January 2025

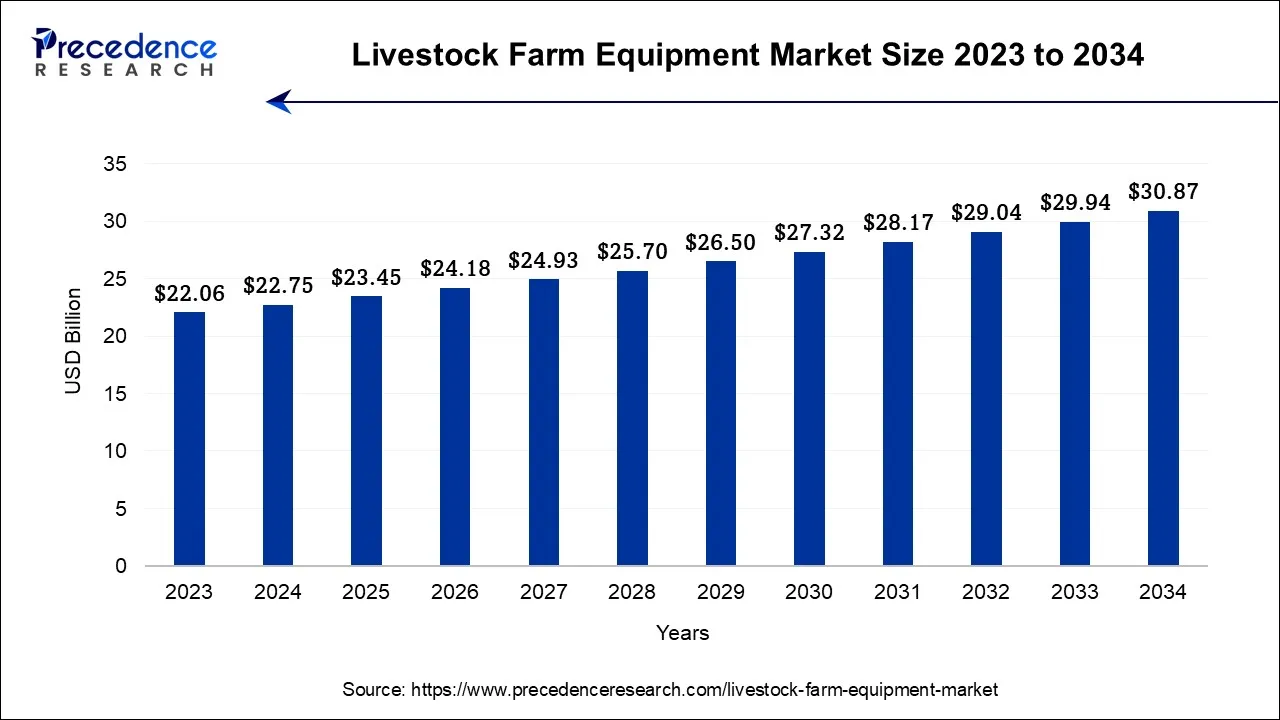

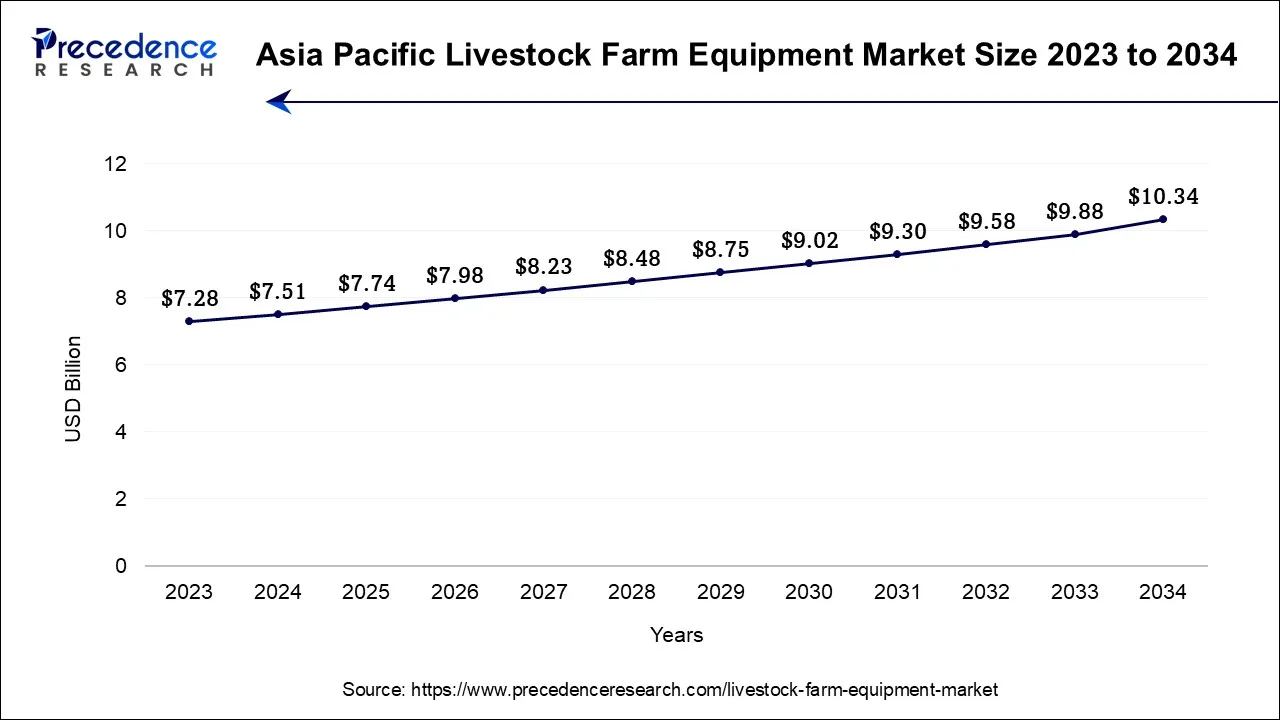

The global livestock farm equipment market size is calculated at USD 22.75 billion in 2024, grew to USD 23.45 billion in 2025, and is predicted to hit around USD 30.87 billion by 2034, poised to grow at a CAGR of 6.8% between 2024 and 2034. The Asia Pacific livestock farm equipment market size accounted for USD 14.86 billion in 2024 and is anticipated to grow at the fastest CAGR of 7.07% during the forecast year.

The global livestock farm equipment market size is expected to be valued at USD 22.75 billion in 2024 and is anticipated to reach around USD 30.87 billion by 2034, expanding at a CAGR of 6.8% over the forecast period from 2024 to 2034.

The Asia Pacific livestock farm equipment market size is accounted for USD 7.51 billion in 2024 and is projected to be worth around USD 10.34 billion by 2034, poised to grow at a CAGR of 6.97% from 2024 to 2034.

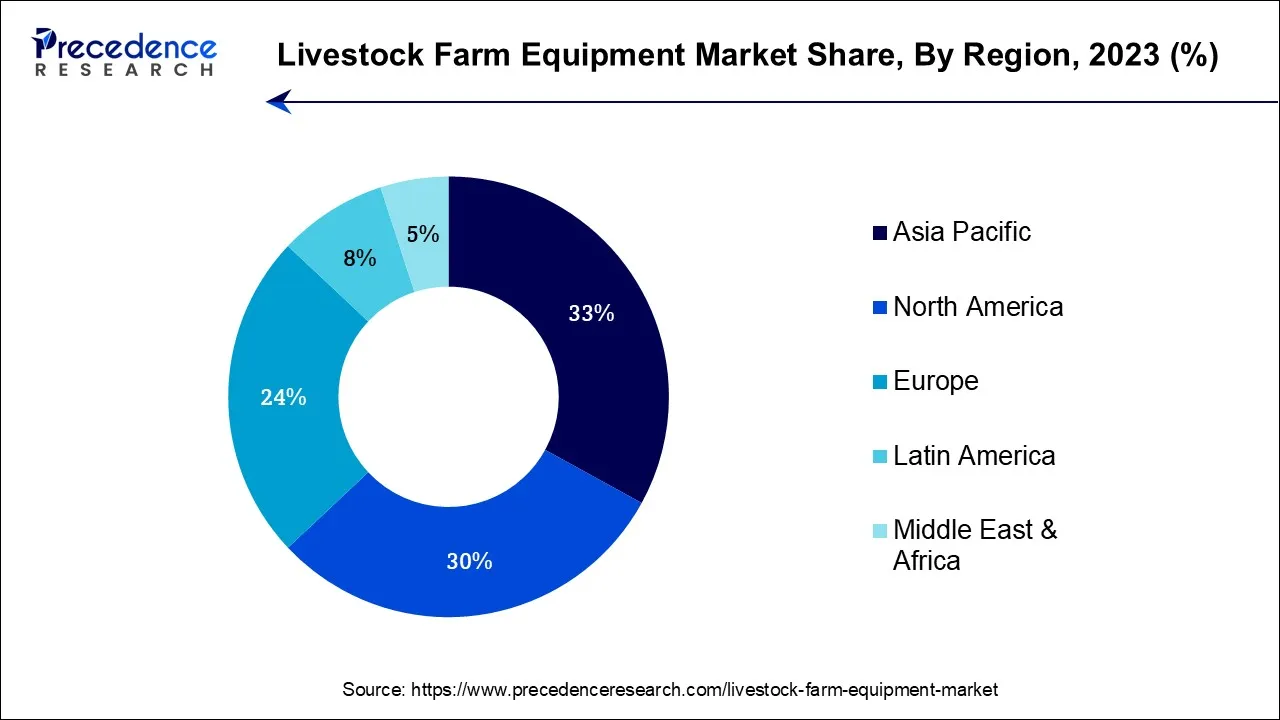

Asia-Pacific has held the largest revenue share of 33% in 2023. In the Asia-Pacific region, the livestock farm equipment market is experiencing significant trends. The growing demand for high-quality animal products, driven by rising incomes and urbanization, fuels the adoption of advanced livestock equipment. Automation and digitalization are on the rise, enhancing farm productivity. Apart from this in Asia-Pacific, the trend of sustainable and eco-friendly farming practices has led to the adoption of equipment that reduces environmental impact. As the region continues to modernize its agriculture sector, the livestock farm equipment market is projected to witness substantial growth.

Europe is estimated to observe the fastest expansion. In Europe, the livestock farm equipment market is witnessing several key trends including a growing emphasis on animal welfare and sustainable farming practices, driving demand for equipment that enhances livestock comfort and reduces environmental impact. The adoption of precision livestock farming techniques, including IoT and data analytics, is on the rise, improving operational efficiency. Moreover, the pandemic has accelerated the adoption of remote monitoring and automation technologies, further fueling the market's growth in the region.

Moreover, in the LAMEA (Latin America, Middle East, and Africa) region, the livestock farm equipment market is witnessing significant trends. The adoption of modern livestock farming practices is growing, driven by rising meat and dairy consumption. The market is also influenced by sustainability concerns, with an emphasis on eco-friendly equipment. Additionally, technological advancements, such as IoT integration for remote monitoring, are gaining traction, improving farm management efficiency. Overall, the LAMEA region is experiencing a shift toward advanced and sustainable livestock farming practices.

The livestock farm equipment market is poised for continuous growth, as Livestock farmers are increasingly investing in equipment that provides better living conditions for animals, reduces stress, and minimizes the environmental impact of farming practices. These considerations align with evolving consumer preferences for ethically produced and sustainable animal products. In addition, there is rising demand for animal-derived products such as meat, dairy, and eggs, such factors heightened demand necessitates higher levels of efficiency and productivity in livestock farming operations, spurring the adoption of advanced farm equipment.

Technological advancements play a pivotal role in the market's expansion. Automation and data-driven solutions have become integral components of modern livestock farming. Smart feeding systems, automated milking machines, and sensor-based monitoring devices enhance productivity, reduce labor costs, and optimize resource utilization, contributing to overall profitability. Furthermore, government initiatives and regulations promoting sustainable farming practices and the adoption of advanced technologies encourage farmers to invest in modern livestock farm equipment. Grants, subsidies, and incentives provided by governments further stimulate market growth.

Moreover, the globalization of the food supply chain and the need for efficient livestock operations to meet export requirements and international quality standards fuel the demand for advanced equipment. The integration of data analytics and precision agriculture techniques into livestock farming practices enhances decision-making, animal health management, and resource optimization. As the world grapples with increasing population and food security concerns, the Livestock Farm Equipment Market remains a vital component in addressing the challenges of sustainable, efficient, and responsible animal farming.

| Report Coverage | Details |

| Market Size in 2024 | USD 22.75 Billion |

| Market Size by 2034 | USD 30.87 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.1% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Precision livestock farming, automation, and IoT integration

Precision livestock farming (PLF) is propelling market demand in the livestock farm equipment market. PLF leverages advanced technologies such as IoT sensors and data analytics to monitor and manage livestock with precision. Farmers benefit from real-time insights into animal health, behavior, and feeding patterns. This not only enhances productivity and animal welfare but also optimizes resource utilization. The demand for PLF-driven equipment is rising as farmers seek to modernize operations, maximize efficiency, and meet sustainability goals. Moreover, automation and IoT integration drive market demand in the livestock farm equipment sector by enhancing operational efficiency and animal management. IoT sensors and smart devices monitor livestock health, feeding, and environmental conditions in real time, enabling timely interventions and resource optimization. This not only boosts productivity but also reduces labor costs and enhances animal welfare, making such equipment indispensable for modern, data-driven livestock farming practices.

High initial investment and compatibility issues

The high initial investment required for livestock farm equipment poses a significant restraint on market demand. Many farmers, especially small-scale and resource-constrained operations, may find it challenging to afford the upfront costs associated with advanced equipment. This financial barrier can deter potential buyers from adopting modern farming technologies, limiting their ability to improve efficiency and productivity. Reduced affordability can hinder market growth and widen the technology gap between well-funded and less-resourced farms.

Moreover, compatibility issues in the livestock farm equipment market can hinder market demand by creating complexities for farmers. When equipment from different manufacturers is not seamlessly interoperable, it can lead to inefficiencies, increased costs, and operational disruptions. Farmers may hesitate to invest in equipment that doesn't integrate smoothly into their existing systems, delaying adoption and potentially opting for more compatible solutions or delaying upgrades, affecting market growth.

Data analytics and remote monitoring services

Data analytics surge market demand for livestock farm equipment by providing actionable insights into animal health, behavior, and productivity. Farmers can make informed decisions, optimize feeding regimes, detect diseases early, and improve overall management. This enhances efficiency, reduces operational costs, and increases yield. As the demand for sustainable and efficient livestock farming practices grows, equipment with data analytics capabilities becomes indispensable, driving its adoption and fueling market growth.

Moreover, remote monitoring services elevate market demand in the livestock farm equipment market by offering farmers real-time oversight of livestock operations. These services provide valuable data on animal health, feeding patterns, and environmental conditions, enabling proactive decision-making and preventing potential issues. This not only improves animal welfare but also enhances operational efficiency and profitability. Farmers increasingly recognize the benefits of these services, which foster higher adoption rates of advanced equipment integrated with remote monitoring capabilities.

According to the product type, the feed equipment held a 23.5% revenue share in 2023. Feed equipment in the livestock farm equipment market includes tools and machinery designed for the efficient handling, storage, and distribution of animal feed. This encompasses feed mixers, silos, conveyors, and automated feeding systems. A key trend is the integration of digital technology, allowing precise control of feed portions and monitoring of consumption. This minimizes wastage, enhances nutrition management, and ultimately improves livestock health and productivity, aligning with modern farming practices that prioritize resource efficiency and sustainability.

The housing equipment sector is anticipated to expand at a significant CAGR of 4.6% during the projected period. Housing equipment in the livestock farm equipment market refers to structures and systems designed for sheltering and managing livestock. This includes barns, pens, feeding and watering systems, and ventilation solutions. Trends in this segment involve the integration of automation and IoT technologies to create smart and climate-controlled housing. Additionally, there is a growing focus on sustainability, with equipment designed for efficient resource utilization and eco-friendly materials, aligning with the broader agricultural industry's move towards environmentally responsible practices.

Based on the end users, poultry farm is anticipated to hold the largest market share of 38.3% in 2023. Poultry farming involves the rearing of domesticated birds, primarily chickens, ducks, turkeys, and geese, for their meat, eggs, and feathers. In the Livestock Farm Equipment Market, poultry farms represent a significant end-user segment. Trends in this segment include a growing focus on automation, biosecurity measures, and sustainability. Equipment such as automated feeders, climate control systems, and disease monitoring technologies are increasingly adopted to enhance poultry welfare, productivity, and farm profitability while reducing environmental impact.

On the other hand, the dairy farm sector is projected to grow at the fastest rate over the projected period. Dairy farms are livestock farming operations primarily focused on the production of milk and dairy products. They house and manage dairy cattle, utilizing specialized equipment for milking, feeding, and animal health. In the Livestock Farm Equipment Market, trends related to dairy farms include the increasing adoption of automated milking systems, data-driven herd management solutions, and precision feeding equipment. These trends aim to enhance milk production efficiency, improve animal welfare, and align with sustainability goals in the dairy industry.

Market Segmentation

By Product Type

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024