October 2024

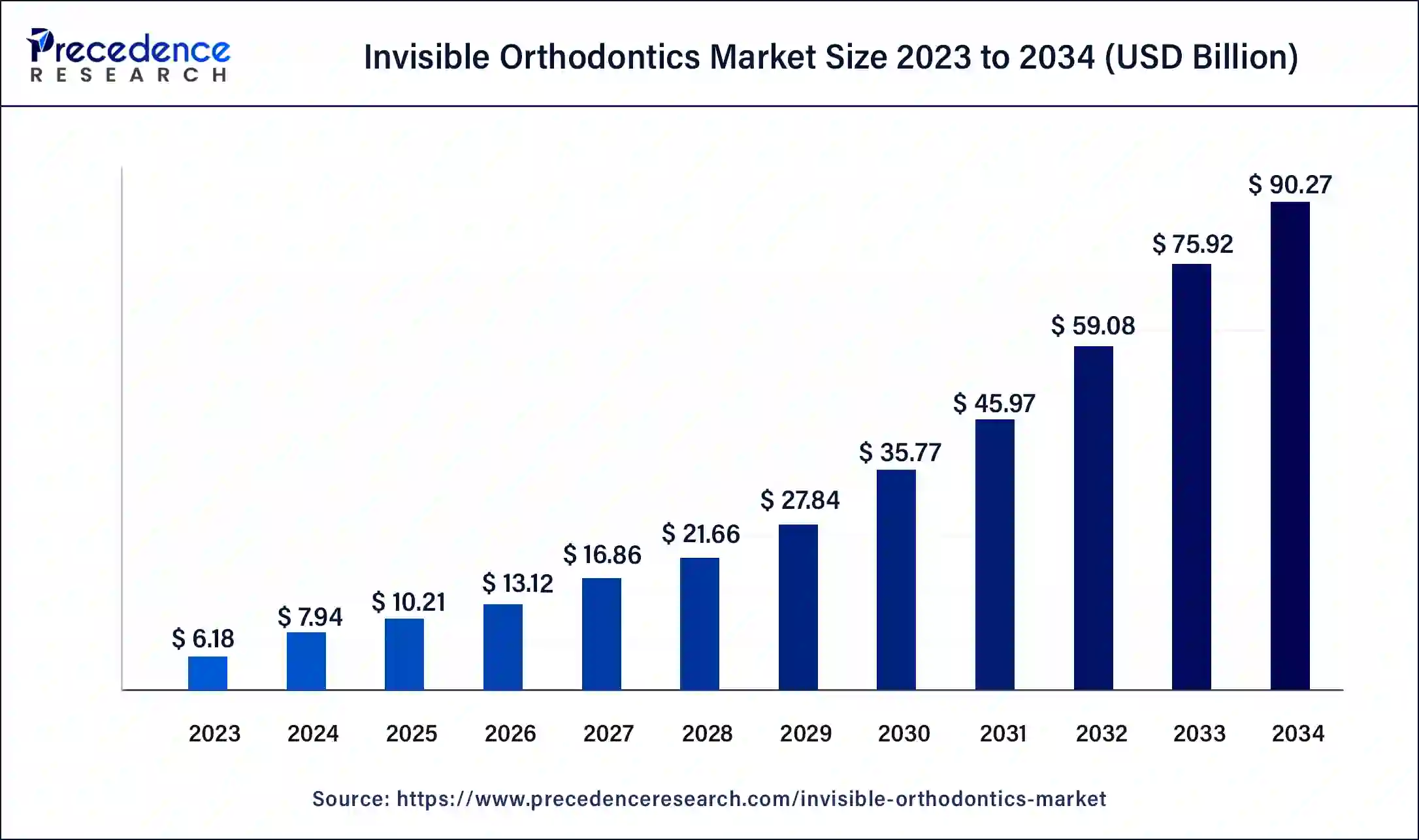

The global invisible orthodontics market size was USD 6.18 billion in 2023, estimated at USD 7.94 billion in 2024 and is anticipated to reach around USD 90.27 billion by 2034, expanding at a CAGR of 27.52% from 2024 to 2034.

The global invisible orthodontics market size accounted for USD 7.94 billion in 2024 and is predicted to reach around USD 90.27 billion by 2034, growing at a CAGR of 27.52% from 2024 to 2034. Growing demand for invisible orthodontics and rapid technological advancements in dental health tailored for adults and teenagers are raising the demand of the market globally.

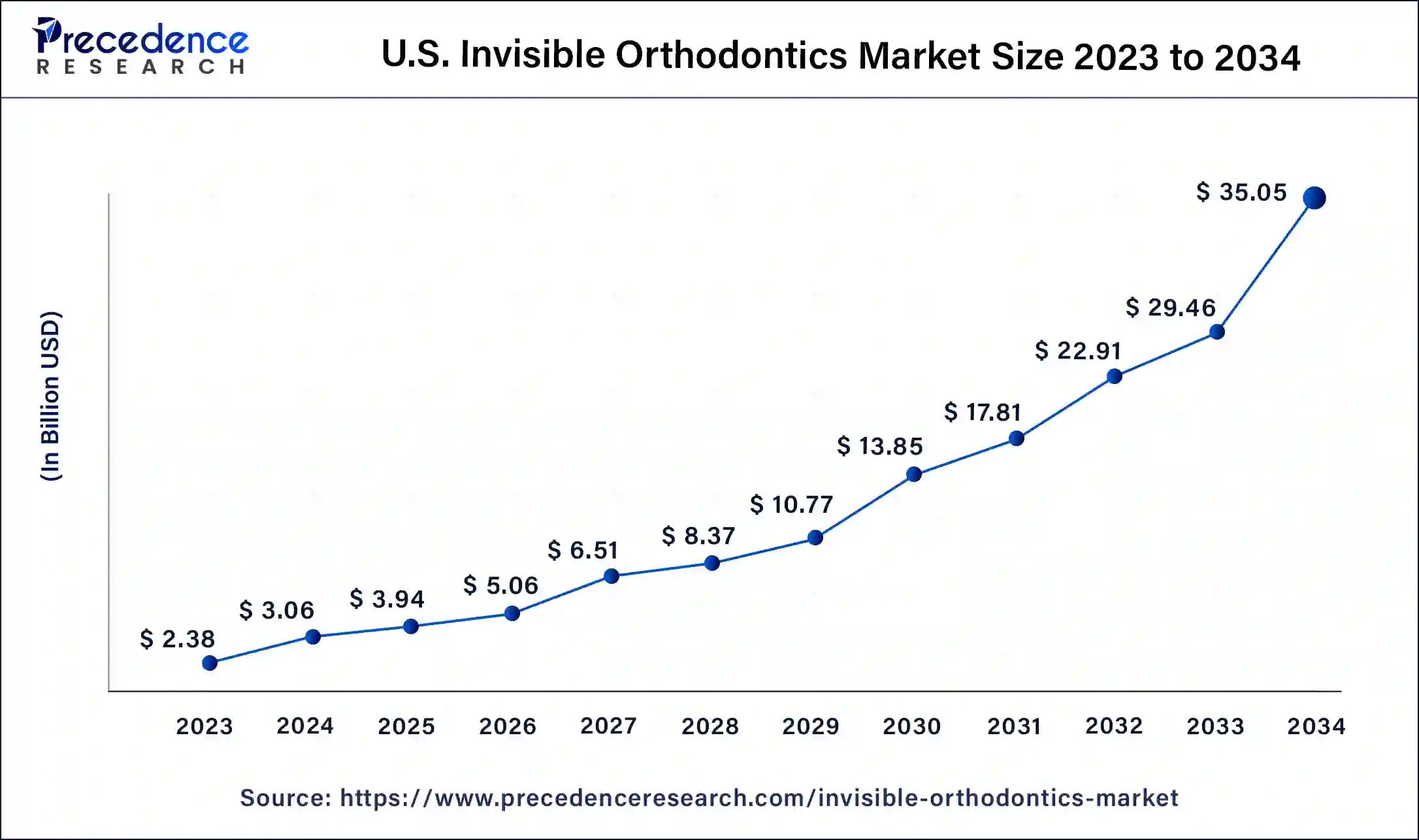

The U.S. invisible orthodontics market size was estimated at USD 2.55 billion in 2023 and is predicted to be worth around USD 35.05 billion by 2034, at a CAGR of 27.62% from 2024 to 2034.

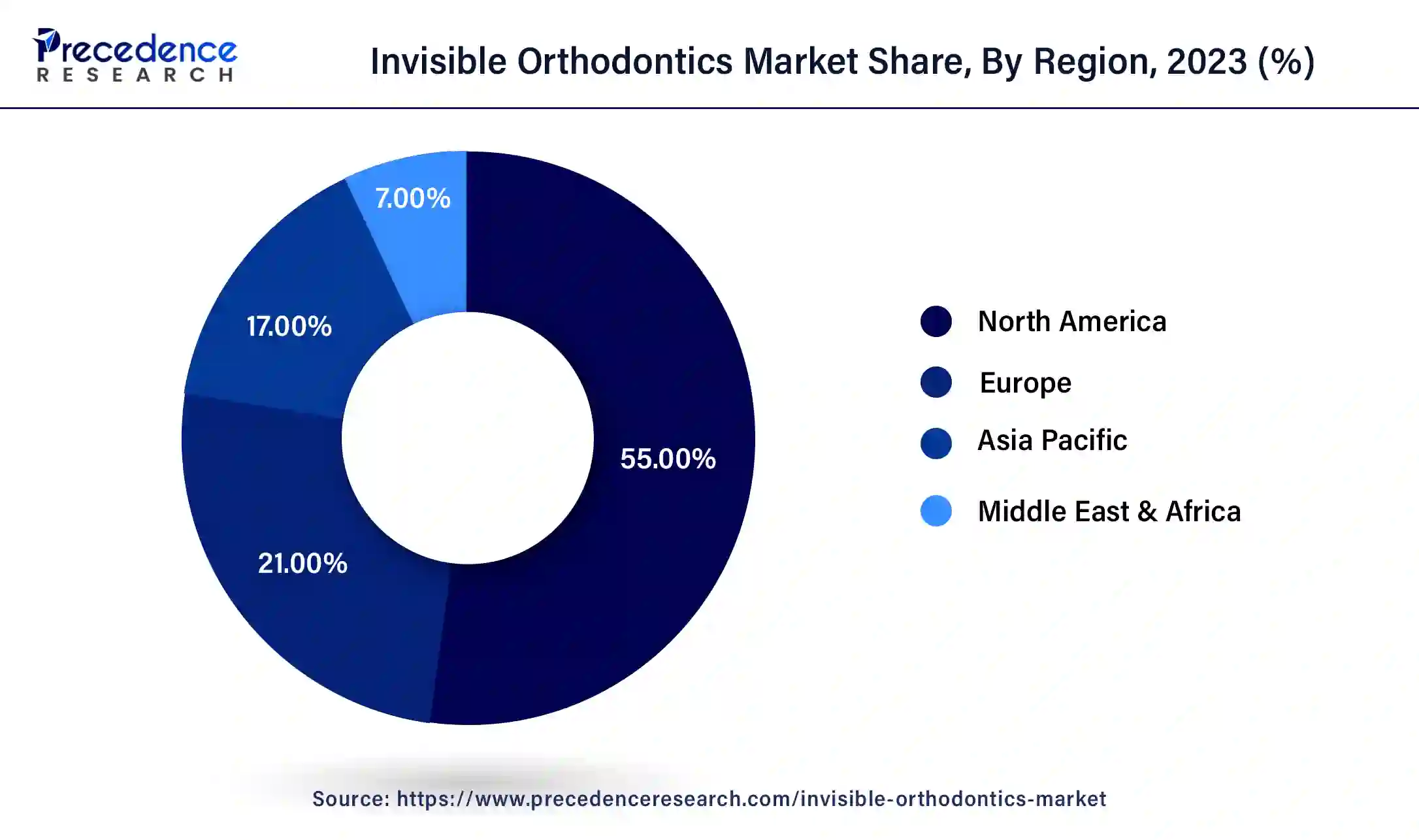

North America held the largest share of the global invisible orthodontics market. The region has high adoption rates and advanced healthcare infrastructure drives. The United States leads the region with the largest market share, fueled by strong demand for invisible orthodontic treatments among adults and teenagers seeking aesthetic solutions. Similarly, Canada follows closely behind, experiencing steady growth in the market due to increasing awareness and accessibility to orthodontic care.

Asia Pacific is showcasing significant growth in the invisible orthodontics market. The growth rate is attributed to factors such as rising disposable income, increasing awareness of dental aesthetics, and a large population base. Countries like China, Japan, and India are witnessing significant growth in the adoption of invisible orthodontic treatments, driven by urbanization, improving healthcare infrastructure, and changing consumer preferences.

Additionally, Southeast Asian countries such as Singapore, Malaysia, and Thailand are emerging as key markets for invisible orthodontics, supported by growing dental tourism and a rising middle-class population seeking advanced dental treatments. As the demand for aesthetic orthodontic solutions continues to rise across the region, it is expected to become a prominent growth engine for the global invisible orthodontics market in the coming years.

The invisible orthodontics market has seen exponential growth in recent years, driven by increasing demand for discreet teeth alignment solutions. With a focus on aesthetic appeal and convenience, invisible orthodontic treatments such as clear aligners have gained significant traction among both adolescents and adults. Market players are innovating with advanced technologies like 3D printing and digital scanning to customize treatments and improve efficiency.

The growing awareness of the benefits of orthodontic treatment for oral health and confidence enhancement has expanded the consumer base. The invisible orthodontics market is witnessing intense competition among key players, leading to aggressive marketing strategies and product developments to capture market share. Factors such as rising disposable income, changing lifestyles, and the influence of social media on beauty standards further drive market expansion.

However, challenges such as high treatment costs and limited insurance coverage in some regions may impede market growth to some extent. Overall, the invisible orthodontics market is poised for continued expansion as technological advancements and consumer preferences evolve.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 27.52% |

| Global Market Size in 2023 | USD 6.18 Billion |

| Global Market Size in 2024 | USD 7.94 Billion |

| Global Market Size by 2034 | USD 90.27 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Age, End-use, Dentist Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Customize treatments

The primary driver fueling the growth of the invisible orthodontics market is the continuous advancement in technology coupled with the ability to customize treatments. Innovations such as 3D printing and digital scanning have revolutionized the orthodontic industry, as have customized clear aligners tailored to each patient's unique dental structure. This customization not only enhances treatment effectiveness but also improves patient comfort and satisfaction.

Furthermore, technological advancements have streamlined the treatment process, reducing the time required for orthodontic procedures and making them more accessible to a wider range of consumers.

High cost of treatment

Despite the growing demand for invisible orthodontic treatments, one significant restraint facing the invisible orthodontics market is the high cost of treatment coupled with limited insurance coverage in some regions. The expenses associated with invisible orthodontics, including consultation fees, treatment costs, and follow-up appointments, can pose a financial barrier for many prospective patients.

Additionally, limited insurance coverage for orthodontic procedures may deter individuals from seeking treatment or lead them to opt for less costly alternatives. This disparity in affordability could hinder market growth, particularly in regions with lower income levels or inadequate insurance coverage, as it restricts access to invisible orthodontic treatments for a significant portion of the population.

Conscious consumers with aesthetics

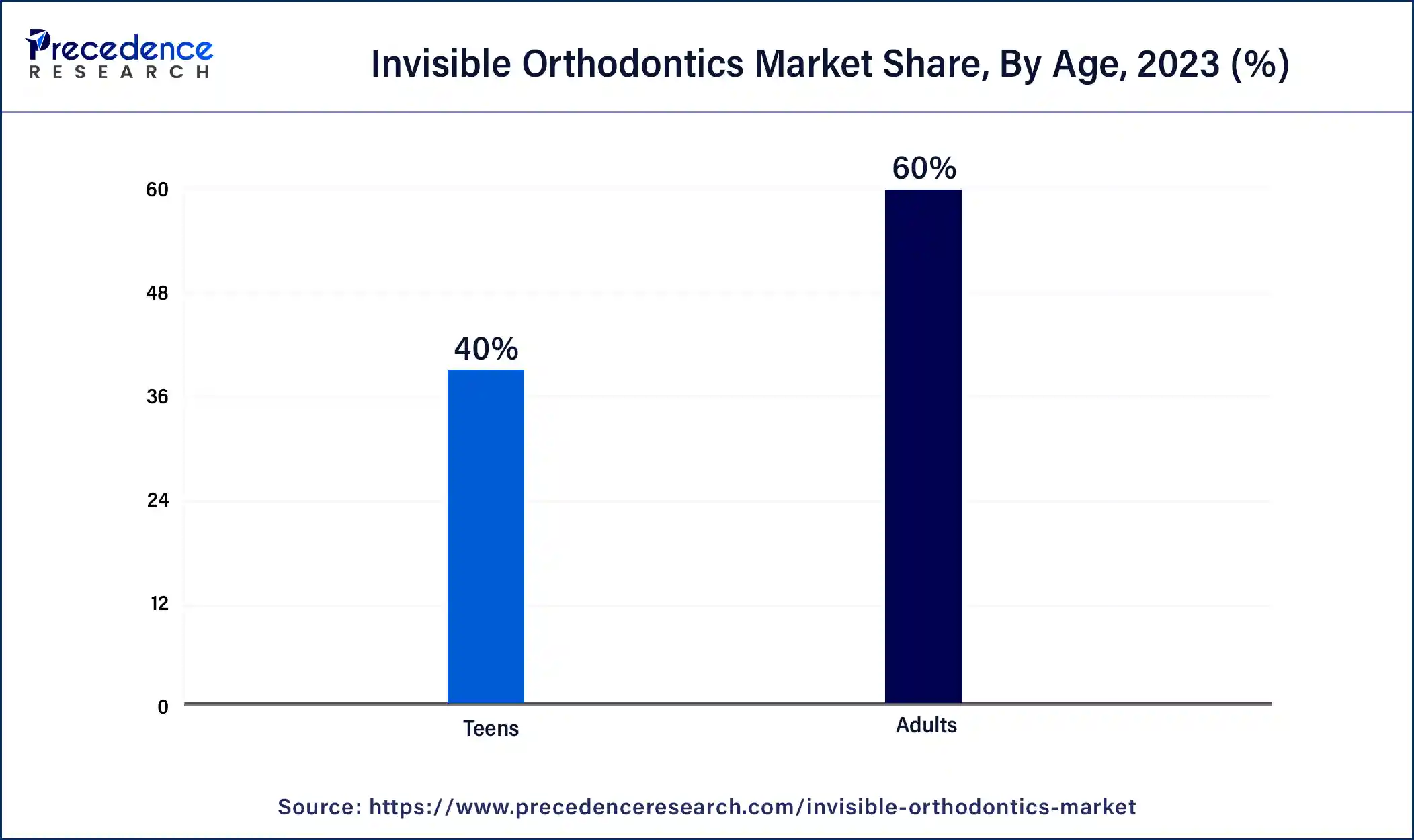

An emerging opportunity for the invisible orthodontics market lies in the growing acceptance and adoption of these treatments among older adults. Traditionally, orthodontic treatments were predominantly associated with teenagers only. However, there is a shifting trend towards adults seeking orthodontic solutions to improve both oral health and aesthetics. As the aging population becomes increasingly conscious of their appearance and dental health, there is a substantial market opportunity for invisible orthodontic treatments tailored to the specific needs and preferences of older adults.

Market players can capitalize on this trend by developing targeted marketing campaigns and specialized treatment options tailored to address the unique concerns of older adult patients, thereby expanding their consumer base and driving market growth. Also, educating older adults about the benefits of invisible orthodontic treatments for oral health and overall well-being can further stimulate demand and expansion of the invisible orthodontics market.

The clear aligners segment dominated the invisible orthodontics market in 2023. These transparent, removable trays gradually shift teeth into alignment, catering to individuals seeking a more aesthetically pleasing orthodontic solution. Clear aligners boast advantages such as ease of use, minimal impact on daily activities, and virtually invisible appearance, which are some factors that appeal to a wide range of patients, including adults and teenagers. Hence, major key players are investing in building a clear alignment with maximum benefits and comfort for consumers.

In the invisible orthodontics market, the ceramic braces segment is expected to show significant growth in the upcoming years. While the segment showcases significant growth and is anticipated to be further fostered in the upcoming years, these braces blend with the natural color of teeth, offering a more discreet alternative to traditional metal braces. Ceramic braces appeal to patients who desire a less noticeable orthodontic treatment option while still achieving effective teeth alignment. With improvements in ceramic material technology, these braces now offer enhanced durability and reduced visibility. As consumer awareness and demand for less conspicuous orthodontic solutions continue to rise, the ceramic braces segment is expected to experience rapid growth and significant market expansion.

The adult segment accounted for the highest share of the invisible orthodontics market in 2023. Adults increasingly prioritize aesthetics and convenience when considering orthodontic options, driving demand for invisible orthodontic solutions such as clear aligners. Factors such as improved technology, shorter treatment times, and the desire for a more discreet option contribute to the popularity of invisible orthodontics among adults. Additionally, the societal acceptance of adult orthodontic treatment has further fueled the growth of this segment, as adults seek to improve their smiles and oral health without the stigma associated with traditional braces.

The teenager segment is anticipated to show the fastest growth in the invisible orthodontics market over the forecasted period. Teenagers represent a significant portion of orthodontic patients, with many seeking treatments for aesthetic reasons or to address dental issues during adolescence. Clear aligners, with their discreet appearance and removable nature, appeal to teenagers who desire orthodontic treatment without the visibility and discomfort of traditional braces. As awareness and acceptance of invisible orthodontic options grow among teenagers and their parents, this segment is expected to continue expanding in the coming years.

The stand alone practice segment dominated the invisible orthodontics market in 2023. These standalone clinics offer patients a focused approach to orthodontic care, with specialized expertise and personalized treatment plans tailored to individual needs. Patients often prefer standalone clinics for their specialized knowledge, advanced technology, and dedicated focus on orthodontic treatments.

The hospital segment is predicted to register the fastest growth in the foreseeable future period. Hospitals are increasingly incorporating invisible orthodontic treatments into their services, offering patients a comprehensive range of orthodontic options under one roof. This trend is fueled by the growing recognition of the importance of oral health within the broader healthcare landscape and the desire to provide patients with convenient access to advanced orthodontic treatments. With hospitals investing in state-of-the-art technology and skilled orthodontic professionals, the hospital segment is poised for significant growth in the market, catering to a diverse patient population seeking high-quality orthodontic care in a medical setting.

The orthodontists segment was estimated to hold the highest share of the invisible orthodontics market in 2023. The growth of this segment is owing to their specialized training and expertise in orthodontic treatments. Orthodontists possess advanced knowledge and skills specifically focused on correcting dental misalignments and bite issues, making them the preferred choice for patients seeking invisible orthodontic solutions.

With their specialized training and experience, orthodontists offer patients personalized treatment plans and comprehensive care throughout the orthodontic journey, ensuring optimal results and patient satisfaction. Their prominence in the market underscores the importance of specialized orthodontic expertise in delivering effective and high-quality invisible orthodontic treatments.

The general dentists segment is expected to grow at a significant CAGR in the invisible orthodontics market during the foreseen period. General dentists, while not specialized in orthodontics, are increasingly incorporating invisible orthodontic treatments into their practices to meet the growing demand for aesthetic orthodontic options. With advancements in clear aligner technology and training programs, general dentists are expanding their scope of services to include orthodontic treatments, offering patients a convenient and familiar setting for invisible orthodontic care. This trend reflects the evolving landscape of dental care, with general dentists playing a significant role in providing accessible and comprehensive orthodontic solutions to patients.

Segments Covered in the Report

By Product

By Age

By End-use

By Dentist Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025