December 2024

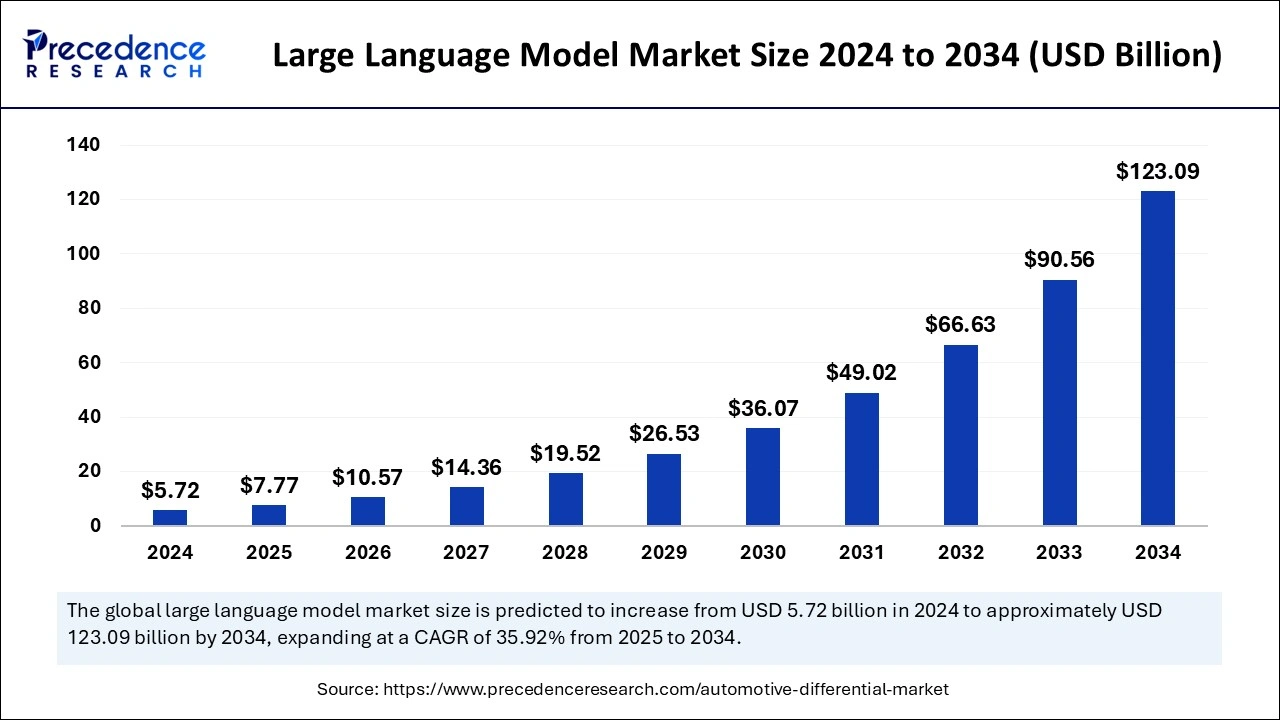

The global large language model market size is calculated at USD 7.77 billion in 2025 and is forecasted to reach around USD 123.09 billion by 2034, accelerating at a CAGR of 35.92% from 2025 to 2034. The North America market size surpassed USD 1.80 billion in 2024 and is expanding at a CAGR of 36.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global large language model market size accounted for USD 5.72 billion in 2024 and is expected to exceed USD 123.09 billion by 2034, growing at a CAGR of 35.92% from 2025 to 2034. The market growth is attributed to the increasing adoption of AI technologies across various industries and the growing demand for automation and data-driven decision-making.

Businesses use Artificial Intelligence in supply chain management, customer experience improvements, and efficiencies by eliminating the need for manual work, which in turn helps companies in the large language model market reduce costs and increase efficiency and productivity. The emergence of new advanced AI technologies, such as machine learning and natural language processing, engulfs the propagation of specialized hardware and software and skilled professionals, hence enlarging the global economy. That is why ethical issues and a lack of skills in organizations are topics that need attention to make AI work for everyone.

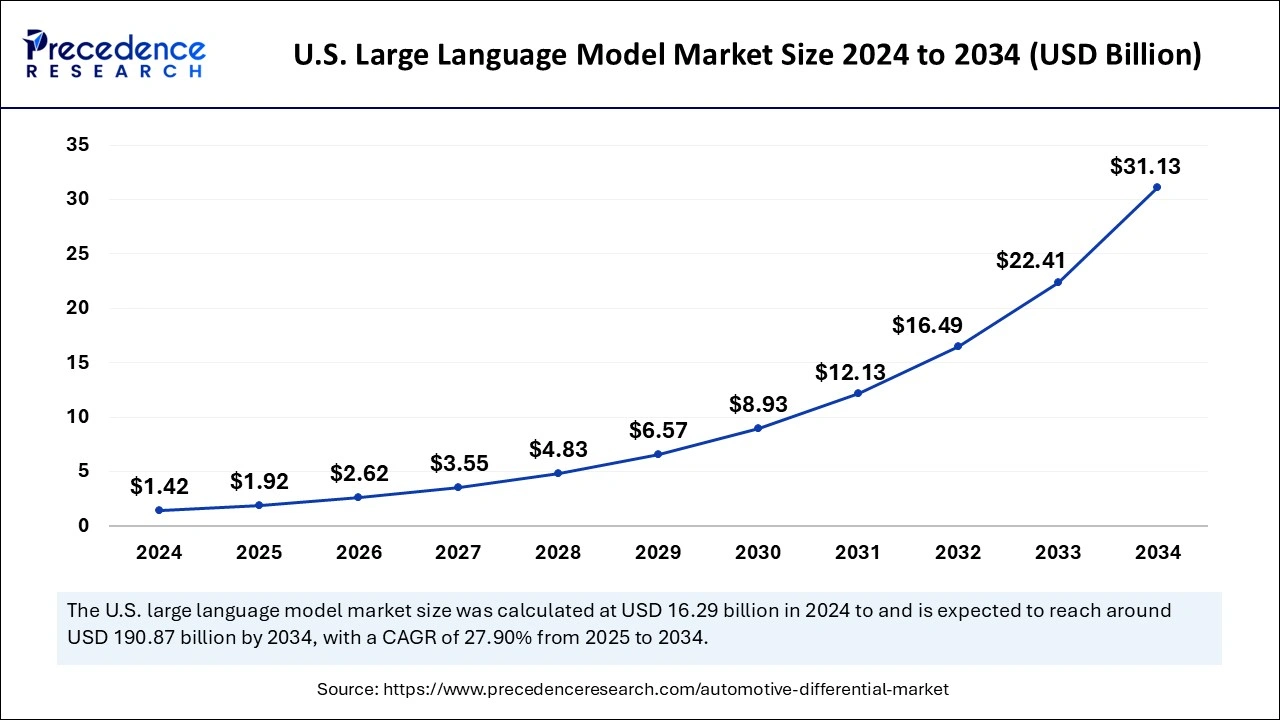

The U.S. large language model market size was evaluated at USD 1.42 billion in 2024 and is projected to be worth around USD 31.13 billion by 2034, growing at a CAGR of 36.17% from 2025 to 2034.

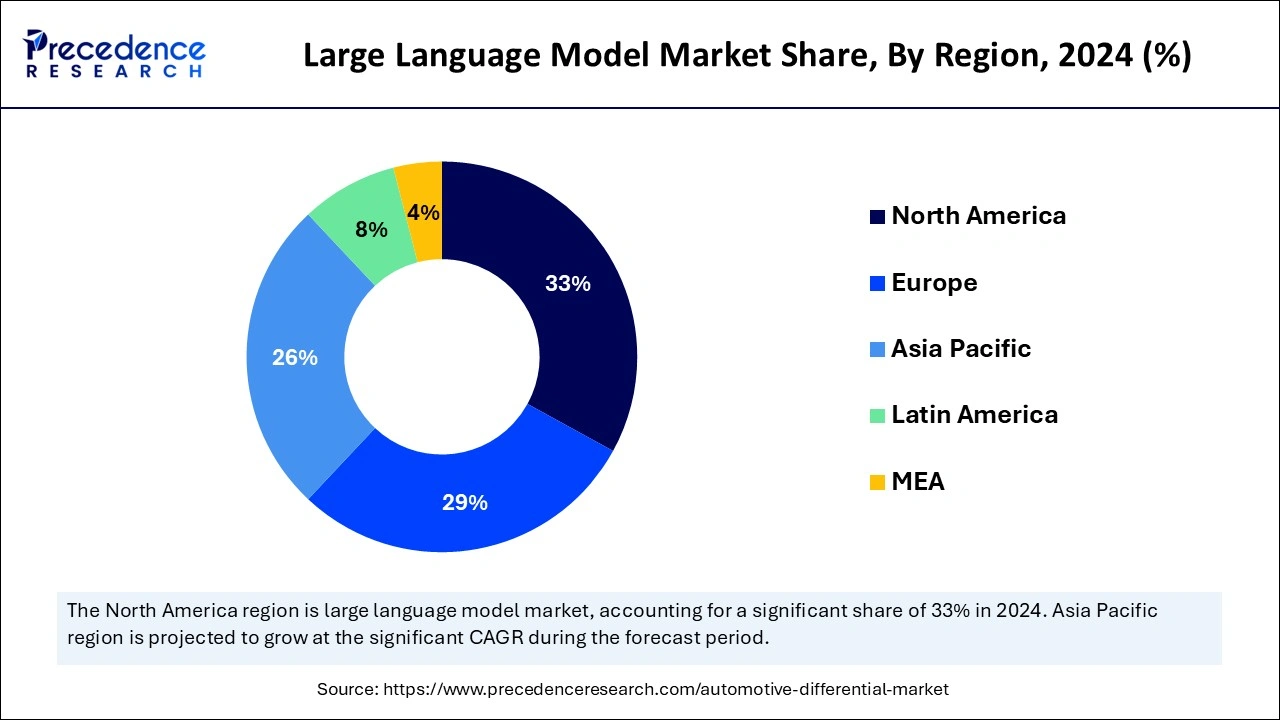

North America dominated the global large language model market in 2024 due to well-developed digital infrastructure and more attention to artificial intelligence investment. The region has key stakeholders, including Google, Microsoft, IBM, and other giants in technology that have been pioneers in AI technology rollouts into markets. The United States especially has supported the growth of AI through government and industry partnerships and good legislation on the use and application of AI.

Asia Pacific is projected to host the fastest-growing market in the coming years, owing to the implementation of AI technologies, digital transformation in various sectors, and a high level of government engagement in the development of technology. China is becoming a world leader in development in the field, with other countries such as Japan and South Korea following behind. Language model adoption in the region is driven by rapid urbanization coupled with high population literacy and high usage of smartphones and internet services.

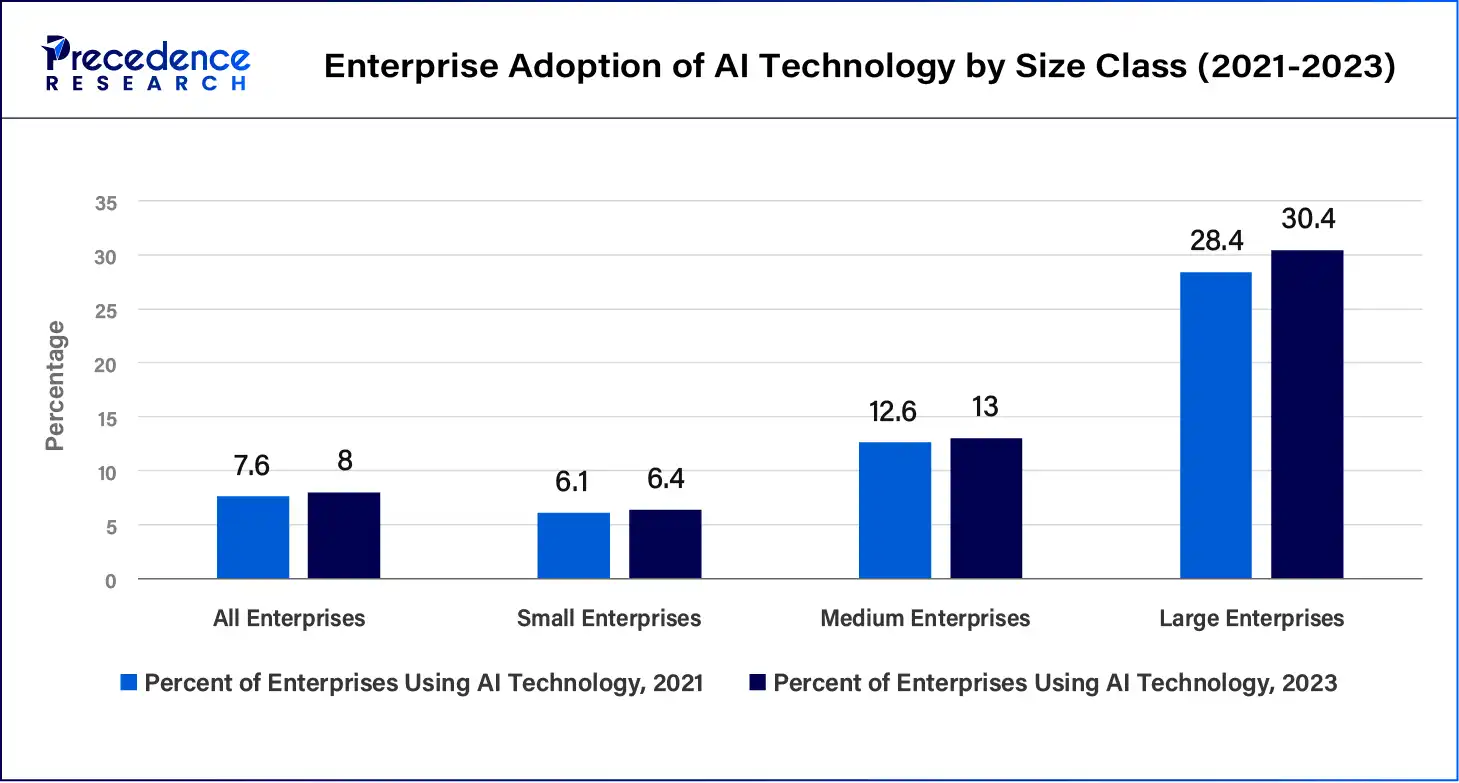

The growing trend of implementation of artificial intelligence to enhance various sectors is facilitating the large language model market. A technology that involves the use of artificial intelligence in analyzing and creating natural languages is altering industries to embrace better automation, boost customer relations, and make better decisions from the data collected. Approximately 13.8% of these businesses indicated active use of AI technology, driven by growing demand in sectors such as healthcare, finance, and e-commerce for applications like content creation, language translation, and sentiment analysis. These models assist organizations in sorting large volumes of complex, unstructured data and managing and enhancing their interactions with customers.

| Report Coverage | Details |

| Market Size by 2024 | USD 5.72 Billion |

| Market Size in 2025 | USD 7.77 Billion |

| Market Size in 2034 | USD 123.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 35.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Industrial Vertical, Application, Deployment, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising demand for AI-driven solutions

Increasing demand for AI-driven solutions is driving the growth of the large language model market. Businesses and industries increasingly rely on AI technologies to automate and enhance processes, such as customer support, content generation, and language translation. This trend reflects a global shift towards leveraging AI technologies to automate and enhance processes such as customer support, content generation, and language translation.

The increasing use of artificial intelligence-integrated chatbots, virtual assistants, and self-serve customer services also drives this need and fuels the market. These models have been adopted across industries, including health and finance, among others, as the basis of competitive advantage through decision-making based on huge records.

Regulatory challenges

Hampering regulatory challenges is a significant restraint for the large language model market, likely to slow its market growth. Governments all over the world are putting policies in place for autonomous control of AI technologies, such as data protection, algorithms), and accountability, among others. These regulations have probably been the source of confusion for various companies, preventing them from investing in artificial intelligence solutions. The regulations and national and international laws are different in companies; these regulations slow down the development and deployment of products.

Surging demand for technology in customer service

High demand for AI in customer service is expected to create immense opportunity in the large language model market, which is projected to boost the market. Businesses are increasingly adopting AI-driven solutions, including chatbots and virtual assistants, to enhance customer support operations. The use of chatbots and other virtual assistant tools is slowly being implemented in different industries and businesses, as they are AI-based and support customer service departments.

Well-training expands customer interactions through context-sensitive instant replies to hurdles the customers face, hence leading to high customer satisfaction from the models. These models are being adopted in a number of organizations, particularly those in the e-commerce, banking, and telecommunications industries, for managing customer inquiries and complaints cheaply and effectively.

In 2024, the healthcare segment held a notable share of the large language model market due to the quest for effective use of AI to help process and analyze substantial volumes of medical information. AI assimilates applications in healthcare facilities to enhance clinical choices, review administrative tasks, and help in patient care. AI-driven platforms such as Deciphex's Diagnexia and Patholytix are revolutionizing diagnostics by assisting pathologists, addressing the global shortage in the field, and boosting productivity by up to 40%, as revealed in a 2025 report by the Medical Laboratory Observer. Furthermore, industries were adopting AI, and government funding and attention to the development of health technology led to the healthcare industry’s continued advances in AI in the coming years.

The finance segment is projected to expand rapidly in the market in the coming years. Financial organizations turn to automation to improve efficiency within decision-making processes by incorporating AI into existing processes, including fraud prevention, credit risk assessments, customer relations, and rules and compliance. This adoption focuses on enhancing financial safety, mitigating potential risks, and anticipating market shifts effectively. Moreover, the financial industry is set to be the most active sector in the adoption of large language models due to the growing demand for more efficiency and security in the sector.

The chatbots and virtual assistant segment held the largest share of large language model market in 2024, owing to the integration of AI into the routine of modern companies and organizations. These models enable organizations to streamline customers’ communication through websites, social accounts, or other platforms, with constant service accessibility. It is evident that such tools are needed most in businesses such as retail, healthcare, and financial sectors due to the high emphasis placed on customer care and service. This trend stems from the growing demand among businesses for more effective methods to engage with customers and enhance user experiences through real-time, automated interactions.

The customer service segment is observed to grow at the fastest rate in the large language model market during the forecast period due to the increasing importance that firms have ascribed to the improvement of their customer support service outcomes. As per estimations, there will be surge in use of artificial intelligence (AI) in organizations’ service delivery efforts as companies seek to provide customized and efficient service to their clients. These are generative AI systems mostly based on large language models, receiving a high number of queries and providing customers with fast context-based responses that significantly decrease the need for human-based agents and, therefore, minimize operational costs.

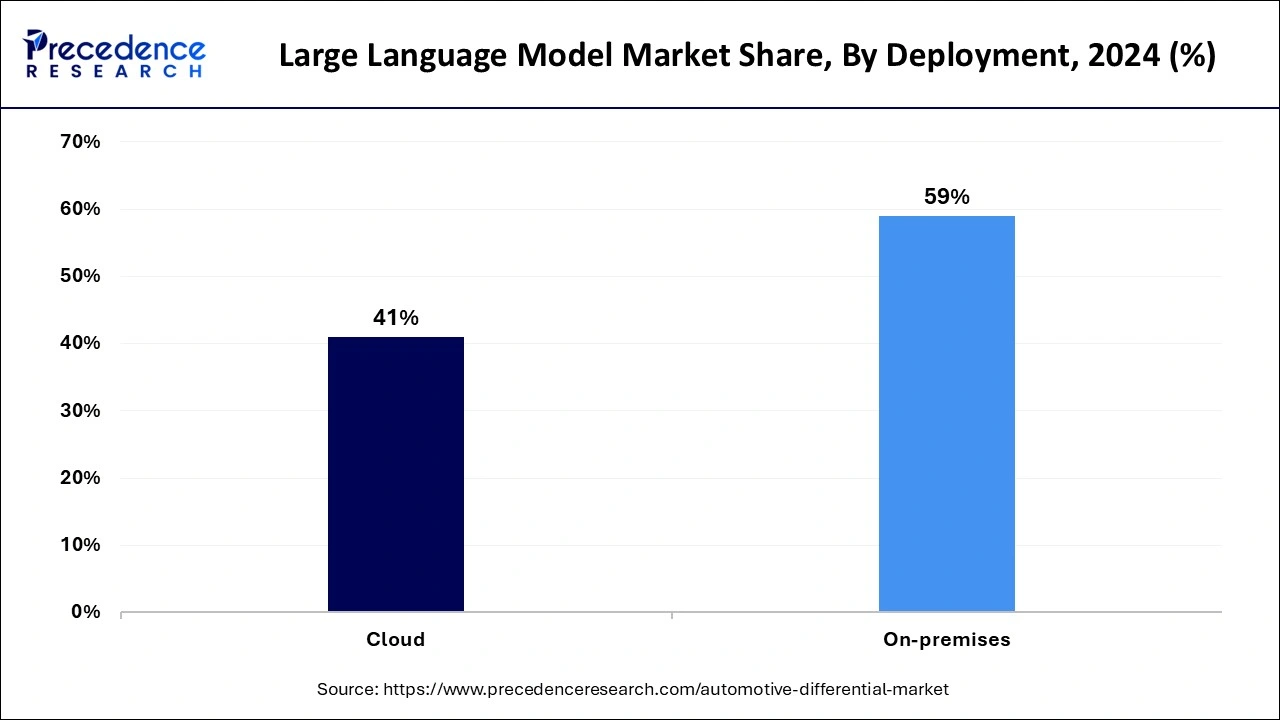

The on-premises segment held the largest share of the large language model market in 2024, owing to the focus on industries that are regulated in terms of privacy or those industries that need comprehensive control of their AI systems. On-premises deployment enables organizations to collect, store, and process highly sensitive data within the organizational premises and third-party facilities, in this case, excluding the ability of sensitive customer data to leave the organization or third-party facilities. This is even more evident in areas of specialization such as the healthcare industry, finance, and governance, which prioritize issues of security and compliance.

The cloud segment is observed to be the fastest growing in the predicted timeframe because the use of the cloud presents several benefits, such as flexibility, affordability, and expansibility, which make the cloud a viable solution for organizations intending to harness AI solutions. Cloud-based deploys enable business organizations to work with robust language models that require a lot of capital investment in hardware and ICT infrastructure. Furthermore, the nature of cloud services allows organizations to expand the scope of their activities faster growth. Furthermore, by using cloud infrastructure, large language models can be deployed in different parts of the world.

By Application

By Deployment

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

July 2024

July 2024