November 2024

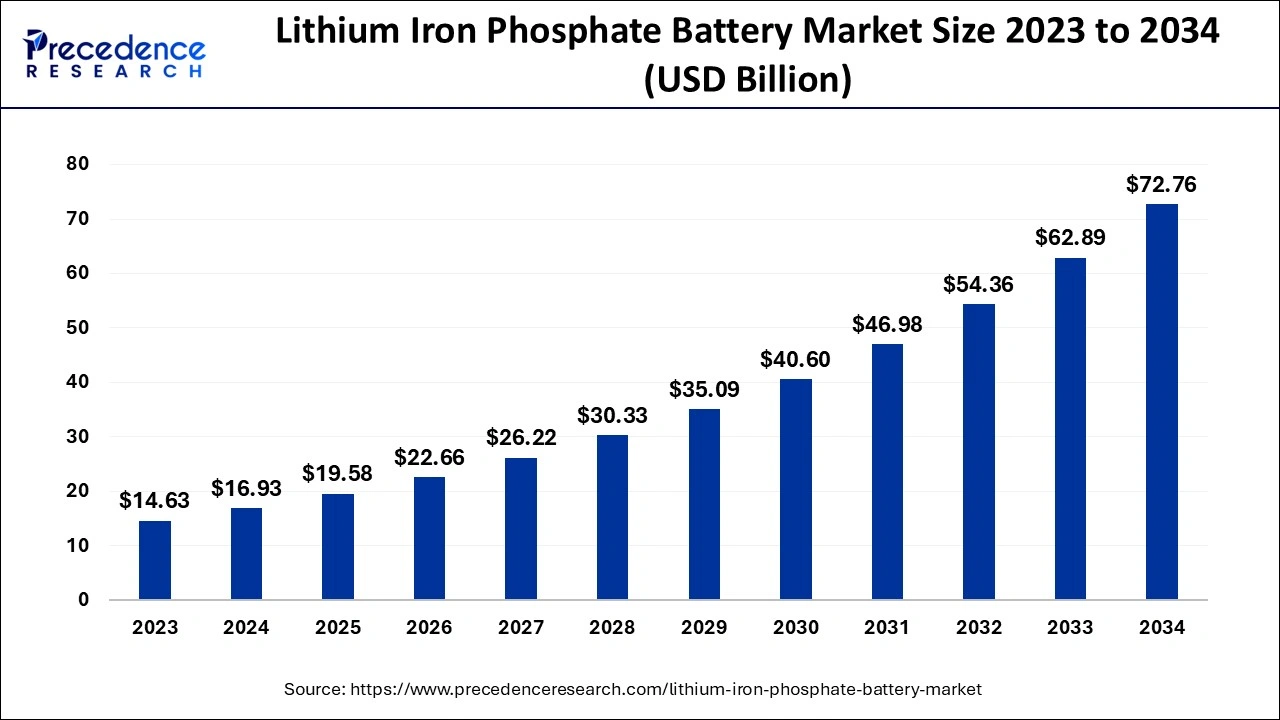

The global lithium iron phosphate battery market size accounted for USD 16.93 billion in 2024, grew to USD 19.58 billion in 2025 and is predicted to surpass around USD 72.76 billion by 2034, representing a healthy CAGR of 15.70% between 2024 and 2034.

The global lithium iron phosphate battery market size is accounted for USD 16.93 billion in 2024 and is anticipated to reach around USD 72.76 billion by 2034, growing at a CAGR of 15.70% from 2024 to 2034.

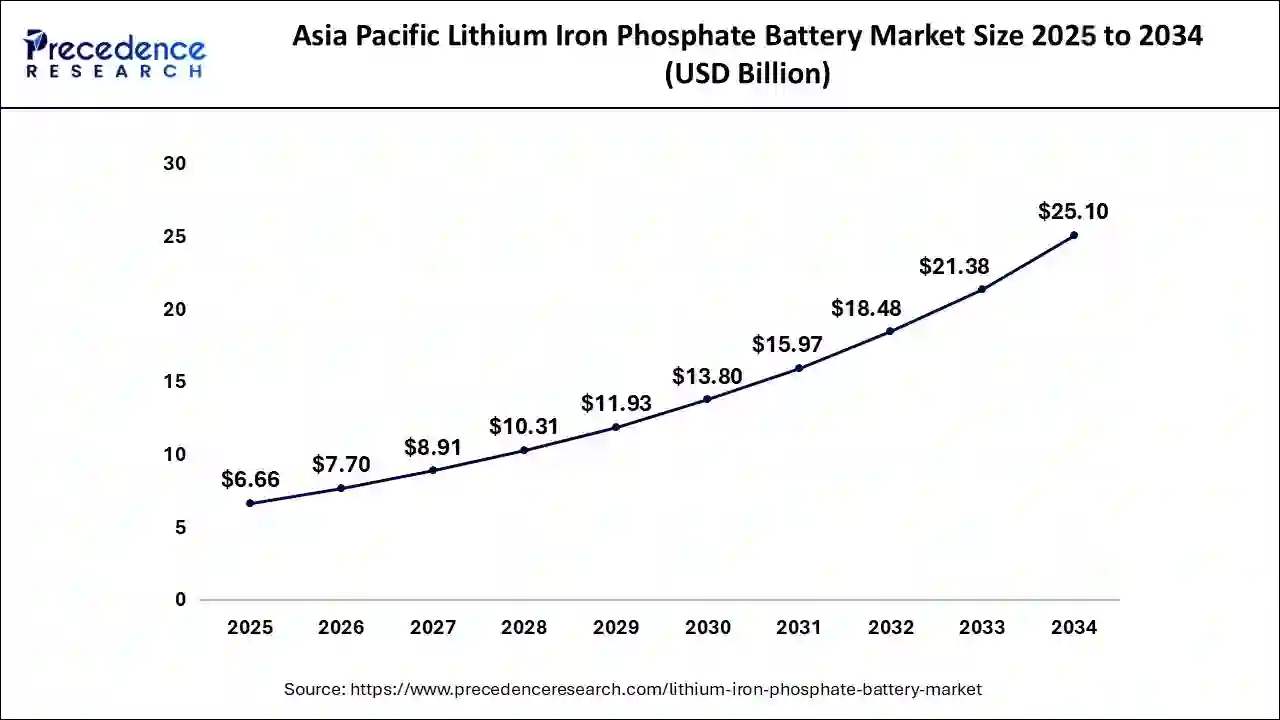

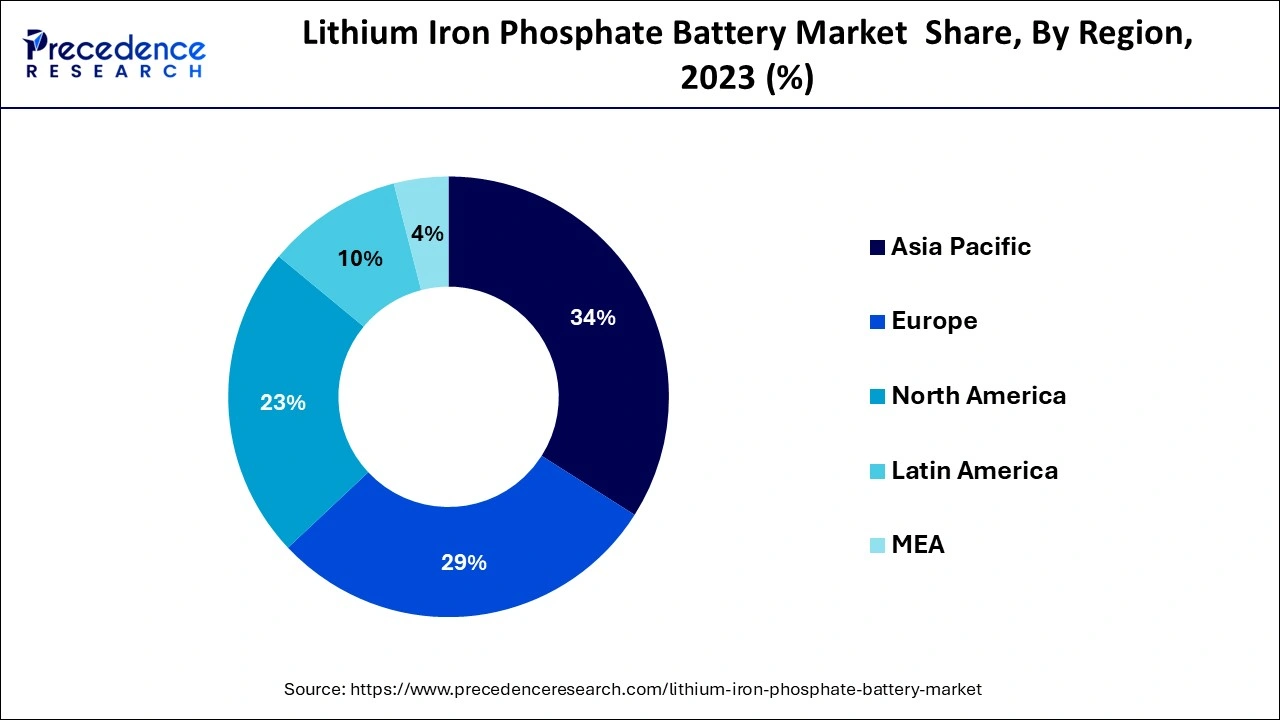

The Asia Pacific market size is evaluated at USD 5.76 billion in 2024 and is predicted to be worth around USD 25.10 billion by 2034, rising at a CAGR of 15.86% from 2024 to 2034.

The marketplace for lithium iron phosphate batteries inside the Asia-Pacific region is expected to increase due to the rising popularity of electric cars. It's conceivable that manufacturers in India, China, Australia, and Japan, will invest money in LFP cells. The Asia Pacific may offer opportunities for expansion for such energy makers with the increase in the need for computers, cellphones, as well as other electrical gadgets. In light of growing environmental problems, market players see European as a favorable fishing field. To meet the no emission goal before 2050, lithium-ion battery manufacturers increased their expenditures in Germany and the United Kingdom.

General populace collaborations will probably be launched by consumer advocates like the European Commission as well as the Regional European Cooperation Organizations to support scientific initiatives around the area. Due to the existence of major producers, participants are projected to increase the share of lithium iron phosphate batteries in the United States. Importantly, pro-growth federal programs like tax breaks would help the sector develop. Increased EV sales will probably result in increased LFP battery output.

Lithium-iron-phosphate battery producers are currently concentrating mostly on organizational improvement to particular criteria and technical progress to minimize operating costs and boost production. The automobile, manufacturing, & energy industries all have a strong market for such devices, which drives producers to enhance and boost LFP battery output. The proliferation of lithium-iron phosphate batteries has also received encouragement from the authorities of numerous nations worldwide. For instance, at its Centre for Nanoparticles, the Indian government has created indigenous technology for such manufacturing of lithium-iron phosphate electrode materials.

So, during the projection timeframe, rising production and LFP battery technology advances are anticipated to fuel statistics in business development. Businesses are encouraged to utilize LFP batteries by legal provisions that are strict enough to control and maintain increasing pollution problems. Companies that produce electricity are already focusing on producing clean energy and preserving this for later use. LFP devices were increasingly being used in networks & power storage systems because of their high personality frequency, low cost, and small deployment space. The market for LFP cells is anticipated to rise as a result of such devices' enhanced thermal stability and suitability for thermal management applications.

Owing to its efficiency in terms, lithium-ion batteries are widely utilized in devices and vehicles. After some time, lithium-ion batteries may also be recharged. Well over an anticipated timeframe, increasing electric vehicle usage will fuel the expansion of the worldwide battery pack business. The lithium polymer battery may be used in cars and other vehicles with ease because of its high capacity for energy & prolonged shelf life. Private consumption offers consumer technology represents one of the main reasons for boosting the worldwide lithium-ion industry. Furthermore, individuals have begun to use electric cars widely due to the prohibitive expense of fossil energy and petroleum distillates.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.93 Billion |

| Market Size by 2034 | USD 72.76 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 15.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Capacity, End User, Application, Voltage and Geography |

Increasing the market for industrial automation: Material handling technology has developed along with factory applications to accommodate the shifting needs of many sectors. The market for material handling machines has undergone numerous new technologies throughout the period. There have several technical improvements that call for batteries in automatic manufacturing and raising technology, such as autonomous guided automobiles, raising machinery, industrialized vehicles, and some kinds of devices. For example, Toyota completely redesigned a squeeze electrical lift vehicle in Japan and also added a larger number of variants in European and the United States as a swift response to expanding environmental protection amongst consumers with increasing strictness of pollution restrictions. Consequently, the industry of lithium-iron-phosphate batteries was expanding due to the demand for battery-powered transmission electron microscopy.

Growing usage of the Electric Grid and falling battery prices increase the growth potential for growth: End-users have shown a keen desire to invest money in LFP batteries as the demand to reduce emissions increases. Producers of grid and power storage media had displayed prominently a preference for batteries due to their small deployment footprint, poor self-incidence, & affordable prices. In addition, the falling cost of lithium-ion batteries has prompted the development of cutting-edge technology. Given this surge in popularity by end frameworks, market players were likely to invest money in equipment.

Increased Battery Use in Power Storage and Power Network Technologies to Drive Industry: Industries are required to use lithium-ion batteries as a result of strict government regulations imposed to control escalating pollutant concentrations. The electricity sector is working to produce sustainable power & stockpile it for later use. In addition, lithium-ion batteries are increasingly being used in network & electricity storage solutions due to their low price, low discharge rate, and minimal deployment space. The item is ideal for use in remote locations and thermal management systems due to its increased resistance to extreme temperatures.

Technical issues with LFP batteries: Comparing lithium-iron-phosphate batteries to other batteries, they have a lower density of energy. A crucial factor in the present situation is also that battery used for EVs must be lightweight and compact. The electrode paste must have fewer granules since doing so makes it compact greater tightly. Creating a broad contact area would boost the electrolyte by area, increasing the material's power density and recharging speed. But because of the increased ions produced by the bigger contact area and much more undesired interactions, the current battery lifespan is also shortened and its capacity is degraded. This can be fixed by applying an extremely thin interlayer to every particle. Getting such coatings extremely conducting & chemical inertness is difficult, though.

low cost or long service life is creating new opportunities: The lithium-ion batteries offer a wide range of advantages, including low cost or long service life, which is creating new chances for such market expansion of lithium-ion batteries. The economy has evolved and is additionally fueled by the increased usage of consumer technology. The desire for lithium-ion batteries in the worldwide industry is rising as a result of the desire and need for them in commercial items.

In 2023, the lithium-ion batteries market will be controlled by the lithium iron phosphate category. The increasing requirement for long-lasting and effective batteries is one reason supporting the company's development, as is the increase in the market for lithium iron phosphate cells in wearable electronics. Additionally, benefits like a long-life span and safer suggested solutions with lithium iron phosphate batteries are promoting sector expansion.

In 2023, the lithium magnesium, nickel, and cobalt category will experience the fastest growth. High-speed trains & electrical motorcycles are just two examples of technology that frequently uses lithium nickel and manganese cobalt. Life span & low cost are two advantages of lithium, nickel, manganese, and cobalt that are opening up potential approaches again for a company's expansion.

The sector between 16,251 and 50,000 mAh is anticipated to experience the largest CAGR during the projection time frame as a result of growing usage in several industries, including industrial, automotive, and electricity production.

Due to a rise in need from APAC Region, the automobile category is predicted to have rapid expansion over the coming years. For such automobile sectors, non-traditional power storage technologies which can improve automobile effectiveness and performance are just a major topic of interest. Lithium iron phosphate reactors are anticipated to emerge as the most popular option for an alternative power storing battery pack due to their high energy content and lengthy throughput times. As a result, it is anticipated that increased global growth of the automotive, particularly in China, will drive up the price of lithium iron phosphate batteries.

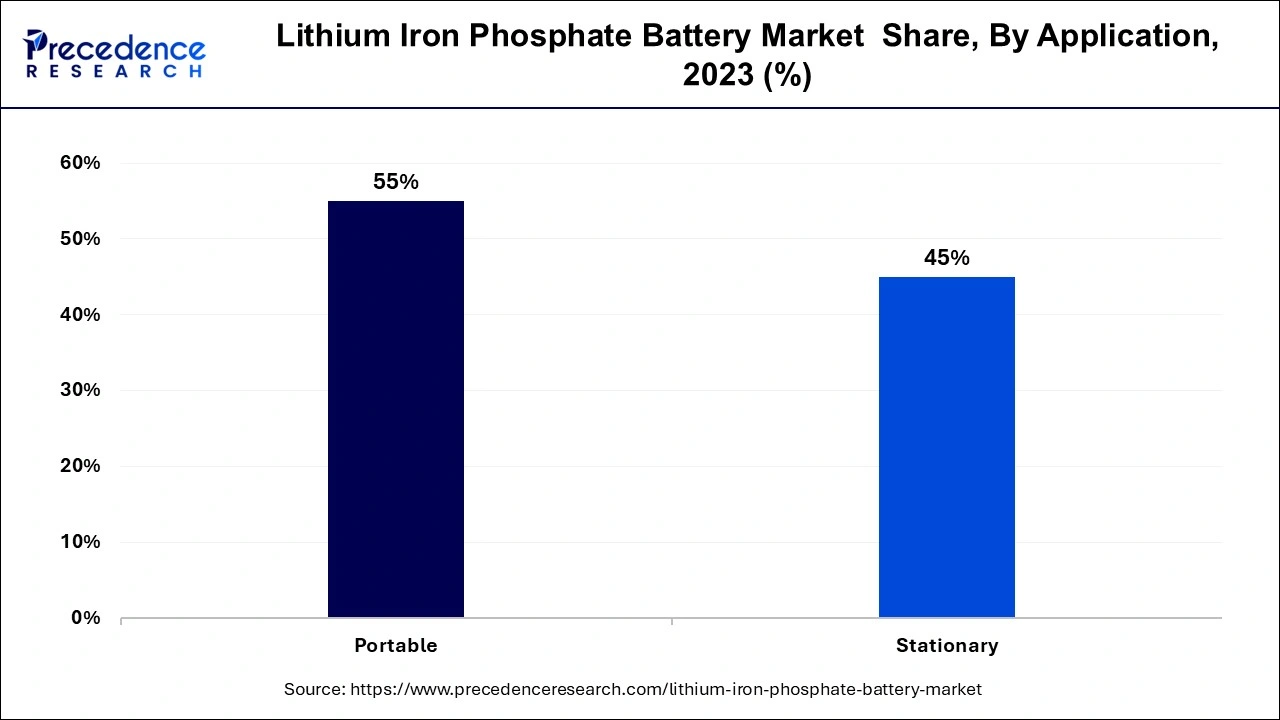

During the projected timeframe, the portable category is anticipated to account for the highest share of the lithium iron phosphate battery market. Removable lithium iron phosphate cells are dominating the market with the program due to their considerably greater organizational effectiveness. In 2023, the portable application sector held a majority (55%) of the international market. It is explained by the increased need on LiFePO4 batteries coming from the automobile industry, which represents the main source of demand.

Furthermore, as the requirement for storing renewable energy projects grows, the permanent service sector may face competition from the versatile application sector. Due to the necessity to switch toward renewable power sources, such as solar and wind power for environmentally friendly and safe electricity, the static usage market is anticipated to have significant expansion within the next few years. It is anticipated that large expenditures will be made across the public and industrial domains as a result of the switch to sustainable energy sources, which will increase the supply of this kind of device.

It is being used more frequently as storing energy for renewable power sources, clear obvious grid storage units, maritime, or other applications, the 12-20 KV category is anticipated to have the biggest market share over the projected timeframe.

By Type

By Capacity

By End User

By Application

By Voltage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

December 2024

January 2025

November 2024