February 2025

The global lung stent market size surpassed USD 189.60 million in 2023 and is estimated to increase from USD 211.46 million in 2024 to approximately USD 629.72 million by 2034. It is projected to grow at a CAGR of 11.53% from 2024 to 2034.

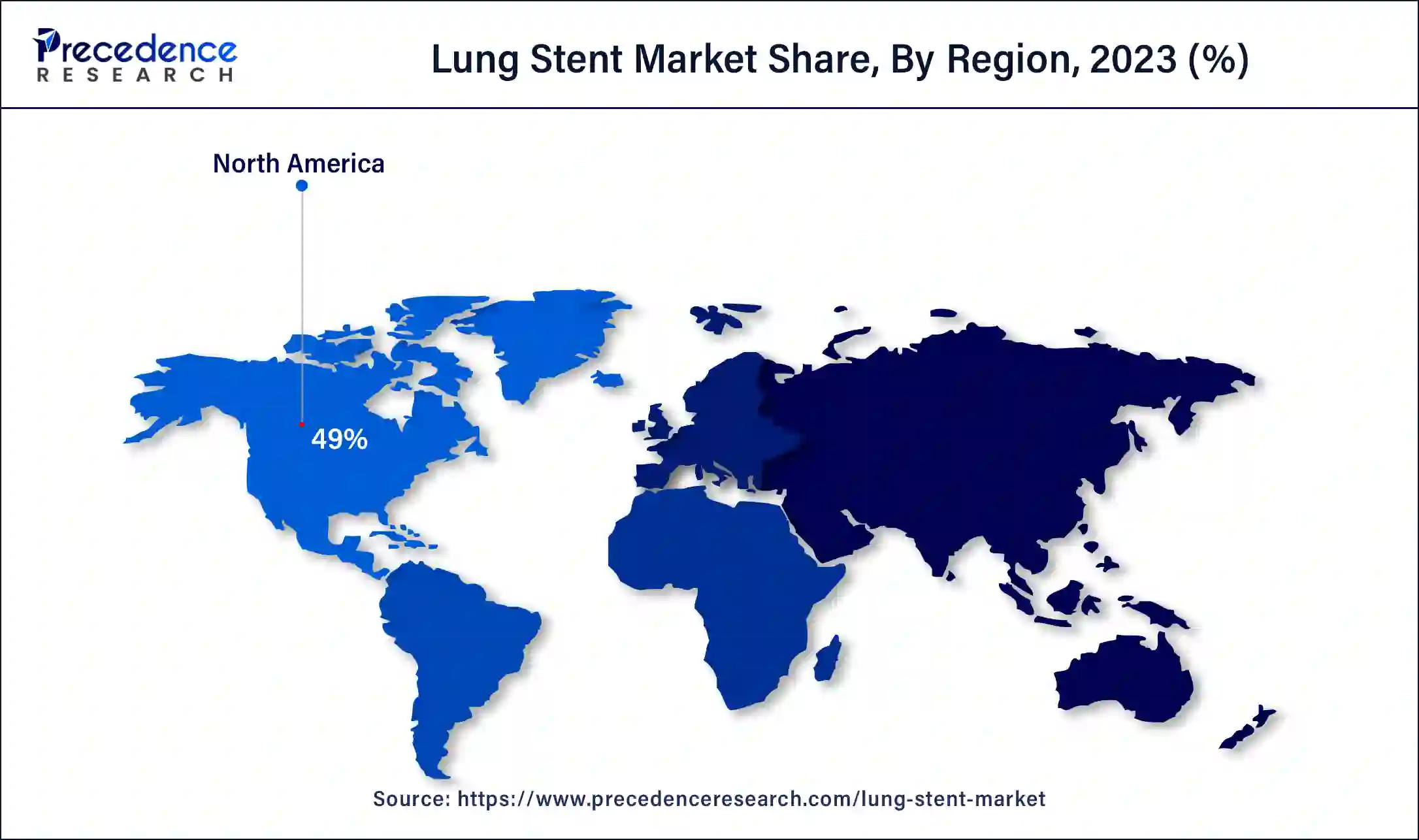

The global lung stent market size is projected to be worth around USD 629.72 million by 2034 from USD 211.46 million in 2024, at a CAGR of 11.53% from 2024 to 2034. The North America lung stent market size reached USD 92.90 million in 2023 The rising investment by private and public organizations for the development of the non-vascular stent is driving the growth of the market. The growing number of lung-related disorders is increasing the demand for lung stents.

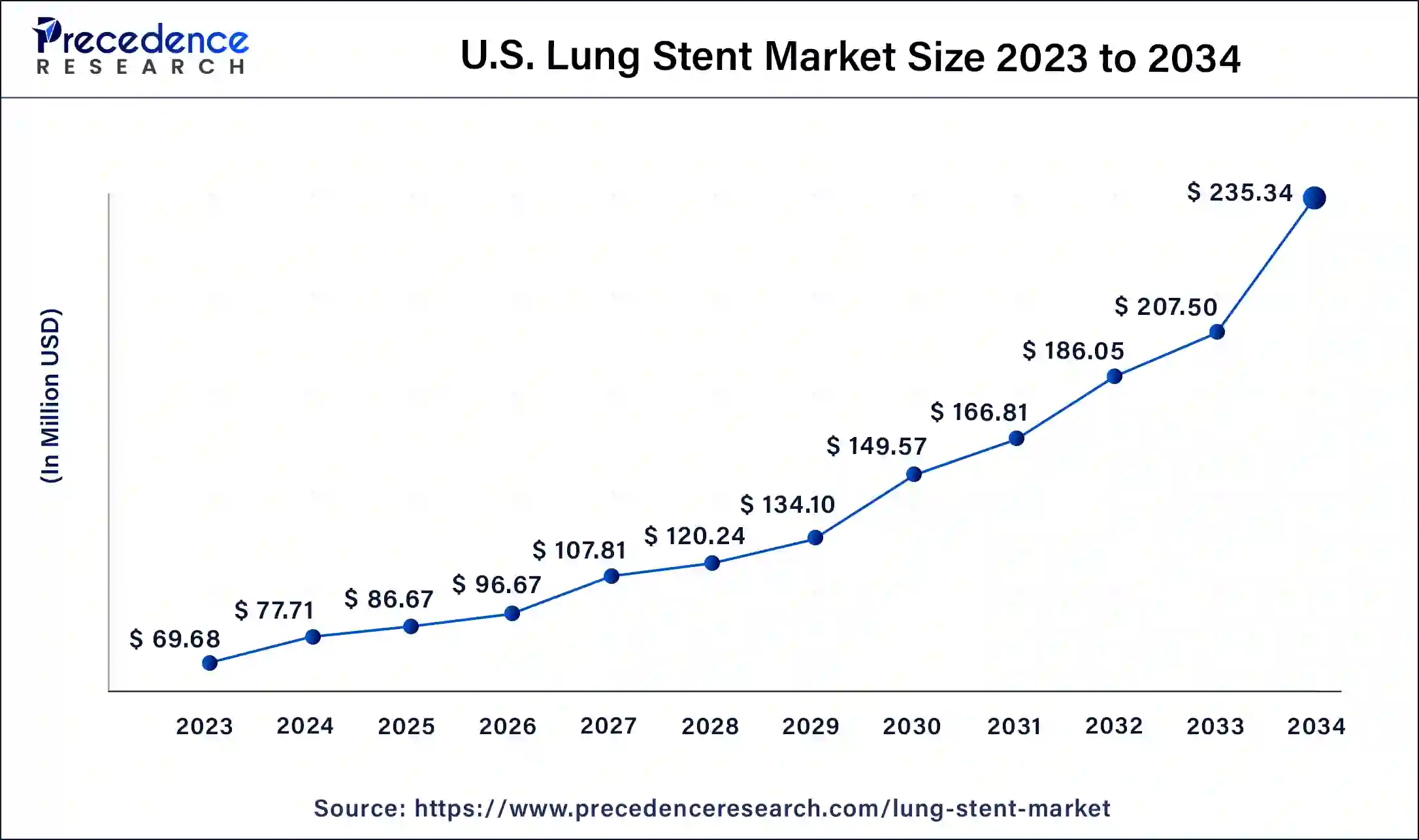

The U.S. lung stent market size was exhibited at USD 69.68 million in 2023 and is projected to be worth around USD 235.34 million by 2034, poised to grow at a CAGR of 11.70% from 2024 to 2034.

North America dominated the lung stent market in 2023. The increase in hospitalizations for respiratory diseases contributes to the growth of the market in the North American region. The high healthcare investment, renowned healthcare infrastructure, and the presence of leading medical device industries drive the market growth. The robust focus on research and development led to a novel product launch for the expansion of the market.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. Rapidly developing economies like India and China contribute to the growth of the lung stent market in the Asia-Pacific region. The high investment opportunities, expanding healthcare infrastructure, rising healthcare expenditures, increasing preference for minimally invasive procedures in patients, improving reimbursement policies, and regulatory guidelines contribute to the market’s growth.

The lung stent market refers to buyers and sellers of lung stents, which are small mesh tubes that are inserted into the lung airways of the lungs by a minor procedure known as bronchoscopy. A lung stent is a hollow tube that is placed in the airways to help breathe and open a narrowed area. It may be placed in either the bronchi or trachea, depending on the narrowing area. The stent can be used to treat narrowed airways in the lungs because of many procedures or conditions, including diseases or infections that may cause congenital conditions, swelling, or other problems that press on the lungs.

How is AI Revolutionizing the Lung Stent?

The use of artificial intelligence (AI) in the lung stent plays a significant role in the growth of the lung stent market. The benefits of AI-based lung stents include improved diagnosis and planning; AI-based lung stents help to analyze imaging data to identify accurate locations and better extent of airway obstructions. AI can process a high amount of patient data to modify treatments. AI-based tools can improve stent placement accuracy. AI can predict complications by analyzing patient data and historical outcomes.

| Report Coverage | Details |

| Market Size by 2034 | USD 629.72 Million |

| Market Size in 2023 | USD 189.6 Million |

| Market Size in 2024 | USD 211.46 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Products, Material, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing prevalence of lung cancer

The increasing prevalence of lung cancer demands treatments, which contribute to the growth of the lung stent market. The causes of lung cancer include cigarette smoking; there are chances of getting lung cancer for non-smokers, also. Cigarette smoke enters the lung, which causes lung tissue damage. It also includes radiation therapy, a family history of lung cancer, asbestos, and other heavy metals like selenium, cadmium, etc., which can also increase the risks. Air pollution and radon gas may also cause lung cancer, which needs lung stents for the treatment of disorders.

Presence of alternative treatments

The presence of alternative treatments and other disadvantages like strict regulations, blood vessels may collapse, side effects of medicated coatings on the lung stents, formation of scar tissue around the lung stents, procedure-related issues like damage to blood vessels on the lung stent blood clot formation, allergic reactions due to lung stent material, etc. can hamper the lung stent market growth. Problems with living with a stent include lung infection, which may possibly be a risk from an airway stent; mucus may form in the stent and block it.

Development of resorbable and biodegradable stents

The development of resorbable and biodegradable stents is an opportunity for the growth of the lung stent market. The benefits of biodegradable stents include no permanent metal, no more lifelong dedication to a metal stent, the fact that it allows the artery to regain its ability to dilate and constrict naturally, preservation options, etc. Most biodegradable or resorbable stents are made of a naturally dissolvable material, polylactic acid, which is used in medical implants to dissolve sutures.

The tracheal stents segment dominated the lung stent market in 2023. Tracheal and laryngeal stents are made from hollow and solid materials to prevent the airway lumen collapse. These stents help to stabilize the surgical reconstructions of the trachea or larynx and expand areas mechanically that are affected by tumor encroachment or scar tissue. It is treated with surgery to remove the narrowed area of the trachea or stretch trachea. The artificial tracheal stent’s structure and material may be selected from many options as a proper way to get over the lack of grafted tissue. These artificial tracheal stents can help the growth of the market and signaling molecules that support the development of cells, tissue, proliferation, and differentiation.

The bronchial stents segment is expected to be the fastest-growing during the forecast period. The benefits of bronchial stent benefits include disease or many disease complications that can block or narrow the airway, causing it to feel short of breath, which helps the growth of the lung stent market. If one of the bronchi is narrowed, the bronchial stent may be used to enhance that narrowing, and hence, it helps to enhance breathing. The insertion of bronchial stent feels that this is the best option.

The hybrid segment dominated the lung stent market in 2023. The benefits of hybrid lung stents include these are advanced medical devices, robotic hybrid coronary revascularization combined coronary stents to enhance long-term survival, better appearance due to those incisions leaving less visible scars, faster recovery, less time in the hospital, ICU, and more freedom to resume daily activities, lower risks of complications like reduced infection risk and bleeding, less pain due to smaller incisions mean less discomfort which contributes to the growth of the market.

The silicon segment is estimated to be the fastest-growing during the forecast period. Silicone-based lung stents play a significant role in managing many respiratory diseases, which contributes to the lung stent market. The benefits of silicone-based lung stents include airway restoration, customization of silicone lung stents for each patient, which helps to ensure better outcomes and enhanced patient comfort, innovations in 3D printing silicone stents, safe imaging, minimally invasive procedures, clinical improvement, etc.

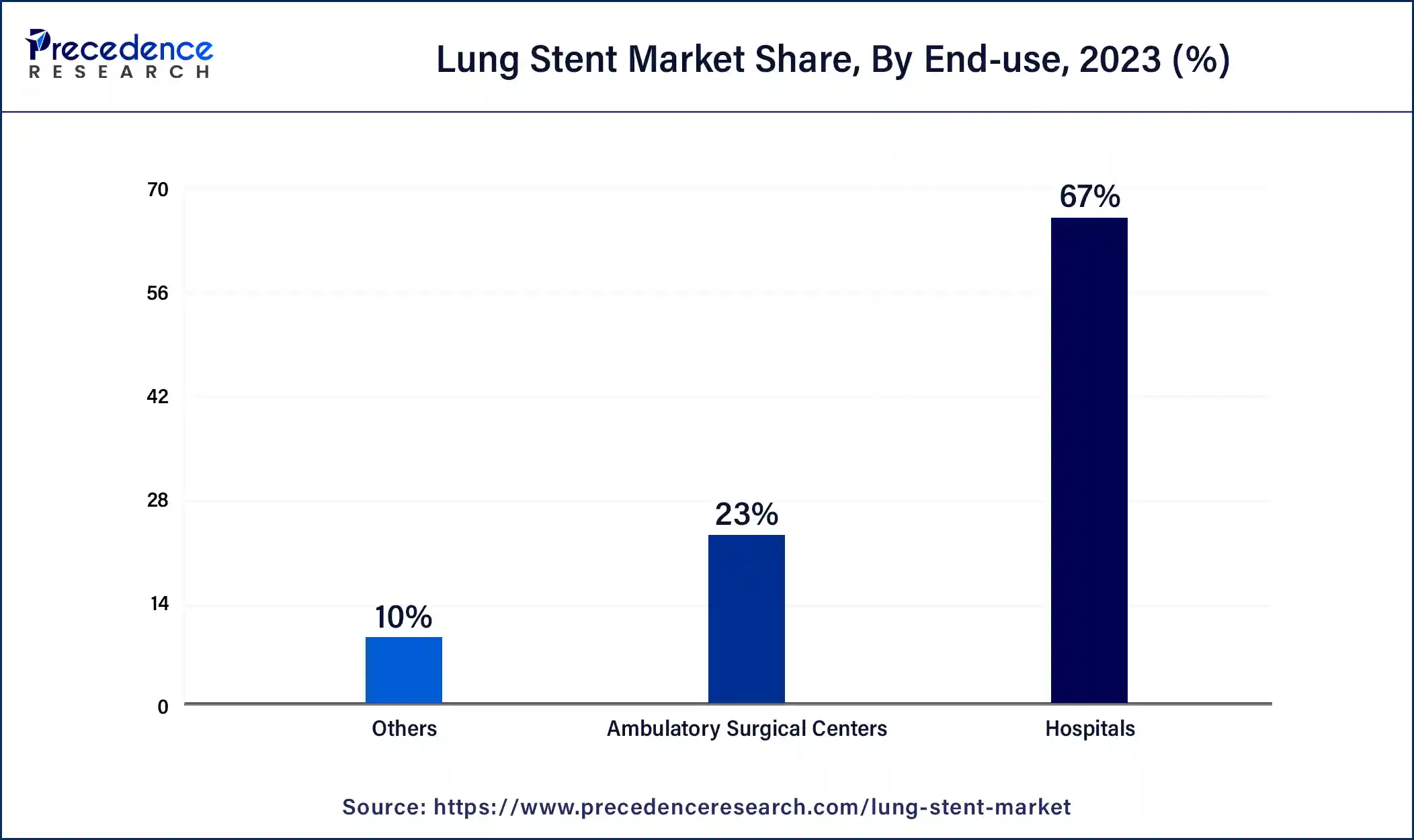

The hospitals segment dominated the lung stent market in 2023. The benefits of lung stents include allowing people to breathe more easily or allowing blood and other fluids to continue flowing freely through the body. People may require a stent placement because of lung cancer, heart attack, or other conditions that affect passageways in the body. The benefits of hospitals include health insurance, life insurance, flexible spending accounts, retirement plans, time off, family medical leave, extended sick leave, work/life balance programs, etc.

The ambulatory surgical centers segment is anticipated to be the fastest-growing during the forecast period. The ambulatory surgical centers offer many benefits, including less time-intensive procedures carried out at a lower cost, cost savings of 45-60% compared to hospitals, predictable scheduling, more personalized care, high patient satisfaction, efficiency, etc., contributing to the growth of the lung stent market.

Segments Covered in the Report

By Products

By Material

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

October 2024

November 2024