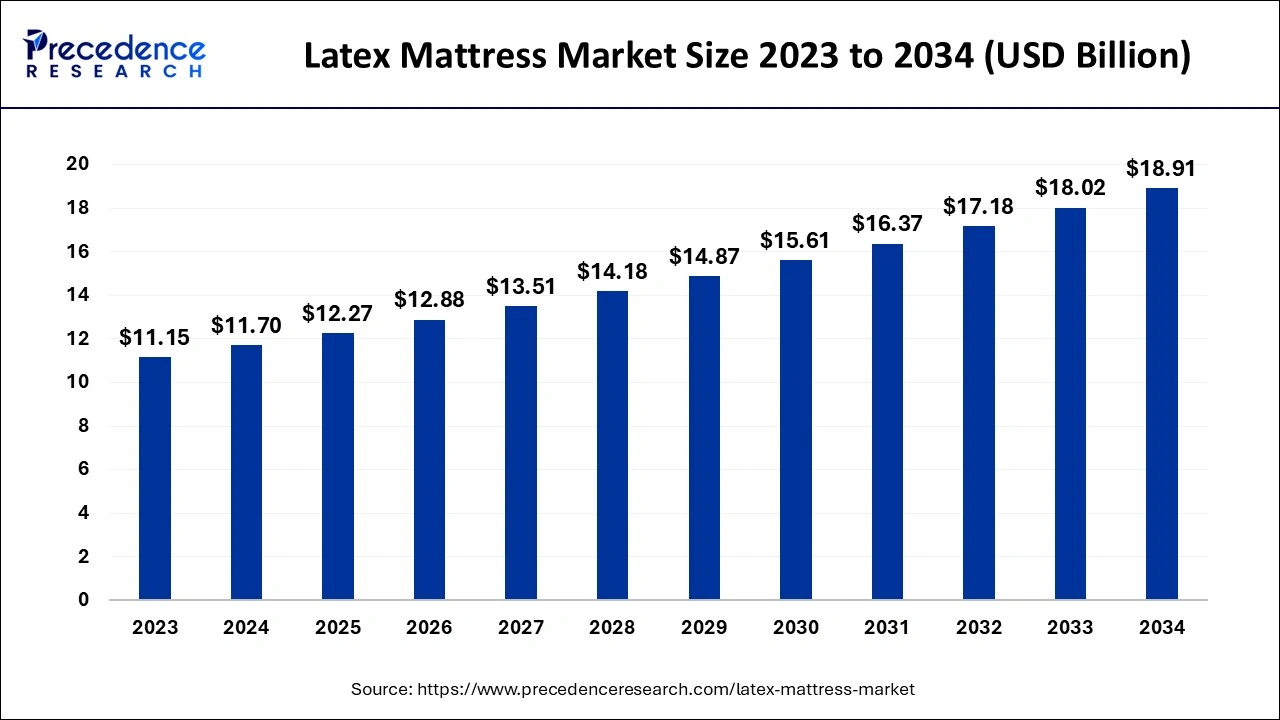

The global latex mattress market size accounted for USD 11.70 billion in 2024, grew to USD 12.27 billion in 2025 and is projected to surpass around USD 18.91 billion by 2034, representing a healthy CAGR of 4.92% between 2024 and 2034. The North America latex mattress market size is calculated at 4.80 billion in 2024 and is expected to grow at a fastest CAGR of 5.04% during the forecast year.

The global latex mattress market size is calculated at USD 11.70 billion in 2024 and is anticipated to reach around USD 18.91 billion by 2034, expanding at a CAGR of 4.92% between 2024 and 2034. The latex mattress market is expanding because consumers are increasingly aware of its health advantages, sustainability, durability, and comfort.

The U.S. latex mattress market size is estimated at USD 3.60 billion in 2024 and is expected to be worth around USD 5.92 billion by 2034, growing at a CAGR of 5.08% from 2024 to 2034.

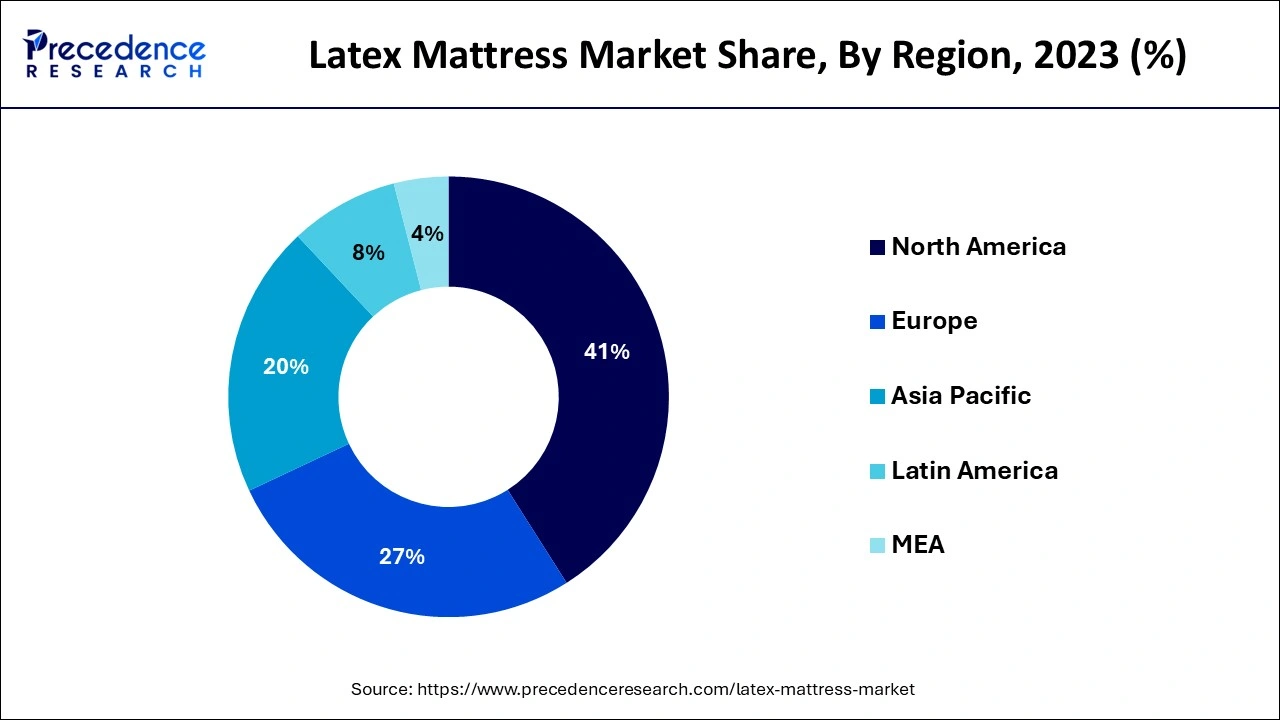

North America led the global latex mattress market in 2023. A robust growth response from customers for organic and sustainable bedding solutions. The trend of using natural materials picked up momentum with the increasing awareness of health and well-being. Major stakeholders stepped up their efforts by balancing new ads and novel ideas to suit changing market needs. In addition, the growth of e-commerce channels has enhanced the saturation of using latex mattresses.

Asia Pacific is expected to host the fastest-growing latex mattress market throughout the forecast period. This growth is due to the enhancement of investments in the hospitality industry. Furthermore, rising commercial and residential construction activities are likely to create a demand for the use of products in the future. China, Japan, South Korea, India, and Australia are the countries in the lead regarding commercial and residential real estate construction, which has significantly increased the number of residential units in these countries. Other factors that increased expenditure for making sleeping and bedding furniture more comfortable and smart include an increase in income and high levels of urbanization.

A latex foam mattress is created using latex foam, which may come from natural, synthetic, or a mix of both sources. Latex is a high-quality, firm mattress material. Latex provides better comfort and durability than memory foam and other types of mattress foam. A firm and durable sleeping surface is produced by a latex mattress, which combines latex foam with either springs or reflex foam. Latex is considered a natural material as it is derived from the sap of a rubber tree and resembles an ideal natural mattress. Because of the demand for mattresses with -relieving properties, they are driving the latex mattress market in both commercial and residential sectors.

| Market Scope | Details |

| Market Size by 2034 | USD 18.91 Billion |

| Market Size in 2024 | USD 11.70 Billion |

| Market Size in 2025 | USD 12.27 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Health benefits of latex mattresses

Latex mattresses are recognized for their capacity to enhance spinal alignment and sleep quality, resulting in a range of health advantages. They conform to the body naturally, evenly distributing weight to alleviate pain. They provide a durable and eco-friendly option for restful sleep while also reducing motion transfer and providing targeted support.

Latex mattresses are effective in reducing motion transfer, conforming to the body to offer targeted support. Being a natural, durable, and flexible material, latex contours the body, which can alleviate pain in the back, neck, and joints while also improving circulation. Additionally, there is a rise in back pain, joint pain, and other musculoskeletal disorders linked to sedentary and hectic lifestyles.

Existence of auxiliary products

Consumers select memory foam products for mattresses instead of latex mattresses because they are more affordable and provide similar levels of comfort. Industry players face a tough challenge in retaining the latex mattress market share due to the availability of alternative products that attract consumers with their quality and affordability. As a result, more and more consumers are opting for memory foam mattresses instead of latex mattresses.

Awareness of environmentally friendly options

People are becoming increasingly aware of the advantages of non-toxic products. The rubber plants that make latex turn about 90 million tons of carbon dioxide into oxygen. This ensures that the latex mattress market products is among the most eco-friendly mattresses. As customers become more conscious of environmentally friendly products, the market for eco-friendly mattresses is being driven by people choosing to purchase them.

Natural latex includes pure rubber, offering incredible comfort and a bacteria-resistant mattress. They are also a more eco-friendly choice than other types of mattresses since they can decompose and contain fewer chemicals. Consumers’ growing awareness of environmentally friendly products due to the rising popularity of eco-friendly mattresses.

The blended mix segment contributed the largest share of the latex mattress market in 2023. Blended mix mattresses are made of natural latex and other things like memory foam and synthetic latex. The blended latex is natural latex blended with synthetic latex, whereby an amount of the purest latex is used. This blend could be dependent on the manufacturer’s preference, yet the addition of the highest purity natural latex makes this fabric more uniform in nature.

The natural latex segment is expected to show considerable growth in the latex mattress market over the forecast period. Natural latex is taken from rubber trees, and they are hypoallergenic and do not support the formation of dust mites, which are ideal for people with asthma or other allergies. It offers good support and ensures correct spinal positioning, thus lessening back pain. The trend towards the utilization of natural materials in latex mattresses, notably pure rubber without any other polymeric material, is boosting its demand as it supports rubber tree cultivation and the healthy growth of rubber trees.

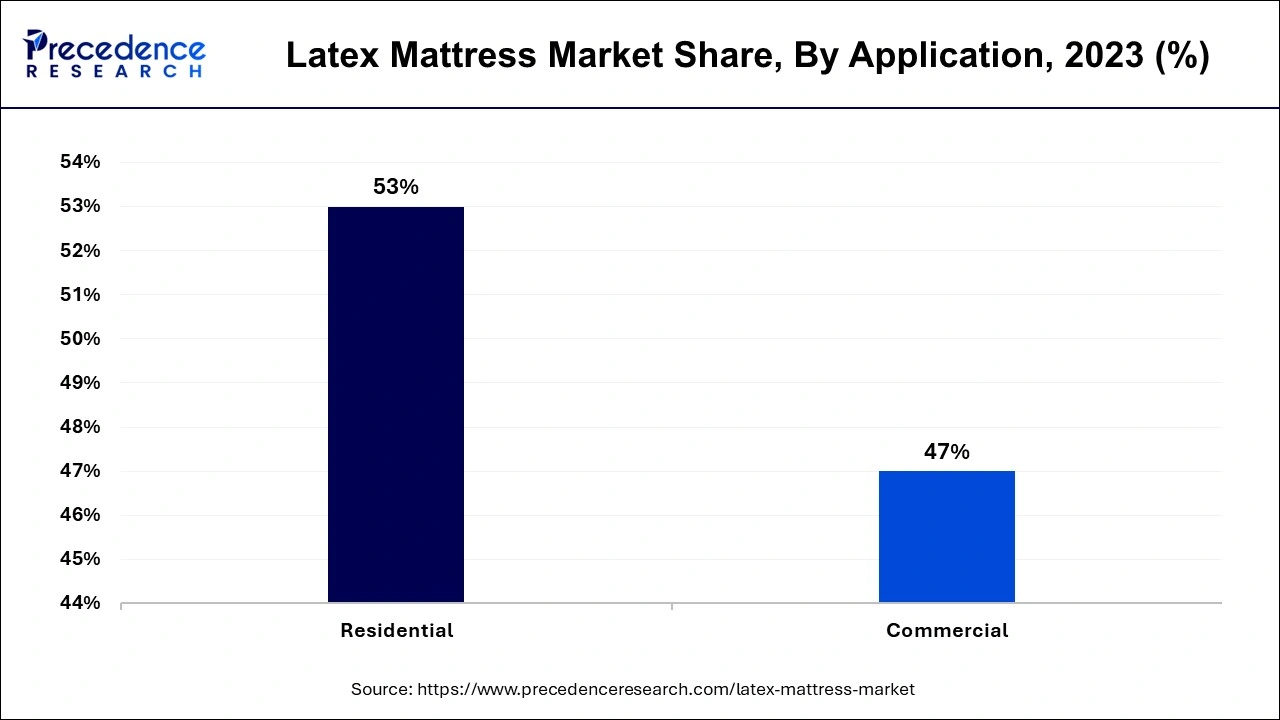

The residential segment accounted for the largest share of the latex mattress market in 2023. The application of latex mattresses for households is centered on comfort. They are of different sizes and have different degrees of hardness, depending on the user in a specific household. This has been attributed to the increased population, and therefore, more homes are needed to afford latex mattresses and other home bedding accessories. Thus, latex mattresses can be used in residential homes because they are long-lasting products that are very comfortable to use and do not cause allergic reactions.

The commercial segment is anticipated to witness significant growth in the latex mattress market over the studied period. Healthcare, hotels, resorts, and other sectors related to the hospitality industry use commercial latex mattresses. The mattresses should have a general design for the various requirements of the users, and these mattresses are designed for durability, washability, and sanitization. Commercial development has enhanced the growth of these mattresses. The expansion of the hospitality industry has led to more hotel establishments across the world and has created a high demand for high-quality latex mattresses.

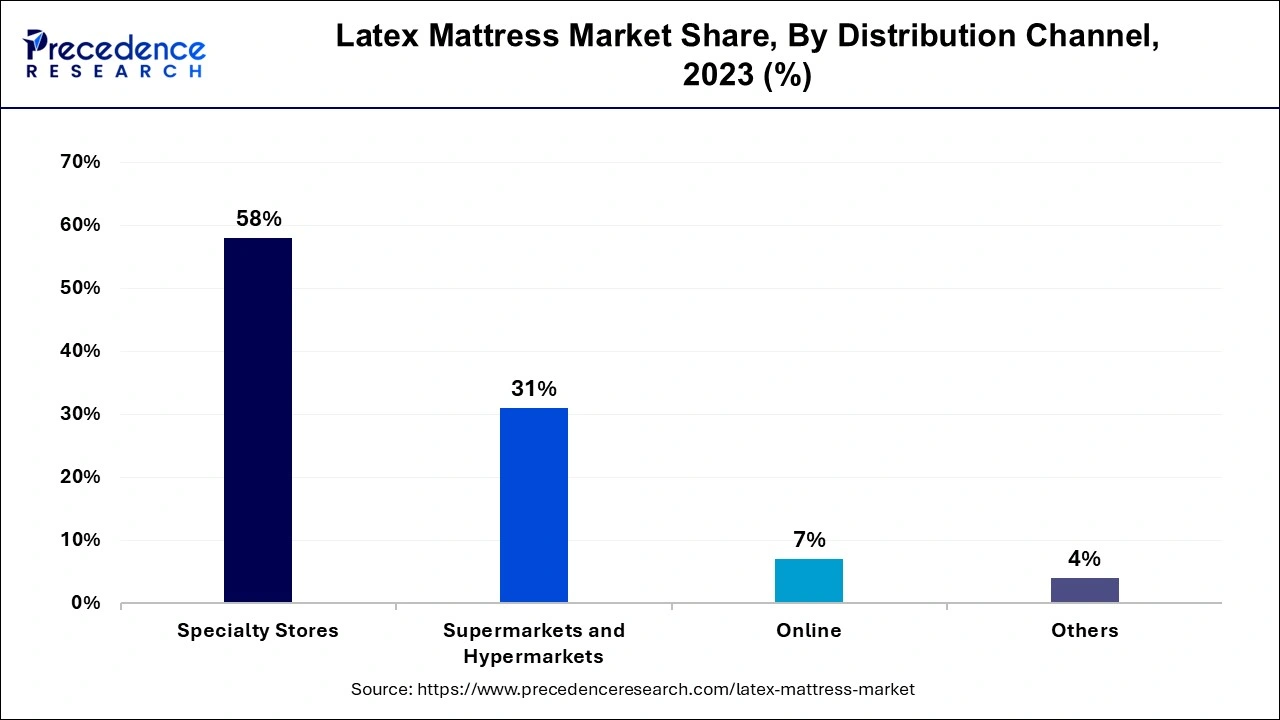

The specialty stores segment has contributed the largest latex mattress market share in 2023. They offer an inclusive range of latex mattresses of different brands and possibly sell with the purchasing experience. The strength of the specialty stores is that they can provide good customer service with professional knowledge to the purchaser which plays a great role in customer’s decision making.

The online segment is expected to show considerable growth in the latex mattress market over the forecast period. Internet hosting firms tend to have a relatively small operating cost compared to traditional retail stores, hence they can be able to sell their products at cheaper prices. Social media has individual customer feedback that includes ratings and recommendations that may help a potential buyer make the right purchase.

Segments Covered in the Report

By Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client