April 2025

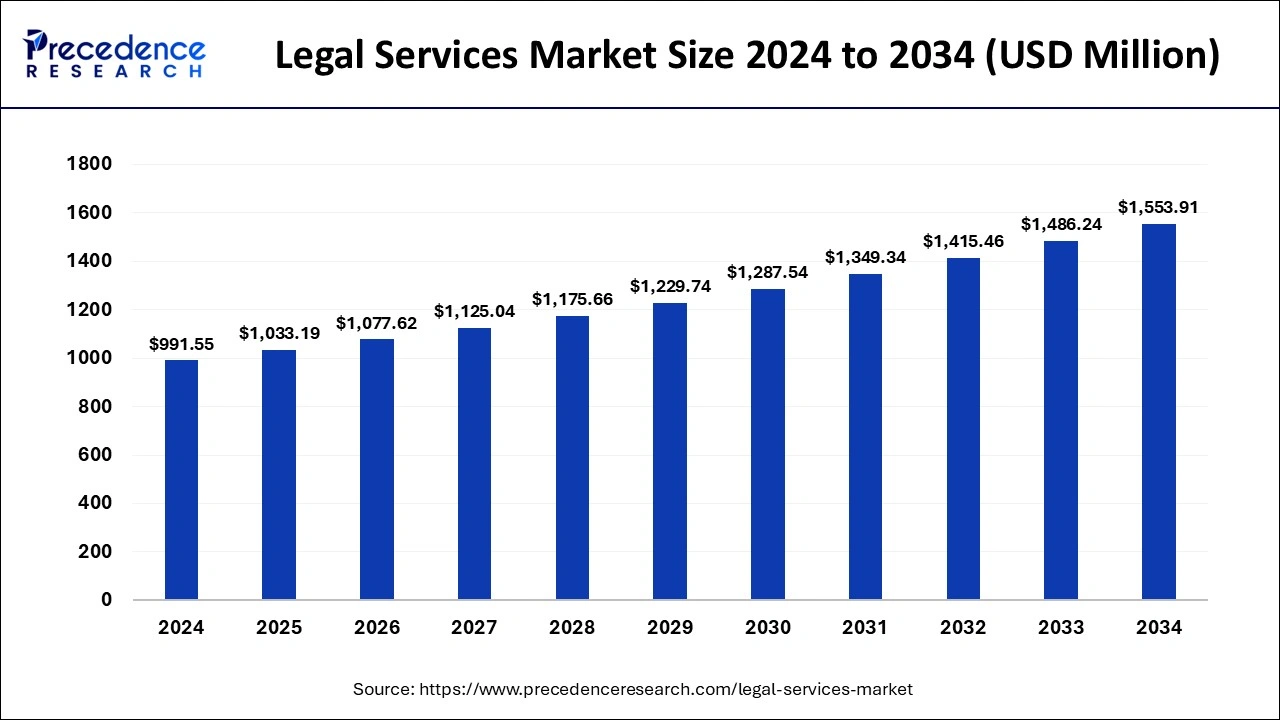

The global legal services market size is calculated at USD 1,033.19 billion in 2025 and is forecasted to reach around USD 1,553.91 billion by 2034, accelerating at a CAGR of 4.60% from 2025 to 2034. The North America market size surpassed USD 416.45 billion in 2024 and is expanding at a CAGR of 4.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global legal services market size accounted for USD 991.55 billion in 2024 and is predicted to increase from USD 1,033.19 billion in 2025 to approximately USD 1,553.91 billion by 2034, expanding at a CAGR of 4.60% from 2025 to 2034.

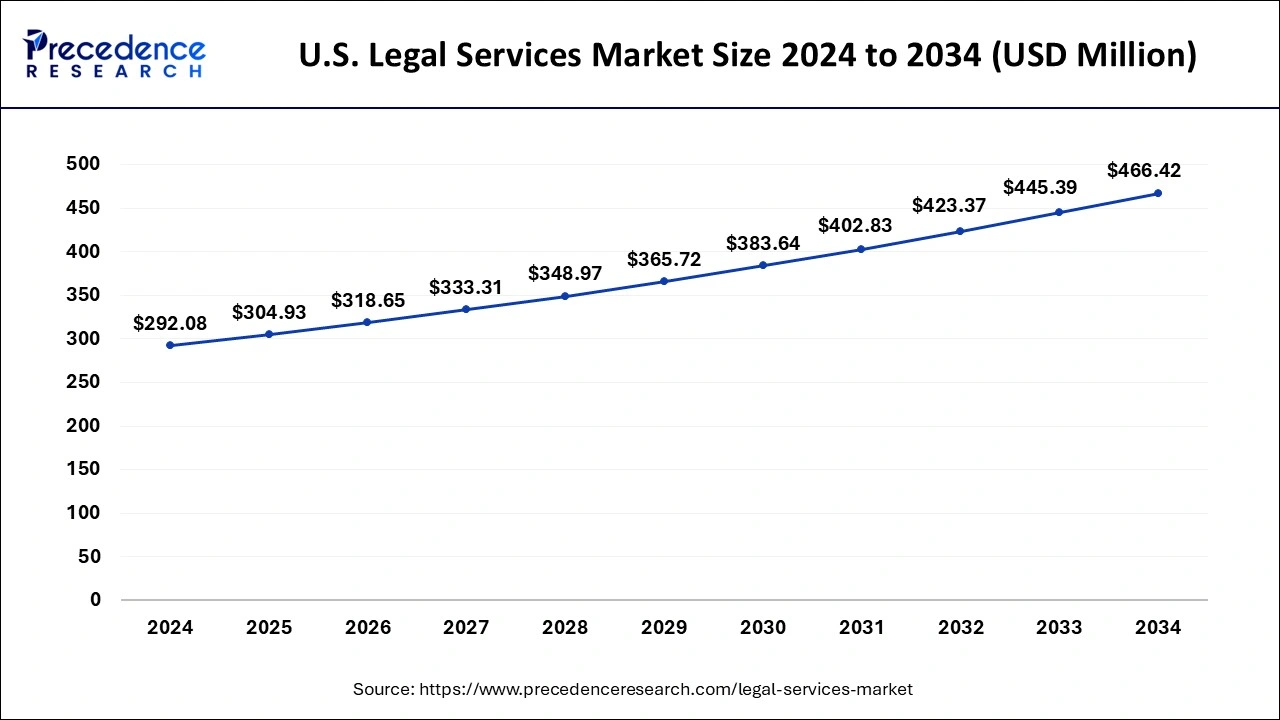

The U.S. legal services market size was exhibited at USD 292.08 billion in 2024 and is projected to be worth around USD 466.42 billion by 2034, growing at a CAGR of 4.79% from 2025 to 2034.

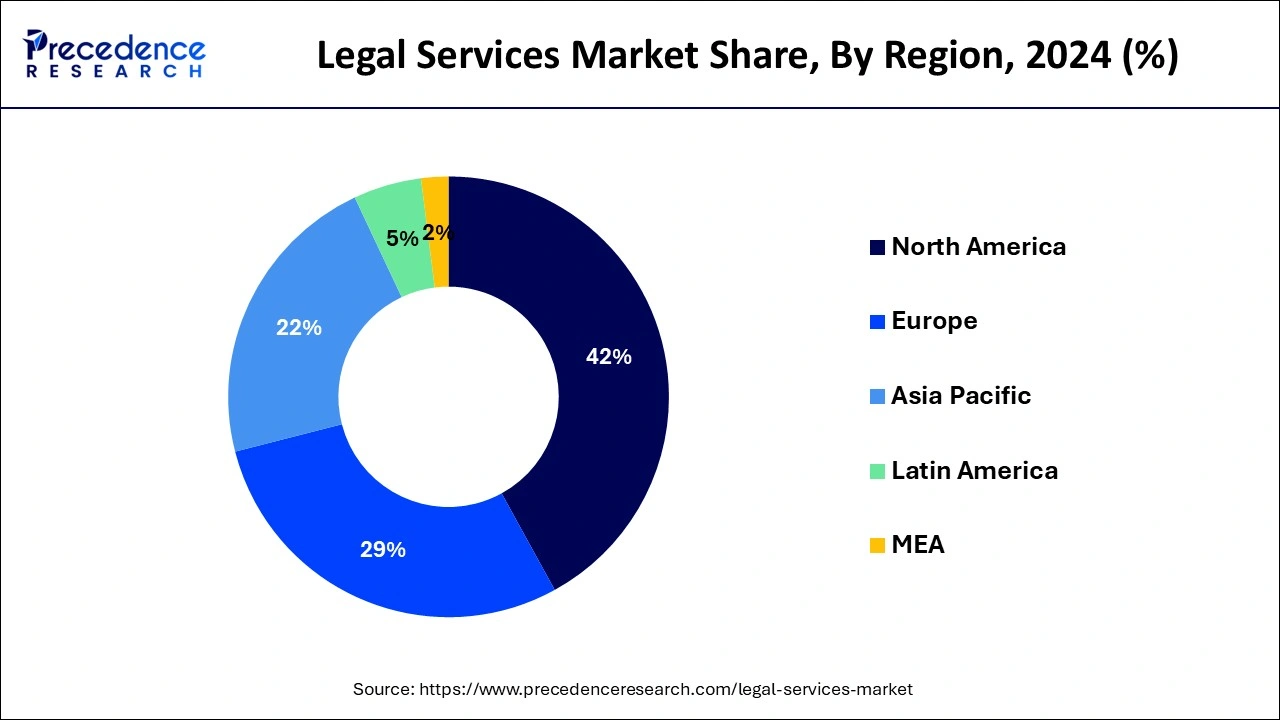

In 2024, North America held a share of 42% in the legal services market due to its mature legal infrastructure, robust regulatory environment, and the presence of numerous multinational corporations. The region's advanced legal technology adoption, high demand for specialized legal expertise, and the prevalence of complex regulatory frameworks contribute to its major market share. Additionally, the concentration of leading law firms and legal service providers in North America further solidifies its position as a key player in the global legal services landscape.

Asia-Pacific is expected to witness rapid growth in the legal services market due to several factors. The region's robust economic development, increasing cross-border transactions, and a burgeoning middle class are driving the demand for legal expertise. Additionally, evolving regulatory frameworks and the rise of complex business structures contribute to heightened legal complexities. As businesses seek legal support for expansion and compliance, law firms and practitioners in the Asia-Pacific region are experiencing a surge in opportunities, making it a focal point for substantial growth in the legal services sector.

Meanwhile, Europe is experiencing notable growth in the legal services market due to various factors. The region's economic expansion, increasing cross-border transactions, and evolving regulatory landscapes are driving demand for legal expertise. Additionally, the digital transformation within the legal sector, with a growing emphasis on technology adoption, is enhancing efficiency and attracting clients. The demand for specialized legal services, particularly in areas like data protection and environmental law, further contributes to the market's growth as law firms adapt to meet the changing needs of businesses and individuals in the European market.

Legal services encompass a range of professional assistance provided by lawyers and legal professionals to individuals, businesses, and organizations. These services aim to navigate and address legal issues, ensuring compliance with laws and regulations. Common legal services include advice on contracts, representation in court, and assistance with legal documents. Lawyers may specialize in various areas such as family law, real estate, or criminal law, offering expertise tailored to specific needs. Legal services play a crucial role in safeguarding rights, resolving disputes, and upholding justice within the framework of the legal system. Access to legal services is fundamental for individuals seeking guidance, protection, and resolution in legal matters, contributing to a fair and orderly society.

Legal Services Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 1,033.19 Billion |

| Market Size by 2034 | USD 1,553.91 Billion |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Firm Size, and Provider |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Government initiatives in healthcare

The surge in corporate legal needs has become a significant driving force behind the growing demand in the legal services market. As businesses expand and operate in an increasingly complex environment, the need for legal expertise within corporations has risen sharply. Companies are grappling with intricate legal challenges, from regulatory compliance to contractual intricacies, prompting a greater reliance on specialized legal services. With a heightened focus on risk management and legal compliance, businesses are increasingly turning to external legal support to navigate these complexities efficiently. This trend not only boosts the demand for legal services but also encourages law firms to tailor their offerings to cater to the specific needs of corporate clients. As a result, the legal services market experiences a notable upswing, driven by the evolving and intricate legal landscape that businesses navigate in today's corporate environment.

Resistance to technology adoption

The reluctance to embrace technological advancements acts as a notable restraint on the market demand for legal services. The legal industry, historically characterized by traditional practices, may encounter challenges in fully harnessing the benefits offered by modern technologies. Resistance to technology adoption within legal circles can impede the streamlining of processes, reducing overall efficiency and limiting the potential for cost savings. Law firms and professionals hesitant to integrate innovative solutions such as artificial intelligence and automation may find themselves at a disadvantage in meeting the evolving needs of clients.

This resistance hinders the ability to optimize workflows, automate routine tasks, and deliver legal services more efficiently. Consequently, the legal services market may experience a slower response to changing client expectations and industry trends, impacting its overall growth potential in an era where technology plays a pivotal role in enhancing service delivery and operational effectiveness.

Alternative legal service providers

The rise of Alternative Legal Service Providers (ALSPs) is creating significant opportunities within the legal services market. ALSPs offer innovative and cost-effective solutions, presenting clients with alternatives to traditional law firms. These providers specialize in services such as legal process outsourcing, contract management, and technology-driven legal solutions. Their flexible and often tech-enabled approaches appeal to clients seeking efficiency, cost savings, and specialized expertise. ALSPs are expanding the scope of services available to clients, fostering competition and driving improvements in service delivery.

As businesses increasingly recognize the benefits of outsourcing legal tasks to specialized providers, the legal services market is becoming more dynamic and diverse. ALSPs are not only meeting client demands for cost-effective solutions but also catalyzing a transformation in how legal services are conceptualized and delivered, thereby creating new avenues for growth and innovation in the broader legal services landscape.

Contingency fee arrangements dominate the legal services market, especially in personal injury, mass tort, and consumer protection lawsuits. This model allows clients to access legal services without upfront payments, empowering underserved populations, and increasing case volumes. The incentive-aligned model also pushes firms to accept only strong cases, enhancing efficiency and client trust. In the U.S., contingency-based work remains a pillar in plaintiff-side firms, particularly in jurisdictions like Texas and California where tort litigation is highly active.

Corporate fee segment is emerging as the fastest growth. Corporate legal departments are using value-based and predictable pricing models such as success-based billing flat rates and capped fees in response to pressure to cut legal expenditures. AFA adoption is being further accelerated by law firms using technology and project management to provide excellent legal work at a reduced cost. The areas where this change is most noticeable are M&A compliance and business contracts.

Large firms dominate the legal services market, because of their extensive resources and capacity to manage intricate cross-border issues. They serve the government and multinational clientele and are frequently the first to use new billing and legal technology. Their market dominance across practice areas is maintained by their capacity to draw in elite legal talent and provide comprehensive services under one roof.

Small firms' segment is emerging as the fastest growth, due to their agility, cost efficiency, and ability to serve local businesses and individuals with more personalized service. These firms often specialize in niche areas like immigration, IP filings, or local commercial disputes. With the rise of legal tech and virtual practice tools, small firms can now operate with enterprise-level efficiency at a fraction of the cost, making them highly competitive.

Civil litigation segment dominates the legal services market, driven by business disputes; personal injury claims, consumer rights, and contract violations are among the many cases that are filed. For law firms, it is a significant source of income, especially for those that use hourly and contingency billing. This market niche gains from both strong demand during periods of economic stability and booms during downturns. 3. employment disputes and bankruptcies).

Intellectual property segment is emerging as the fastest growth, fueled by the boom in technology, biotech, AI, and digital content. Startups and established enterprises alike seek comprehensive IP services from patent filings to trademark defense and IP licensing. With AI-generated content and inventions on the rise, IP law is evolving rapidly and gaining relevance across sectors.

By Fee Type

By Size

By Practice Area

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

October 2024

July 2024

March 2025