July 2024

Intravenous Iron Drugs Market (By Product: Iron Sucrose, Iron Dextran, Ferric Carboxymaltose; By Application: Chronic Kidney Disease, Inflammatory Bowel Disease, Cancer, Other Disease) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

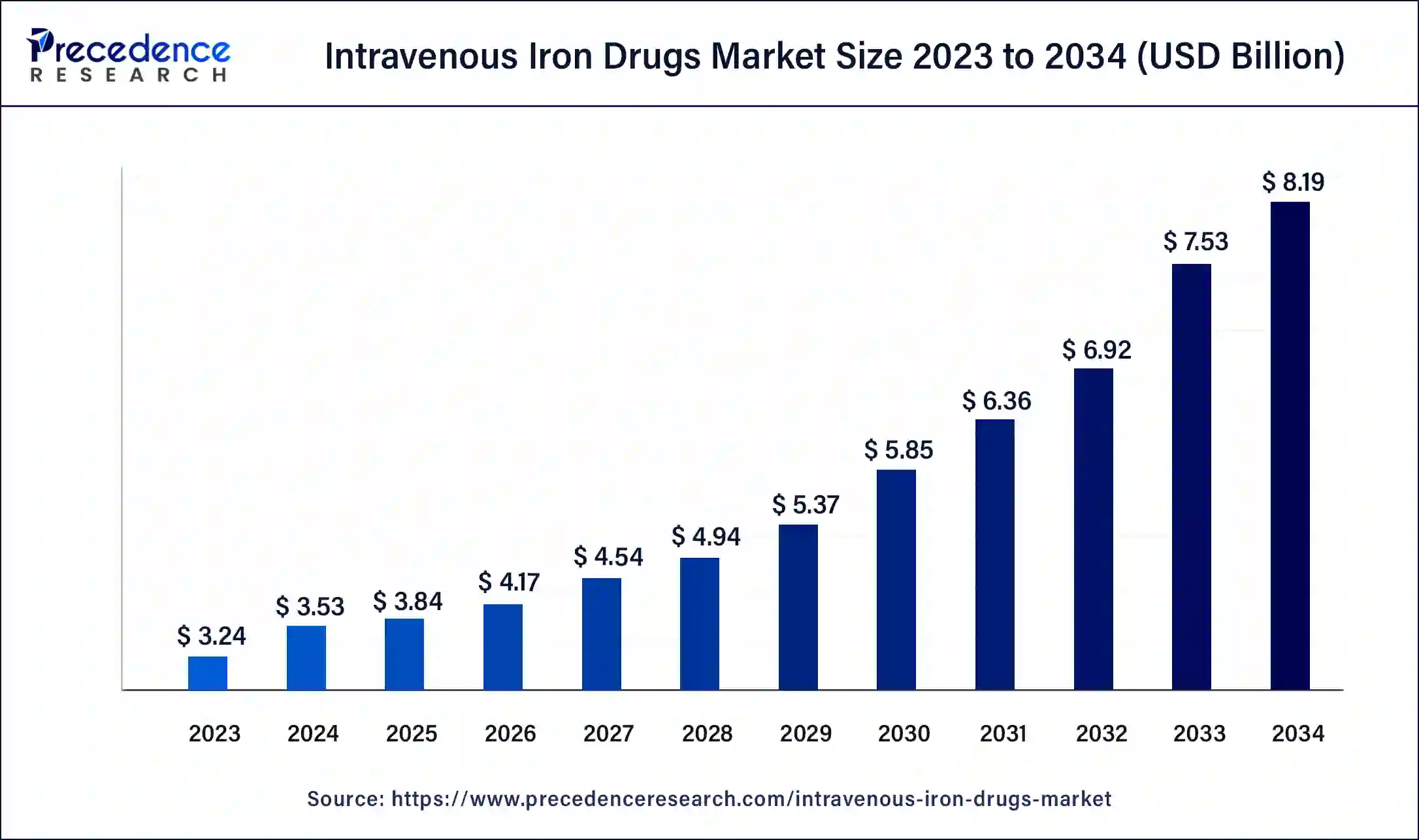

The global intravenous iron drugs market size was USD 3.24 billion in 2023, accounted for USD 3.53 billion in 2024, and is expected to reach around USD 8.19 billion by 2034, expanding at a CAGR of 8.8% from 2024 to 2034. The North America intravenous iron drugs market size reached USD 1.68 billion in 2023. Intravenous iron medications provide a number of benefits over oral iron supplements, including quicker and more effective iron replenishment, particularly for individuals with severe iron insufficiency or malabsorption problems.

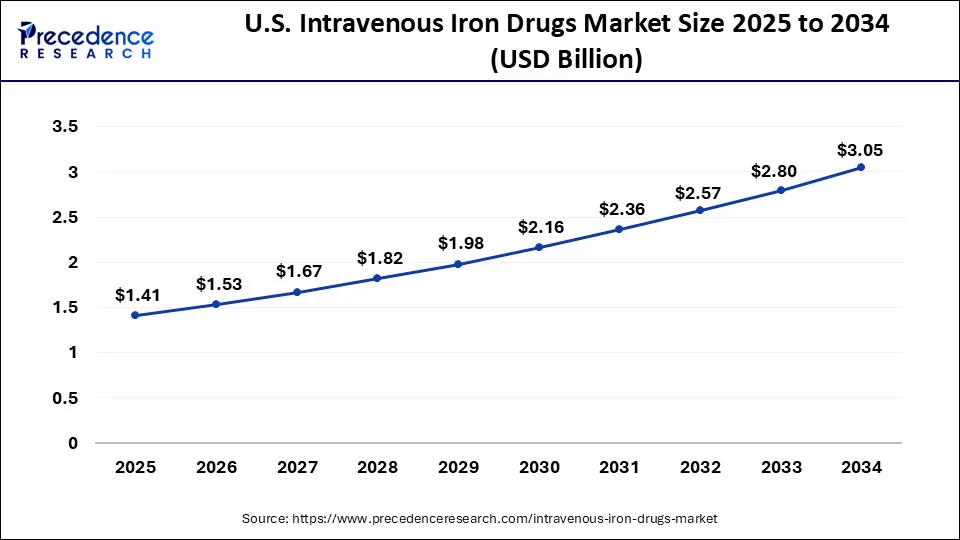

The U.S. intravenous iron drugs market size was estimated at USD 1.18 billion in 2023 and is predicted to be worth around USD 3.05 billion by 2034, at a CAGR of 9% from 2024 to 2034.

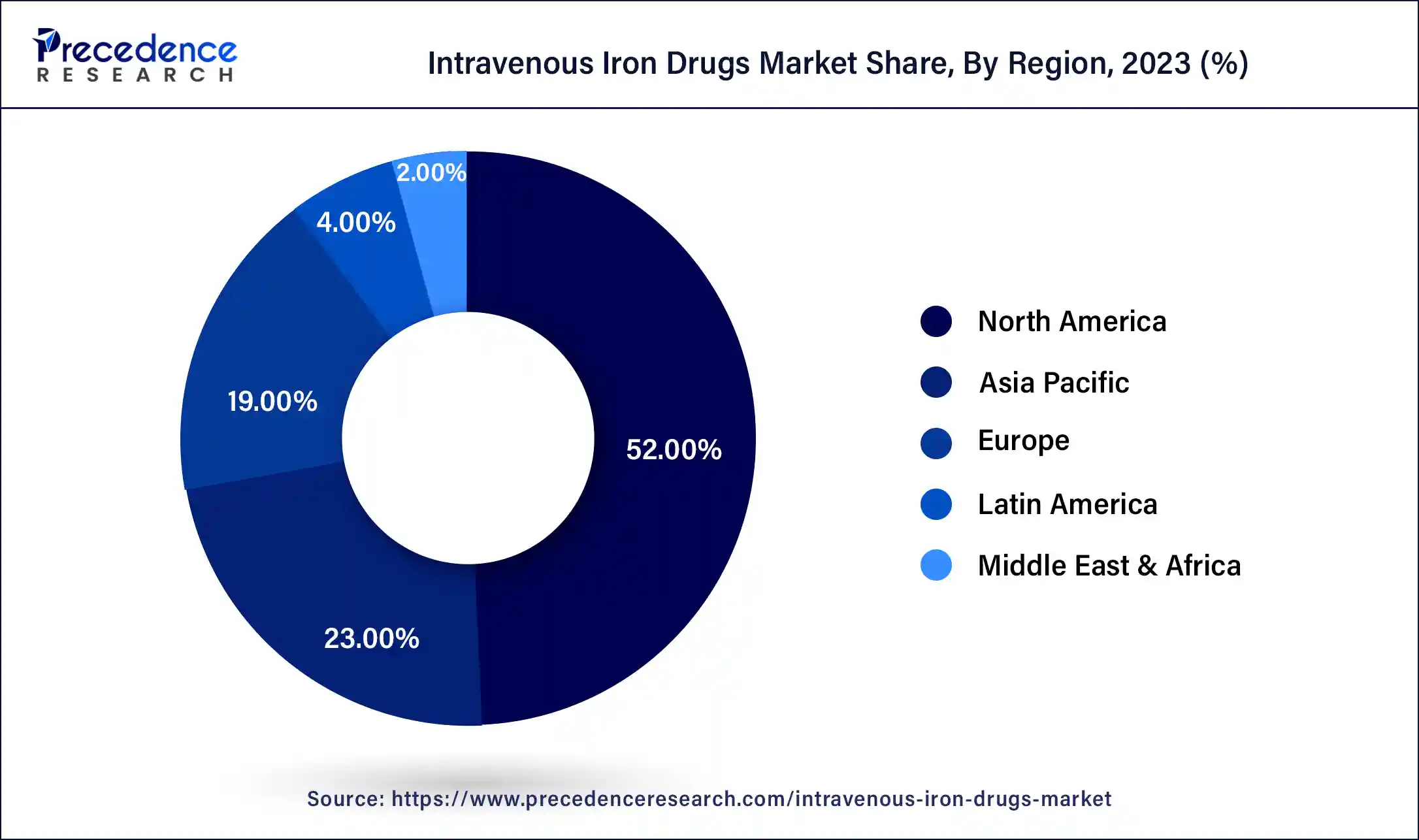

North America held the largest share of the intravenous iron drugs market. A sizeable section of the population in North America suffers from iron deficiency anemia, which is a frequent ailment. This condition is more common due to factors like poor diet, gastrointestinal issues, chronic diseases, and blood loss.

Although iron deficiency anemia has historically been treated with oral iron supplements, intravenous iron therapy is gaining popularity due to its effectiveness, particularly in individuals who cannot stomach or absorb oral iron supplements well. As doctors become more knowledgeable of the advantages of intravenous iron therapy, they are providing these medications to patients with anemia due to iron deficiency more frequently.

Asia Pacific is expected to witness the fastest growth in the intravenous iron drugs market during the forecast period. Due to a number of factors, including the rising frequency of chronic diseases, including chronic kidney disease (CKD), increased awareness of iron deficiency anemia, and improved healthcare infrastructure throughout the area, the intravenous iron medication market in Asia Pacific was witnessing substantial expansion. When oral iron supplements are unsuccessful, or patients are unable to accept them, intravenous iron medications are frequently used to treat iron deficiency anemia.

The burden of anemia in nations around the Asia Pacific is being addressed by government measures, which are also propelling the expansion of the intravenous iron drugs market. The industry is also growing as a result of partnerships between pharmaceutical firms and healthcare institutions and campaigns to increase public knowledge of the value of iron supplements.

The intravenous iron drugs market had been rising steadily and was expected to do so at a rapid rate going forward. The aging population, an increase in the prevalence of chronic illnesses, and growing public knowledge of intravenous iron therapy were all driving factors in the market's growth. One of the main areas of focus for market participants was innovation in intravenous iron formulations.

Products with better safety profiles, fewer side effects, and more efficacy were being developed in the intravenous iron drugs market. This includes creating brand-new medication delivery methods and iron-carbohydrate complexes. Intravenous iron supplements were being utilized to treat heart failure, inflammatory bowel disease, chronic renal disease, and anemia associated with cancer, in addition to iron deficient anemia.

Regional differences were seen in the intravenous iron drugs market, with North America and Europe historically being the largest markets because of their developed healthcare systems and high levels of awareness. On the other hand, growing healthcare spending and better healthcare infrastructure were also propelling the fast expansion of emerging economies in Latin America and Asia Pacific.

For the participants of the intravenous iron drugs market, obtaining regulatory permits and adhering to strict safety regulations were essential. In order to guarantee the safety and effectiveness of intravenous iron medications, regulatory organizations like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) actively participated in the approval process.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.8% |

| Global Market Size in 2023 | USD 3.24 Billion |

| Global Market Size in 2024 | USD 3.53 Billion |

| Global Market Size by 2034 | USD 8.19 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing geriatric population

Older persons frequently suffer from iron deficiency anemia as a result of a variety of conditions, including poor diet, decreased iron absorption, and chronic illnesses. Intravenous iron medications are in high demand due to the growing prevalence of this illness among the senior population. An increasing number of senior citizens are seeking treatment for ailments like iron deficiency anemia as a result of improvements in the healthcare system and increased accessibility to healthcare services.

Maintaining one's functional independence and quality of life as one age becomes more crucial. The demand for these treatments is driven by the potential benefits of treating illnesses such as anemia with intravenous iron therapy, which can enhance energy levels, cognitive function, and general well-being in older persons.

Limited indications

Intravenous iron therapy may cause contraindications in certain patients or cause unfavorable side effects, like hypotension or allergic reactions. This may restrict certain medications' use in specific patient groups. The permitted indications for intravenous iron treatments may be limited by regulatory bodies in response to safety profiles and evidence from clinical trials. This may restrict their application to particular patient groups or medical conditions. In contrast to other disorders or patient groups, intravenous iron therapy may be more effective in treating conditions like inflammatory bowel disease or chronic renal disease. Its usage might, therefore, be restricted to these particular indications.

Growing prevalence of iron deficiency anemia

The intravenous iron drugs market has grown significantly in recent years due in large part to the rising prevalence of iron deficiency anemia. A disorder called iron deficiency anemia is defined by an inadequate amount of iron in the body, resulting in a deficit of healthy red blood cells. Symptoms of this illness include weakness, exhaustion, dyspnea, and compromised cognitive function.

Iron deficiency anemia can be caused by a poor dietary intake of foods high in iron, particularly in populations with limited access to nutrient-dense foods. Anemia can result from chronic inflammatory diseases that affect iron absorption and use, such as rheumatoid arthritis and chronic heart failure.

The ferric carboxymaltose segment held the largest share of the intravenous iron drugs market in 2023 and is expected to continue its dominance throughout the forecast period. For people with iron deficiency anemia who are intolerant to oral iron or do not respond well to oral iron, an intravenous iron formulation known as FCM is administered. It is a well-liked option among healthcare professionals due to its safety record and reputation for effectiveness.

Due to several factors, including the growing prevalence of iron deficiency anemia, growing public knowledge of the advantages of intravenous iron therapy, and improvements in drug formulation, the intravenous iron drugs market has been expanding.

The intravenous iron drugs market has been growing owing to the part to ferric carboxymaltose and other intravenous iron formulations, including iron dextran and iron sucrose. Ferric carboxymaltose is becoming more and more popular in the intravenous iron medication market due to its easy dosing schedule, lower risk of hypersensitivity reactions than some other formulations, and quick correction of iron deficient anemia.

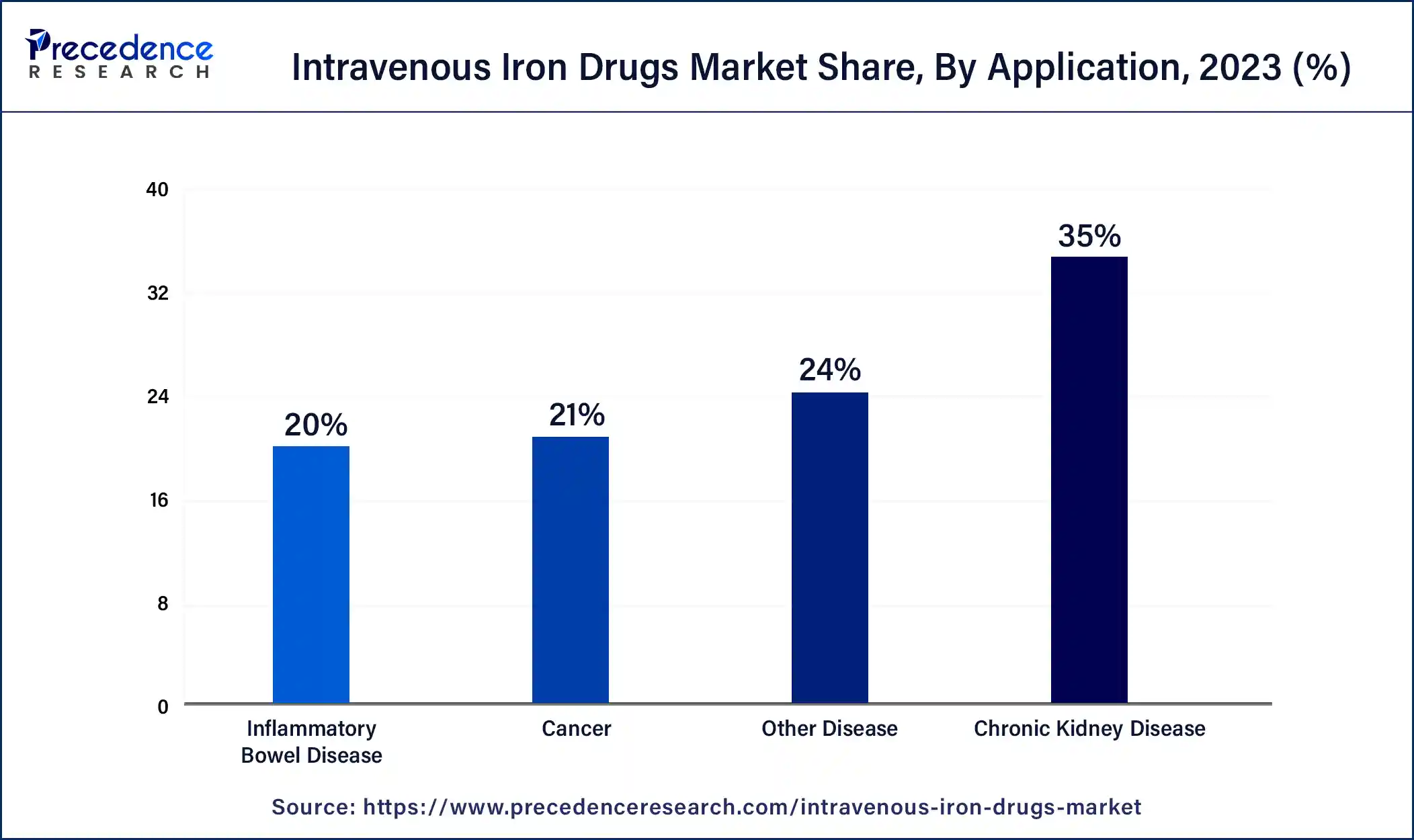

The chronic kidney disease segment dominated the intravenous iron drugs market in 2023. Because intravenous iron supplements provide more iron to stimulate red blood cell synthesis, they are essential in the therapy of anemia linked to chronic kidney disease (CKD). These medications are injected straight into the circulation, avoiding the gastrointestinal tract, which is frequently damaged in those with chronic kidney disease. Worldwide, CKD is a common disorder, and one of the most common complications for CKD patients is anemia.

The need for intravenous iron medications to treat anemia in this patient population has grown as CKD prevalence has increased. The effectiveness of oral iron supplementation may be limited in people with CKD due to gastrointestinal problems such as malabsorption. Patients with CDK who may not be able to absorb oral iron supplements well are better served by intravenous iron medications since they avoid the gastrointestinal tract.

To treat anemia in individuals with chronic kidney disease, intravenous iron therapy is frequently combined with erythropoiesis-stimulating agents (ESAs). Intravenous iron supplies the required iron substrate for the production of red blood cells, which is triggered by ESAs. The demand for intravenous iron medicines is further driven by the synergy between intravenous iron and ESAs, which leads to their combination usage in patients with chronic kidney disease.

Intravenous iron therapy is a commonly recommended therapeutic option for anemia in patients with chronic kidney disease according to clinical standards and recommendations. The treatment of CKD-related anemia continues to depend on intravenous iron supplements as long as medical professionals adhere to these recommendations.

Segment Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

November 2024

December 2024

April 2025