April 2025

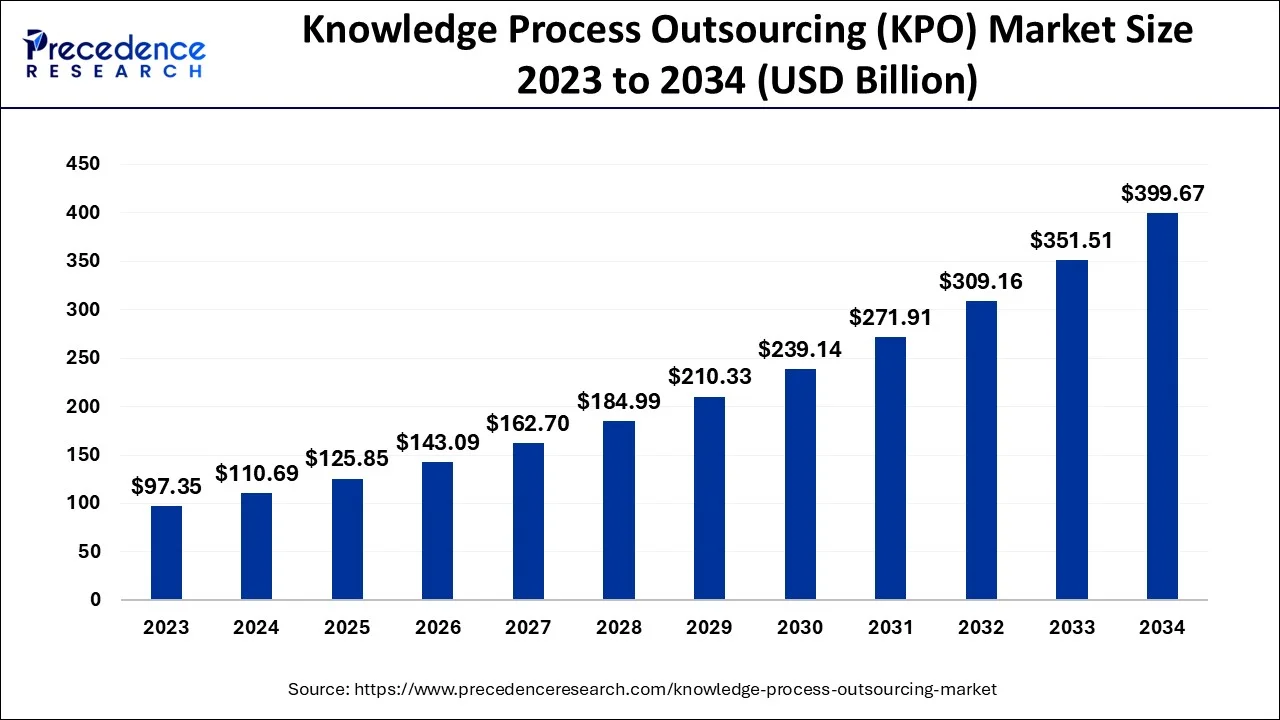

The global knowledge process outsourcing (KPO) market size is estimated at USD 110.69 billion in 2024, grew to USD 125.85 billion in 2025 and is predicted to surpass around USD 399.67 billion by 2034, expanding at a CAGR of 13.70% between 2024 and 2034.

The global knowledge process outsourcing (KPO) market size accounted for USD 110.69 billion in 2024 and is anticipated to reach around USD 399.67 billion by 2034, expanding at a CAGR of 13.70% between 2024 and 2034.

The Asia Pacific knowledge process outsourcing (KPO) market size is estimated at USD 86.34 billion in 2024 and is expected to expand around USD 313.74 billion by 2034, expanding at a CAGR of 13.77% between 2024 and 2034.

The area with the greatest concentration of KPO firms and consultants worldwide in 2023 was Asia Pacific. This is a result of the professional services and critical processes being quickly offshored. The rise in the number of qualified professionals, including engineers, architects, and lawyers, in emerging countries like India, China, and the Philippines is what is driving the market's development.

Over the forecast years, Latin America is forecast to see the fastest growth, with a CAGR of 20.60%. Businesses in the area are expected to drive market expansion during the projected period by increasing their attention on R&D and expanding their analytical insights. By 2022, it was predicted that the knowledge process outsourcing (KPO) market in the US would be worth $14.5 billion.

KPO products and services are thought to have enormous development potential in India. The development of this area is expected to be aided by the presence of highly qualified professionals and workers with specialized knowledge in law, engineering, education, media, publishing, industrial machinery, entertainment, textiles, automotive, software, electronics, aerospace, insurance, healthcare, biotechnology, pharmaceuticals, and financial services.

Industries may save a lot of time and money by outsourcing crucial system processes. Another factor fueling the industry's expansion is the growing need for professional services, including training, research, managed services, and maintenance. Highly qualified professionals, including attorneys, engineers, and architects, may offer professional services at cheaper prices than their western counterparts in developing nations like China, India, and the Philippines. It might be challenging to glean valuable knowledge from the sources that are available due to the abundance of information in the globe. The accelerated global industry competitiveness has decreased the cycle time for developing new products and services. Customers expect high-quality services, so firms must have organizational structures and rules in place that not only boost efficiency but also advance their goods and services strategically. KPO assists businesses with key hardware management, product and service research, market and competitor research, increasing organizational performance in business administration, and dealing with dynamic business conditions. KPO's main goal is to offer better services and customized solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 110.69 Billion |

| Market Size by 2034 | USD 399.67 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Fill the knowledge and skill gaps in business

Rising adoption of KPO in the retail sector

Demand for KPO is surging

Due to the effectiveness of the services offered and the cost savings, it is predicted that the knowledge process outsourcing market's legal process outsourcing service category would have the quickest growth. From 2024 to 2034, the market is anticipated to expand at a CAGR of 23.50%. Contract management, litigation management, and legal analytics are among the typical legal tasks that are outsourced.

Due to a rise in demand for business information and analytical tools that lessen employee strain, analytics and market research services now have the biggest market share in the KPO sector.

Other services, such as outsourcing for engineering and design, financial processes, and research and development, are anticipated to expand at a higher rate throughout the projected period. New instruments have been created as a result of technological growth to provide clients with knowledge-based services.

In the 2023 knowledge process outsourcing market, the research and development outsourcing sector attracted a promising revenue share. Businesses are using KPO companies more frequently to fulfill their R&D activities. Additionally, by outsourcing research and development work, firms may have access to a pool of highly qualified individuals who can provide innovative solutions to problems and speed up the introduction of new products and services to the market.

In the IT and telecom sectors, knowledge process outsourcing is becoming more popular. Over the forecast years, the category is predicted to increase at a CAGR of 21%. The fragmented and continually growing large database in the IT and telecom sector is anticipated to fuel market expansion throughout the forecast period.

Due to the vast number of applications in the category, the BFSI segment is now leading the market. Sensitive data about consumers and financial databases from multiple banks are included in the BFSI category. Companies outsource tasks like financial analytics, equities research, and data administration, among others, to keep information effective. Several businesses, like CRISIL Ltd., Credit Suisse Group AG, and WNS (Holdings) Ltd., offer financial services to other businesses.

In terms of revenue, the healthcare and pharmaceutical sector accounted for a sizeable portion of the KPO market in 2022. A medical KPO may include administrative or diagnostic tasks. The healthcare business has been the most effective at outsourcing administrative tasks like medical coding. Coding needs the expertise of a specialist in order to determine the appropriate billing codes that may be used to describe a patient's particular diagnosis.

Segment Covered in the Report

By Service

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

March 2024

March 2025