April 2025

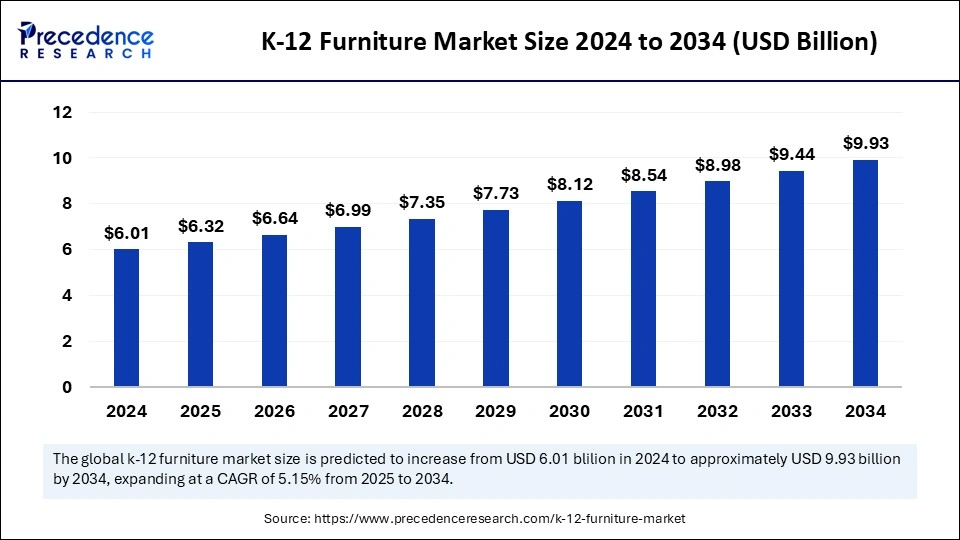

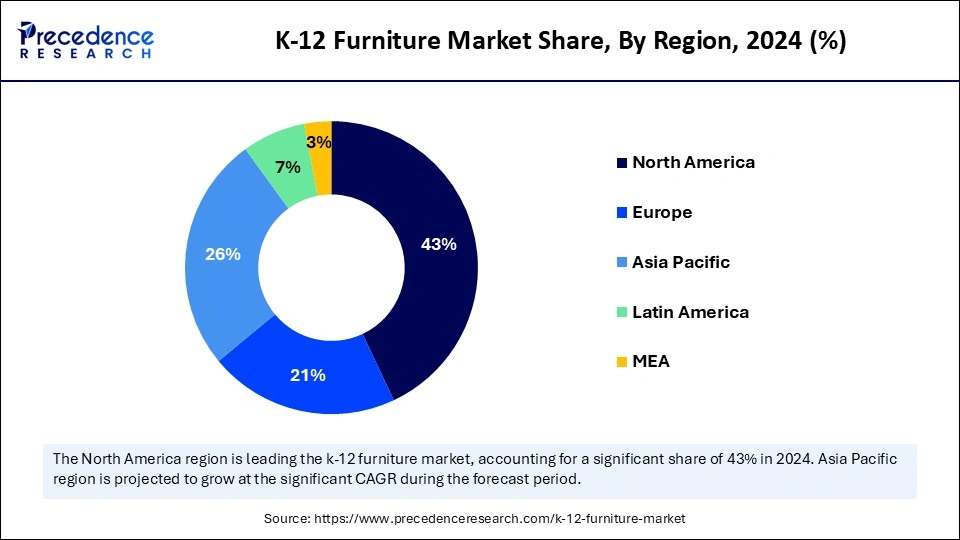

The global K-12 furniture market size is calculated at USD 6.32 billion in 2025 and is forecasted to reach around USD 9.93 billion by 2034, accelerating at a CAGR of 5.15% from 2025 to 2034. The North America market size surpassed USD 2.58 billion in 2024 and is expanding at a CAGR of 5.28% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global K-12 furniture market size accounted for USD 6.01 billion in 2024 and is predicted to increase from USD 6.32 billion in 2025 to approximately USD 9.93 billion by 2034, expanding at a CAGR of 5.15% from 2025 to 2034. growing demand for durable, sustainable, and aesthetically appealing classroom furniture for better learning and teaching experience drives the growth of the market.

The association of Artificial Intelligence in the furniture industry is transforming the landscape of overall operations, value chain, manufacturing, and sales. AI in the K-12 furniture market helps in analyzing the designs and material of furniture and making a virtual image of the furniture in 3D virtualization. AI can analyze the recent trends, searches, and purchase rate of the specific furniture and offers real-time insights to the designers for meeting the needs of the consumer from their furniture. Additionally, robotics advancements in the furniture industry simplify the manufacturing process with enhanced speed and precision.

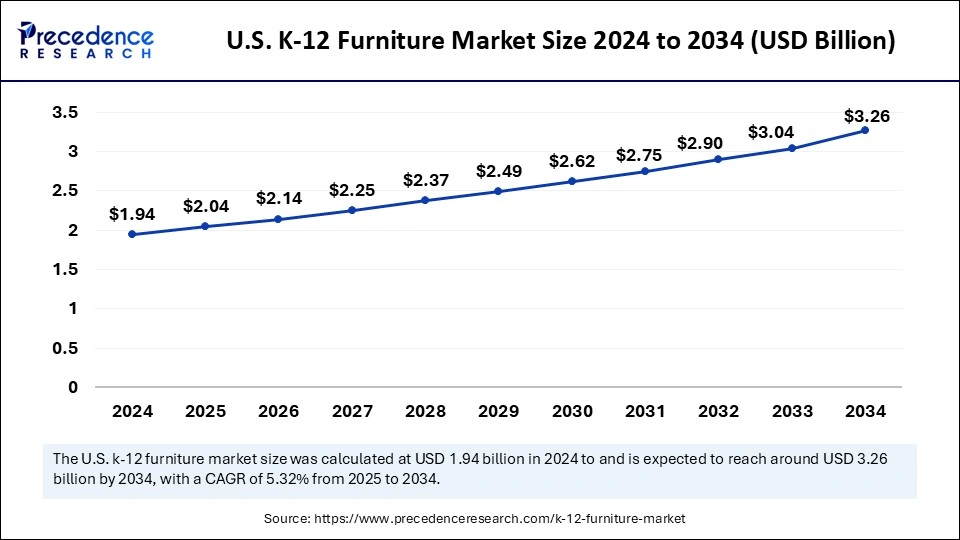

The U.S. K-12 furniture market size was exhibited at USD 1.94 billion in 2024 and is projected to be worth around USD 3.26 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034.

North America dominated the K-12 furniture market in 2024. The growth of the market is attributed to the rising awareness regarding education, and the government intervention on the development of the educational infrastructure is driving the demand for K-12 furniture. The rising investment in the development or renovation of schools and the modernization of educational facilities are driving the demand for different types of furniture, such as chairs, desks, storage cabinets, collaborative desks, and others.

The United States is one of the leading economies around the world and in North America. The rising awareness regarding the educational facilities and the government participation in improving the educational qualities and modernization of educational facilities with the enhanced infrastructure is contributing to the growth of the market.

Asia Pacific is expecting the fastest growth in the K-12 furniture market during the predicted period. The growth of the market is attributed to the continuously increasing population in the regional countries and the growing emphasis on educational facilities, and the development of the schools, colleges, and other educational facilities is driving the demand for K-12 furniture. The growing demand for different types of commercial furniture is accelerating the growth of the market across the region.

India is one of the largest economies with a growing population that boosts the demand for the improved education sector. The growing demand for the furniture market in the country and investment in the educational sector development, and government initiative for providing quality education to every child collectively drive the growth of the market.

Europe expects significant growth in the market during the forecast period. The growth of the market is attributed to the rising government focusing on infrastructural development in the education sector. The modernization of schools and educational reforms are majorly driving the demand for efficient and engaging classroom furniture that contributes to the growth of the K-12 furniture market in the region.

The growing infrastructural development in the country with economic development and disposable income in the population boosts the lifestyle expansion and surge in the spending on educational qualities by the people of the country. Furthermore, the government intervention for providing improved and quality education with the standard infrastructure is accelerating the expansion of the market.

K-12 furniture is modernized school furniture with elevated comfort, easy mobility, and aesthetics. The modernization of schools and educational institutes causes the demand for highly specified, durable, flexible furniture that can elevate the learning experience of students. The demand for engaging and activity-based furniture attracts the students as well as teachers for the collaborative initiatives in the learning, and learning activities boost the demand for the K-12 furniture in the classroom. There are several leading furniture manufacturers focusing on the development of innovative and flexible K-12 furniture.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.93 Billion |

| Market Size in 2025 | USD 6.32 Billion |

| Market Size in 2024 | USD 6.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.15% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, Composite Materials, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for high-quality classroom infrastructure

The growing modernization of educational infrastructure is driving the demand for high-quality classroom furniture. The furniture is one of the most important parts of the classroom for elevating the learning experience, offering comfort and beauty in the classroom. The rising demand for the flexible, durable, increased storage solution, and enhanced furniture for the classrooms and the intervention of the leading educational furniture manufacturer is investing in the innovative designs of classroom furniture.

Cost of furniture

The cost of the furniture is somehow limiting the adoption of the K-12 furniture by a number of educational facilities. The K-12 furniture is made from high-cost raw material that makes it higher in cost and unaffordable for the consumer, which hampers the growth of the K-12 furniture market.

Innovations in the adaptive K-12 furniture

The increasing marketplace for the adaptive K-12 furniture with enhanced mobility options, comfort, and learning experience. The adaptive K-12 furniture can be used in all age groups of students and used in exploring the different styles in teaching and learning. There are different types of furniture for adaptive furniture that are developed for elementary, middle, and high school students. Chair, post leg desks, whiteboard, stack chair with bookrack, activity tables, stout tables, and others are some types of adaptive K-12 furniture. Additionally, the customization availability of the K-12 furniture is accelerating the growth opportunity in the market expansion.

The desks segment dominated the K-12 furniture market in 2024. The desks are the most important part of the school furniture. The rising development in educational infrastructural development globally creates the increased demand for educational furniture in which desks play an important role in providing suitable comfort while performing the school tasks. The demand for the different designs, shapes, and lengths of the desks as per the requirements by the schools drives the demand for the segment.

The storage solution segment expects substantial growth during the predicted period. The demand for the furniture in the schools can store the educational utilities like stationaries, and other items. The storage furniture comes in different variants and can be customized according to the demand that can accelerate the demand for the segment.

The wood segment led the K-12 furniture market in 2024. The increasing demand for wooden furniture by the number of end-use applications. The schools prefer to choose wooden furniture due to its durability and longer life. The wooden furniture is relatively stronger than its alternative material furniture and offers enhanced aesthetics to the buildings. Government participation in the development of the infrastructure drives the growth of the market.

The plastic segment expects notable growth in the forecast period. The rising preference for plastic-based school furniture due to its cost effectiveness and longevity makes them run for a longer period. The plastic furniture comes in different shapes, colors, and sizes and can be customized according to the requirements of the consumer.

The primary schools segment accounted for the largest share of the K-12 furniture market in 2024. The increasing number of primary schools globally is due to the rise in the population and the increasing awareness regarding primary education in children. The rising demand for efficient furniture in primary schools supports the young learners in doing their routine learning activities. There are several types of primary school furniture found in the market, such as chairs, desks, collaborative desks, single desk chairs, collaborative learning furniture, modern desk chairs, and several others. There are a number of furniture manufacturers investing in the development of innovative and comfortable kids' learning furniture.

The public schools segment expects notable growth during the forecast period. The rising investment by the government for the development of educational infrastructure is driving the demand for the different types of furniture in the public schools. The public furniture includes teachers' desks, storage, meeting tables, students' desks, flexible seating, chairs, soft seating, and tables.

The online retail segment dominated the K-12 furniture market in 2024. The rising inclination toward online shopping and the rise in the e-commerce market globally is accelerating the expansion of the online retail segment. The online channels provide specialized offers, discounted pricing, and availability of a number of brands with different varieties. The rising inclination of youth toward digital media and online shopping is contributing to the expansion of the segment.

The retail stores segment expects notable growth during the forecast period. Retail stores have been one of the highly trusted distribution channels for different types of goods for decades. The retail stores offer discounted pricing with warranties on the product.

Recent Developments

By Product Type

By Material

By End User

By Distribution Channel

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

June 2023

March 2025