September 2024

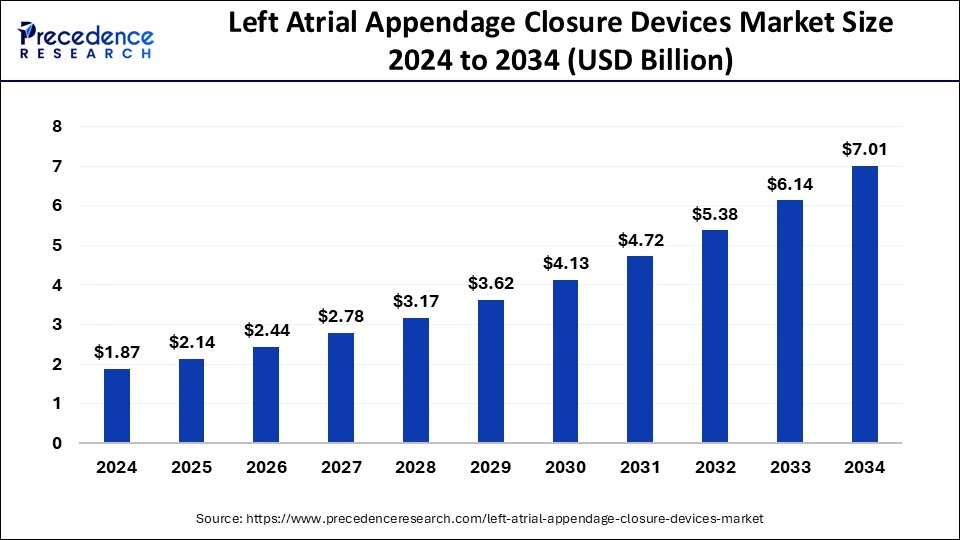

The global left atrial appendage closure devices market size was USD 1.64 billion in 2023, calculated at USD 1.87 billion in 2024 and is expected to be worth around USD 7.01 billion by 2034. The market is slated to expand at 14.12% CAGR from 2024 to 2034.

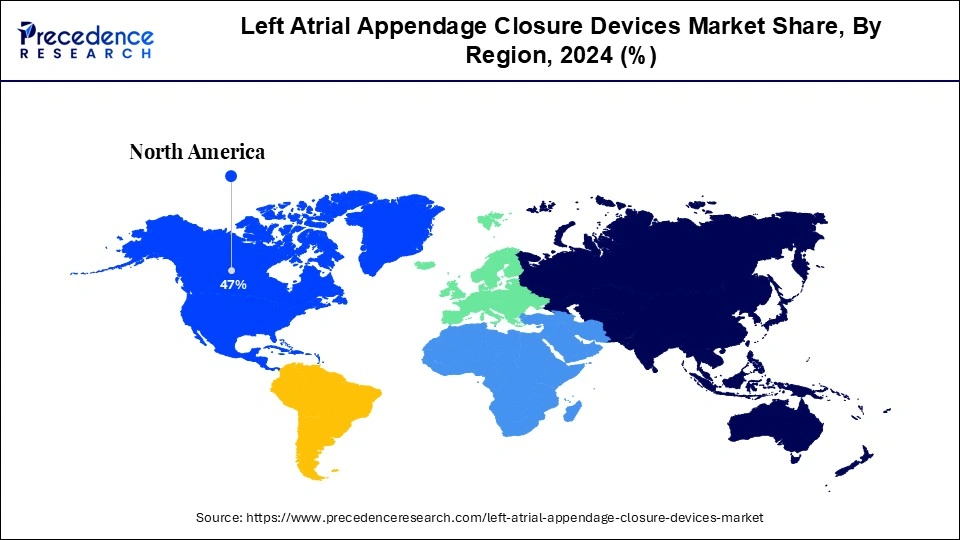

The global left atrial appendage closure devices market size is projected to be worth around USD 7.01 billion by 2034 from USD 1.87 billion in 2024, at a CAGR of 14.12% from 2024 to 2034. The North America left atrial appendage closure devices market size reached USD 720 million in 2023. The rising prevalence of atrial fibrillation and rising government initiatives contribute to the growth of the market. The growing technological advancement is also promoting the growth of the market.

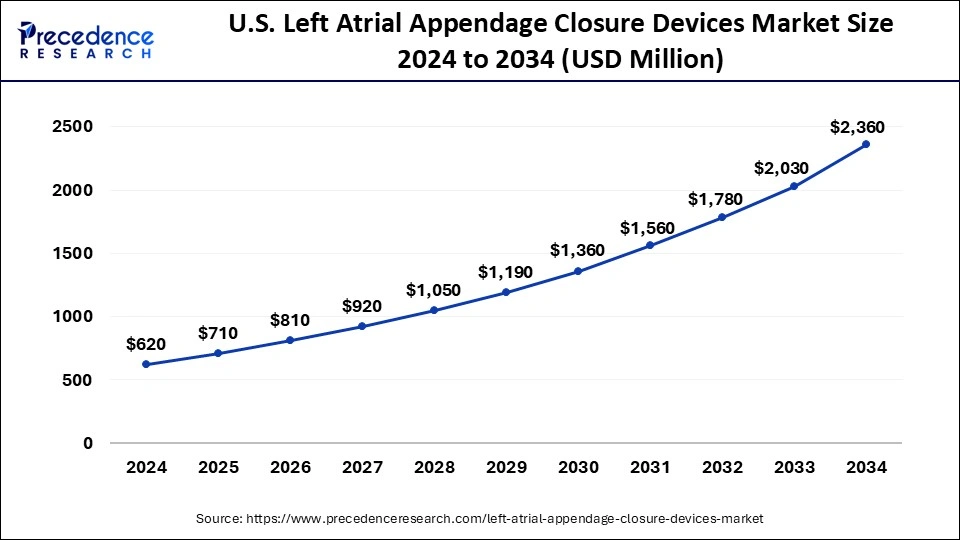

U.S. Left Atrial Appendage Closure Devices Market Size and Growth 2024 to 2034

The U.S. left atrial appendage closure devices market size was exhibited at USD 540 million in 2023 and is projected to be worth around USD 2.36 million by 2034, poised to grow at a CAGR of 14.34% from 2024 to 2034.

North America dominated the left atrial appendage closure devices market in 2023. Rising atrial fibrillation incidences and increasing senior population contribute to the growth of the market in the North American region. Left atrial appendage management is critical because atrial fibrillation increases the risk of heart attack; the availability of leading medical device manufacturers and robust focus on R&D contribute to the growth of the market in the North American region. A high rate of advanced medical procedures, a broad network of specialized cardiac centers, and the strong healthcare system of the United States help the market’s growth.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. The increasing healthcare systems, increasing healthcare expenditure, and rising awareness about the importance of left atrial appendage closure devices. The company initiatives support the growth of the left atrial appendage closure devices market in the Asia Pacific region. Collaborative acquisition, agreements, geographical expansions, and investment in products by key players help the market’s growth.

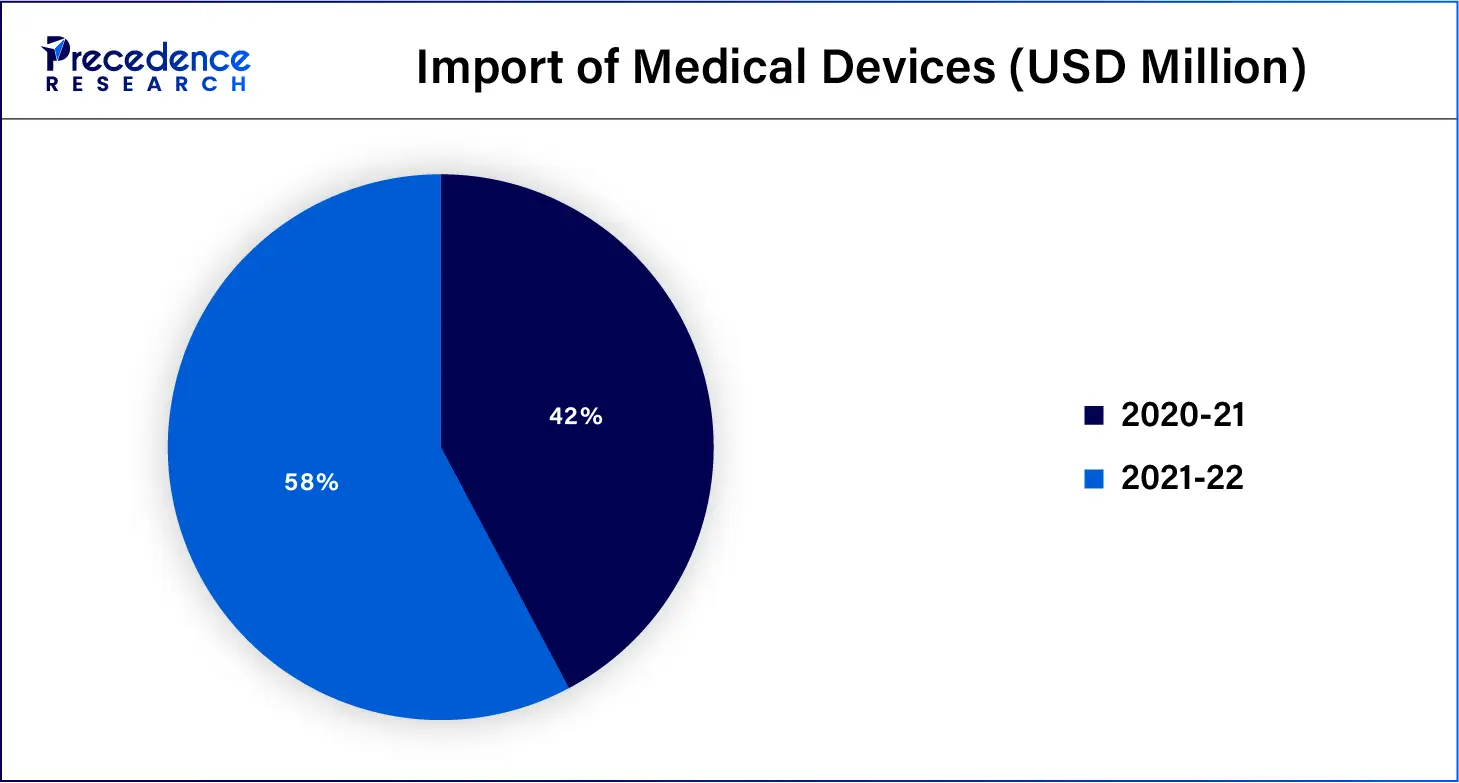

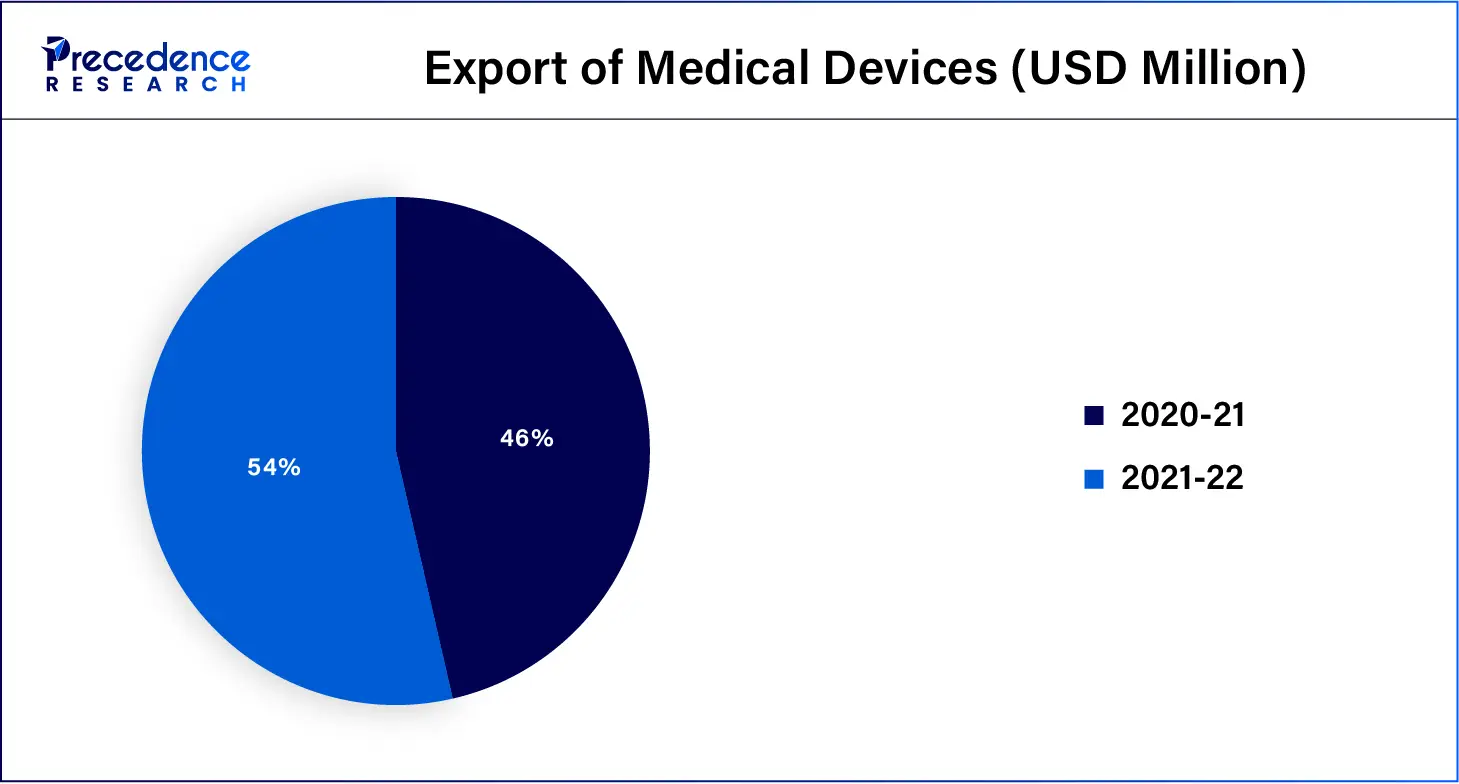

According to data from the Government of India Ministry of Chemicals & Fertilizers Department of Pharmaceuticals, Indian medical device market export and import data for the past two financial years:

Import of medical devices in the past two financial years:

Export of medical devices in the past two financial years:

The left atrial appendage closure devices market refers to buyers and sellers of left atrial appendage closure (LAAC) devices, which are medical devices designed to prevent blood clots from forming the LAA (Left atrial appendage) of the heart that may cause stroke in patients with atrial fibrillation. LAA Closure procedure that closes or blocks the opening of left atrial appendages to keep blood clots from going into or leaving their bloodstreams. The benefits of left atrial appendage closure devices include helping to reduce the risk of stroke, stopping blood thinners use, etc.

What are the benefits of AI in the Left Atrial Appendage Closure Devices?

The use of AI in left atrial appendage closure devices offers significant benefits, mainly in reducing stroke risks and treating atrial fibrillation. The benefits of AI in left atrial appendage closure devices also include improving pre-procedural imaging and planning by providing more precise and detailed images of heart anatomy. AI algorithms can analyze patient data to predict the best treatment options and contribute to the growth of the left atrial appendage closure devices market. AI can help in personalized treatment, improved safety and efficacy, the time required for the procedure can be reduced, and post-procedural monitoring ensures that any signs of complications are detected early.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.01 Billion |

| Market Size in 2023 | USD 1.64 Billion |

| Market Size in 2024 | USD 1.87 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Procedure, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing prevalence of atrial fibrillation

The growing prevalence of atrial fibrillation causes include hereditary, obesity, alcohol consumption, heart diseases, uncontrolled high blood pressure, older age higher risk, obesity, viral infections, lung and kidney diseases, sleep disorders, stress, previous heart surgeries, abnormal heart valves, viral infections, high blood pressure, heart attacks, etc. needs the left atrial appendage closure devices which driving the growth of the left atrial appendage closure devices market.

High cost and availability of alternative technologies

The high cost and availability of alternative technologies for LAAC devices can hamper the growth of the left atrial appendage closure devices market. The left atrial appendage closure device risks also include infection, abnormal heart rhythm, cardiac arrest, chest pain, bleeding, a reaction to anesthesia, a problem with the device itself, risk of stroke, risk of peripheral vascular damage, risk of tamponade that requires urgent drainage or blood transfusion, blood clots forming on the device, damage to structures in the heart, incomplete closure of the left atrial appendage, etc.

Research and development

The research and development in left atrial appendage closure devices, there is an opportunity for the left atrial appendage closure devices market. Advances in data analysis and technology for more effective research, increasing demand for research in emerging fields, and collaborative cross-disciplinary approaches and research initiatives contribute to the growth of the market in the future.

The endocardial LAA devices segment dominated the left atrial appendage closure devices market in 2023. Endocardial LAA devices are easier to use and are also known as watchman devices. The presence of a broad range of products and a strong product line contribute to the market’s growth. It helps to reduce the thromboembolic stroke in atrial fibrillation. The benefits of freedom from lifestyle risks because of blood thinner risks and the worry that comes along with them eliminate stroke risks without long-life blood thinner medications, prevent blood clots, etc. The endocardial LAA devices are permanent implants, one-time, minimally invasive, and safe.

In September 2023, the United States Food and Drug Administration approved the new generation WATCHMAN FLX Pro LAAC (Left Atrial Appendage Closure) Device, which was announced by Boston Scientific Corporation. The new WATCHMAN Technology is used to reduce stroke risk in patients with NVAF ( Non-vascular atrial fibrillation) who need an alternative to oral anticoagulation therapy.

The epicardial LAA devices segment is expected to grow significantly during the forecast period. The epicardial LAA devices are also known as lariat devices. The benefits of epicardial LAA devices are decreased medical visits and blood tests after the procedure, minimum discomfort from the procedure, shorter recovery time, lowered risk of stroke, etc., contributing to the growth of the left atrial appendage closure devices market. There is no need for short-term anticoagulation therapy.

The percutaneous segment dominated the left atrial appendage closure devices market in 2023. The percutaneous left atrial appendage closure is a transcatheter procedure where a device is implanted into a left atrial appendage to exclude it from systemic circulation. The benefits of percutaneous left atrial appendage closure devices include lower risks of stroke by preventing the forming of blood clots and leaving the left atrium of the heart. In this procedure, it doesn't treat atrial fibrillation itself. Thereafter, we may still need to use treatments and take other medicines to keep the heart in a normal rhythm.

The surgical segment is estimated to be the fastest-growing during the forecast period. The benefits of surgical left atrial appendage closure procedures include minimally invasive procedures for LAA closure, the ability to stop taking blood thinners, reduced risk of stroke, etc., contributing to the growth of the left atrial appendage closure devices market.

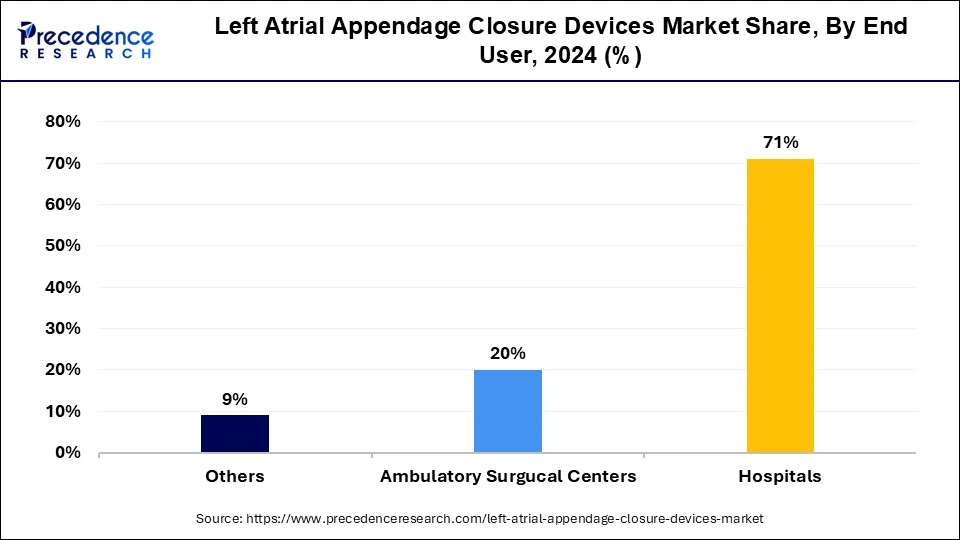

The hospitals segment dominated the left atrial appendage closure devices market in 2023. Left atrial appendage closure devices play an important role in hospitals for the treatment of risks of stroke in patients. It does not require blood tests or restrictions on drinking or food and reduces the risk of excessive bleeding that exists with the use of thinners. The benefits of left atrial appendage closure device use in hospitals include prescription drugs, mental health services, maternity and newborn care, emergency services, access to the latest treatments, research and innovation, technological advancements, patient-centric approach, nursing excellence, and medical expertise.

The ambulatory surgical centers segment is anticipated to be the fastest-growing during the forecast period. The left atrial appendage closure devices play a significant role in ambulatory surgical centers, which contribute to the growth of the left atrial appendage closure devices market. These ambulatory surgical centers offer patients many benefits over traditional hospital-based surgical procedures, including lower chances of infectious disease exposure, lower costs, and shorter wait times.

Segments Covered in the Report

By Product

By Procedure

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

March 2025

September 2024