July 2024

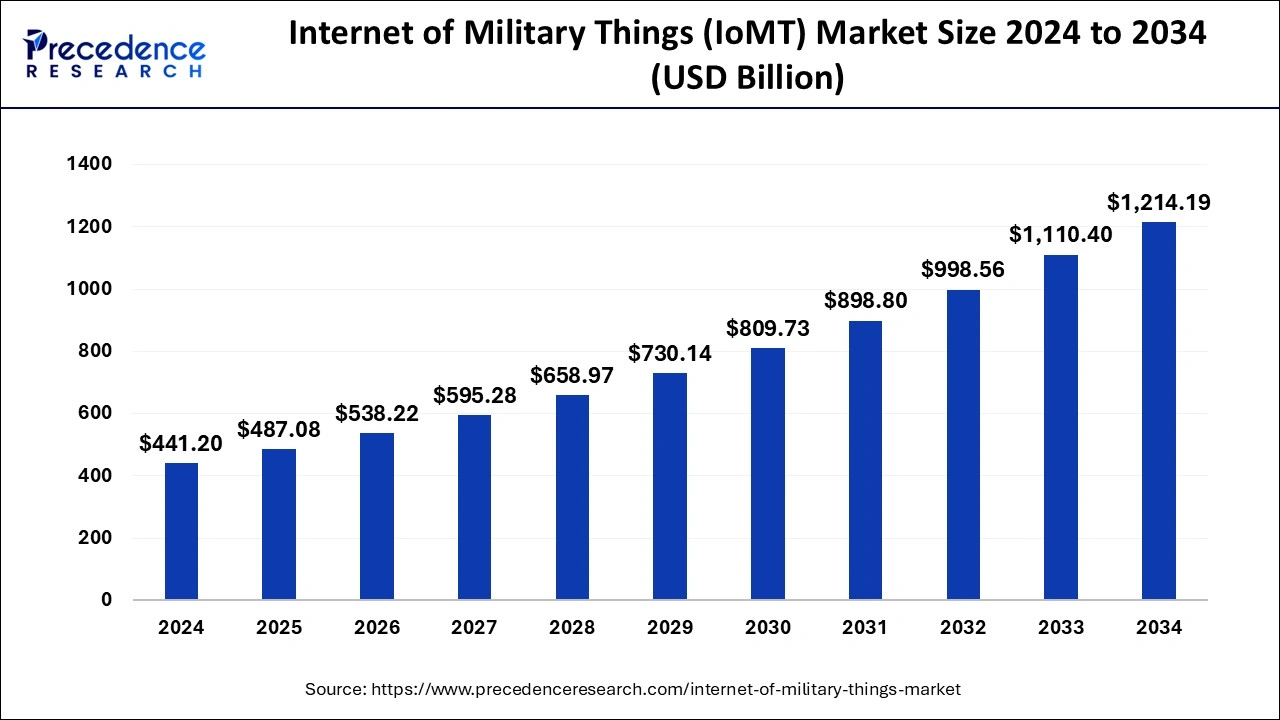

The global internet of military things (IoMT) market size is calculated at USD 487.08 billion in 2025 and is forecasted to reach around USD 1214.19 billion by 2034, accelerating at a CAGR of 10.65% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The internet of military things (IoMT) market size was estimated at USD 441.20 billion in 2024 and is predicted to increase from USD 487.08 billion in 2025 to approximately USD 1214.19 billion by 2034, expanding at a CAGR of 10.65% from 2025 to 2034. The internet of military things (IoMT) market is driven by warfare that is changing and the requirement for improved situational awareness.

The internet of military things (IoMT) market is aimed at offering a class of heterogeneously connected devices for the military and defense sector. Such solutions are widely applicable to both intelligence-driven warfare and sophisticated combat operations. Most highly developed military forces have incorporated IoMT into their battlefield operations to improve their observation and response tactics. The military has several strategic possibilities with this notion. Deploying several Internet of military things (IoMT) sensors across different domains, such as air, land, sea, space, and cyber, can facilitate the acquisition of comprehensive situational awareness and understanding of the battlefield's information ecology. This will ultimately aid in timely and precise planning and execution of future combat by expediting the Observe, Orient, Decide, Act (OODA) decision-making loop.

| Report Coverage | Details |

| Market Size in 2025 | USD 487.08 Billion |

| Market Size by 2034 | USD 1214.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.65% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution, By Technology, By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing focus on cyber security

Rising focus on cyber security in defense sector is observed to act as a driver for the internet of military things (IoMT) market. The growth of connected devices within the military infrastructure greatly expands the assault surface. Every linked device is a possible point of entry for cyberattacks, which can take many forms, from sabotage to espionage. Massive volumes of sensitive data, such as troop movements, operational plans, and classified information, are produced and sent via IoMT devices. Maintaining military superiority and defending national security interests depend critically on the confidentiality of this data. Military companies must constantly adjust their cyber security policies to counter new attack vectors, malware variants, and hacking techniques as cyber threats evolve and become more sophisticated.

Advancements in technology

Highly advanced sensors that collect data in real-time from various military assets, including vehicles, weapons, and equipment, result from technological breakthroughs. These sensors improve situational awareness and decision-making abilities by offering valid data on location, state, performance, and other topics. Cybersecurity is becoming more and more crucial as IoMT devices become more networked. Sophisticated cybersecurity tools, including intrusion detection systems, encryption, and secure communication protocols, guard private military information and stop illegal access or manipulation.

Limited power supply

IoT devices used by the military are frequently used in harsh or isolated locations with restricted access to power sources. Thereby, the power supply factor is observed to act as a restraint for the internet of military things (IoMT) market. Thus, these gadgets need to be highly energy-efficient to save energy and prolong their operating lives. IoT devices for the military need to be flexible and deployable in various situations, including ones where standard power systems are unavailable. Due to limited power supplies, alternative energy sources like solar, kinetic, or fuel cells must be used; nevertheless, these sources may only sometimes be dependable or practical.

Requirement of Improved logistics and maintenance

Predictive maintenance is made possible by IoMT, which permits real-time asset monitoring for the military. By gathering and evaluating equipment performance data, potential problems can be found and fixed before they result in expensive malfunctions, increasing overall operating effectiveness. Instead of using set schedules or reactive repairs, IoMT can proactively schedule maintenance chores depending on usage and wear. By doing this, unscheduled downtime is reduced, and military equipment is kept functional as needed. Thereby, the requirement of improved logistics offered by IoT is observed to act as an opportunity for the internet of military things (IoMT) market.

Enhanced situational awareness

IoMT devices and sensors collect massive amounts of real-time data from various sources, including wearable technologies, satellites, ground sensors, and drones. Armed forces personnel can use this data to gain a thorough picture of their surroundings, including the geography, the weather, enemy movements, and the whereabouts of friendly forces.

Military leaders can make better decisions in intricate and dynamic operating contexts with improved situational awareness. They can foresee dangers, spot opportunities, and deploy resources more effectively to accomplish mission goals with the least risk to people and property.

The hardware segment held the largest share of the internet of military things (IoMT) market in 2024. Sensors play a critical role in military applications by gathering and analyzing data. For these sensors to perform well in harsh settings like rural locations or battlegrounds, they need specific gear. Larger military systems like vehicles, aircraft, and weapons platforms contain many embedded IoMT devices. Custom hardware is required for these embedded systems to integrate smoothly and dependably under challenging circumstances.

The software segment shows a notable growth in the internet of military things (IoMT) market during the forecast period. The analysis of massive volumes of data produced by military IoT devices is made possible by software solutions in IoMT. These analytics offer insightful information that can be used to improve military operations, situational awareness, and decision-making. The scalability, flexibility, and accessibility of cloud-based software solutions enable military organizations to handle and process IoMT data across various operating situations effectively. This integration accelerates defense agencies' deployment of IoMT software.

IoMT software vendors provide flexible solutions to meet specific military needs and applications. This adaptability makes integrating IoMT solutions across different military sectors easier and integrates them seamlessly with current systems.

The cellular segment held a significant share of the internet of military things (IoMT) market in 2024. Military equipment can maintain contact even in difficult or distant locations thanks to cellular networks offering robust and dependable connectivity. This connectivity improves decision-making and situational awareness by facilitating real-time data transfer and communication across military assets. Due to the broad worldwide coverage provided by cellular networks, military assets can stay connected even when operating in different areas and theaters of operation. This worldwide reach guarantees that military troops, no matter where they are, can easily coordinate and communicate.

The training and simulation segment had the largest share in 2024 in the internet of military things (IoMT) market. IoMT integrates different sensors, devices, and systems to make it easier to create realistic training settings. This increases military personnel's effectiveness and readiness by allowing them to participate in simulations that resemble real-world situations. IoMT technologies are used to create virtual settings for training, which reduces the danger of equipment damage or personnel injury that comes with live exercises. Because of this, it's a safer choice for training military troops for various operational situations.

The real-time fleet management segment shows a notable growth in the internet of military things (IoMT) market during the forecast period. Real-time fleet management solutions enable military organizations to maximize productivity, guarantee mission readiness, and optimize operations by providing them with better visibility and control over their assets. This capacity is vital in military operations where prompt and precise decision-making is critical. Furthermore, real-time fleet asset monitoring and analysis is now possible thanks to technological improvements like IoT sensors, GPS tracking, and data analytics. This has enhanced situational awareness and operational performance.

North America dominated the internet of military things (IoMT) market in 2024 and is expected to maintain its position during the forecast period. The United States and the rest of North America are home to many cutting-edge communication systems, strong networks, and vast facilities for research and development. This architecture offers a strong base for building and implementing IoMT solutions. North American defense corporations frequently work with other essential actors in the technology sector, including data analytics organizations, cybersecurity experts, and software developers. By allowing the integration of various technologies, these strategic collaborations improve the usefulness and efficacy of IoMT solutions.

Asia Pacific shows a significant growth in the internet of military things (IoMT) market during the forecast period. Many Asia-Pacific nations are raising their defense budgets to modernize their armed forces. This includes spending on cutting-edge technologies, such as IoMT, to improve military capabilities. The use of IoMT in military applications is propelled by the swift progress made in internet of things (IoT), artificial intelligence (AI), and other related technologies. These technologies benefit military operations by allowing autonomous operations, predictive maintenance, and real-time data processing.

By Solution

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

December 2024

December 2024