January 2025

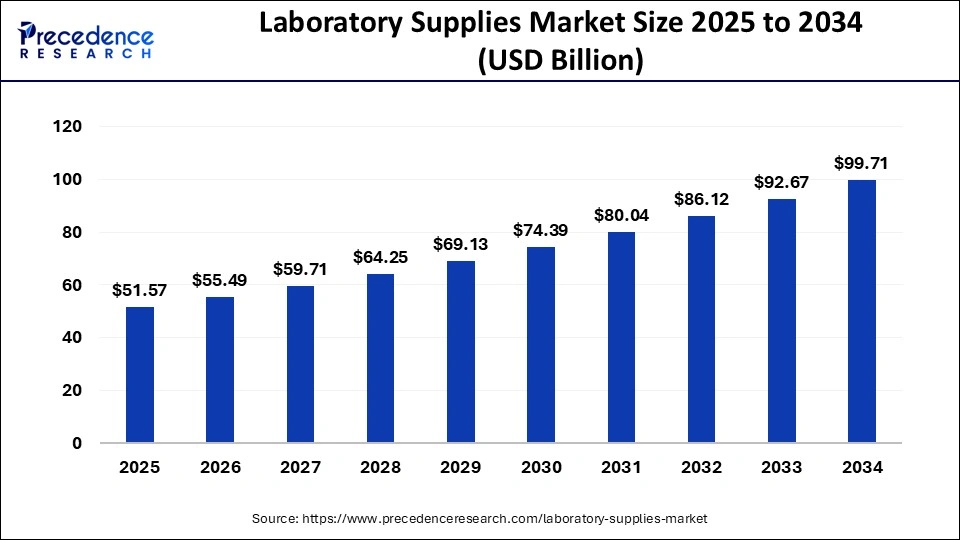

The global laboratory supplies market size was USD 44.55 billion in 2023, calculated at USD 47.93 billion in 2024 and is projected to surpass around USD 99.71 billion by 2034, expanding at a CAGR of 7.6% from 2024 to 2034.

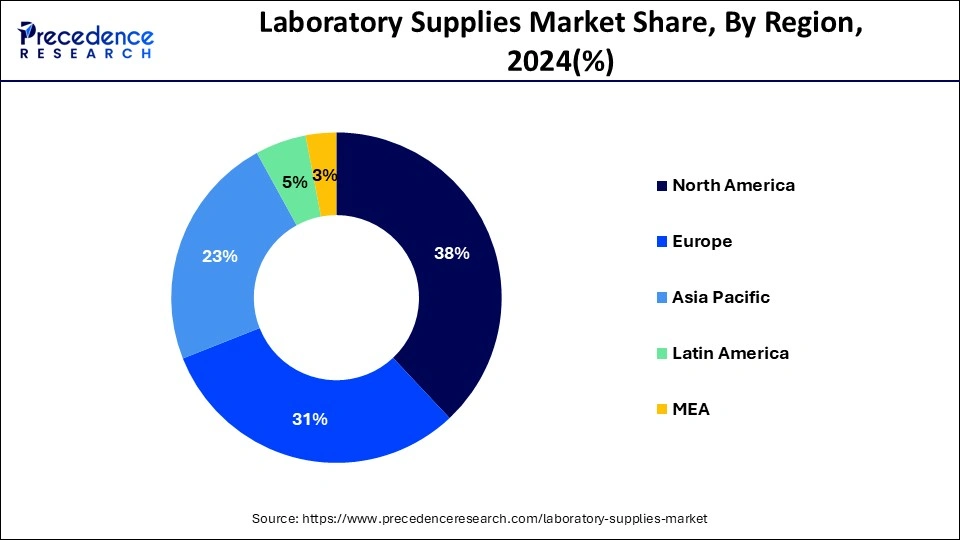

The global laboratory supplies market size accounted for USD 47.93 billion in 2024 and is expected to be worth around USD 99.71 billion by 2034, at a CAGR of 7.6% from 2024 to 2034. The North America laboratory supplies market size reached USD 16.93 billion in 2023.

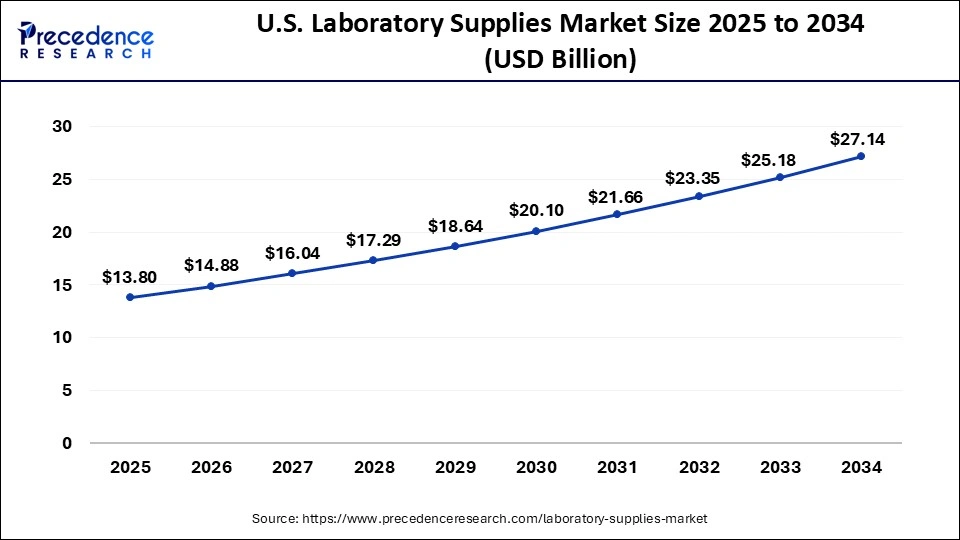

The U.S. laboratory supplies market size was estimated at USD 11.87 billion in 2023 and is predicted to be worth around USD 27.14 billion by 2034, at a CAGR of 7.8% from 2024 to 2034.

North America has captured the highest revenue share of around 38% in 2023. North America is home to numerous top biopharmaceutical companies. Biopharmaceutical companies are the major investors in most research in North America. Therefore, the growth of the laboratory supplies market is highly influenced by the growth of the biopharmaceutical industry in the region. The supportive government regulations, the active role of the FDA in observing clinical test results and developments, and the rising number of approvals are the major drivers of the laboratory supplies market in North America. The rising number of contract research organizations (CROs) in the region and the increasing healthcare spending are further fostering the growth of the market. For instance,

The market in Asia Pacific is expected to expand at the fastest CAGR during the forecast period. This is attributed to the favorable government regulatory frameworks that attract the investments of the top pharmaceutical companies in the region. Moreover, the availability of qualified research professionals in countries like China and India is expected to boosts the number of research organizations in the region. Moreover, the expansion of biotech organizations is expected to drive the growth of the laboratory supplies market in the region.

Laboratory supplies refer to apparatuses that are used in laboratories to perform testing and experiments. These supplies include various products, such as test tubes, beakers, consumables, and safety gear. They are widely used in clinical labs, biotechnology companies, and academic institutions. Moreover, they are usually very delicate; thus, they need to be handled carefully and regularly maintained. The escalating demand for eco-friendly laboratory products across the globe, the rapid advancements in technology, and the high demand for laboratory supplies in pharmaceutical companies and hospitals contribute to the growth of the laboratory supplies market. Moreover, the rising research & development activities and the increasing number of clinical trials boost the market.

The laboratory supplies market is highly influenced by the developments in the pharmaceutical and biotechnology industries. The demand for laboratory supplies is growing owing to the rising research activities. The laboratory supplies are extensively used in experiments, measurements, and data extraction. The rising investments by the market players in biotechnology research are fueling the growth of the global laboratory supplies market. An uninterrupted and continuous supply of laboratory products is needed to conduct the lab experiments efficiently. The surging presence of numerous contract research organizations across the globe is expected to foster the demand for various laboratory supplies during the forecast period. The rising number of clinical lab tests and research on the life sciences is significantly driving the demand for laboratory consumables.

The need for a wide variety of equipment and tools to conduct research and tests that allow quick analyses and results is likely to boost the market growth. Technological advancements are enhancing laboratory capabilities by improving the performance of the lab products and reducing the consumption of consumables. The proliferation of technologies such as artificial intelligence, miniaturization of devices, and automation is changing the way laboratories operate. The increasing pressure on labs to provide faster results to boost the development process of medicines and diagnostic devices is expected to fuel the growth of the global laboratory supplies market. The high demand from the pharmaceutical sector and the rising prevalence of chronic and gene diseases are further boosting the market.

| Report Coverage | Details |

| Market Size in 2023 | USD 44.55 billion |

| Market Size in 2024 | USD 47.93 billion |

| Market Size by 2034 | USD 99.71 billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Rapid Advancements in Technology

Continuous technological advancements within the pharmaceutical and biotechnology sectors drive the laboratory supplies market. These sectors are significantly increasing their investments in research and development, leading to a rapid surge in demand for advanced lab equipment. High-quality and innovative lab supplies are crucial to ensure the accuracy and efficiency of various laboratory processes, including clinical testing and life sciences research. For instance, in 2023, major pharmaceutical companies like Pfizer and Moderna invested heavily in research and development, allocating billions of dollars to improve laboratory infrastructure. The development of more precise diagnostic tools, including air-driven microscopes and automated laboratory systems, reflects how technological advancements change the capabilities of lab supplies. These annotations not only improve research productivity but also ensure accuracy in diagnostic and pharmaceutical research, which drives the market.

Moreover, governments worldwide are placing a special emphasis on investing in developing and improving the healthcare sector. In many countries, government support has drastically enhanced the healthcare infrastructure and related medical technologies, ultimately contributing to the expansion of the laboratory supplies market.

Volatility in Raw Material Prices

Volatile pricing of raw materials is one of the biggest challenges facing the lab supplies market. The fluctuating prices of raw materials, such as plastics, glass, and other key materials used in manufacturing lab supplies, result in higher production costs. For instance, in early 2024, global steel prices increased by around 15% due to supply chain disruptions and higher demand. This directly impacted the manufacturing of laboratory equipment, such as benchtop centrifuges and microscope parts, as they rely heavily on such raw materials. The resulting cost burden is often passed on to the end-users, which can limit the adoption of new equipment. Moreover, compliance with stringent regulations and quality assurance significantly restrain the market growth.

Expansion of Testing Facilities

The laboratory supplies market is set to benefit from several emerging opportunities. One of the key growth areas is the rising number of testing facilities globally. These facilities are becoming more critical due to the rising health concerns, such as the spread of infectious diseases and rising incidences of chronic illnesses, driving the need for accurate and fast diagnostic solutions. Laboratories that conduct genetic testing, pathology and microbial analysis are expanding and boosting the demand for lab supplies. The rising investments by biopharmaceutical companies in research activities for developing novel drugs for various chronic diseases are expected to spur the demand for laboratory supplies in the forthcoming years.

Based on product, the equipment segment dominated the market with the largest market share in 2023. This is because equipment are important in performing research. The laboratory equipment is generally a long-term investment that needs to be installed once and operated for many years. This involves high costs, which results in increased revenue for this segment. The laboratory equipment is generally utilized for experiments and similar procedures. The easy availability of different laboratory equipment and instruments, along with the rising number of CROs, is further spurring the growth of the equipment segment.

On the other hand, the disposable is anticipated to be the most opportunistic segment during the forecast period. The surging number of laboratories, scientific companies, and research organizations across the globe is fostering the demand for various lab disposables. The demand for consumables, like gloves, masks, pipettes, and tubes, is increasing rapidly and the continuous supply of these disposable consumables is fueling the growth of the segment.

The clinical and diagnostic laboratories segment is projected to expand at the highest CAGR in the coming years. Since diagnosing, monitoring, and testing patients requires several pieces of equipment, disposables, and chemicals, laboratory supplies find a wide range of applications in these laboratories. In addition, the increasing number of clinical trials and research contributes to the segmental growth.

Segments Covered in the Report

By Product

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025