December 2024

Intragastric Balloon Market (By Balloon Type: Single, Dual, Triple; By Filling Material: Saline Filled, Gas Filled; By Administration: Endoscopy, Pill Form; By End-use: Hospitals, Ambulatory Centers) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

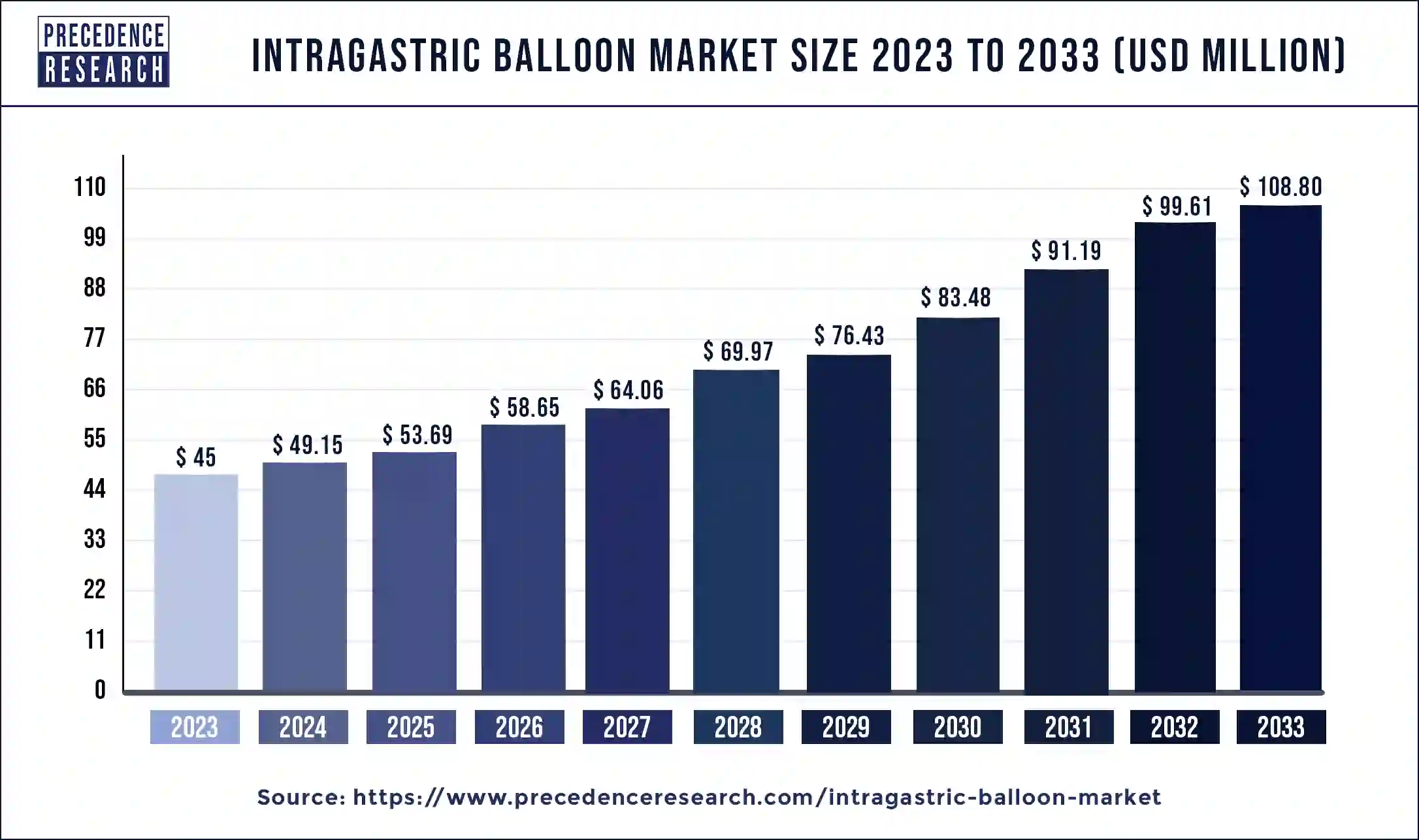

The global intragastric balloon market size was valued at USD 45 million in 2023 and is anticipated to reach around USD 108.80 million by 2033, expanding at a CAGR of 9.22% from 2024 to 2033. The increasing acceptance and endorsement of intragastric balloons by regulatory bodies across different areas is shown in the regulatory approvals for these devices, which instills confidence in patients and healthcare professionals.

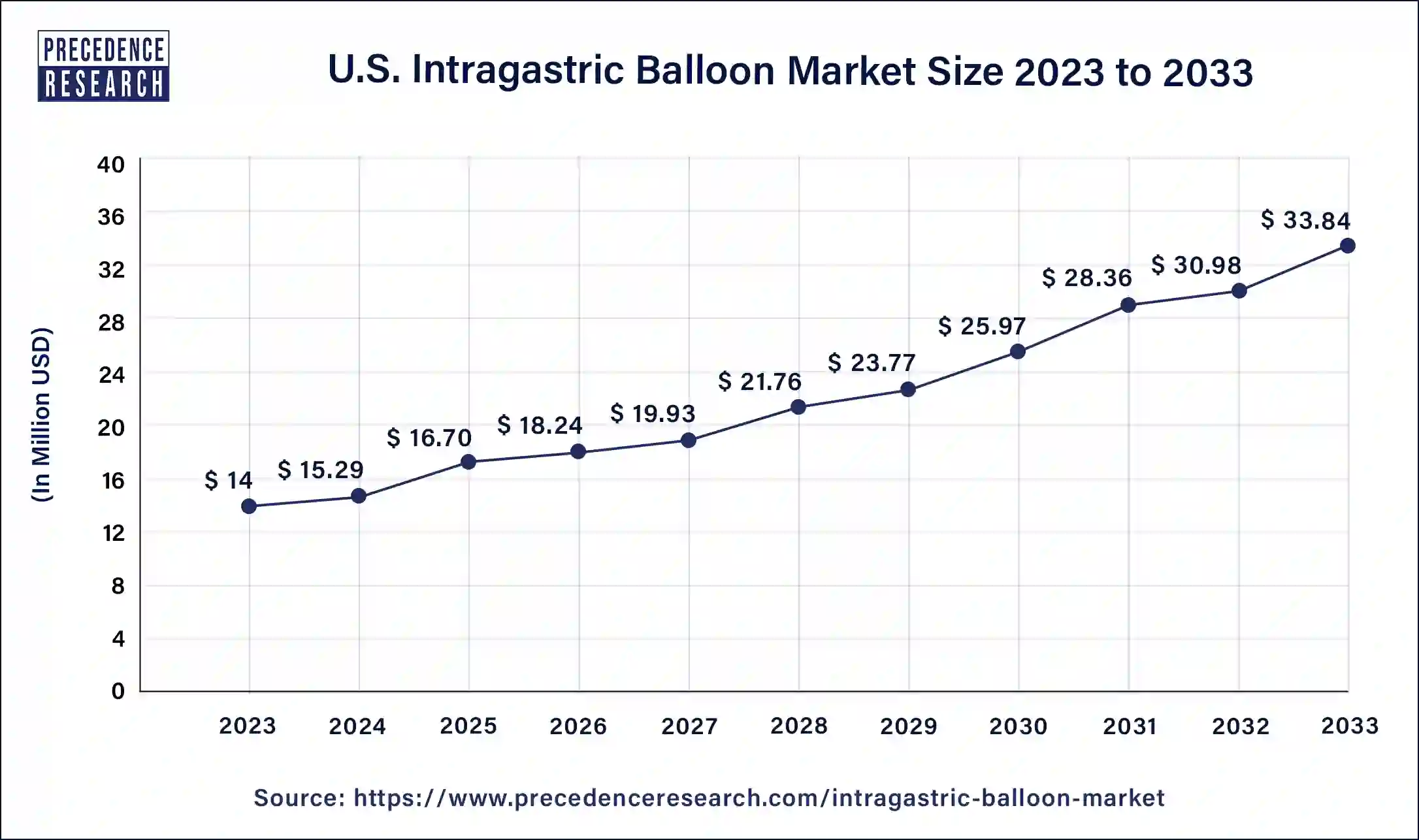

The U.S. intragastric balloon market size was estimated at USD 14 million in 2023 and is projected to surpass around USD 33.84 million by 2033 at a CAGR of 9.30% from 2024 to 2033.

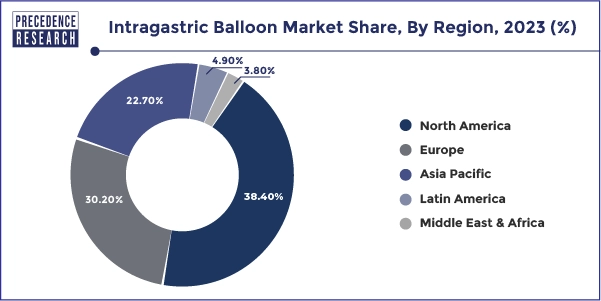

North America holds the largest share of the intragastric balloon market. Non-surgical weight loss devices called intragastric balloons are inserted into the stomach to help people feel fuller and eat less. Growing obesity rates, increased understanding of the value of weight control, and improvements in medical technology that make these operations safer and more widely available are some of the drivers driving this industry. Because of its well-established healthcare system and high obesity incidence, the United States has been the largest market for intragastric balloons in North America. Though not as much as the U.S., Canada nevertheless makes a contribution to the market.

Asia Pacific is also expected to hold the largest share of the intragastric balloon market during the forecast period. Due to shifting food choices, urbanization, and lifestyle changes, obesity rates were significantly rising in nations like China, India, and Indonesia. The desire for efficient weight loss methods was being driven by this demographic shift. Healthcare providers and patients in the area were becoming more aware of the dangers associated with obesity and the availability of less intrusive weight loss techniques like intragastric balloons.

More people were able to access cutting-edge medical treatments, such as intragastric balloon procedures, thanks to rising healthcare spending in Asia Pacific's expanding nations. Patients from other nations were being drawn to the region for intragastric balloon treatments due to the accessibility of reasonably priced healthcare services and the standing of certain nations as medical tourism destinations.

Intragastric Balloon Market Overview

With obesity rates rising globally and people's choice for less invasive weight loss methods, the intragastric balloon industry was growing steadily. Non-surgical intragastric balloons are inserted into the stomach to increase feelings of fullness and decrease food intake, which in turn helps with weight loss. Due to its link to a number of chronic illnesses, including diabetes, cardiovascular disease, and several types of cancer, obesity has emerged as a major global health concern. Consequently, there has been a rise in the need for efficient weight reduction methods.

When considering weight loss procedures, intragastric balloon insertion is less invasive than standard methods such as gastric bypass or sleeve gastrectomy. Therefore, it is a recommended choice for people looking for weight loss procedures with lower risks and complications. Technological developments in intragastric balloons have resulted in the creation of safer and more effective devices. Better results and patient comfort are provided by more recent balloons with enhanced materials and designs.

A growing number of people are investigating options such as intragastric balloons as a result of increased knowledge about the health hazards linked to obesity and the availability of various weight loss methods. Many nations' regulatory agencies have been in favor of intragastric balloon treatments, which has allowed the industry to flourish by guaranteeing that safety and efficacy requirements are met. The intragastric balloon market is subject to various factors that could impact its current state, including changes in consumer preferences, rising rivals, regulatory changes, and technological breakthroughs.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.22% |

| Global Market Size in 2023 | USD 45 Million |

| Global Market Size in 2024 | USD 49.15 Million |

| Global Market Size by 2033 | USD 108.8 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Balloon Type, By Filling Material, By Administration, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Increasing obesity rates

As obesity rates rise, there may be a greater need for weight loss treatments, such as intragastric balloons, as individuals look for practical ways to control their weight and associated health problems. Increased demand could spur technological innovation and developments in the intragastric balloon market, resulting in the creation of safer and more effective balloon designs and materials.

A wider range of people may be able to afford and obtain intragastric balloons as the intragastric balloon market grows, taking into account the socioeconomic aspects that contribute to obesity. Increased public knowledge of non-surgical weight loss methods, such as intragastric balloons, may result from rising obesity rates, which may encourage healthcare professionals to inform patients about these options.

Restraint: Cost and insurance coverage

Pre-operative examinations, follow-up treatment, anesthetic expenses, surgeon fees, hospital or facility fees, and the cost of the balloon itself are some of the typical costs associated with an intragastric balloon surgery. Patients should also take into account any possible costs that they might incur out of cash, such as co-insurance, deductibles, and co-payments, even if their insurance covers the surgery.

There are major differences in insurance coverage for intragastric balloon treatments. When a procedure is considered medically necessary, insurance companies may pay for it. This is often the case for people with high body mass index (BMI) who have not responded well to conventional weight loss techniques and who have associated medical issues like diabetes or hypertension. It can be necessary to get pre-authorization from the insurance company even if coverage is available.

Opportunity: Patient-centric approach

Intragastric balloon manufacturers are placing a greater emphasis on creating devices that minimize adverse effects, promote patient comfort, and are simple to insert. This involves minimizing discomfort and improving tolerability through improvements in balloon materials, forms, and sizes. Patients receiving intragastric balloon treatment are increasingly being offered extensive support services in addition to the device.

It is essential to teach patients about intragastric balloon therapy's advantages, disadvantages, and anticipated results in order to promote treatment adherence and well-informed decision-making. The intragastric balloon devices can be made to better fulfill patients' expectations and real-world demands by working with patient advocacy groups and incorporating patient feedback into product development and marketing strategies.

The single segment held the largest share of the intragastric balloon market. An intragastric balloon device that only has one balloon falls into a particular category or type, which is referred to as a single balloon type segment. These devices, which are intended to be endoscopically put into the stomach and filled with gas or saline to take up space, are used to treat obesity. This contributes to the sensation of fullness, which lowers food intake and promotes weight loss.

The sector for a particular balloon type may contain a range of goods from distinct producers, each with unique features, sizes, compositions, and designs. To help people lose weight, these balloons—which are typically only meant to be worn temporarily before needing to be taken down—can be utilized in conjunction with dietary and lifestyle changes.

The triple segment is expected to witness significant growth during the forecast period. The acceptance and success of products in this market are influenced by variables such as patient tolerance, safety, effectiveness, ease of insertion and removal, and regulatory approval status.

Furthermore, continued research and development initiatives might result in technological breakthroughs for balloons, which might increase the range of products available in the intragastric balloon market's triple balloon type segment. Other intragastric balloon market segments could include double balloon systems, other balloon designs, and alternative building materials like silicone or other biocompatible materials.

The saline filled segment held the dominant share of the intragastric balloon market in 2023. One of the main kinds of intragastric balloons used in weight loss operations is saline-filled balloons. Once inserted into the stomach, these balloons are usually filled with saline solution. This occupies space in the stomach and causes a feeling of fullness, which reduces food intake and aids in weight loss.

The ability of intragastric balloons to effectively encourage weight loss and support the management of obesity is a major factor propelling market expansion. The successful market adoption of saline-filled balloons is largely dependent on clinical research and empirical data. It is crucial to guarantee the safety of intragastric balloon treatments. Developments are meant to lessen unfavorable outcomes related to balloon insertion and aid in market growth. Producers make investments in creating balloons with enhanced safety features.

For intragastric balloon market participants, adherence to regulatory obligations is crucial. The commercialization of saline-filled intragastric balloons requires approvals from regulatory bodies such as the FDA (Food and Drug Administration) in the United States and CE marking in Europe. There is fierce competition among the players in the intragastric balloon market as they compete for market share. For businesses in this industry, competing on elements like product effectiveness, pricing, and after-sales service is essential. Expanding the market requires educating patients and medical professionals about the advantages and disadvantages of intragastric balloon therapy. Saline-filled balloon demand may be driven by growing knowledge of intragastric balloons and obesity therapy options.

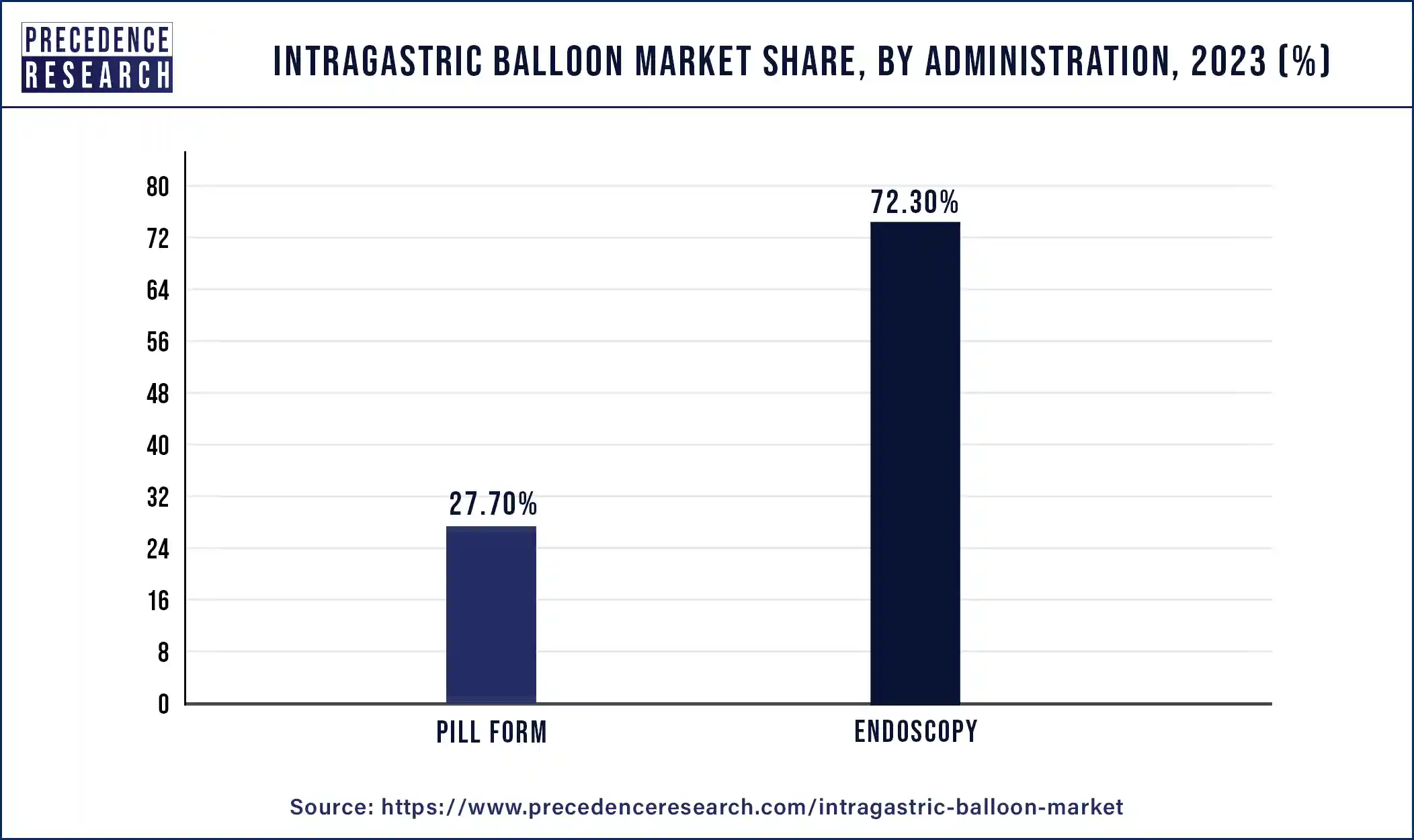

The endoscopy segment held the largest share of the balloon market in 2023. Compared to surgical operations, endoscopic techniques are considered to be less intrusive when it comes to placing intragastric balloons. The balloon can usually be inserted endoscopically, which reduces the chance of problems and downtime and is, therefore, a desirable alternative for physicians and patients alike.

Endoscopic procedures provide patients with a less intrusive option for surgery, which can lead to a decreased risk of postoperative complications, faster recovery times, and less discomfort. The increased use of intragastric balloons as a therapy option for obesity and associated comorbidities is partly due to the better patient experience. The insertion of intragastric balloons can now be done in a safer and more effective manner thanks to developments in endoscopic technology.

In order to prioritize patient safety, endoscopic procedures for intragastric balloon implantation have evolved. For example, using intragastric balloons with integrated safety features, including anti-migration mechanisms and biocompatible materials, lowers the possibility of unfavorable outcomes and guarantees the procedure's overall safety. By precisely placing and removing intragastric balloons, endoscopy lowers the risk of problems and guarantees the best possible outcome for patients. During the insertion and removal processes, medical professionals may see the stomach in real time, enabling them to make any necessary modifications. Compared to standard surgical techniques, endoscopic operations are less invasive, which means that patients experience fewer complications and quicker recovery times.

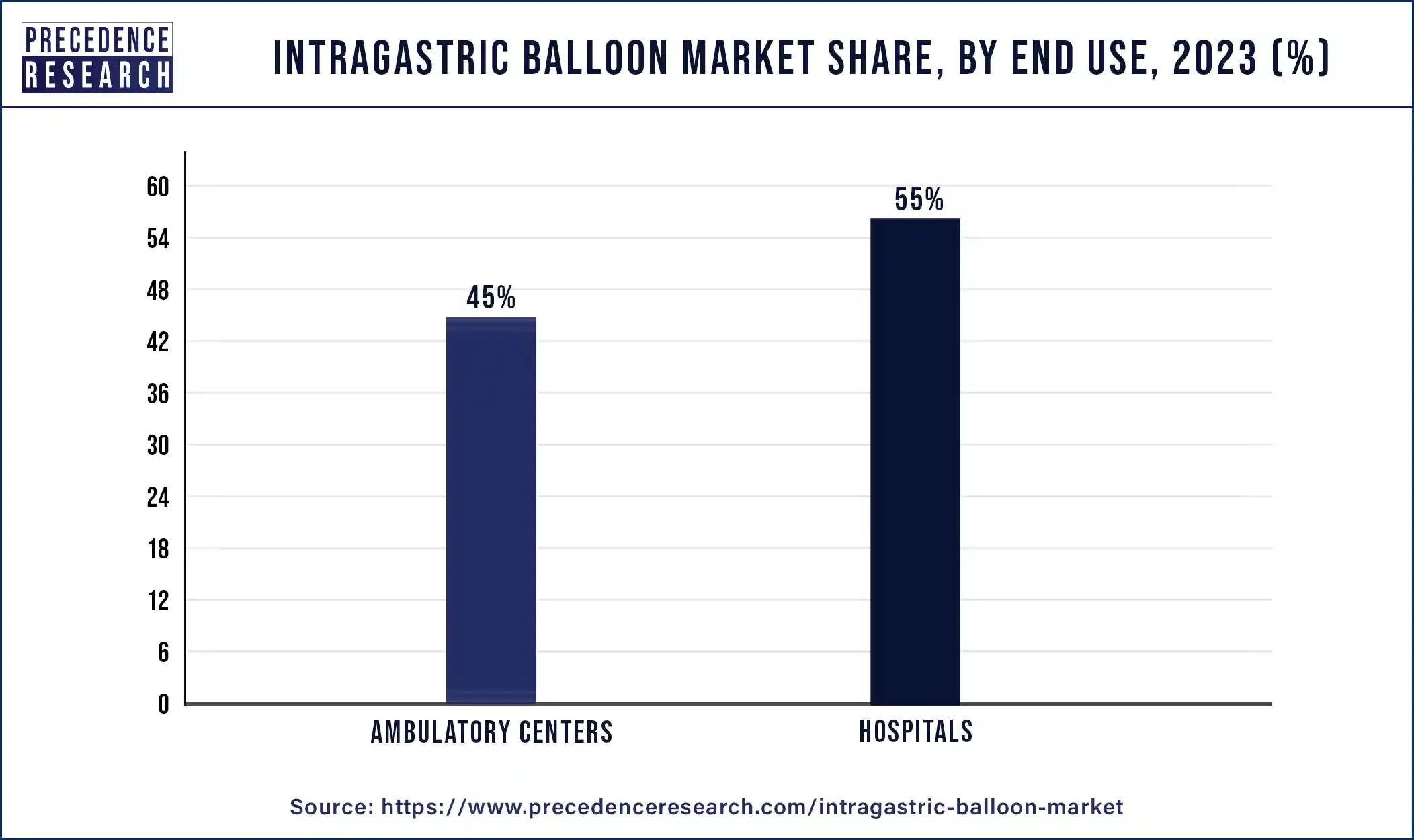

The hospital segment dominated the intragastric balloon market in 2023. The use of intragastric balloons (IGBs) for weight reduction procedures in hospital settings is referred to as the hospital segment in the intragastric balloon market. By taking up room in the stomach, increasing satiety, and decreasing food intake, intragastric balloons are a minimally invasive weight reduction therapy option that can assist people in losing a considerable amount of weight.

Intragastric balloon treatments are usually carried out in hospital settings in specialist endoscopy suites or operating rooms by medical professionals with training in bariatric surgery or gastroenterology. In the hospital setting, patients having intragastric balloon implantation frequently receive thorough pre-procedural assessments, counseling, and post-procedural care.

Hospitals usually have the specific tools, spaces, and qualified medical personnel needed to carry out intragastric balloon treatments in a secure and efficient manner. Comprehensive care routes, such as pre-procedural evaluation, nutritional counseling, follow-up visits, and management of any problems, are frequently provided by hospital-based weight reduction programs. By following strict safety guidelines and regulations, hospitals give patients peace of mind and trust when they undergo intragastric balloon treatments. Patients seeking weight loss therapies are frequently referred to hospitals by primary care physicians, dietitians, and other healthcare professionals. For individuals who qualify, hospital-based intragastric balloon operations may be a more accessible choice since they may be more likely to be funded by health insurance plans in some areas.

Segment Covered in the Report

By Balloon Type

By Filling Material

By Administration

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

July 2024

June 2024