February 2025

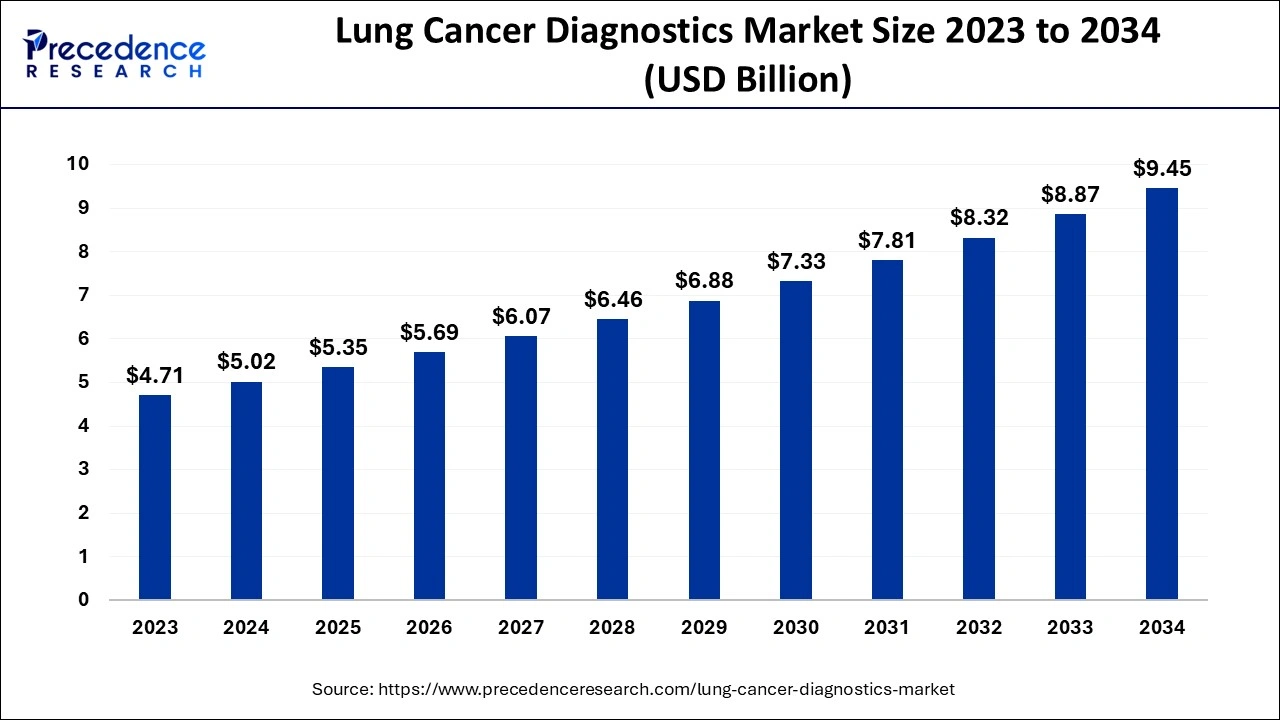

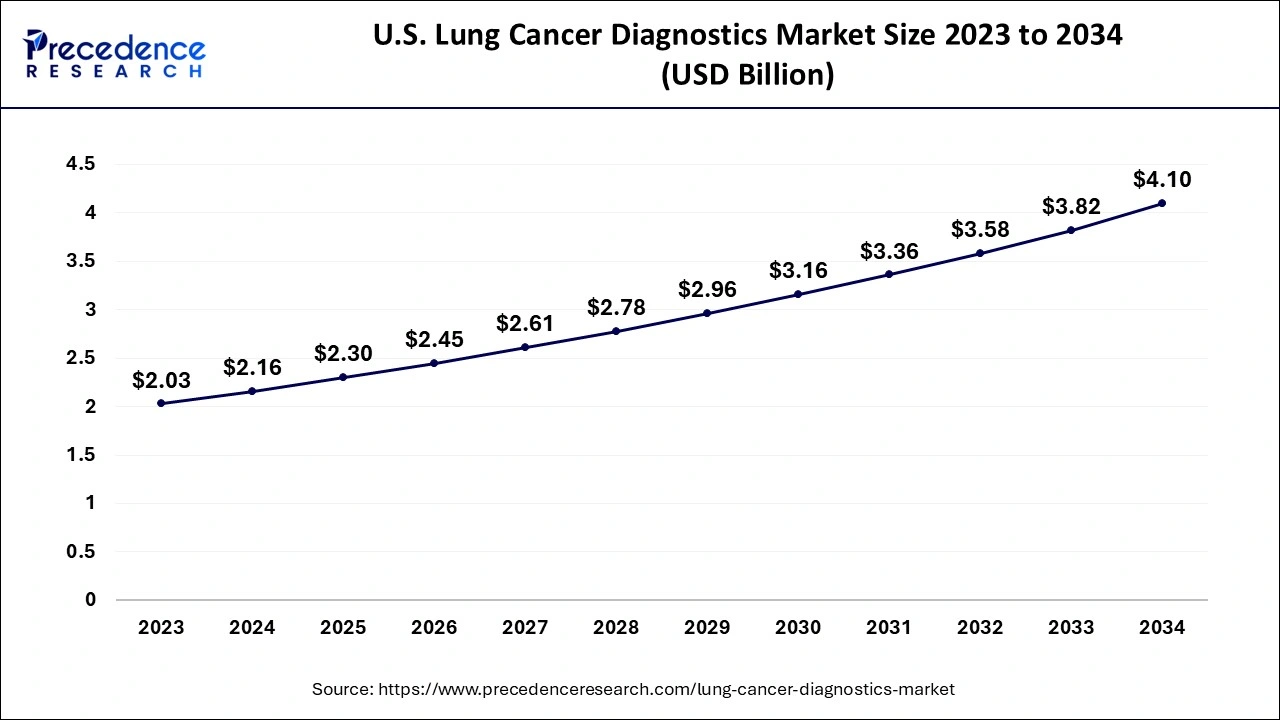

The global lung cancer diagnostics market size is estimated at USD 5.02 billion in 2024, grew to USD 5.35 billion in 2025 and is predicted to surpass around USD 9.45 billion by 2034, expanding at a CAGR of 6.53% between 2024 and 2034. The North America lung cancer diagnostics market size accounted for USD 2.38 billion in 2024 and is anticipated to grow at a fastest CAGR of 6.54% during the forecast year.

The global lung cancer diagnostics market size accounted for USD 5.02 billion in 2024 and is anticipated to reach around USD 9.45 billion by 2034, expanding at a CAGR of 6.53% between 2024 and 2034. surge in active smokers and unhealthy lifestyles is the key factor driving the growth of the market. Also, the increasing demand for innovative diagnostic tools and services in imaging technologies like CT scans can fuel market growth further.

The U.S. lung cancer diagnostics market size is estimated at USD 5.02 billion in 2024 and is expected to be worth around USD 9.45 billion by 2034, growing at a CAGR of 6.53% from 2024 to 2034.

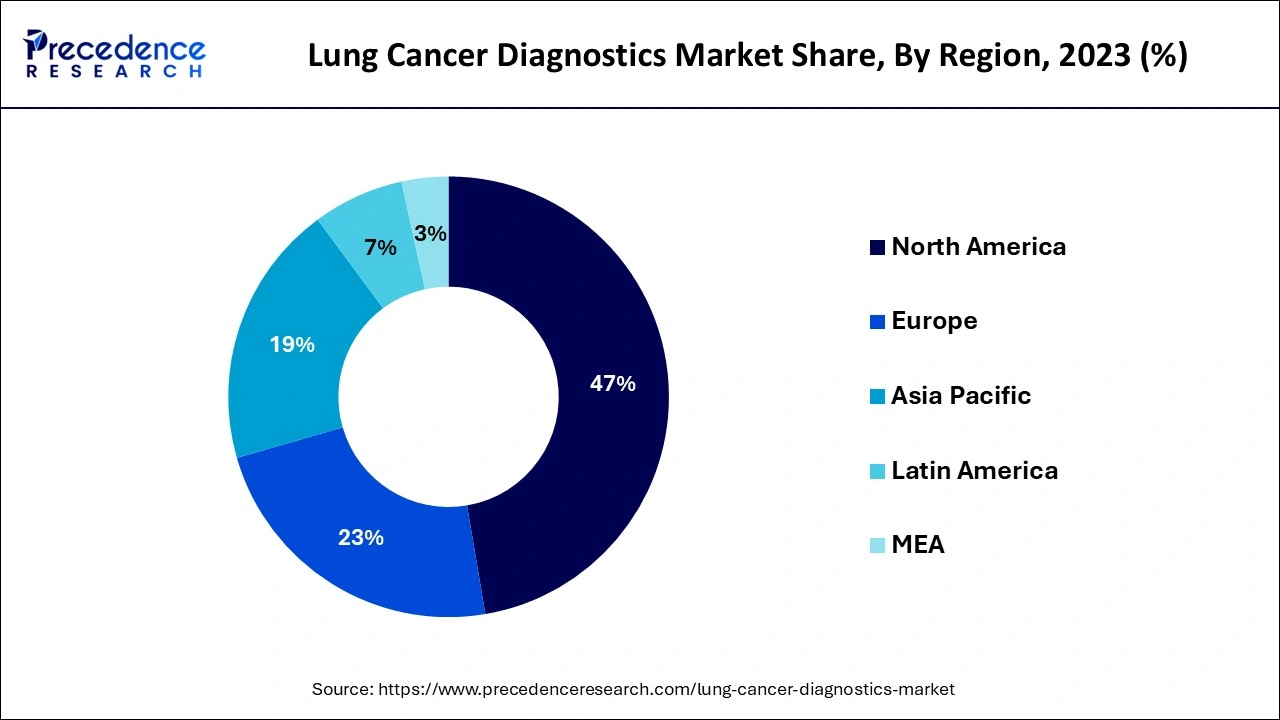

North America dominated the lung cancer diagnostics market in 2023. The dominance of the region can be attributed to the developed healthcare infrastructure, extensive reimbursement regulations, and high healthcare spending for diagnosis of cancer. Moreover, the healthcare industry in the region has experienced an increase in patient pool, due to poor diet habits, unhealthy lifestyles, and growing cases of stage-IV lung cancer in many individuals.

Asia Pacific region is expected to show significant growth over the studied period. The growth of the region can be credited to the increasing adoption of innovative diagnostics technologies and growing prevalence of lung cancer in the region. Furthermore, the market is ready to expand because of awareness programs arranged by healthcare organizations and government for early cancer detection.

Lung cancer is a type of tumour that emerges in the tissues of the lungs typically in the lining of the alveoli. It is mainly caused by frequent exposure to substances like asbestos, cigarette smoke, and air pollution. There are two main types of lung cancers non-small cell lung cancer NSCLC) and small cell lung cancer (SCLC) each has different properties and treatment options. Symptoms may include shortness of breath, chest pain, persistent cough and, coughing up blood.

Role of AI in lung cancer diagnostics

Artificial Intelligence (AI) can analyze CT scans to detect symptoms associated with lung cancer and analyze a patient's risk of developing lung cancer in the futrue.AI can also be utilised to help radiologists interpret CT scans. Furthermore, AI can find patterns in DNA fragments in the blood that are related to lung cancer. This can directly lead to detecting lung cancer at an early stage and can also help recommend probable drug candidates for further treatment.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.45 Billion |

| Market Size in 2024 | USD 5.02 Billion |

| Market Size in 2025 | USD 5.35 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Test, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing awareness of early detection and screening

As public education campaigns increase awareness about potential risk factors for lung cancer such as environmental pollutants and smoking, peoples are more anticipated to look for preventive healthcare measure like regular screenings. Additionally, the advocacy efforts by various medical organizations can further optimize awareness prompting medical providers to prioritize lung cancer diagnosis and screening in their practice.

Availability of Alternative Diagnostic Methods

The availability of more cost-effective and accessible alternative diagnostic practices can impact market growth negatively. Some potential alternative diagnostic methods are NGS sequencing, Blood-based screening, and Targeted DNA enrichment methods. However, most current diagnostic techniques only detect lung cancer in a much-advanced stages, when cure and treatment may not be that effective.

Increasing Demand for Specialized Diagnostic Solutions

The risk of developing lung cancer rises as people age fuelling the demand for screening programs and diagnostic tests specific to ageing population. The elderly population often witnesses comorbidities and has unique healthcare requirements. Furthermore, the increasing geriatric population in many regions, especially in developed countries creates a lucrative opportunity for lung cancer diagnostics.

The non-small cell lung cancer (NSCLC) segment led the lung cancer diagnostics market in 2023. The dominance of the segment can be attributed to the increasing need for targeted drug therapy, imaging, and immunotherapy treatment options. NSCLC is further categorised into adenocarcinoma, squamous cell carcinoma and large cell carcinoma. In addition, NSCLC is the most common kind of lung cancer that takes place in people who have a long history of smoking.

The small-cell lung cancer (SCLC) is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the growing technological developments in SCLC treatment options such as biopsy, imaging, and bronchoscopy. SCLSC is further categorized into small-cell carcinoma and combined small-cell carcinoma. Patients who have shared history of disease in the family are more prone to developed SCLC conditions.

The EGFR mutation tests segment dominated the lung cancer diagnostics market in 2023.The dominance of the segment can be credited to the increasing demand for biomarker testing, treatment options and clinical assessment for EGFR. Untreated EGFR rapidly incorporates the tumour cells in the individuals, which is a factor for the occurrence of lung cancer in people irrespective of their stage. Moroever, ,liquid biopsy has increasingly become convenient tool l in metastatic settings.

The HER2 test segment is anticipated to grow at the fastest rate during the forecast period. the HER2 test measures the quantity of the human epidermal growth factor receptor 2 (HER2) protein in a cancer cell. HER2 is a protein that controls cell growth and differentiation for normal cell growth. Other treatment solutions like pills that inhibit HER2 from growing in the body are gaining traction among healthcare professionals, leading to segment growth further.

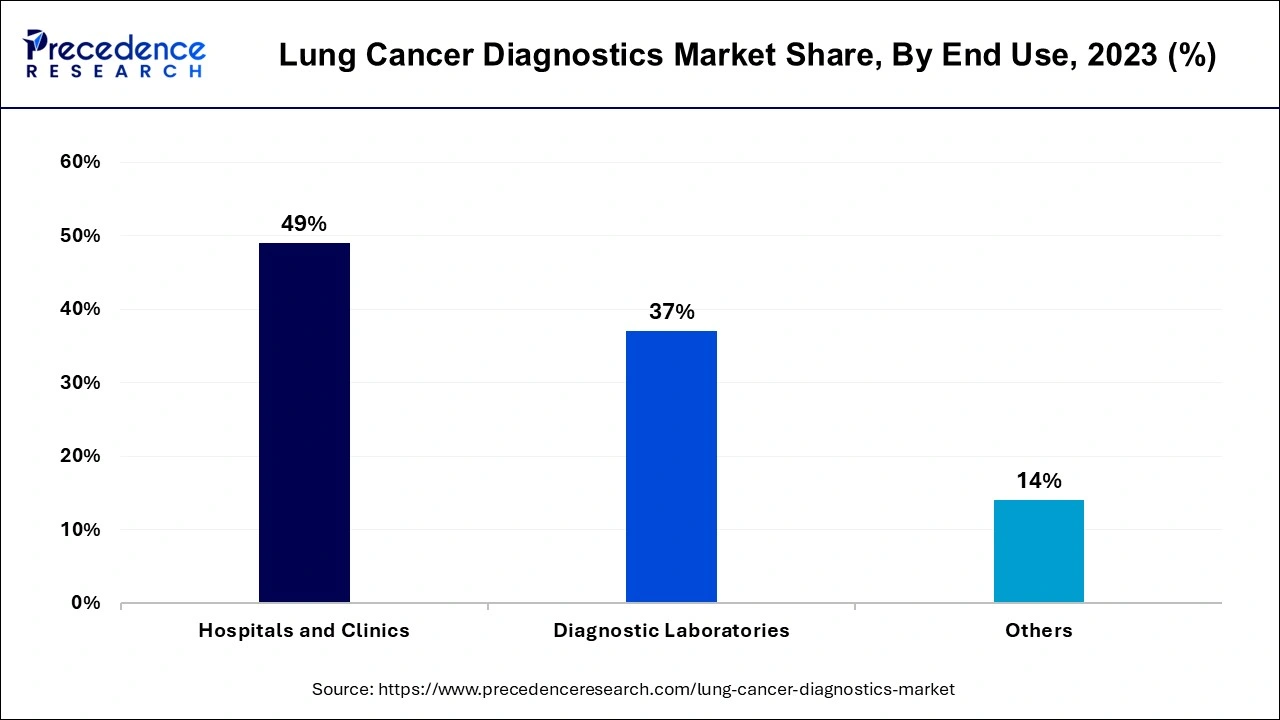

In 2023, the hospitals and clinics segment led the lung cancer diagnostics market by holding largest market share. The dominance of the segment can be driven by facilities with advanced imaging technologies and superior diagnostic tools offered by hospitals and clinics for precise detection of lung cancer. Furthermore, they also possess multidisciplinary groups of pathologists, radiologists, and oncologists to achieve treatment goals. This segment is the main facility for administering complicated treatments including chemotherapy and surgical procedures.

The diagnostic laboratories segment is anticipated to show the fastest growth over the projected period. The growth of the segment can be linked to the increasing contribution of the laboratories in detecting and treating cancer coupled with the personalised treatment plan offered by them based on the patient profile. The laboratory tests comprise ultrasound, X-rays, MRI & CT scans, and PET scans among others.

Segments Covered in the Report

By Type

By Test

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

October 2024

September 2024