April 2025

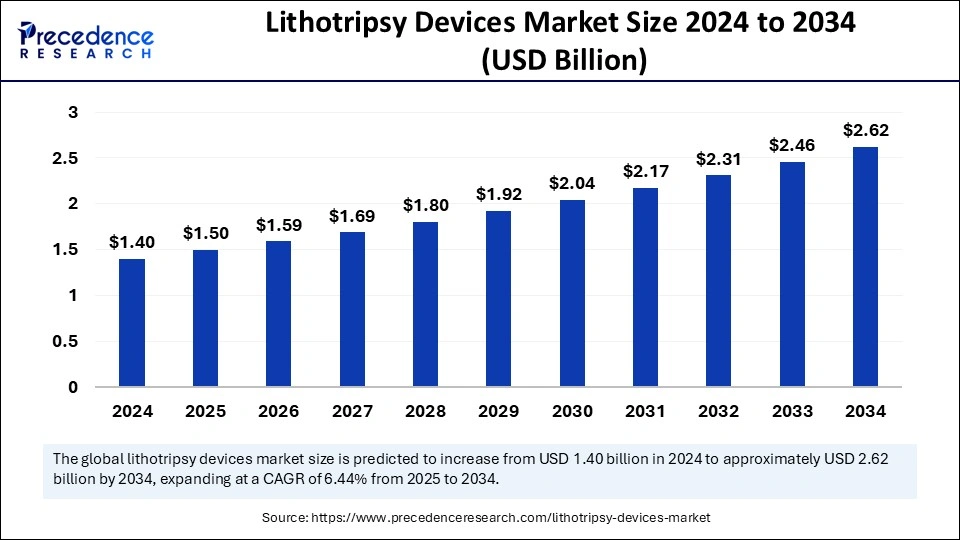

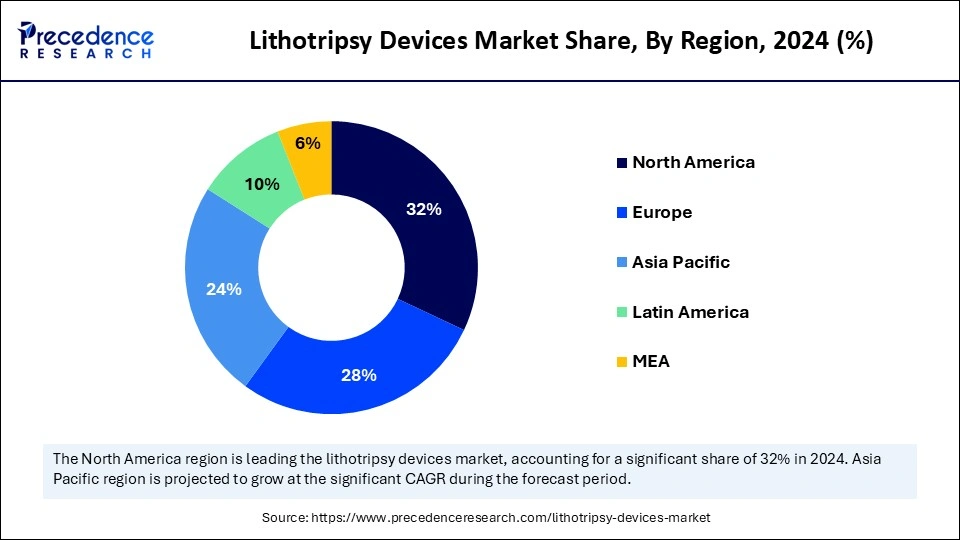

The global lithotripsy devices market size is calculated at USD 1.5 billion in 2025 and is forecasted to reach around USD 2.62 billion by 2034, accelerating at a CAGR of 6.44% from 2025 to 2034. The North America market size surpassed USD 448 million in 2024 and is expanding at a CAGR of 6.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lithotripsy devices market size was calculated at USD 1.4 billion in 2024 and is predicted to increase from USD 1.5 billion in 2025 to approximately USD 2.62 billion by 2034, expanding at a CAGR of 6.44% from 2025 to 2034. The lithotripsy devices market is expected to grow at a rapid pace due to the rising government initiatives to boost the domestic production of medical devices.

Artificial Intelligence integration in lithotripsy devices significantly enhances both treatment effectiveness and patient outcomes. AI-driven imaging and monitoring devices are enhancing the precision of stone removal procedures. The seamless incorporation of robotics and AI holds promises for enhancing the efficacy and efficiency of stone removal technology. AI enhances the effectiveness of kidney stone procedures, providing modern solutions for treatment planning, diagnosis, and medical intervention. By harnessing the power of AI, healthcare providers deliver more effective, efficient, and personalized care to people with kidney stones with the help of lithotripsy devices, eventually enhancing medical outcomes and the quality of life.

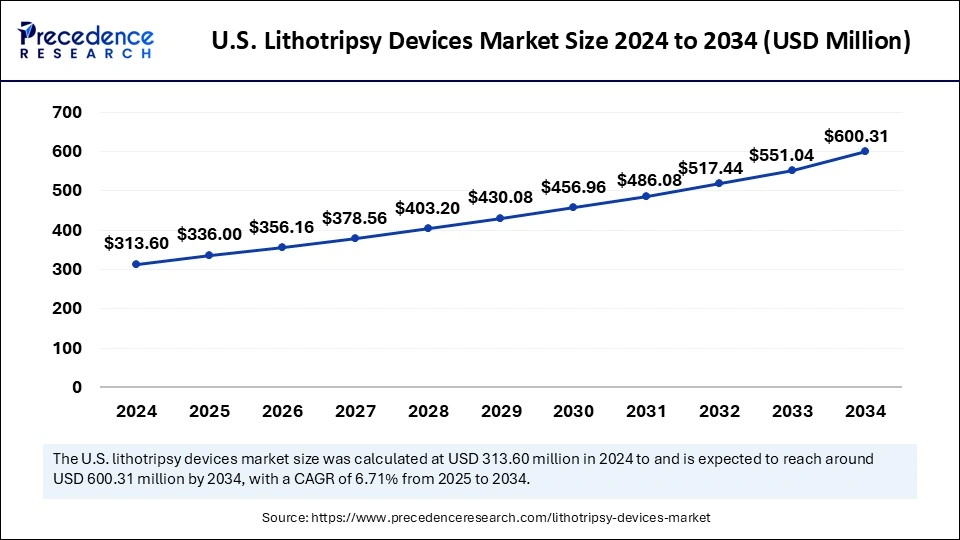

The U.S. lithotripsy devices market size was exhibited at USD 313.60 million in 2024 and is projected to be worth around USD 600.31 million by 2034, growing at a CAGR of 6.71% from 2025 to 2034.

North America registered dominance in the lithotripsy devices market by holding the largest share in 2024. This is mainly due to its advanced healthcare sector, boosting the adoption of cutting-edge lithotripsy devices. There is a rapid shift toward advanced care options for various diseases, increasing the adoption of advanced technologies and medical devices to enhance patient care and outcomes. The North American healthcare system is considered the world’s best system as it offers expedient access to a highly subspecialized network of doctors.

The U.S. is a major contributor to the North American lithotripsy devices market. The increasing burden of kidney diseases in the U.S. is a major factor driving the growth of the market. For instance, according to the National Institutes of Health (NIH), the U.S. population living in high-risk zones for nephrolithiasis will grow from 40% in 2000 to 56% by 2050 and 70% by 2095. This highlights the need for lithotripsy in the country. In addition, the country is an early adopter of minimally invasive surgery, supporting market growth. Advancements in kidney disease management and increasing programs nationwide to optimize screening for kidney diseases, high demand for targeted therapies, and increasing development of advanced medical devices are expected to boost market growth.

Asia Pacific is anticipated to witness the fastest growth in the coming years. The regional market growth can be attributed to the growing aging population, which significantly boosts the need for minimally invasive surgeries, and so does the demand for lithotripsy devices. The rising prevalence of Kidney stones further supports market growth. Moreover, governments of various Asian countries are investing heavily to advance healthcare infrastructure and boost the domestic production of medical devices, contributing to market growth.

India is expected to have a stronghold on the Asia Pacific lithotripsy devices market. There is a high prevalence of urolithiasis due to the scarcity of clean water resources, especially in remote or rural areas. The consumption of polluted water can lead to kidney stones, increasing the volume of patients in the country. The rising Indian government initiatives to increase the accessibility to healthcare in rural areas further support market growth.

The lithotripsy devices market is witnessing rapid growth due to the increasing incidence of kidney stones and uric acid nephrolithiasis among the old age population. Lithotripsy devices use shock waves to fragment stones in the kidney and parts of the ureter. These devices reduce complications, recovery time, and trauma in the management of kidney stones. Ongoing advancements in endoscopic devices and minimally invasive solutions further contribute to market expansion. Modern lithotripters commonly deliver shock waves with lower energy, resulting in lower patient discomfort. The increasing healthcare expenditure and growing awareness about urological and kidney disorders further support market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.62 Billion |

| Market Size in 2025 | USD 1.5 Billion |

| Market Size in 2024 | USD 1.4 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.44% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Geriatric Population

The growing geriatric population worldwide is a major factor driving the growth of the lithotripsy devices market. Kidney stone formation is common in older adults as they often experience dietary changes and dehydration, which are key causes of kidney stones and uric acid nephrolithiasis. As the global population ages, the prevalence of kidney stones is likely to increase. Moreover, older adults often face other health issues, making it complex to perform traditional surgical procedures. This, in turn, boosts the demand for lithotripsy devices. Management of urolithiasis in older adults requires a multidisciplinary approach involving urologists, nephrologists, and geriatric specialists to address age-related comorbidities and physiological considerations. As older adults often present higher surgical risk, the adoption of minimally invasive procedures, such as ureteroscopy and extracorporeal shock wave lithotripsy (ESWL), is expected to increase due to their safety, efficacy, and shorter recovery time.

Technical Limitations and Limited Accessibility

Despite the rising adoption of lithotripsy, numerous challenges continue to restrain the growth of the market. Lithotripsy procedures often fail due to difficulties in fragmenting the stone, requiring trained surgeons to handle lithotripsy devices. Anatomical risk, especially stones located in the lower ureter or near sensitive structures, increases the risk of tissue damage and reduces the effectiveness of the procedure. This, in turn, limits the adoption of lithotripsy devices. Moreover, the high costs associated with lithotripsy procedures compelled patients to seek alternative, cost-effective procedures, limiting the growth of the market.

Technological Advancements in Imaging and BWL

Recent technological innovation in the field of lithotripsy creates novel opportunities for the growth of the lithotripsy devices market. New techniques like break wave lithotripsy (BWL) noninvasive ultrasound-based modality are gaining attention for their capability to effectively and safely fragment urinary stones without the need for surgical intervention or anesthesia. Furthermore, future advancement aims to merge BWL with stone-specific ultrasound imaging technologies, increasing treatment outcomes and precision. Next-generation lithotripters are also integrating real-time ultrasound monitoring with fluoroscopy, expressively lowering patient exposure to ionizing radiation.

Advances in laser lithotripsy further support market growth. Laser lithotripsy is a more effective process of stone breaking than electrohydraulic lithotripsy (EHL) for breaking hard stones. Laser lithotripsy is often performed by urologists through ureteroscopy. In this process, a flexible laser fiber is inserted through a scope into the urinary tract to fragment the stones. These modern developments enhance clinical efficiency and safety and also align with the growing demand for minimally invasive, patient-friendly solutions.

The extracorporeal shockwave lithotripsy devices segment dominated the lithotripsy devices market with the largest share in 2024. This is mainly due to the rise in the demand for minimally invasive procedures. Extracorporeal shockwave lithotripsy procedure is completely non-invasive and is a common treatment for kidney stones. This procedure is performed in a short period, like 60-90 minutes, and sometimes takes longer depending on the number of stones and size of stones. This procedure does not require anesthesia, significantly reducing trauma associated with surgery and enhancing patient outcomes.

The intracorporeal lithotripsy devices segment is projected to expand at a significant CAGR in the coming years. Intracorporeal lithotripsy is a powerful device based on pneumatically driven projectiles that strike a metallic probe placed endoscopically on a calculus. The probe is passed in a rigid endoscopic way and placed on the stone. This equipment works better when used with a rigid endoscope and is associated with stone migration throughout the treatment. Moreover, intracorporeal lithotripsy devices come in various types, such as ballistic, ultrasonic, and laser lithotripters, enhancing the accessibility.

The kidney stones segment held the largest share of the lithotripsy devices market in 2024. This is mainly due to the increased prevalence of kidney stones. Lithotripsy devices manage kidney stones by delivering shock waves or ultrasonic energy to the stone. These shock waves break stones into very small pieces, which can then pass through urine. With the heightened awareness among people about the benefits of minimally invasive procedures, the adoption of lithotripters has increased for treating kidney stones, which bolstered the growth of the segment.

The pancreatic stones segment is expected to grow at the fastest rate during the forecast period. Lithotripsy devices also find applications in treating pancreatic stones. Lithotripsy is considered the first-line treatment for complex or large stones. Pancreatic stones are sequelae of chronic pancreatitis, resulting in frequent hospitalizations, poor quality of life, and potential economic burden. Extracorporeal shock waves can be applied to pancreatic stones, enhancing surgical effectiveness and patient outcomes.

The hospitals segment dominated the lithotripsy devices market in 2024. This is mainly due to the easy availability of a range of lithotripsy devices, attracting a large base of patients. Hospitals often have trained healthcare staff, encouraging patients to perform surgical procedures in these settings. Moreover, the availability of other essential devices like ultrasound or X-ray in these settings makes it easier to optimize the success rate of lithotripsy, enhancing patient outcomes. The rise in hospital admissions associated with kidney stones further bolstered the segment.

The ambulatory surgical centers segment is anticipated to register the fastest growth during the forecast period. This is mainly due to the rapid shift toward outpatient healthcare facilities for surgical procedures. Ambulatory surgical centers (ASCs) often provide personalized care, reducing the risk of complications and attracting more patients. Moreover, these settings offer cost-effective treatments than hospitals and provide same-day surgery, reducing the need for hospitalization.

By Type

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

February 2025