August 2024

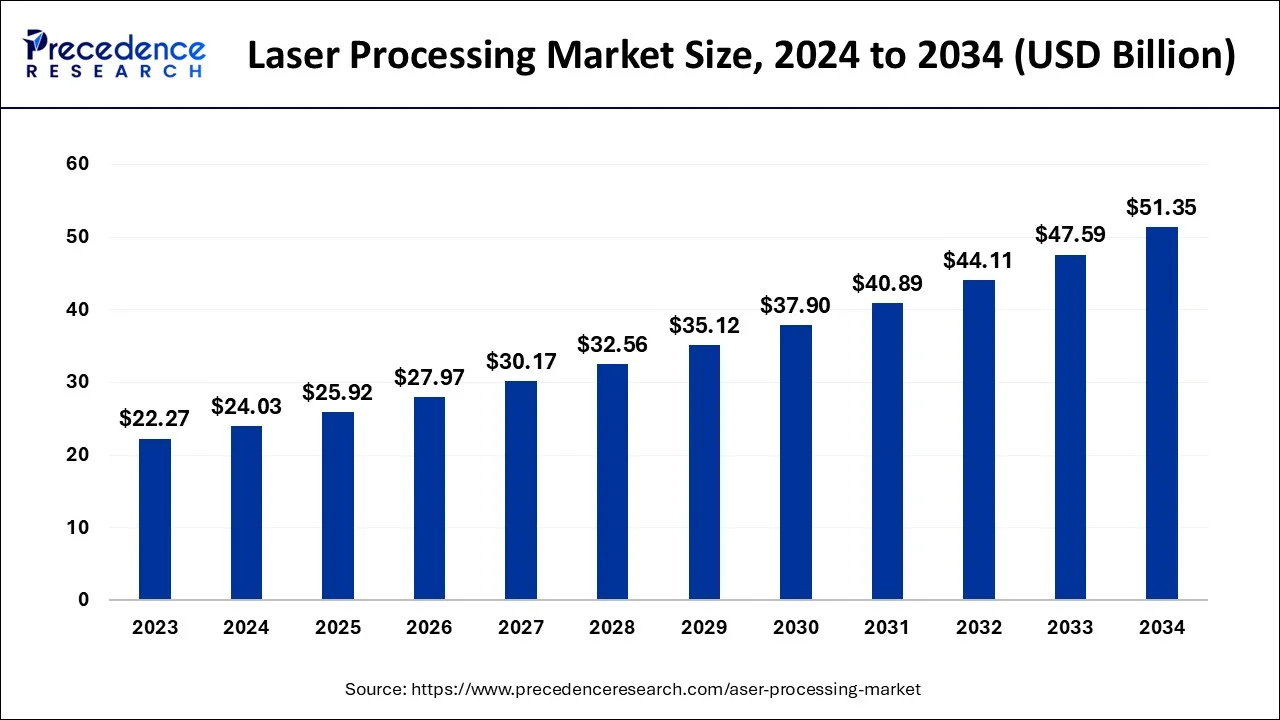

The global laser processing market size accounted for USD 24.03 billion in 2024, grew to USD 25.92 billion in 2025 and is predicted to surpass around USD 51.35 billion by 2034, representing a healthy CAGR of 7.89% between 2024 and 2034.

The global laser processing market size is exhibited at USD 24.03 billion in 2024 and is predicted to surpass around USD 51.35 billion by 2034, growing at a CAGR of 7.89% from 2024 to 2034.

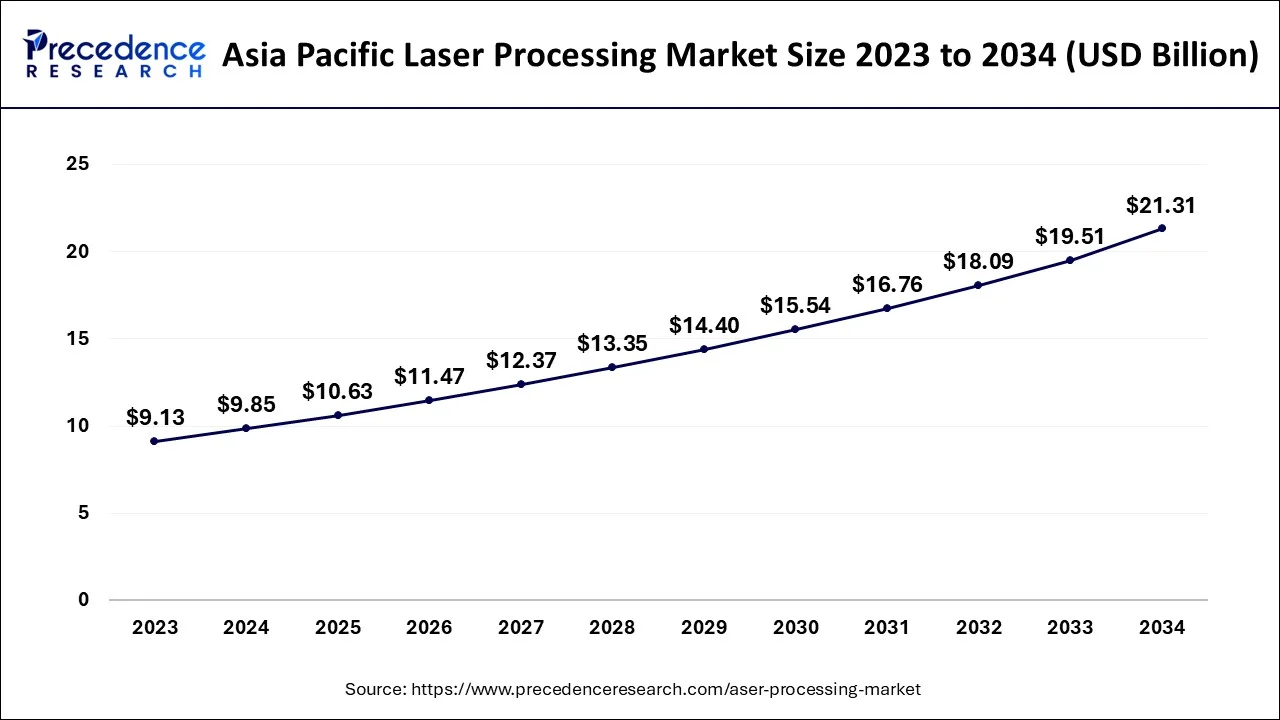

The Asia Pacific laser processing market size is estimated at USD 9.85 billion in 2024 and is expected to be worth around USD 21.31 billion by 2034, rising at a CAGR of 8.01% from 2024 to 2034.

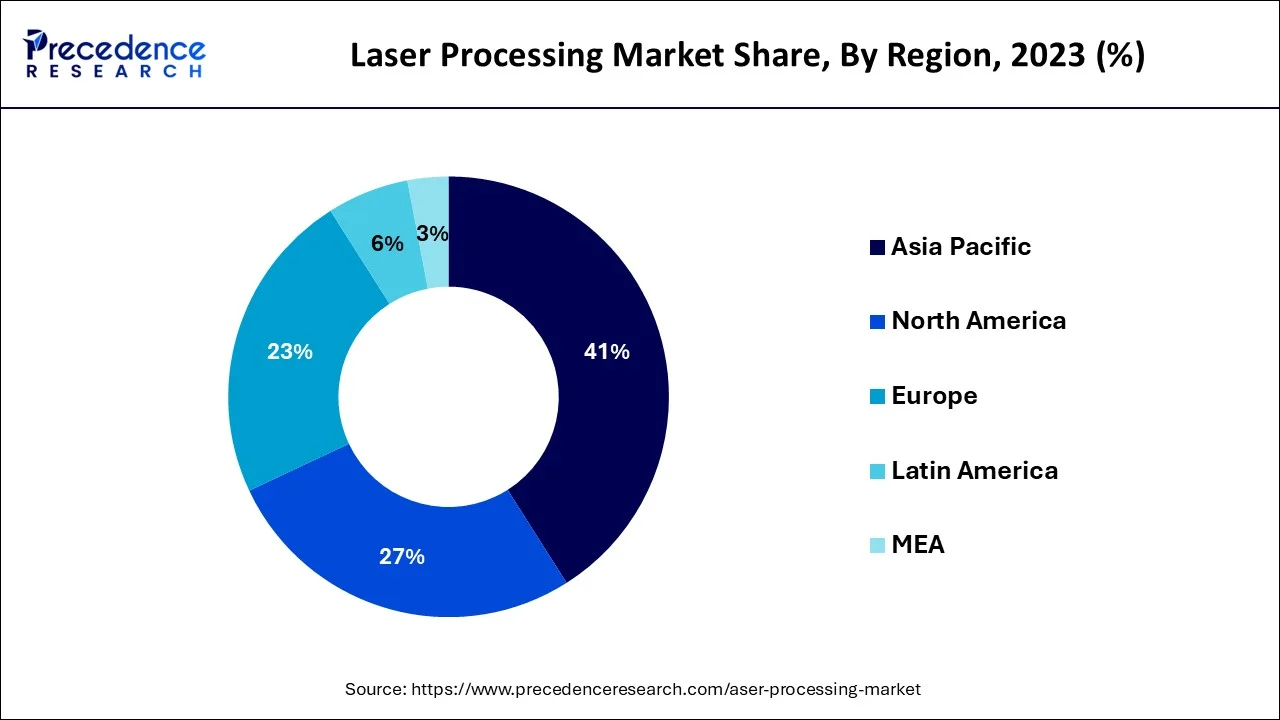

In 2023, Asia Pacific will lead the market with a revenue share of more than 41%. It is expected to grow significantly due to the rising number of OEMs. China will likely become a significant consumer of industrial lasers, materials processing, and micro-processing systems. Countries such as India, South Korea, Japan, and China are expected to grow rapidly due to factors such as increasing OEMs and automobile industry growth.

Furthermore, the region's increasing adoption of laser systems across different application areas is expected to drive market growth. Government regulations requiring permanent and clear markings on consumer goods are expected to increase the adoption of laser processing technology in several countries.

Europe is anticipated to grow over the fastest period. The market's growth can be attributed to the increasing use of lasers in medical equipment and activities. Moreover, the rapid advancement of nanofabrication technology is expected to aid market expansion. Since the system has several advantages over traditional material processing, the manufacturing industry has increased its acceptance of laser technology for material processing.

Government laws governing the use of laser techniques in product marking and engraving are expected to fuel market growth. The market is expected to grow rapidly in the coming years due to the technology used in various applications such as welding, marking, piercing, cutting, and engraving.

Laser systems use electromagnetic radiation to enable material processing activities such as welding, cutting, lithography, and engraving. The increased use of lasers in medical devices and surgery applications is attributed to market growth. Additionally, the rapid advancement of nanofabrication technology is expected to expand the global market.

Furthermore, due to numerous advantages over traditional material processing, the manufacturing sector has increased its adoption of laser technology for material processing, which is anticipated to be one of the key factors propelling the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.03 Billion |

| Market Size by 2034 | USD 51.35 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.89% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Process and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapidly increasing application of laser processing in the automotive sector

The growing use of laser processing in the automotive industry is propelling the market due to the growing demand for high-power carbon dioxide lasers for manipulating automotive components. Moreover, the rising proclivity of automobile manufacturers to implement laser-wielding sheet assemblies as a replacement for resistance spot welding is expected to be a significant driving factor in the market.

Lasers will be used at every stage of the car manufacturing process in 2022, from design and development to final assembly. For instance, Volkswagen AG employs more than 800 high-power lasers in its global assembly plants.

Pros of laser processing over traditional material processing

The benefits of laser material processing over traditional methods are anticipated to increase laser adoption for material processing during the forecast period. Laser cutting is becoming more popular as the demand for microelectronics miniaturization grows. Compared to traditional cutting methods, laser processing has an extremely high level of precision.

This is because the laser beam does not wear out during the cutting process, resulting in a consistent, distortion-free cut. It is quick and produces items without the need for retooling. Furthermore, the laser weld has increased weld strength because it is thin and has an excellent depth-to-width ratio.

Complex as well as an expensive process

The installation of laser technology for the required application is difficult and costly. The enormous resources required to process a wide range of applications are impacting the overall growth of the laser processing market. According to a survey, the maintenance costs for conventional plasma cutting are around USD 5000 per year.

In contrast, the maintenance costs for laser processing and cutting machines are around USD 10000 per year. Although the prices of products processed with laser technology are declining, the technology remains expensive.

Rising use in the medical as well as the additive manufacturing sector

Nd: YAG lasers and carbon dioxide are the most often used technology in the medical sector. Lasers are used frequently to treat skin, eyes, and hair cancer. Laser technology has made many therapies possible, including artery cleansing, surgery for a detached retina, and other aesthetic procedures. Furthermore, the technology can remove permanent birthmarks on the skin, skin imperfections, and other skin treatments. Lasers are used in hospitals & dispensaries for processing medical items such as implants & surgical instruments.

Covid-19 Impact:

The widespread adoption of COVID-19 had an adverse impact on the overall growth of the laser processing industry. COVID-19 impacted production rates in several industrial verticals, owing to a reduction in human resources; stringent regulations for temporary lockdowns imposed across several countries eventually resulted in various industries' closure.

As a result, the demand for laser processing decreased significantly, along with the need for various industrial products. Medical emergencies were prioritized during the pandemic, and thus only related industries were operational. Supply chain and raw materials for manufacturing automotive parts, industrial products, metals, steel, and copper were adversely impacted. According to a recent National Association of Manufacturers survey, the pandemic caused over 80% of metal manufacturers financial distress causing an adverse impact on the industry's growth.

Based on the product, the laser processing market is segmented into gas, solid, and fiber. In 2023, the gas segment dominated the market. Copper, nitrogen, carbon dioxide, carbon monoxide, argon-ion, and helium-neon lasers are all part of the gas segment.

The benefits of the gas segment include strong coherence, a stable central wavelength, high spectral purity, and good beam and alignment quality, among others. Furthermore, gas lasers are inexpensive and widely available. Helium-neon (HeNe) lasers are anticipated to gain popularity over the forecast period due to their dependability and high range of applications.

Over the forecast period, the solid laser industry is expected to grow rapidly. This laser minimizes material waste in the active medium while producing high-quality continuous and pulse output. Endoscopy in medicine, drilling holes in metals, and military targeting are some of the applications for solid lasers. The rising demand for these lasers in various industries, including automotive, aerospace, machine tools, medical, and packaging, is anticipated to propel global market growth over the forecast period.

Based on the process, the laser processing market is segmented into material processing, marking & engraving, and micro-processing. In 2023, the material processing segment dominated the industry.

Material processing includes hybrid processes, laser beam welding development and implementation, micro-drilling, surface modifications, cutting, and machining. It is also used in direct manufacturing in the formation of micro deposition and removal of bulk material & coating, which is anticipated to propel the market growth.

On the other hand, the microprocessor segment is the fastest-growing segment during the forecast period. A microprocessor is an electronic component integrated into a single integrated circuit (IC) and contains millions of small parts that work together, such as diodes, transistors, and resistors. This chip performs various functions, including timing, data storage, and interaction with peripheral devices.

These integrated circuits are found in multiple electronic devices, including servers, tablets, smartphones, and embedded devices. Demand for smartphones and tablets is anticipated to propel market growth over the forecast period.

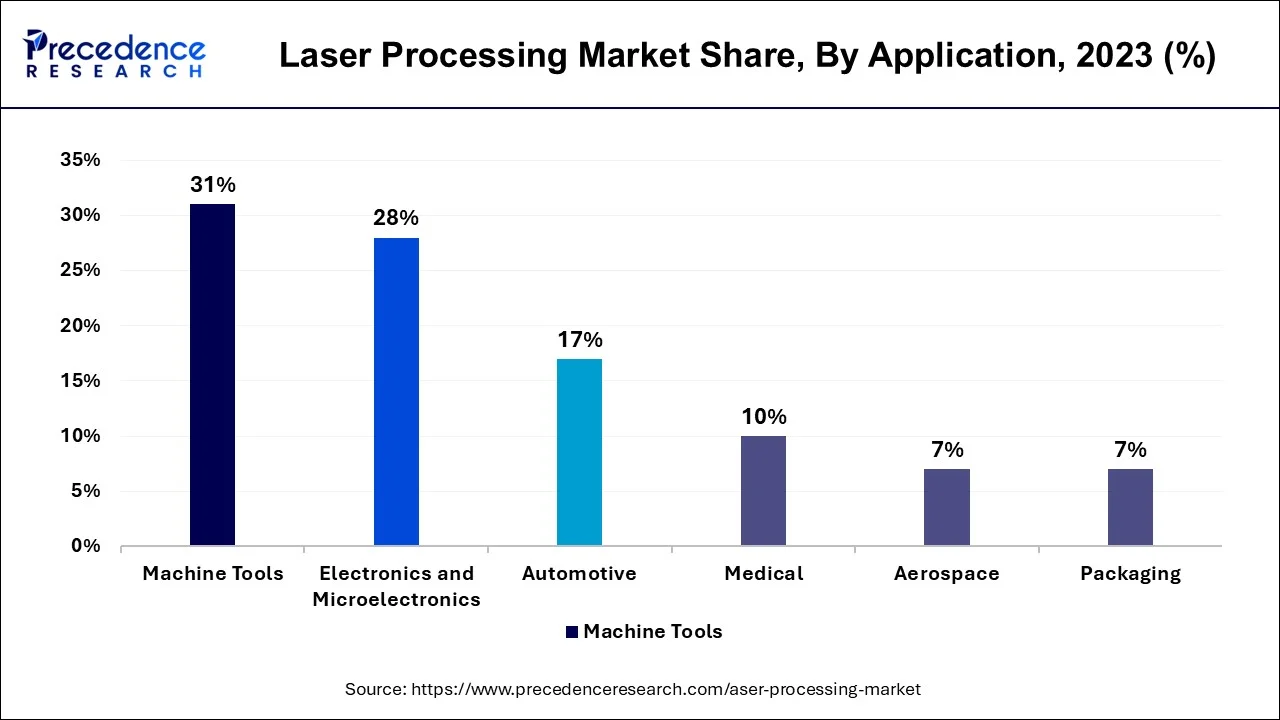

Based on the application, the laser processing market is segmented into automotive, aerospace, machine tools, electronics and microelectronics, medical, and packaging. In 2023, the machine tools segment led the industry with a revenue share of more than 31%.

The growing use of lasers in the industrial sector for various material processing applications such as cutting, welding, drilling, and engraving is expected to fuel the machine tools application segment. Machine tools are also likely to become more popular as the demand for passenger and electric vehicles grows. Industry 4.0 can improve machine tools used in manufacturing operations by reducing idle time.

The electronic & microelectronics segment will be the fastest-growing segment from 2023 to 2032. The growing demand is due to the extensive use of welding in the manufacture of medical devices. Pacemakers, implantable devices, and surgical tools are vital medical applications requiring ultra-fine wires and non-porous and sterile surfaces used in cardiac procedures. This led to an increasing requirement for microelectronics.

By Product

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

October 2024

January 2025