April 2025

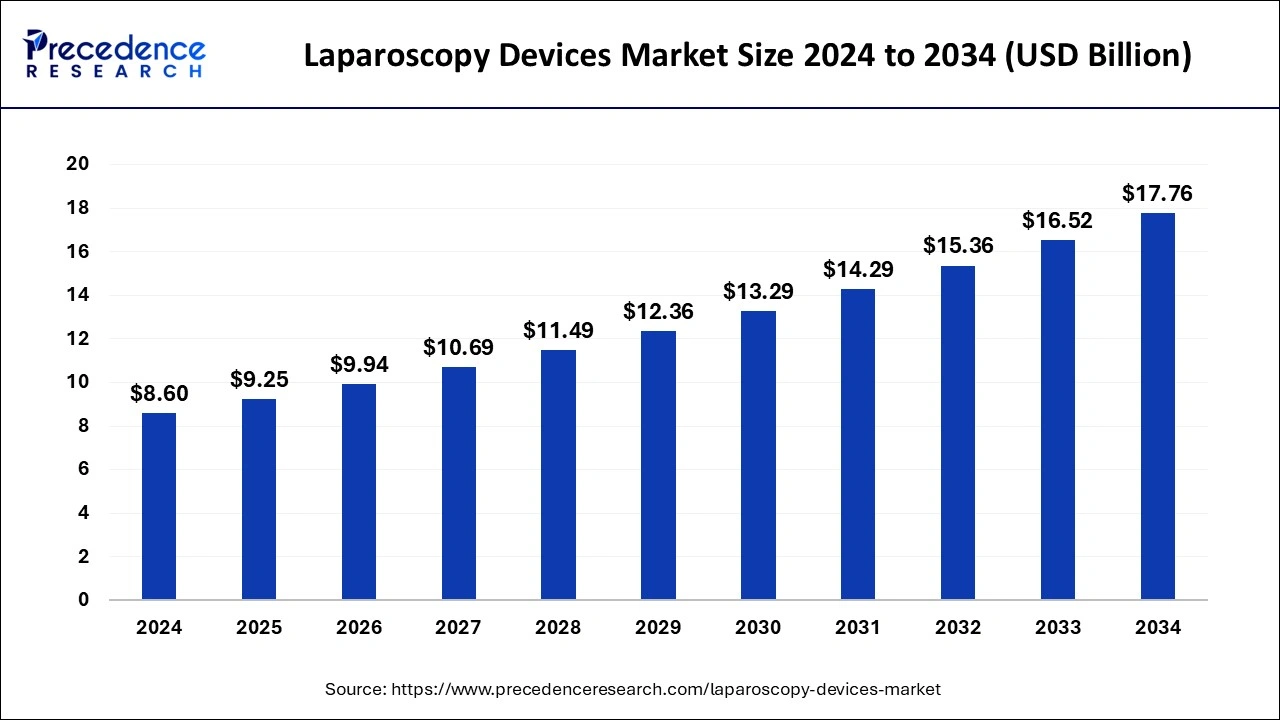

The global laparoscopy devices market size is calculated at USD 9.25 billion in 2025 and is forecasted to reach around USD 17.76 billion by 2034, accelerating at a CAGR of 7.52% from 2025 to 2034. The North America laparoscopy devices market size surpassed USD 2.92 billion in 2024 and is expanding at a CAGR of 7.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global laparoscopy devices market size was estimated at USD 8.60 billion in 2024 and is anticipated to reach around USD 17.76 billion by 2034, expanding at a CAGR of 7.52% from 2025 to 2034.

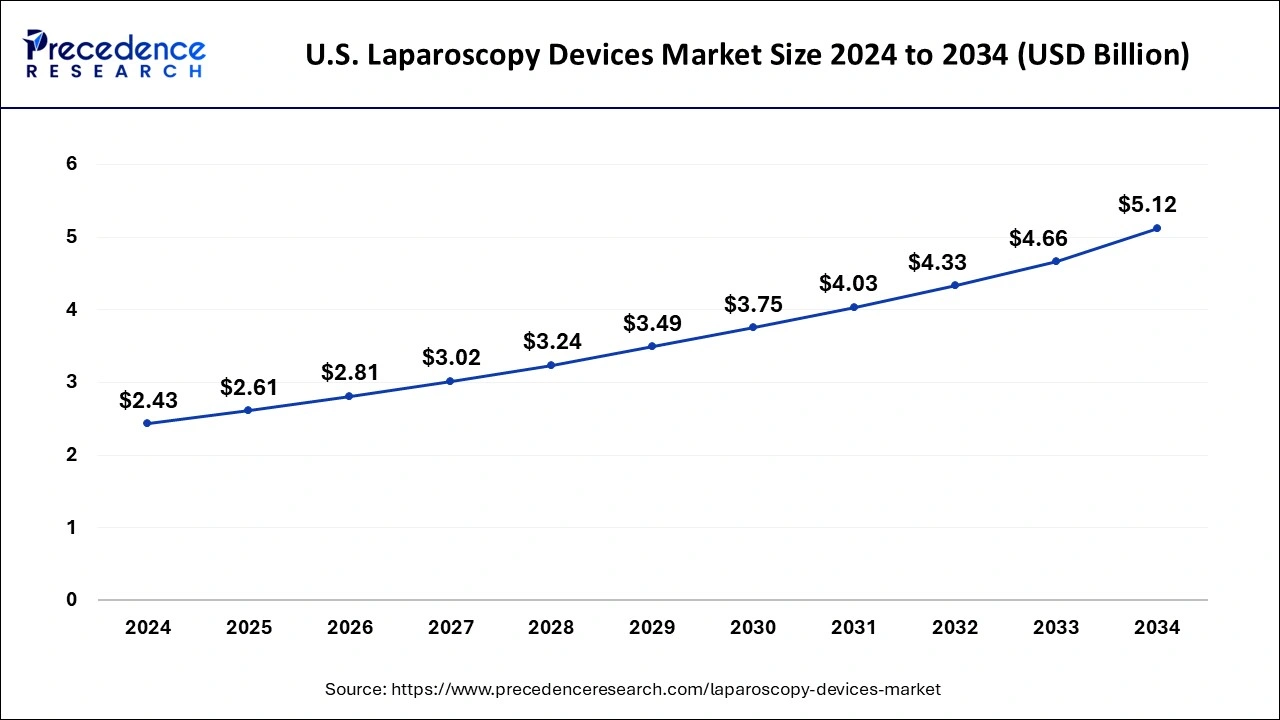

The U.S. laparoscopy devices market size was evaluated at USD 2.43 billion in 2024 and is predicted to be worth around USD 5.12 billion by 2034, rising at a CAGR of 7.74% from 2025 to 2034.

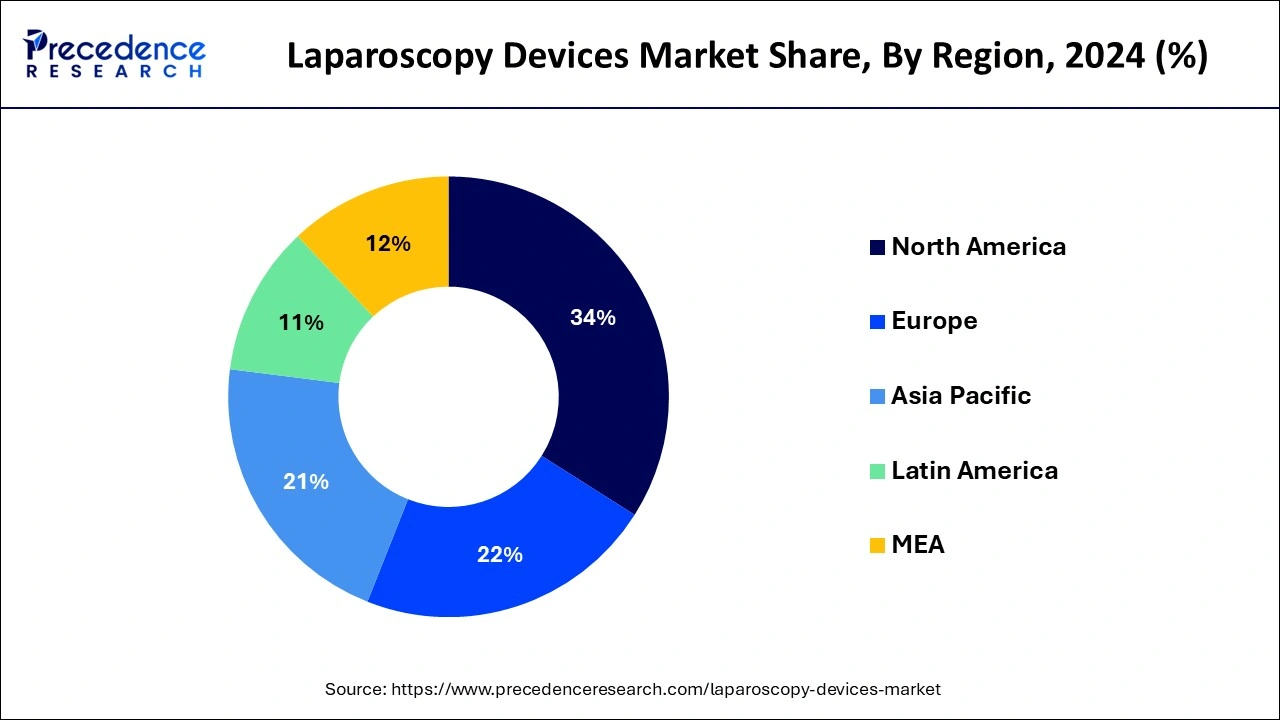

North America dominated the global laparoscopy devices market with the largest market share of 34% in 2024. The growth of laparoscopy devices market in North America is attributed to the growing prevalence of chronic disorders and rising adoption of non-invasive or minimally invasive surgical devices. As per the Centers for Disease Control and Prevention, six out of ten persons in the U.S. have at least one chronic disease, and four out of ten adults have two or more chronic diseases. Thus, the growing number of disorders and infections is driving the demand for laparoscopy devices in North America region. In addition, presence of major market players is also paving way for the expansion of laparoscopy devices market in the region.

Asia-Pacific is expected to expand at a solid CAGR of 8.02% during the forecast period. South Korea and Singapore dominates the laparoscopy devices market in Asia-Pacific region. The growing number of hospitals and healthcare centers for surgeries are driving the growth of laparoscopy devices market in the region. In addition, other factors such as growing trend of medical tourism, technological advancements, and enhancement of reimbursement policies are contributing towards the expansion of Asia-Pacific laparoscopy devices market.

One of the key factors driving the growth of global laparoscopy devices market is rising prevalence of chronic disorders. As per the World Health Organization (WHO) statistics, cardiovascular disorders account for 17.9 million fatalities globally in 2021, followed by cancer for 9.3 million, respiratory disorders for 4.1 million, and diabetes for 1.5 million. Thus, the global laparoscopy devices market is expected to expand in coming years.

Bariatric surgery is gaining popularity in the global laparoscopy devices market. The growing obesity among people all around the world are driving the demand for bariatric surgery all around the world. The rising disposable income is also supporting the growth and development of global laparoscopy devices market. Obesity has nearly tripled in the world since 1975, as per the World Health Organization (WHO) in 2021. Obesity grew from less than 1% to 7% in the 5 to 19 age group over the same period of time. These figures emphasize the importance of adopting of laparoscopy devices for bariatric surgeries.

As per the American Congress Obstetricians and Gynecologists, the number of minimally invasive hysterectomy procedures performed in the U.S. increased from 14% in 2004 to 53% in 2013. According to the American Society of Plastic Surgeons, 20 million surgical operations were performed worldwide in 2014, with 52% of these being minimally invasive procedures. Thus, the growing demand for minimally invasive surgeries is propelling the expansion of global laparoscopy devices market. The other factors such as technological advancements and adoption of unique strategies by major market players are also supporting the growth and development of the global laparoscopy devices market.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.6 Billion |

| Market Size in 2025 | USD 14.6 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The energy systems segment captured maximum revenue share in 2024. As per the IFSO Global Registry Report 2019, there were 833,687 bariatric procedures conducted in 61 countries worldwide in 2019. Thus, the growing number of bariatric procedures is driving the demand for energy systems in the global laparoscopy devices market.

The insufflation device segment is projected to reach at a CAGR of 7.9% from forecast period. The growing prevalence of colorectal cancer is boosting the demand for insufflation devices. As per the World Cancer Research Fund International, colorectal malignancy or cancer was the 3rd most common cancer in both women and men in 2020, with over 1.90 million new cases reported. Thus, this factor is driving the growth of segment.

The bariatric surgery segment accounted for the highest market share of 28%% in 2024. The other surgeries such as colon laparoscopy, thoracic laparoscopy, prostate laparoscopy, and cholecystectomy laparoscopy are among other types of surgeries. The growing prevalence of colon laparoscopy is boosting the growth of the global laparoscopy devices market. The adoption of minimally invasive laparoscopy devices is contributing towards the growth of the segment.

The general surgery segment is expected to grow at a notable CAGR during the forecast period. The factors such as growing government initiatives for the support of bariatric surgeries are paving way for the expansion of the segment. In addition, in bariatric surgery the requirement for laparoscopy devices is quite high. According to the American Society of Metabolic and Bariatric Surgery, 252,000 bariatric procedures were performed in the U.S. alone in 2018. As a result, the segment is expected to grow in near future.

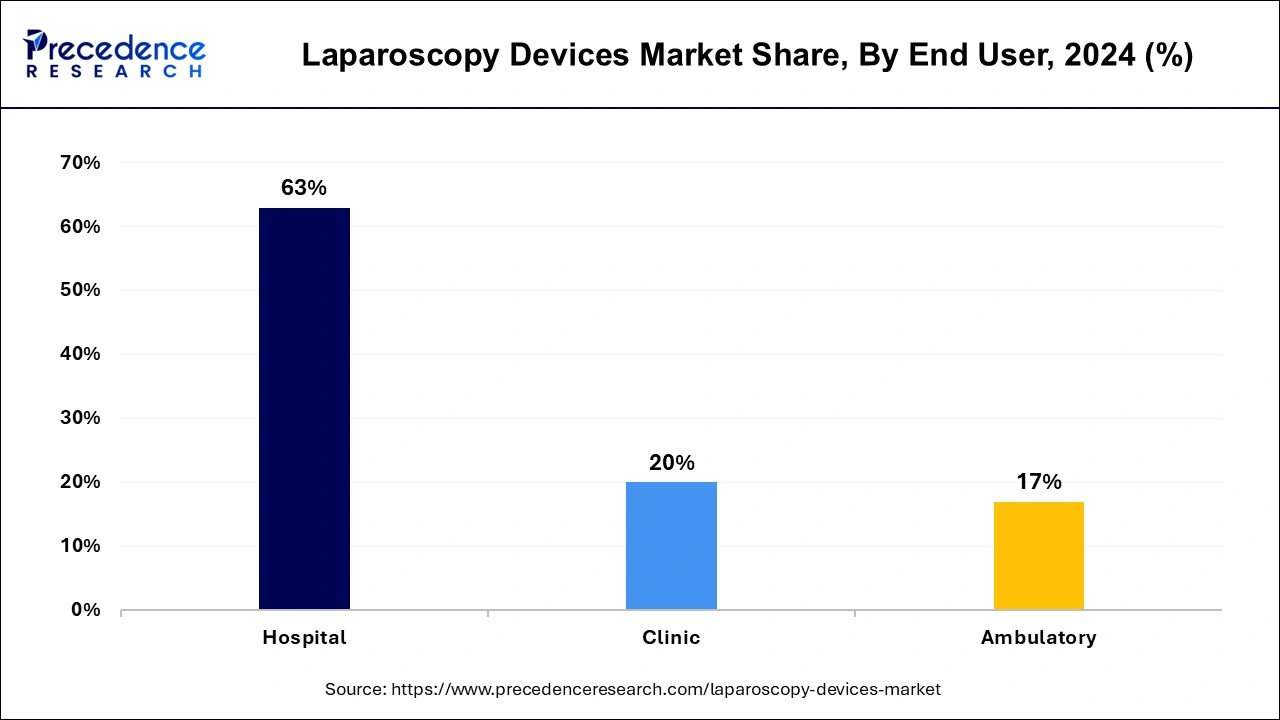

The hospital segment contributed the highest market share of 63% in 2024. The rising prevalence of chronic diseases is increasing the number of patients visiting hospitals. The hospitals have high patient number as compared to other type of healthcare settings. As per the American Society for Metabolic and Bariatric Surgery, weight loss surgery was performed on 256,000 persons in the U.S. in 2019. Thus, all of these factors are driving demand for laparoscopy devices in the hospitals.

The ambulatory segment is projected to grow at a solid CAGR during the forecast period. The demand for laparoscopy devices in the ambulatory surgical devices is attributed to the rise in the use of minimally invasive surgeries and a strong desire and need for outpatient surgeries. Thus, the global laparoscopy devices market is expected to grow due to rising adoption of laparoscopy devices in ambulatory surgical centers.

Segments Covered in the Report

By Product

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

February 2025