps reduce manual, labor-intensive tasks, such as re-entering data from one system to the other. SAl subsequently promotes excellent intellect and decisions.

Al adds a different level of the idea to automation by analyzing data in ways humans cannot, identifying patterns within data and learning from previous decisions to arrive at increasingly intelligent decisions. IPA reduces documentation by removing the human aspect of data entry, document sorting and information validation, resulting in less time in the underwriting stage.

Lack of skilled professional

Skilled labor is required to run a recently automated business model, but searching for people with RPA and Al abilities is critical. This also includes technical expertise, an understanding of an organization's operational processes, and its management expertise to lead the organization toward the future. Giving on or upgrading skills a talent for developing automation is typically on top of the priority list; however, allocating people to continuous maintenance, assistance, and troubleshooting is also critical.

Technological advancements

Increasing the use of artificial intelligence (AI) has been one of the intelligent process automation (IPA) prospects to drive market growth. Suppliers are planning to build an automation-led digital transformation program using technological innovations such as AI-driven decision-making skills, intelligent mindsets based on past instances, and analytical analysis under future scenarios. Hence, this factor is also anticipated to boost the global market's growth.

Based on the offering, the global IPA market is segmented into platforms, solutions, and services. In 2023, the solution segment accounted for the highest market share. Organizations of all sizes are increasingly implementing IPA solutions to boost operational proficiency and reduce human labor. IPA is the application of Al and linked evolving technology, including computer vision, cognitive automation, and machine learning, to robotic process automation. Cognitive capabilities are added to these solutions, allowing programs to gain, translate, and react.

It gives users smart technologies and exile processes, allowing them to make faster and more informed decisions. IPA solutions have two major advantages: increased price efficiency and improved customer experience. According to research, several firms across industries experimented with IPA, with impressive results: automation of 50 to 70% of tasks, resulting in annual run-cost efficiencies of 20 to 35%.

Based on technology, the IPA market is segmented into natural language processing, machine and deep learning, neural networks, virtual agents, mini bots, computer vision, and others. In 2023, the machine learning segment accounted for the highest market share. The growth of this segment is due to benefits such as the ability of computers to learn automatically without the need for human assistance or intervention. Machine learning-based advanced technologies such as voice recognition and image recognition systems drive market growth.

Based on organization size, the IPA market is segmented into large enterprises and SMEs. In 2023, SMEs accounted for the highest market share. This is owing to rising awareness of how automation can result in a high return on investment, process efficiency, and time savings. Furthermore, SMEs are increasingly aggressively investing in new technologies to get the job done. All of these factors are creating numerous growth opportunities in the intelligent process automation industry.

Based on application, the global IPA market is segmented into IT operations, business process automation, application Management, contact center management, security management, and others. In 2023, the IT operations segment accounted for the highest market share. The organization of intelligent process automation arrangements in various tasks, such as application and programming development lifecycle management, can benefit IT, operation teams. These arrangements also support various capacities, such as client the board, administration ticket executives, resource tracking, and programming checking.

An intelligent measurement automation process assists IT activity groups in screening and managing the IT lifecycle in the middle, improving client encounters while lowering operational costs. Lifecycle measures and astute cycle mechanization arrangements in programming and application improvement give clients an adaptable arrangement that speeds up various advancement errands, for instance, test robotization. The benefits provided by smart measure robotization arrangements are pushing IT operation groups to select these arrangements.

Based on deployment, the IPA market is segmented into on-premises and cloud. In 2023, the on-premises segment accounted for the highest market share. On-premises deployment entails installing the hardware and software on the client's premises. It is a more expensive model than cloud-based model. Conventional approach to implement the IPA solution in businesses is on-premises deployment.

The on-premises IPA solution gives businesses complete control over its applications, platforms, data, and systems, which are all managed their internal IT professionals. Businesses that require user credentials for business activities have a preference on-premises deployment due to their complete control over their systems. Governments and BFSI industries are widely expected to prefer the on-premises IPA solution as these industry verticals handle critical and confidential data related to national security and financial operations.

Data-sensitive businesses prefer on-premises developed Al and ML tools for use in IPA solutions. The additional critical factor is the real-time accessibility of data to extract insights; thus, despite the rapid development of cloud-based solutions, IPA solutions are expected to stay on-premises in some regions. However, the rising cost of maintenance and support for on-premises solutions, as well as the increasing dominance of the cloud, are expected to drive the adoption of hosted solutions. As opposed to manual data validation, standardization, and robust matching, on-premises deployment of IPA solutions offers significant improvements.

Based on vertical, the IPA market is segmented into BFSI, telecommunication and IT, manufacturing & logistics, media & entertainment, retail & eCommerce, healthcare & life sciences, and others. In 2023, the BFSI segment accounted for the highest market share and is expected to grow faster during the forecast period.

The BFSI vertical is automating recurring tasks including data input, compliance policies, and installation and the formulation, which allows for improvements in pace and effectiveness. These solutions aid in regulatory and compatibility reporting by collecting data from multiple systems and improving the efficiency and accuracy of various processes.

This information is then used to execute validation checks to draw up a detailed analysis. Automation all over banking functions is assisting in increasing the ability and liberating employees to focus on higher-value projects and assignments. Banks are starting to implement automation in the back-office for risk prevention for the duration of customer-facing process trials. This allows banks to focus on one area while developing a detailed roadmap for implementing intelligent process automation.

Furthermore, the back and middle offices benefit more from automation than the front. Back-office functions such as accounting and financial help drive cost reductions of 13% in organizations implementing automation, compared with 7% in the front office. As competition grows, banks are focusing more on improving operational efficiency and delivering better customer experience management.

In 2023, North America dominated the IPA market accounting for the highest market share and is estimated to remain dominant during the forecast period. Rising enterprise adoption of process control and automation solutions in the United States is driving regional growth. The adoption of highly developed technologies such as AI, machine learning, and RPA across businesses, as well as increased spending to optimize business operations, are key drivers of segment growth. Furthermore, the availability of major vendors in the region is expected to spur growth.

Moreover, Asia Pacific is estimated to be the fastest-growing region during the forecast period. The BFSI sector in China and India is gaining traction as the countries' online transactions increase. Growing interest in automation, machine learning, and artificial intelligence is driving up the demand in intelligent process automation solutions and services. Globalization, economic development, digitalization, and advanced adoption of cloud-based technologies are major drivers of regional market growth.

Segment Covered in the Report

By Technology

By Organization Size

By Application

By Deployment Mode

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

September 2024

March 2024