April 2025

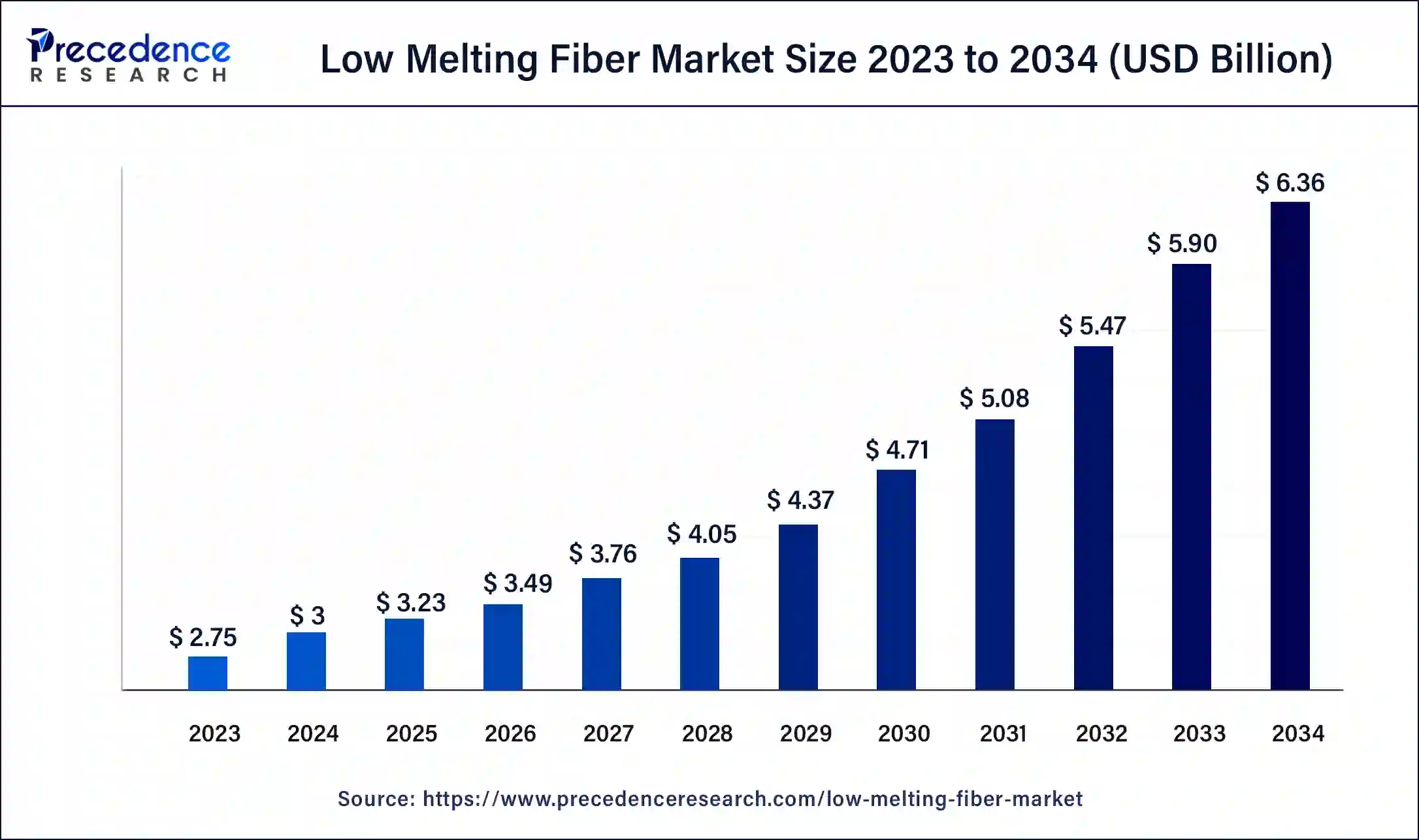

The global low melting fiber market size was USD 2.75 billion in 2023, calculated at USD 3 billion in 2024 and is projected to surpass around USD 6.36 billion by 2034, expanding at a CAGR of 7.8% from 2024 to 2034.

The global low melting fiber market size accounted for USD 3 billion in 2024 and is expected to be worth around USD 6.36 billion by 2034, at a CAGR of 7.8% from 2024 to 2034.

Low-melting fiber is produced by spinning ordinary polyester and modified polyester. This low-melting fiber can be melted at temperatures ranging between 900 C to 2200 C. This type of fiber is suitable for applications requiring hot-melt adhesion and thermal bonding. Low melting fiber provides outstanding bonding properties. Thus, it can be used with other fibers. The increasing need for nonwoven textiles and increasing adoption in the apparel sector contribute to the market growth. Additionally, growing awareness and preference for sustainable materials and the rising demand for lightweight materials are further anticipated to boost the growth of the market during the forecast period.

| Report Highlights | Details |

| Market Size in 2023 | USD 2.75 billion |

| Market Size in 2024 | USD 3 billion |

| Market Size by 2034 | USD 6.36 billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Increasing demand for mattress

Low-melting fiber is used to produce comfortable mattresses, as it has more effective properties than its alternatives, such as cotton, wood, and others. Additionally, there is a significant increase in mattress demand in various sectors, such as education, corporate, commercial, hospital, and others, thus driving the demand for low-melting fiber. Moreover, low-melting fiber is used in nonwoven fabrics and automotive textiles. Thus, the rising demand from the automotive and textile industries further drives the market.

Disposal and recycling issues

While low-melting fibers are beneficial in terms of biodegradability and recycling, their appropriate disposable and recycling require specific procedures and facilities, which may create challenges. Additionally, fluctuations in raw materials costs, such as polypropylene and polyester, may impact manufacturing costs, thus hindering the growth of the market.

Rising demand for recycled low-melting fibers

The demand for recycled low-melting fibers is increasing due to the growing awareness about environmental sustainability. Moreover, the rapid shift of consumers toward more sustainable clothing is a major contributor to the increasing demand for recycled low-melting fibers. Thus, key players are focusing on manufacturing recycled fibers to innovate and compete in the market. For instance,

The mattress segment accounted for the largest market share in 2023. The increasing demand for mattresses in several sectors, such as commercial buildings, residential buildings, hostels, restaurants, and hospitals contributed to the segmental growth. Additionally, mattress made with low-melting fiber provides greater comfort and resistance to bed bug plagues.

Asia pacific dominated the market with the largest share in 2023. The market dominance is mainly attributed to the increasing demand for low-melting fibers in various industries, such as the automotive, construction, and bedding. The rising industrialization in emerging countries, such as India, China, and Japan, along with the rapid expansion of the construction, textile, and automotive industries contributed to the regional market growth.

The market in Asia Pacific is anticipated to expand at the fastest growth rate during the projection period. This growth is primarily attributed to the rising demand for lightweight materials. Furthermore, the rising demand for low-melting fibers in the textile and construction industries propels the market.

Major Market Segments Covered

By Type

By Application

By Geography

Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

January 2025

January 2025