January 2025

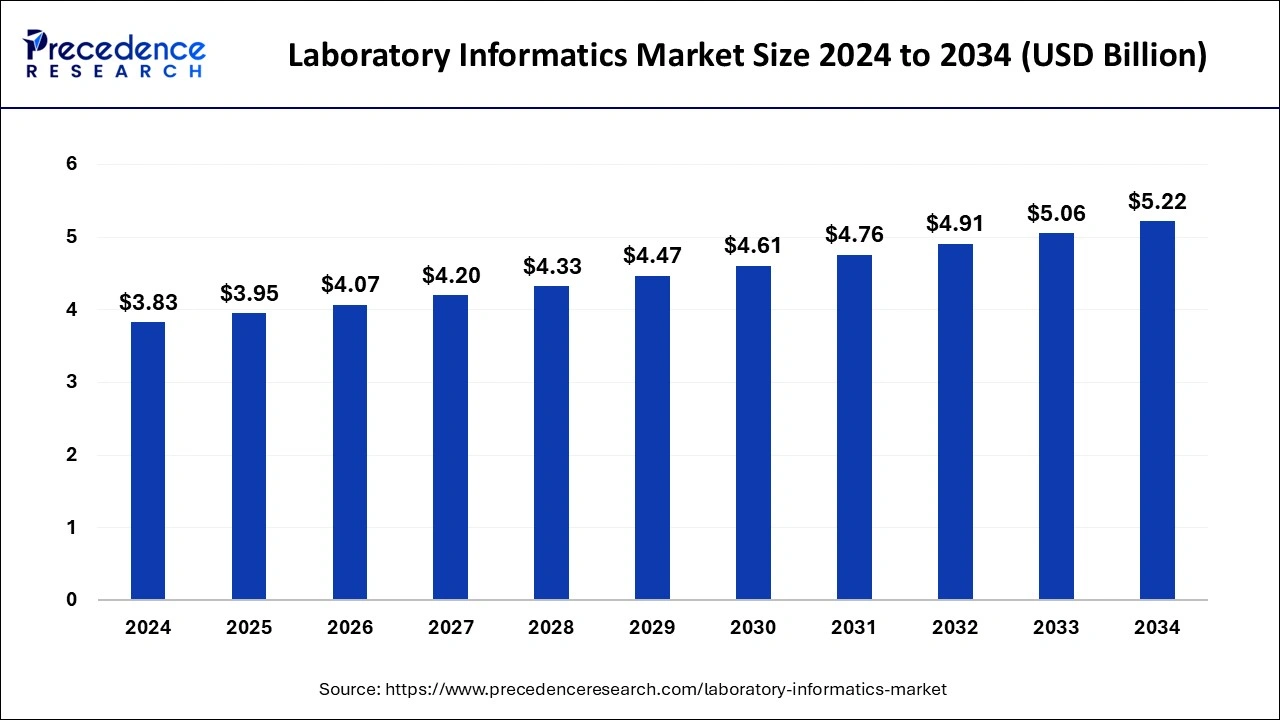

The global laboratory informatics market size is accounted at USD 3.95 billion in 2025 and is forecasted to hit around USD 5.22 billion by 2034, representing a CAGR of 3.14% from 2025 to 2034. The North America market size was estimated at USD 1.65 billion in 2024 and is expanding at a CAGR of 3.24 during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global laboratory informatics market size was calculated at USD 3.83 billion in 2024 and is predicted to reach around USD 5.22 billion by 2034, expanding at a CAGR of 3.14% from 2025 to 2034. The rising adoption of advanced technologies in laboratories and the growing focus on laboratory automation boost the growth of the market.

The integration of artificial intelligence in laboratory informatics will ease the process of storing and extracting data. AI algorithms monitor and analyze large volumes of data easily, which helps in precise diagnosis and treatment planning. AI also reduces human errors and streamlines laboratory workflows. By integrating AI technologies, laboratory informatics enables the systematic gathering, processing, and analysis of scientific data. They can manage and store large volumes of data, which can be then used for future research, lab testing endeavors, and product development activities.

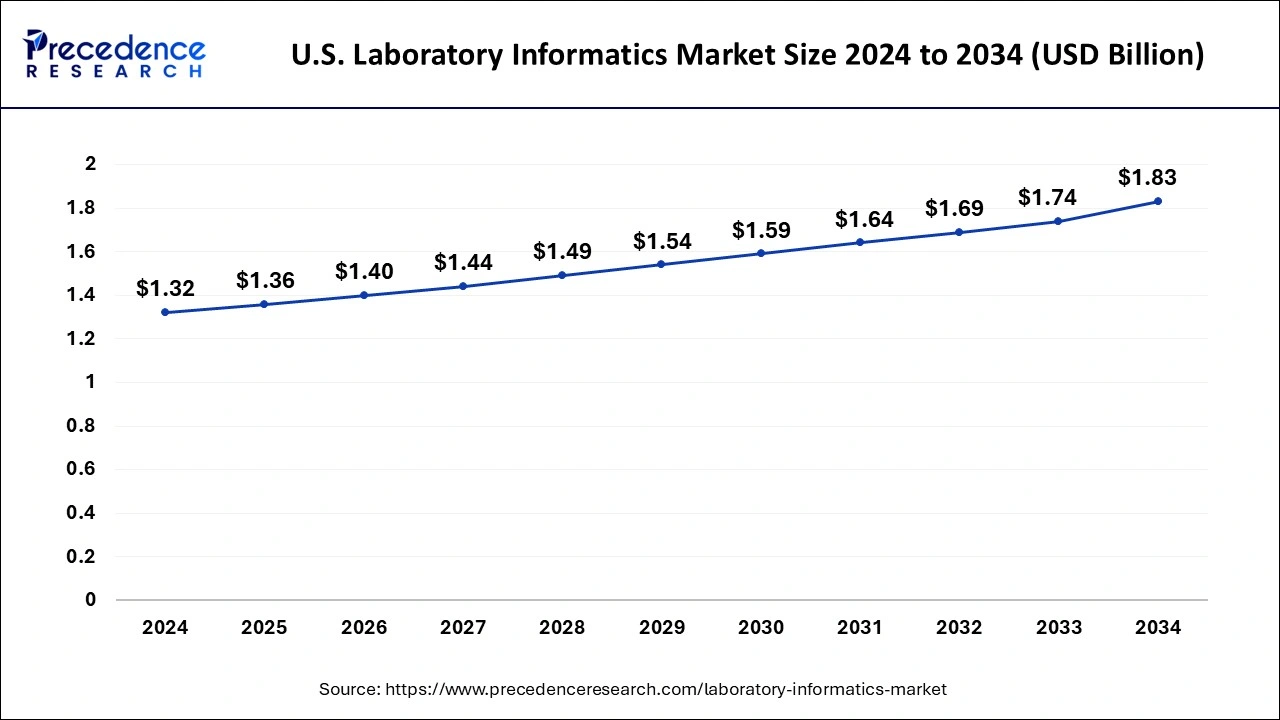

The U.S. laboratory informatics market size was exhibited at USD 1.32 billion in 2024 and is projected to be worth around USD 1.83 billion by 2034, growing at a CAGR of 3.32% from 2025 to 2034.

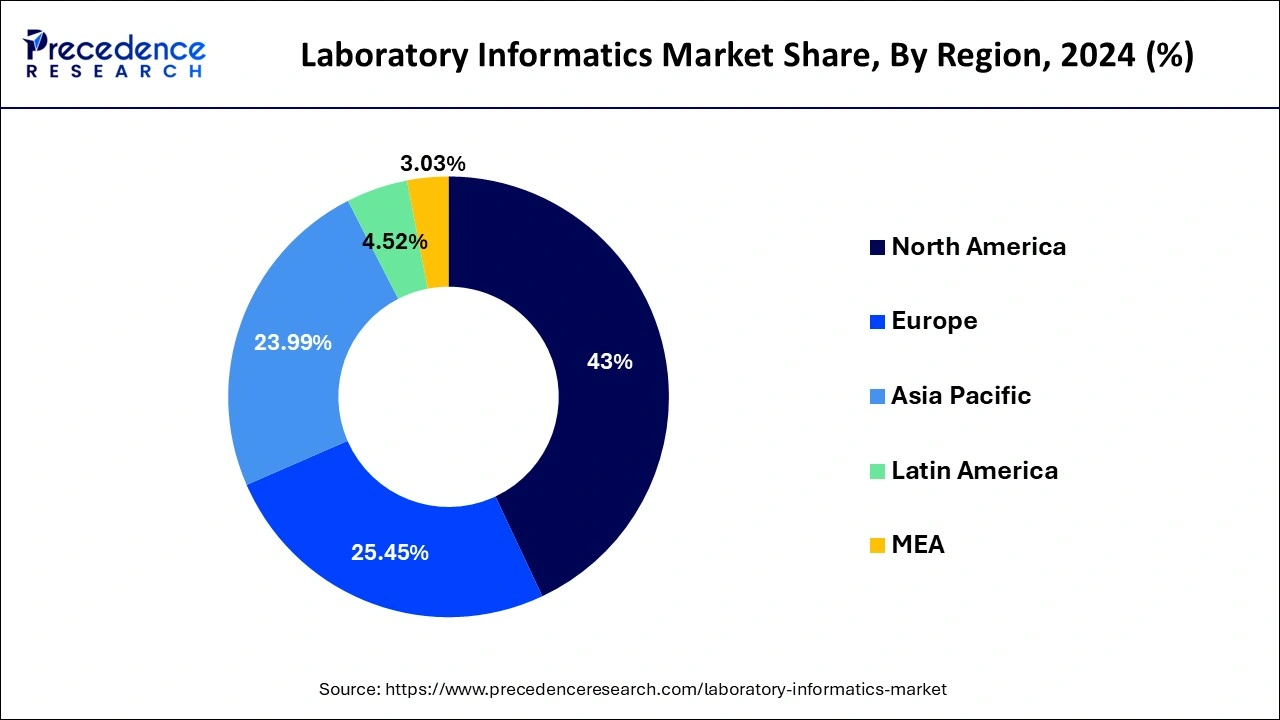

North America dominated the laboratory informatics market in 2024. This is attributed to the availability of infrastructure with high digital literacy as well as legislation promoting the adoption of laboratory information systems.

Asia Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. This is due to the growing number of CROs offering LIMS solutions in the region. To minimize the cost of LIMS support systems and increase operational efficiency, major players outsource LIMS to enterprises in this region.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.95 Billion |

| Market Size in 2034 | USD 5.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.14% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Delivery Mode, Component, End Use, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Patients might spend less time recovering due to medical innovations including more comfortable scanning equipment and better monitoring systems. Automation in surgeries has resulted from the acceptance of technology in medical equipment and telemedicine since, in some situations, clinicians do not even need to be present in the operating room with the patient when the procedure is performed. The constant advancement of technology used in health care has resulted in the adoption of laws and regulations governing its application. As a result, new techniques of providing care can be used.

The growth of the laboratory informatics market could also be fueled by a few factors. An increase in the number of diagnoses and high precision and effectiveness of discoveries are only a few of them. The laboratory informatics solutions are used to handle laboratory information and data and follow progress throughout the laboratory procedure with high precision. As a result, laboratory informatics improves the overall effectiveness of laboratories.

In 2024, the laboratory information management systems (LIMS) segment dominated the laboratory informatics market. In the upcoming years, the demand for completely integrated services in the life sciences and research industries to reduce data management errors and increase qualitative analysis of research data is likely to drive the segment’s growth.

The enterprise content management (ECM) segment, on the other hand, is predicted to develop at the quickest rate in the future years. Enterprise content management is being widely used as it provides integrated and complete solutions to address the healthcare industry’s expanding issues.

In 2024, the cloud-based segment dominated the laboratory informatics market. Cloud-based technology allows for the remote storage of massive volumes of data, saving space on devices and facilitating data retrieval according to customer requirements.

The on-premise segment, on the other hand, is predicted to develop at the quickest rate in the future years. The installation of services and solutions on computers within the organization is known as on-premise delivery.

In 204, the services segment dominated the laboratory informatics market. The expansion of the segment is being added by an increase in the outsourcing of LIMS solutions. Large pharmaceutical research labs outsource these services because they lack the resources and aptitude required for analytics adoption.

The software segment, on the other hand, is predicted to develop at the quickest rate in the future years. This is due to the availability of technologically advanced software such as SaaS, which provides excellent information management solutions for laboratories.

In 2024, the life science companies segment dominated the laboratory informatics market. In order to produce innovative products and increase product quality and operational efficiency, the life sciences sector is growing its demand for laboratory informatics.

The CROs segment, on the other hand, is predicted to develop at the quickest rate in the future years. The lucrative expansion of the CROs segment is being aided by increasing usage by outsourcing organizations to reduce healthcare expenses.

By Product

By Delivery Mode

By Component

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

January 2025