June 2024

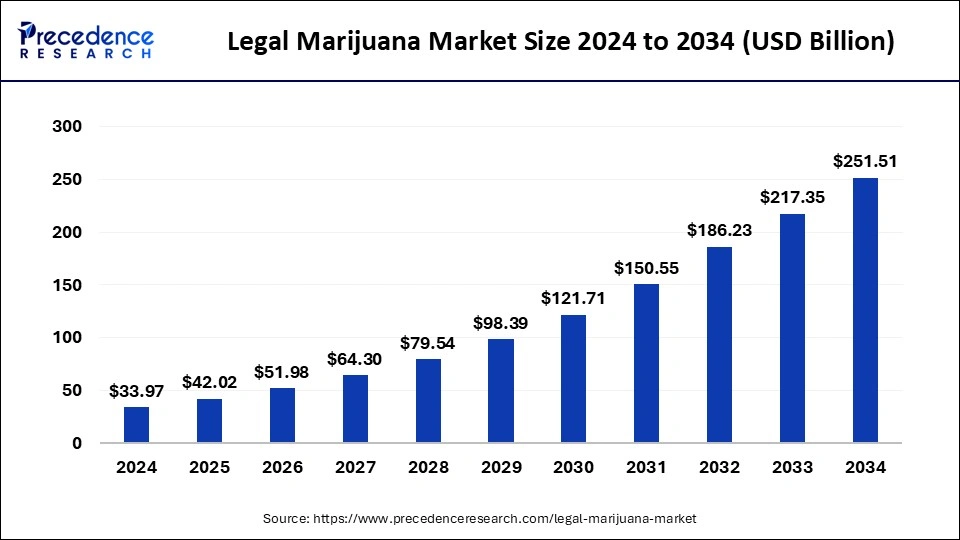

The global legal marijuana market size is calculated at USD 42.02 billion in 2025 and is forecasted to reach around USD 251.51 billion by 2034, accelerating at a CAGR of 22.16% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global legal marijuana market size was estimated at USD 33.97 billion in 2024 and is predicted to increase from USD 42.02 billion in 2025 to approximately USD 251.51 billion by 2034, expanding at a CAGR of 22.16% from 2025 to 2034.

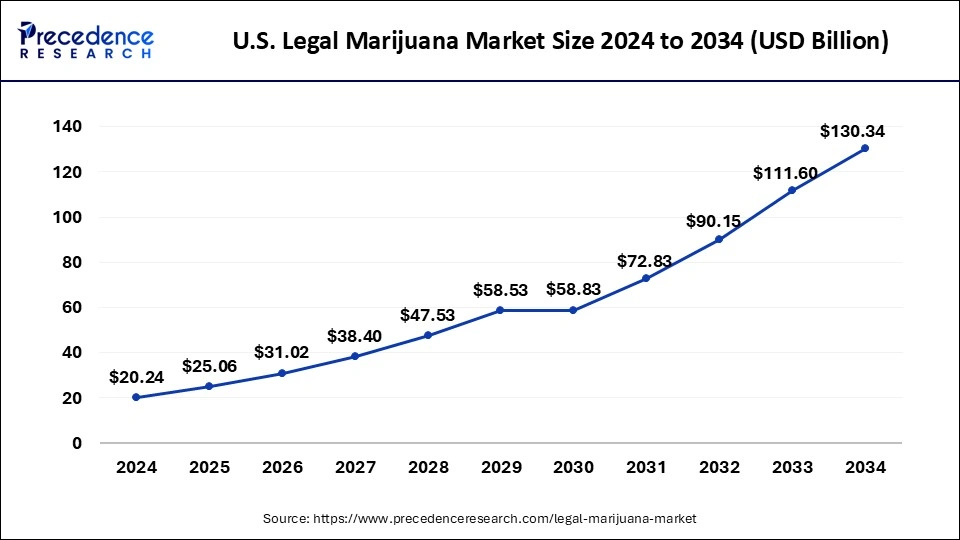

The U.S. legal marijuana market size was valued at USD 20.24 billion in 2024 and is expected to reach USD 150.93 billion by 2034, growing at a CAGR of 22.25% from 2024 to 2034.

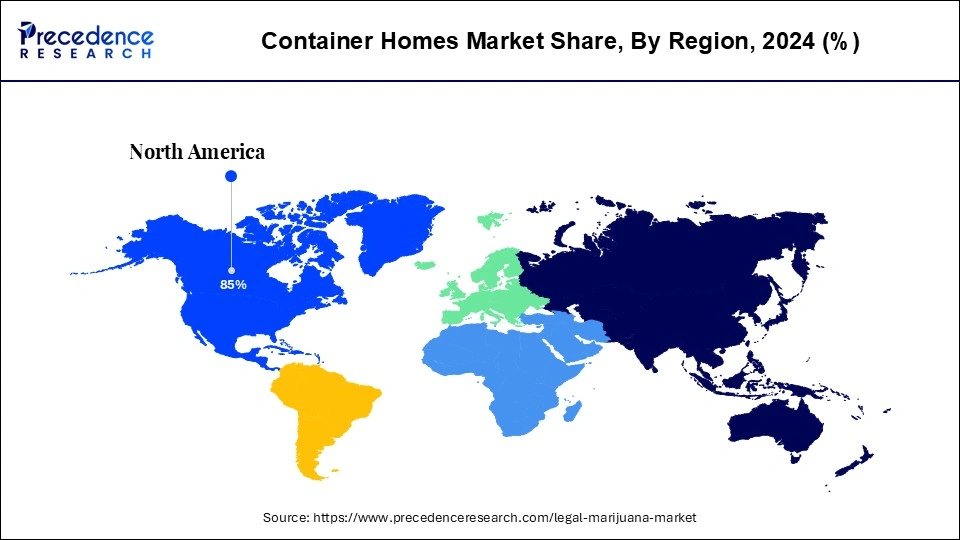

North America governed the global market on account of the cumulative legalization of cannabis for both recreational and medical purposes. There is a budding consciousness among consumers concerning the health assistance offered by cannabis.

North America accounted for more than 85% of the global revenue. Increasing legalization and favorable government guidelines in Canada and the U.S. are the key factors contributing to the growth of the legal marijuana market in North America. Moreover, the 2018 Farm Bill that legalizes hemp-based goods in the United States is playing an important role in boosting the demand for legal marijuana.

In the U.S. around 33 states have endorsed marijuana in some capacity, creating new employment and economic openings within the legal marijuana industry. With more states anticipated to advance cannabis legalization actions in the years to come, and federal lawmakers seeing restructuring legislation, more Americans will soon be able to legally access cannabis.

Furthermore, Europe medical cannabis market is anticipated to perceive significant growth during the estimated timeframe. Legalization of medical usage of marijuana in Germany in 2017 fashioned a domino effect on other European nations for the commencement of marijuana-associated research programs. This also directed the legalization of the medicinal application of cannabis in the UK. With public backing principally in support of the legalization of medical cannabis, most of patients in Europe are hopeful to have legal access to cannabis. Furthermore, varied demographics and a huge patient population are appealing to numerous medical marijuana players in Europe, thus leading to industry development. In February 2019, Thailand became the foremost country in Southeast Asia to permit the consumption and growth of medical marijuana, opening its first legal cannabis greenhouse.

Europe was the second most prominent market majorly due to changes in the legalization of marijuana and increasing awareness regarding its medicinal use. The ‘Cannabis as Medicine Act passed by Germany in March 2017 created a mechanism for quality-controlled cannabis supply, including domestic production. Patients for whom all other treatment options have been exhausted can get a medical prescription for dried cannabis flowers and extracts of standardized quality at a pharmacy. The prescription of cannabis preparations is not restricted to particular specialists, nor is their usage restricted to explicit medical indications.

Marijuana is used in Australia for medicinal and recreational use, with a testified one-third of all Australians aged 22 or older (33.5%, about 5.8 million) having tried marijuana and around 1 million people using it annually. It is estimated that about 750,000 Australians use marijuana every week and approximately 300,000 uses it on a daily basis. Australia has one of the highest rates of marijuana prevalence in the world, and Australia's native population has higher levels of marijuana use. On 24 February 2016, Australia legalized medicinal cannabis at the federal level. On 25 September 2019, the Australia Capital Territory (ACT) passed a bill to make the ACT the first region in Australia to legalize marijuana for personal use as of 31 January 2020.

Cities Consume the Most Cannabis in the World

| Cities | Yearly Consumption |

| New York | 62.3 metric tons |

| Sydney | 45.8 metric tons |

| Los Angeles | 35 metric tons |

| Chicago | 24.9 metric tons |

| Rome | 21.9 metric tons |

| Houston | 18.5 metric tons |

| Toronto | 16.7 metric tons |

| Tokyo | 16.7 metric tons |

| Prague | 15.5 metric tons |

| Vienna | 15 metric tons |

Marijuana or cannabis has been utilized as a medicine for several years. There is now increasing reception of this plant as a legitimate selection for patients who suffer from medical issues, such as seizures or chronic pain. It is widely employed for the treatment of mental disorders and diseases, migraine, chronic pain conditions, arthritis, cancer treatment, and other medical circumstances. The increasing demand for marijuana in the healthcare industry due to its medicinal properties contributes to market growth in the coming years.

Marijuana or cannabis has been utilized as a medicine in several cultures for many years. There is now mounting reception of the plant as a legitimate selection for patients who suffer from medical issues such as seizures or chronic pain. It is widely employed for the treatment of mental disorders and diseases, migraine, chronic pain conditions, arthritis, cancer treatment, and other medical circumstances.

The application of cannabis for medical uses is gaining impetus across the world due to current legalization in several countries. Medical marijuana is employed for treating chronic conditions including arthritis, cancer, and neurological circumstances like depression, anxiety, epilepsy, Parkinson’s, and Alzheimer’s disorders. Such a wide scope of application is predicted to promise well for the medical marijuana market growth. Cannabis legalization is frequently observed with dual discernments where its authorization has been met with skepticism related to probable abuse. On the other hand, it is thought that legalization could, in turn, permit individuals to exercise harmless substance usage, whereas also gaining therapeutic profits. As a consequence, there is a snowballing number of nations that are progressively legalizing the practice of cannabis across the world.

Yet, the numerous contradictory judgments of smoking cannabis, which include the composition of continued cough, mucus, and respiratory contaminations like COPD, will act as constraints for the growth of the market.

Until lately, marijuana and its byproducts were widely limited under legislation in nations such as the UK, and the U.S. which specified they had no medicinal value and carried a considerable risk of misappropriation. Policies concerning the usage of cannabis-based goods for medicinal resolves are rapidly altering, and marijuana can be prescribed for therapeutic use in many nations. The FDA has permitted two synthetically made cannabinoid medications -- dronabinol, and nabilone -- to cure nausea and sickness from the chemotherapy procedure. Epidiolex(cannabidiol) was permitted in 2018 for healing seizures allied with two infrequent and severe patterns of epilepsy, Dravet syndrome, and Lennox-Gastaut syndrome. Medical cannabis commodities have recently become permissible in Germany, the U.K., Italy, the Netherlands, and Portugal, with France and Spain also on track to allow them soon. This is expected to provide significant new opportunities for treating patients.

The major driver for the upsurge in the marijuana market is the skincare benefits associated with the product. People have long used marijuana to treat ailments. Cannabis-based beauty products show results of them being beneficial in all forms of beauty products. CBD-filled anti-wrinkle beauty products exhibit considerable outcomes just after forty days of usage. CBD can regulate inflammation and oil production, 2 of the motives why acne develops. Going by this, it is clear that the cannabis extract market has a bright future as CBD products can be made to suit all skin types. That is the reason that almost 48% of millennials U.S. say they would buy beauty products with infused CBD oil for skin care. Similarly, 18% of millennials purchase hair care products that contain CBD. Even the best-selling beauty products on e-commerce websites such as Amazon are all-natural brands.

| Report Highlights | Details |

| Market Size in 2034 | USD 251.51 Billion |

| Market Size in 2025 | USD 42.02 Billion |

| Market Size by 2024 | USD 33.97 Billion |

| Growth Rate | CAGR of 22.16% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Marijuana Type, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Changing legal landscape

Many countries in the world are cultivating marijuana as it becomes legalized for medical and recreational use. Moreover, the FDA imposed various guidelines and policies to legalize cannabis and regulate its use. For instance, in July 2024, the U.S. Drug Enforcement Administration proposed new rules stating that medications containing delta-9 THC from the cannabis plant are eligible for approval by the U.S. Food and Drug Administration (FDA). This can positively impact the market. Additionally, many startups in Europe and the U.S. are now focusing on alternative uses of cannabis other than medicinal and recreational uses, thereby driving the market.

Higher rate of complications due to frequent use

The frequent use of marijuana can result in paranoia, unpleasant thoughts disorientation, and anxiety. Schizophrenia and temporary psychosis are more likely to be experienced by people who often use marijuana. Moreover, several regulations limit the market growth. For instance, FDA has not approved a marketing application for cannabis for the treatment of diseases, and approved products are only available with a prescription from a healthcare provider.

Skincare benefits associated with the product

Skincare benefits associated with marijuana fuel the market. Marijuana has been used for many years to treat ailments. Cannabis-based beauty products show benefits in all forms of beauty products. CBD-filled anti-wrinkle beauty products exhibit considerable outcomes just after forty days of usage. CBD can regulate inflammation and oil production, reducing the development of acne.

Depending on type, the medical segment seized the foremost revenue stake of more than 69% in 2024, due to the rising acceptance of cannabis as a pharmaceutical product for the treatment of severe medical situations. Moreover, the snowballing necessity for pain management therapies coupled with the creasing disease burden of chronic pain amongst elders is predictable to lift the demand for medical marijuana in the market.

The adult use segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is attributed to changing customer attitudes toward recreational marijuana. Furthermore, in developed countries like Canada and the U.S., medicinal and adult-use cannabis have both been legalized, thereby boosting the segment.

Different types of products assessed in the legal marijuana market are oils, buds, and tinctures. Among all, marijuana buds accounted for the majority of the market revenue share in 2024. The buds are economical as compared to other types of products, making them more popular. Oils are the second-most revenue-generating product type. Its application in treating nausea and cancer is the major reason for its wide use.

Buds are key plant products and are easily obtainable deprived of any processing, which makes them comparatively reasonable for patients with low-income. Furthermore, the quick onset of action of smoking buds than other kinds is expected to supplement the growth of this segment further.

The oils segment is anticipated to grow at the fastest rate during the projected period. Oils derived from marijuana help in treating nausea due to cancer, which is the major factor boosting the adoption of oils. The growth of the segment is further attributed to the growing utilization of cannabis-based products for medical use. Moreover, oils helps in treating sleep disorders and cures stress and anxiety. Thus, many patients prefer marijuana oil over flowers.

Among different medical applications, in 2024, the chronic pain segment dominated the global legal marijuana market due to the occurrence of a huge patient pool. Chronic pain lasts for more than three months. Chronic pain can also interfere with daily activities. However, the moderate use of marijuana products can help to reduce chronic pain in a short time. The increased demand for pain management in a large patient base suffering from chronic disorders contributed to segmental growth.

The mental disorder segment is anticipated to register rapid growth during the projection period due to the rising number of patients undergoing mental disorders like depression, Alzheimer’s illness, and anxiety disorder. However, marijuana can alter the different states of consciousness after consuming it and thus relieve the symptoms associated with mental disorders.

Corporations engaged in this market are executing numerous tactics like novel product launches, partnerships, and acquisitions to seize major revenue stakes in the medical marijuana market. The growth of the market in North America is flourished by the existence of foremost cannabis giants such as Aurora Cannabis Inc., Medical Marijuana Inc., and Canopy Growth Corporation who are incessantly capitalizing and cooperating for the advancement of novel products to cater the consumer demand.

This research report includes a complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers a breakdown of the market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend in global, regional, and country from 2020 to 2032. This report includes market segmentation and its revenue estimation by classifying it on the basis of end-use and region as follows:

By Marijuana Type

By Product Type

By Application

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

June 2023

July 2024