June 2024

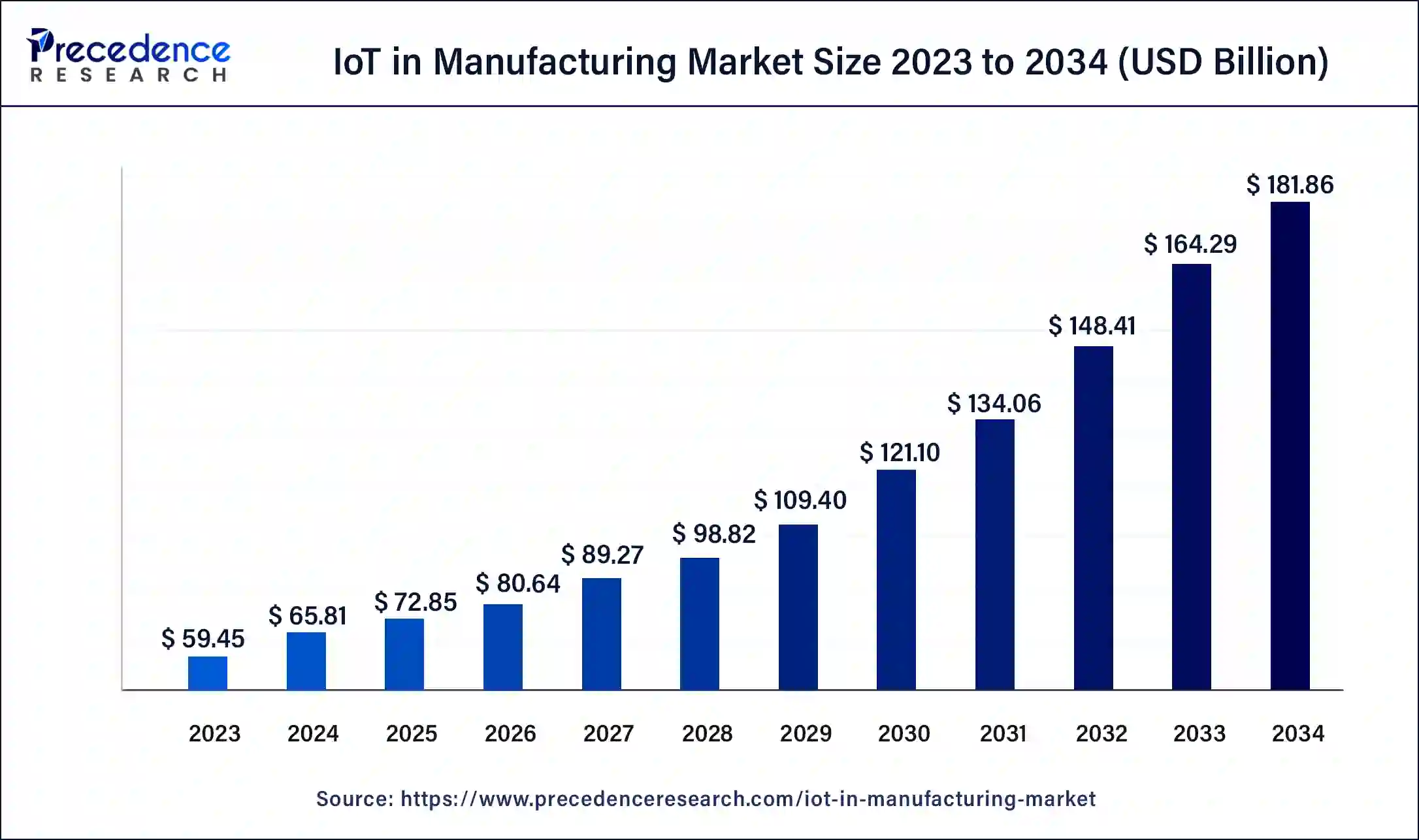

The global IoT in manufacturing market size was USD 59.45 billion in 2023, calculated at USD 65.81 billion in 2024 and is expected to reach around USD 181.86 billion by 2034, expanding at a CAGR of 10.7% from 2024 to 2034.

The global IoT in manufacturing market size accounted for USD 65.81 billion in 2024 and is expected to reach around USD 181.86 billion by 2034, expanding at a CAGR of 10.7% from 2024 to 2034.

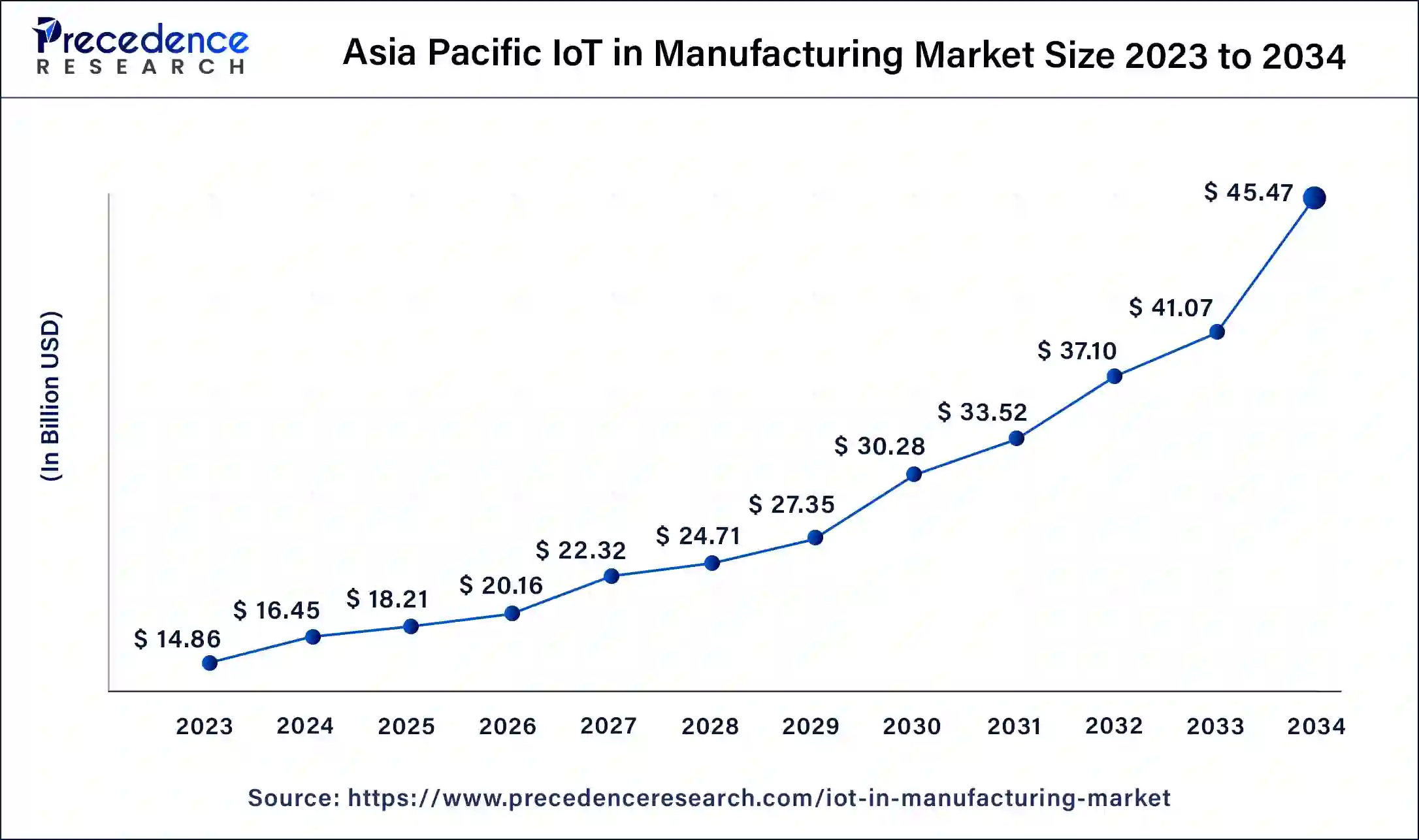

The Asia Pacific IoT in manufacturing market size was estimated at USD 14.86 billion in 2023 and is predicted to be worth around USD 45.47 billion by 2034, at a CAGR of 10.9% from 2024 to 2034.

Asia-Pacific is anticipated to expand rapidly over the next few years as a result of the region's ongoing economic expansion, ageing labor force, and increasing use of mobile devices for work. This will drive the adoption of enterprise mobility solutions to meet the rising demand for safeguarding and protecting sensitive data. The primary drivers of this rapid growth in APAC include regional government programs to encourage the adoption of technology, increased levels of automation at businesses, and the growing digitization of people's lives. Moreover, the presence of impending technological advancements in IoT, creating a lucrative market potential.

The rising investment by government and R&D organizations in IoT manufacturing solutions is expanding due to the uptick in the IT environment. Increased regulatory requirements and the application of AI in IoT will accelerate industry expansion. China is the region's fastest-growing manufacturer; hence it is anticipated that it will have the greatest CAGR. With recent developments in IoT and telematics, which have improved communications, connectivity, and responsiveness to bring infotainment, security, and safety to drivers, passengers, and commuters, India is also a developing technology powerhouse.

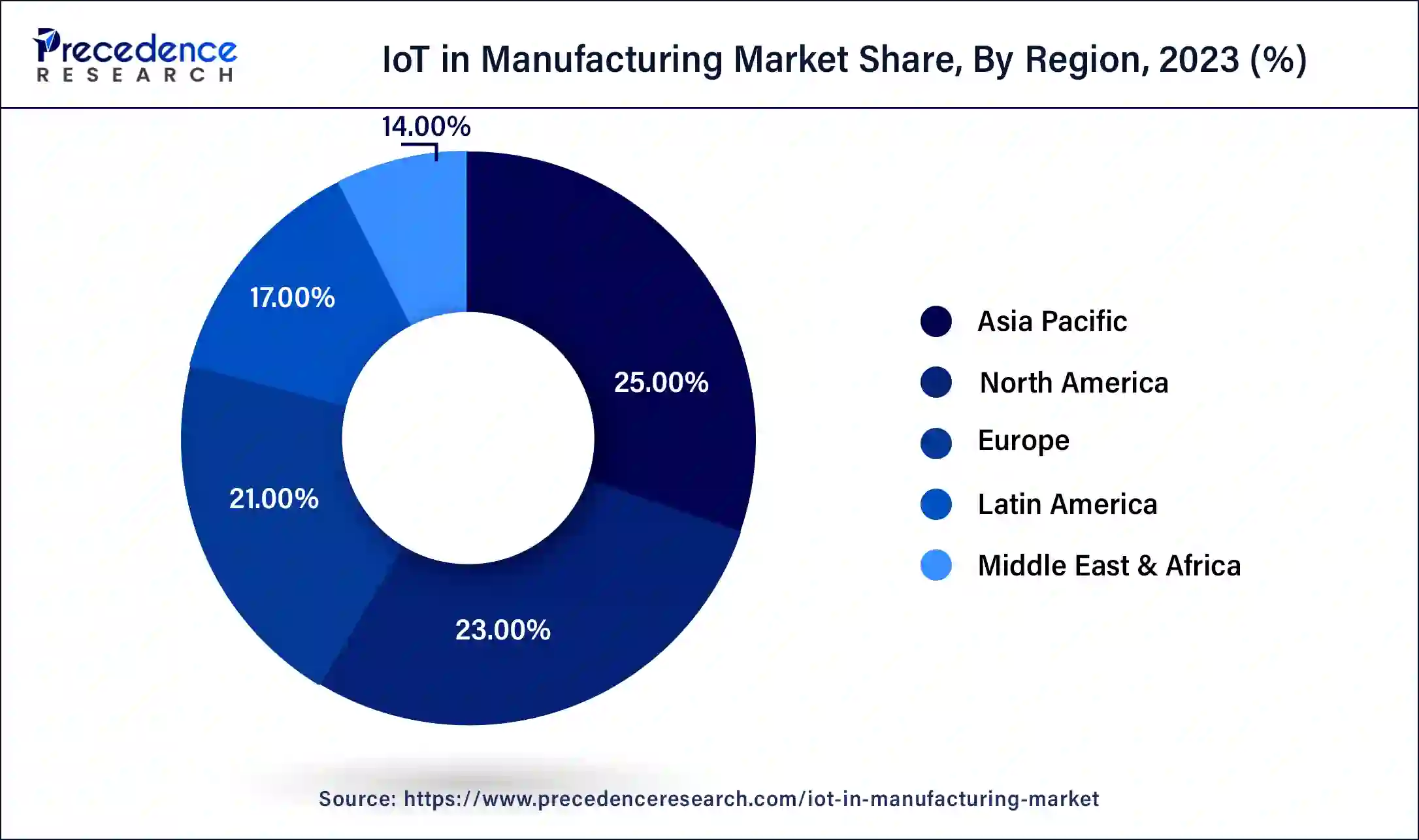

North America is considered as second largest region in IoT in manufacturing market during the forecast period. This region includes mainly U.S., and Canada. The expansion of the regional market will be aided by the rising number of start-ups and the increasing application of machine learning algorithms in both software and hardware.

The networking of physical tools and machines is known as the Internet of Things (IoT), and it has applications in the automotive, electronics, insurance, industrial, manufacturing, and retail sectors. It makes use of device connectivity to remotely control or detect objects.

The difficulty of operating more effectively has faced industrial manufacturing organizations for a long time. Businesses have had to decide whether to relocate their facilities or make significant efficiency improvements in their current ones because they are under assault from rivals who have manufacturing capabilities in areas with cheaper labor costs. The benefits associated with the advancements in technology has benefitted the manufacturing market. The ecosystem's diversity and competitiveness are the results of the existence of numerous significant participants. IoT in manufacturing is a method of digital transformation that manufacturing businesses use to improve the productivity of their personnel and machinery. Critical production data are gathered via a network of sensors, and cloud and analytics tools are then utilized to transform the data into information that can be used to make informed decisions regarding the manufacturing operations. With the implementation of IoT, industrial facilities may automate their processes, which lowers costs, accelerates time to market, allows for mass customization, and boosts safety.

The IoT in manufacturing market is being driven by the rising adoption of automated & intelligent technologies, which result in great production efficiency and less environmental effect. Efficiency is increased by the application of intelligent production and process management strategies in various production facilities. These criteria let manufacturers create items more quickly and cheaply, allowing them to invest in more capable jobs. These technologies enable businesses to learn about customer preferences and design products accordingly. High demand is being generated by the adoption of IoT technology by international firms due to improved worker safety, customer service, and competitive benefits.

The industrial automation has grown significantly in the manufacturing sector. Producers are concentrating more on producing large quantities of high-quality products as a result of increased consumer demand and market competitiveness. As a result, they are now focusing on important aspects of the plant like the manufacturing process, asset monitoring, and asset maintenance and support. By using automation, manufacturers could increase productivity, reduce direct labor costs and expenses, improve the consistency of their processes or products, and produce higher-quality goods. The improvement of industrial automation in the manufacturing industry depends on the Internet of Things (IoT).

The connected supply chain and smart manufacturing processes depend heavily on connected and smart items. Additionally, the introduction of inexpensive connected devices has made it possible for manufacturers to implement IoT technologies to reduce resource consumption and boost overall productivity. Additionally, because IoT applications have a low operational cost, many manufacturers seek to integrate them into their products in order to increase efficiency while lowering costs. These reasons are driving the IoT in manufacturing market.

| Report Coverage | Details |

| Market Size in 2023 | USD 59.45 Billion |

| Market Size in 2024 | USD 65.81 Billion |

| Market Size by 2034 | USD 181.86 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Solution, Connectivity, Deployment Mode, Organization Size, Service, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

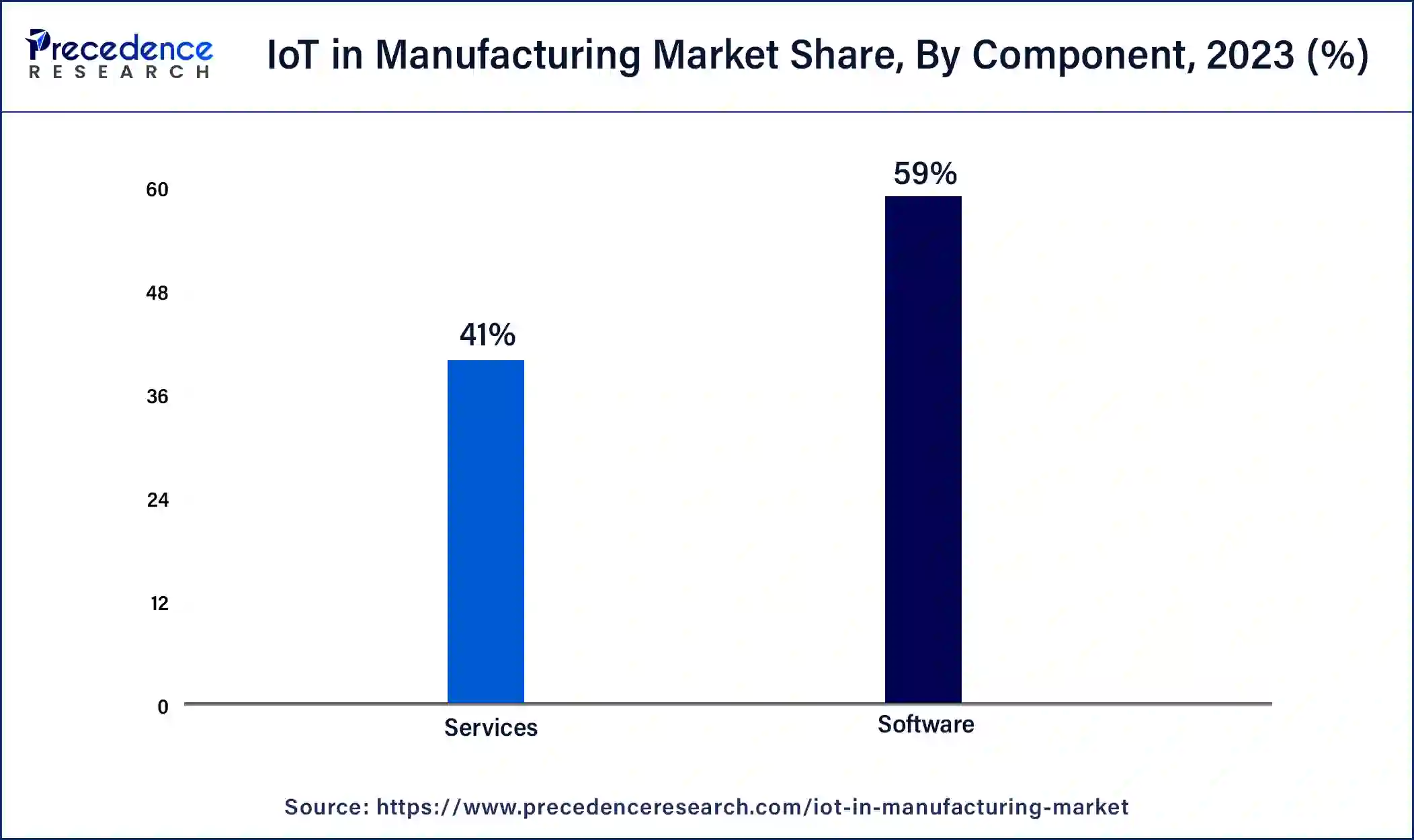

Depending upon the component, the software segment dominant the IoT in manufacturing market in 2023. In order for manufacturing businesses to build linked, digitized production processes with mass customization and an automated, self-configuring manufacturing floor, services play a crucial role in the IoT in manufacturing industry.

As it primarily focuses on enhancing business operations and lowering needless costs and overheads for manufacturing firms, the services category is seen as a crucial part of the IoT in manufacturing market. The adoption of managed services in the U.S. and Canada is one of the contributing causes.

Depending upon the solution, the data management segment accounted largest share in 2023. Due to the rising deployment of end-to-end data management solutions for more effective and flexible capitalization of IoT data across companies, the market for IoT data management is growing. Modernizing data warehouse design, expanding use of data encryption for IoT device security, and growing need for data security and data traffic management are the main factors propelling the market's expansion. The acceptance rate of IoT data management solutions has increased as a result of opportunities including the adoption of established content models in businesses, the emergence of unified metadata services, and effective procedures for boosting return on investment.

Significant demand has been generated in this market as a result of the growing use of Internet of Things (IoT) for various processes. Real-time analytics, security solutions, and data management solutions have all been developed as a result of the technology's rapid change and the requirement for effective management of connected devices. improving digital transformation across the manufacturing sector is becoming more and more necessary. Additionally, businesses are better equipped to make strategic decisions that incorporate the most recent technology to fulfil their expanding needs thanks to the greater reliance on connected devices to streamline industrial processes, increase efficiency, and reduce time to market. Due to the growing need to leave a significant impression in the more competitive global market, manufacturers were also able to implement clever solutions to increase their business efficiency and profitability.

Smart surveillance has a significant share in the IoT in manufacturing market during the forecast period. It includes central monitoring system, and video analytics and events. The Internet of Things (IoT) phenomenal expansion has created novel commercial opportunities and enabled operational models across many different sectors and use cases. Beyond security and video surveillance, the Internet of Things supports business operations, monitoring, and even internal projects like marketing and advertising. For analytics, targeted marketing, and improved branch operations, banks can now deploy smart IoT-enabled video surveillance solutions.

During the projected period, the near field communication segment is anticipated to be the largest in the IoT in manufacturing market. Easy connections, quick transactions, and straightforward data transmission are all advantages of NFC. It addresses the issue of network access being unavailable for powered things. These non-powered items' embedded NFC tags enable the addition of intelligence anyplace. To enhance the user experience, tap an NFC-enabled device to open a URL and provide content. Additionally, it facilitates simple and straightforward device connection. There is no need for tedious data entering or hand shaking.

In order to undertake remote facility monitoring and real-time asset management at unmanned sites and offshore platforms, business activities that extend to geographically remote areas depend on satellites to supply the essential communication infrastructure. Additionally, city managers all over the world are using the IoT to push for energy-saving policies and more intelligent resource allocation in an effort to make cities more sustainable. For example, satellite technology is essential for extending smart grids to remote areas where terrestrial networks are inadequate.

Segments covered in the report

By Component

By Solution

By Connectivity

By Deployment Mode

By Organization Size

By Service

By Vertical

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

January 2025

October 2024

August 2024