July 2024

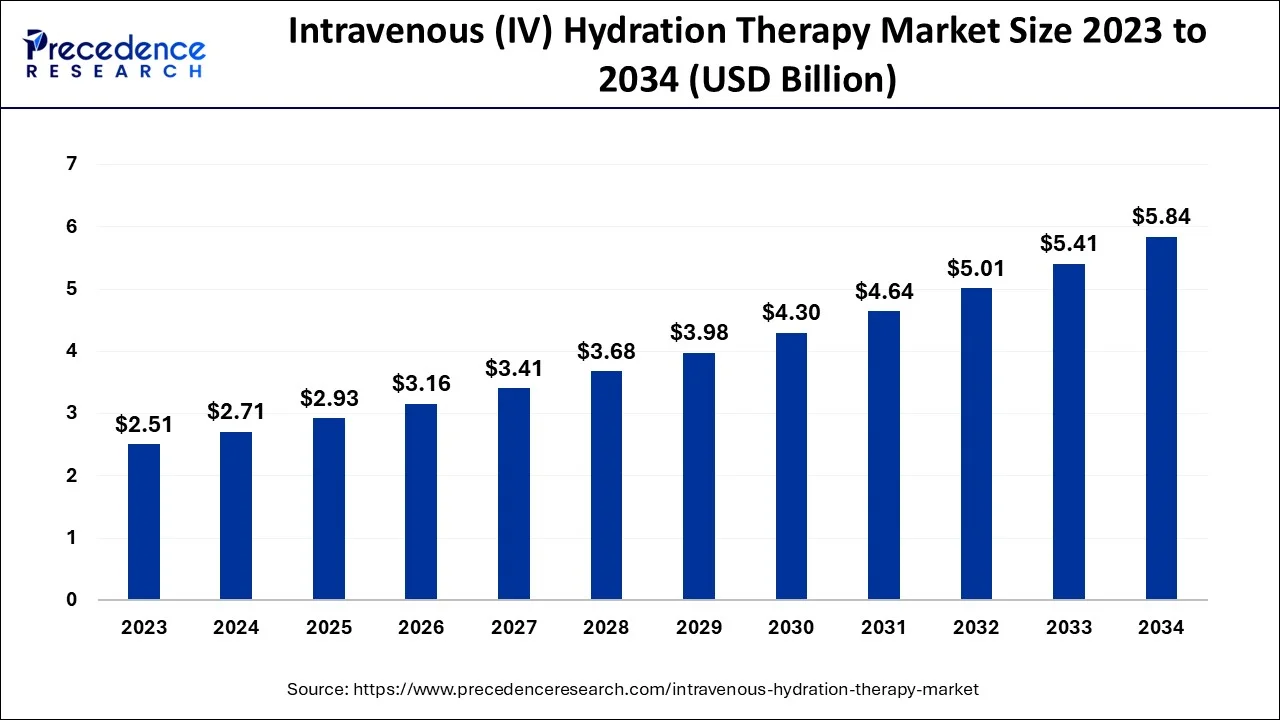

The global intravenous (IV) hydration therapy market size accounted for USD 2.71 billion in 2024, grew to USD 2.93 billion in 2025 and is predicted to be worth around USD 5.84 billion by 2034, registering a CAGR of 7.98% between 2024 and 2034. The North America intravenous (IV) hydration therapy market size is evaluated at USD 1.27 billion in 2024 and is expected to grow at a CAGR of 8.06% during the forecast year.

The global intravenous (IV) hydration therapy market size is calculated at USD 2.71 billion in 2024 and is projected to surpass around USD 5.84 billion by 2034, expanding at a CAGR of 7.98% from 2024 to 2034. The intravenous (IV) hydration therapy market is driven by the rising demand for preventative and wellness services.

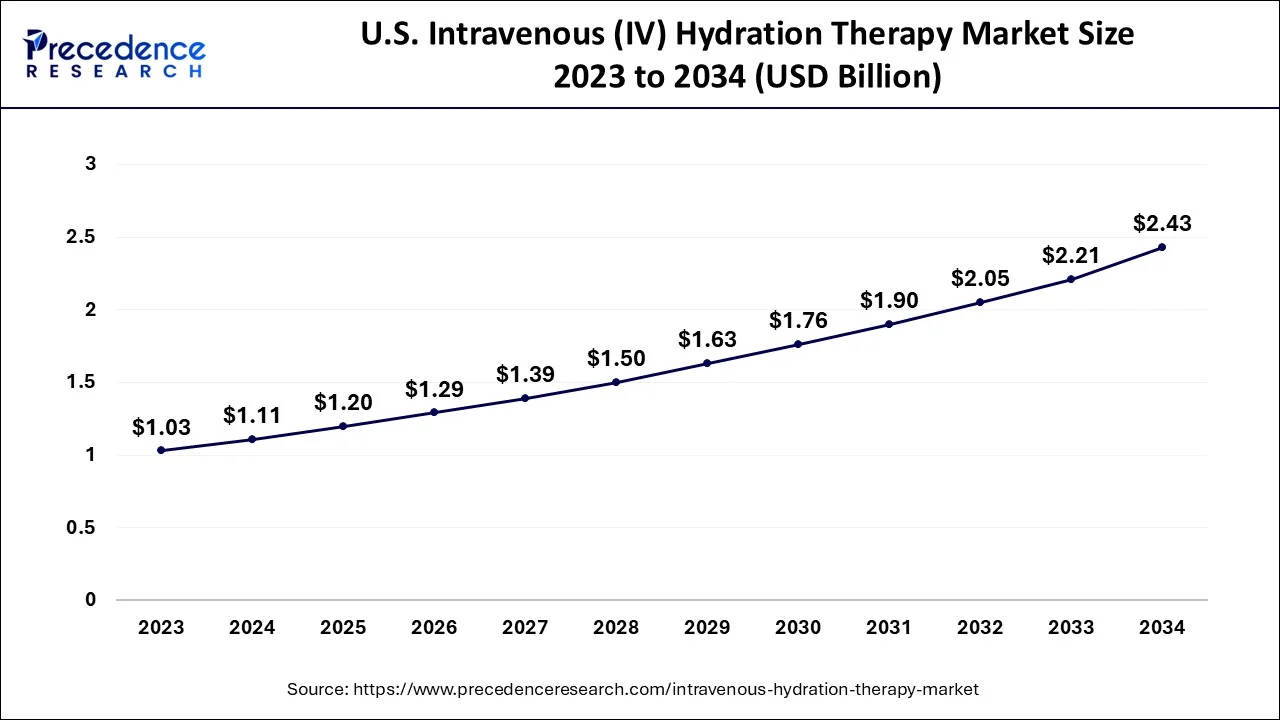

The U.S. intravenous (IV) hydration therapy market size is exhibited at USD 1.11 billion in 2024 and is anticipated to reach around USD 2.43 billion by 2034, growing at a CAGR of 8.11% from 2024 to 2034.

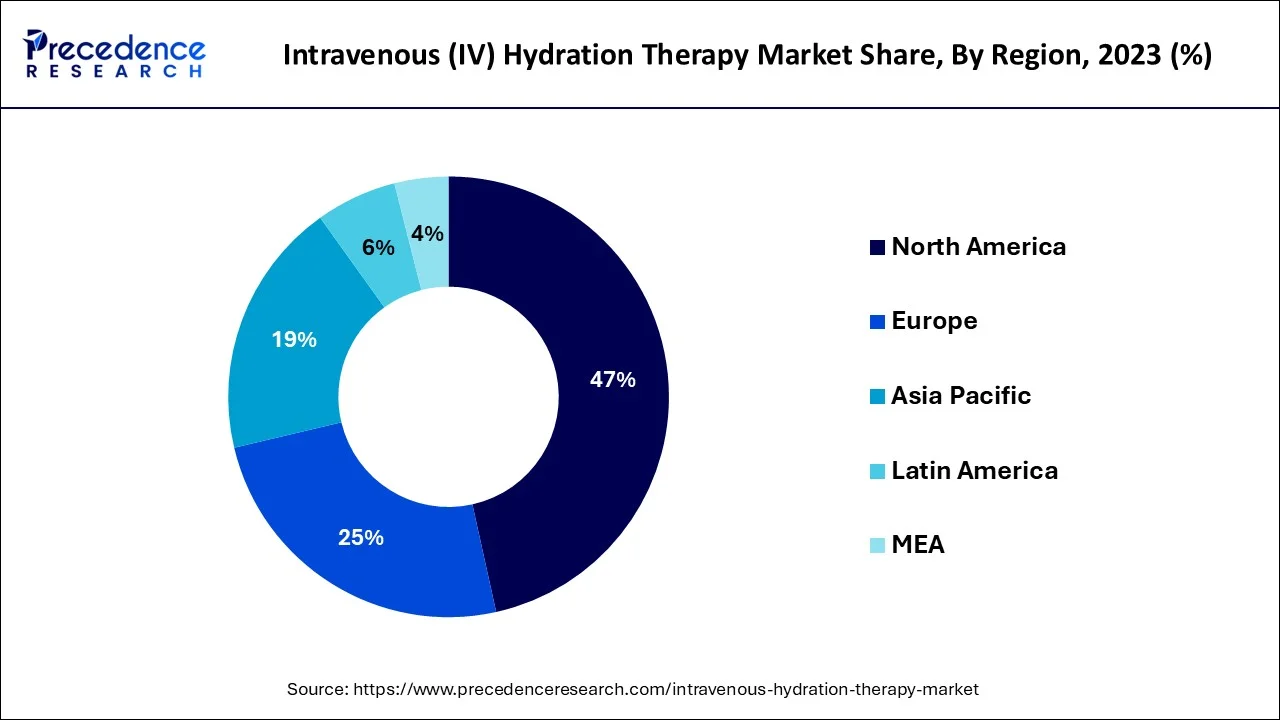

North America dominated the intravenous (IV) hydration therapy market in 2023. The demand for health and wellness services has increased recently in North America, particularly in the U.S. IV hydration therapy is becoming increasingly popular for uses like immune building, anti-aging, recuperation, and sports performance. IV therapy is now a well-liked choice for people looking for rapid health boosts because it has gained widespread acceptability as a treatment for conditions like weariness, jet lag, hangovers, and dehydration.

Asia Pacific is observed to host the fastest-growing intravenous (IV) hydration therapy market during the forecast period. IV hydration therapy is becoming increasingly popular as people become more conscious of their health and well-being. The advantages of IV therapy, such as hydration, food replenishment, and recovery support, are becoming more widely known. IV hydration therapy is becoming more common in alternative medicine clinics, wellness centers, and spas throughout Asia-Pacific. These establishments provide both residents and visitors hydration therapy for detoxification, anti-aging, and wellness.

IV hydration therapy has seen a sharp increase in interest and demand as a supportive treatment for viral illnesses since the COVID-19 pandemic brought attention to the significance of immune support and hydration. A little IV is inserted into the arm to provide fluids directly into the bloodstream as part of the simple intravenous (IV) hydration therapy technique. Enabling the body to absorb nutrients, blood, water, and drugs more rapidly through the circulatory system aids in treatment. Preventive healthcare practices, such as hydration treatment, which helps preserve general health and avoid issues linked to dehydration, have increased in popularity due to growing awareness of health and wellness.

How is AI Helping the Intravenous (IV) Hydration Therapy Market Grow?

Artificial Intelligence (AI) has huge potential to revolutionize medicine and patient care in the intravenous (IV) hydration therapy market. By sorting through mountains of data, identifying trends, and making accurate predictions, AI can speed up the development of new medicines and enhance trial design, safety monitoring, patient recruitment and selection, and drug discovery. It holds promise for advancing customized medicine and more potent treatments by streamlining processes, cutting expenses, and increasing efficiency. This will help the business in enhancing its AI for diagnosis, treatment, and drug discovery.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.84 Billion |

| Market Size in 2024 | USD 2.71 Billion |

| Market Size in 2025 | USD 2.93 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.98% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service, Component, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing health awareness

People's awareness of the need to stay hydrated for general health is growing as they become more health conscious. The need for IV hydration therapy has grown due to awareness campaigns regarding the advantages of maintaining proper hydration, including higher energy, healthier skin, and improved cognitive function. Restoring fluids, electrolytes, and vitamins is a speedy and efficient treatment.

Regulatory agencies set rules and safety requirements for IV hydration therapy as demand and awareness grow. Because of the increased consumer confidence this regulatory support brings, more people are inclined to attempt IV hydration as a secure and efficient medical intervention.

Regulatory challenges

To approve intravenous (IV) hydration therapy market products, regulatory bodies like the FDA in the US and the EMA in Europe have strict requirements. Clinical trials and follow-up assessments can take a long time, delaying market entry and raising expenses. Manufacturers are required to adhere to strict GMP rules that demand strict quality control procedures. Ensuring compliance can be expensive and resource-intensive, especially for small and medium-sized businesses. Businesses must set up guidelines for monitoring and disclosing unfavorable incidents linked to their goods, which can be complex and resource-intensive, mainly for companies with weak infrastructure.

Innovations in IV therapy products

Real-time infusion rate and volume monitoring are possible with smart IV pumps equipped with sophisticated algorithms and software. By lowering the possibility of human error, these pumps guarantee precise drug administration and minimize side effects in the intravenous (IV) hydration therapy market. Healthcare practitioners can more easily monitor patient development by integrating with electronic health records (EHRs), simplifying data administration.

Alerts for any problems can be sent out instantly by combining real-time monitoring systems that keep track of vital signs and infusion parameters in the intravenous (IV) hydration therapy market. The need for cutting-edge IV therapy products is increased by this capability, which also lowers hospital stays, enhances patient safety, and facilitates proactive therapeutic interventions.

The energy boosters segment dominated the intravenous (IV) hydration therapy market in 2023. Preventive care, wellness, and health are becoming increasingly important to consumers. IV hydration treatments, especially energy boosters, are preferred by many people looking for quick and efficient ways to increase their energy levels. The demand for IV energy boosters, which promise rapid regeneration and energy restoration, is propelled by this increased awareness and proactive attitude to wellbeing. IV treatment enables direct nutrient absorption into the bloodstream, offering quicker, more pronounced results than oral hydration and supplements. Energy boosters are more popular because of this effective delivery system, especially among people who want immediate effects. The immediate benefits are viewed as advantageous before essential occasions, during physical activity, or after high physical exertion.

The skin care segment is observed to witness the fastest growth in the intravenous (IV) hydration therapy intravenous (IV) hydration therapy market during the forecast period. It is becoming increasingly popular since IV hydration therapy is thought to provide skincare benefits like increased hydration, collagen stimulation, and fewer fine lines. IV treatments send nutrients straight into the circulation, producing more immediate and significant results than standard skincare products used topically. This has drawn those who want to see noticeable changes in the texture and appearance of their skin. More people can now access these therapies because of the growth of wellness clinics and med spas that provide personalized IV treatments. To meet the rising need for skincare-specific IV treatments focusing on hydration, anti-aging, and skin brightening, clinics are increasingly providing these services.

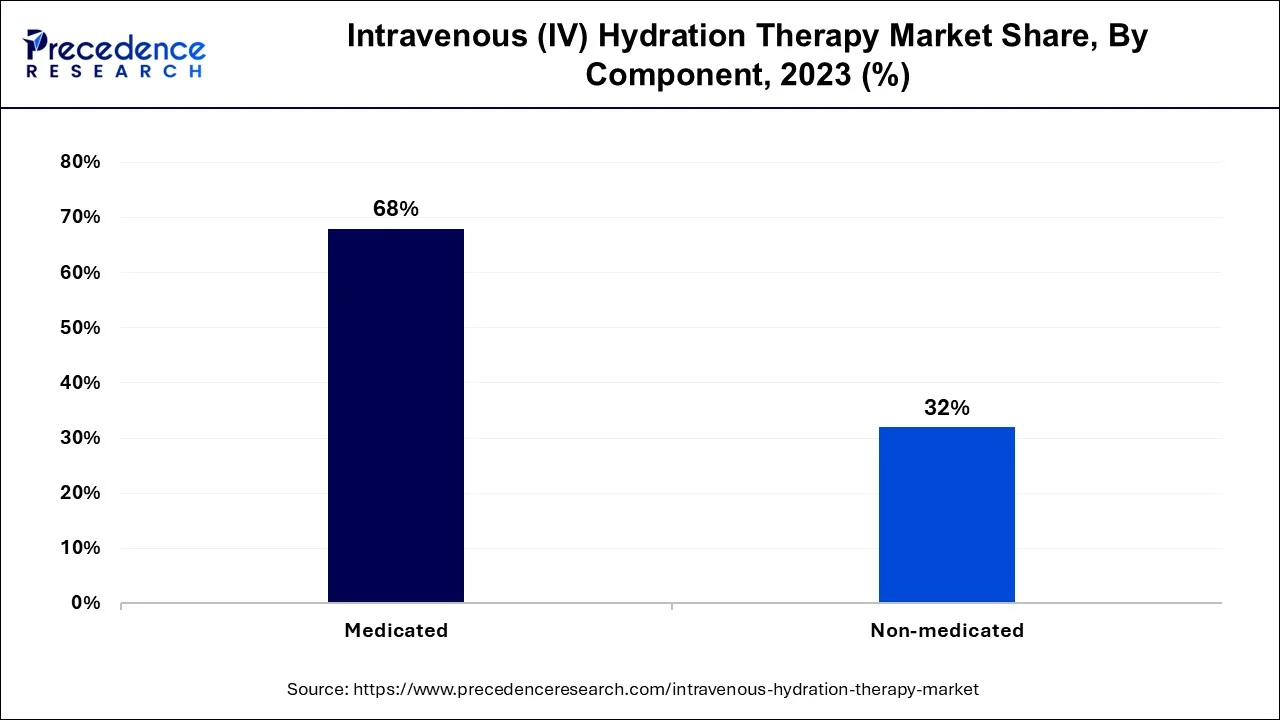

The medicated segment held the largest share of the intravenous (IV) hydration therapy market in 2023. Around the world, the prevalence of chronic diseases like cancer, renal disease, and gastrointestinal disorders has been rising. Because patients may have trouble absorbing nutrients in conventional ways, these illnesses frequently need regular hydration and nutritional supplementation. Wellness-conscious consumers looking for quick and noticeable results are very interested in products that contain antioxidants, collagen-boosting agents, and moisturizing components.

The non-medicated segment is observed to grow rapidly in the intravenous (IV) hydration therapy market during the forecast period. Customers are pursuing non-medicated IV therapies that promote hydration, vitamin replenishment, and detoxification without the use of pharmaceuticals as a result of their growing desire for preventive health measures. This pattern fits perfectly with the general consumer preference for self-care and wellness, and the regulatory barriers are frequently lower for these therapies because they don't involve drugs, making it possible for more providers to enter the market and offer a wider variety of IV choices that cater to specific wellness and health requirements.

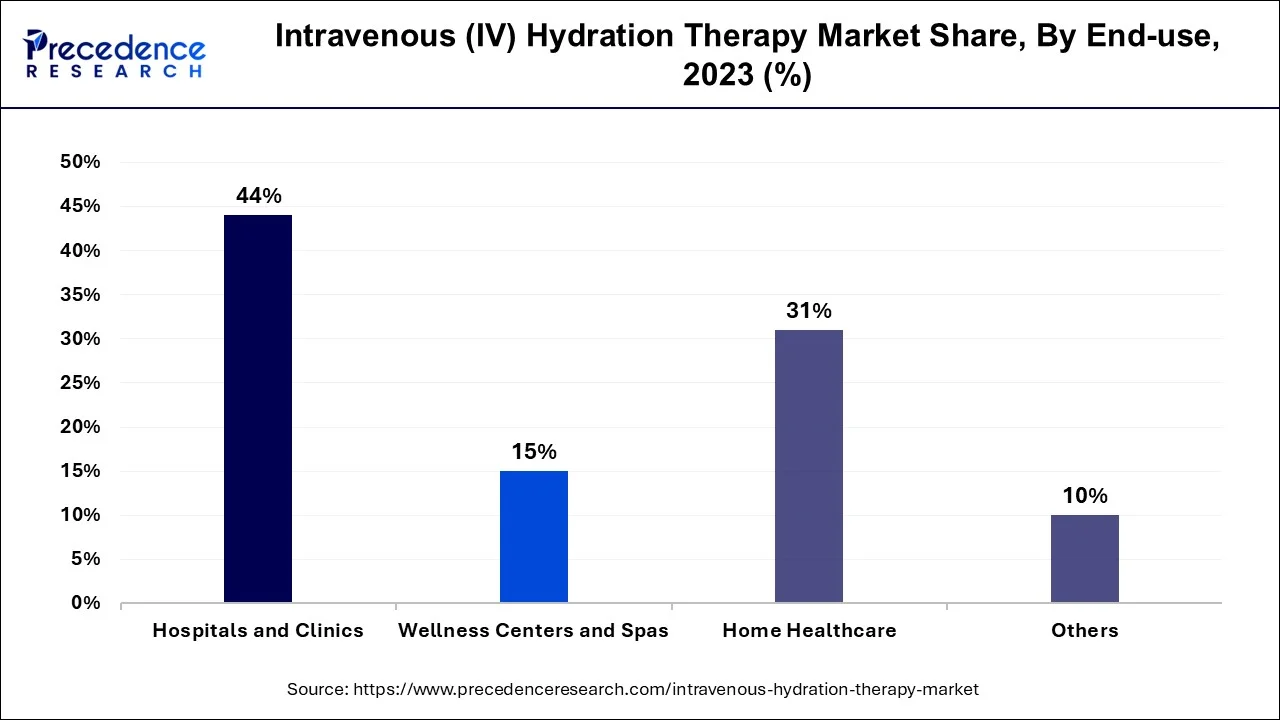

The hospitals & clinics segment dominated the global intravenous (IV) hydration therapy market in 2023. Hospitals and clinics have hygienic surroundings and extensive healthcare facilities for IV hydration therapy to be effective. These tools guarantee that hydration therapy is administered effectively, safely, and with the capacity to handle any potential consequences. Given the growing need for hydration therapy for disorders like dehydration, electrolyte imbalance, and the management of chronic illnesses, hospitals, and clinics have infrastructure designed to handle large patient volumes.

The home healthcare segment is observed to expand significantly in the intravenous (IV) hydration therapy market during the forecast period. At-home medical services are in high demand as healthcare moves toward patient-centric models. A more individualized healthcare experience is made possible by the fact that patients frequently opt to get IV hydration therapy in the convenience of their own homes, which lowers hospital stays and lengthy wait periods. As patients grew more wary of hospital-acquired infections, the pandemic increased the need for home-based care. Particularly, patients with weakened immune systems started to prefer at-home therapies, such as intravenous hydration.

To establish a new company specializing in cutting-edge technology for the treatment of cardiac arrhythmias, Adagio Medical has announced the conclusion of its business combination with ARYA Sciences Acquisition Corp IV, a special-purpose acquisition company supported by an affiliate of Perceptive Advisors.

Segments Covered in the Report

By Service

By Component

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

December 2024

April 2025