September 2024

Machine Safety Market (By Component: Safety Sensors, Safety Interlock Switches, Safety Controller, Others; By Implementation: Individual, Embedded; By Industry Vertical: Oil and Gas, Healthcare, Automotive, Metals & Mining, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2034

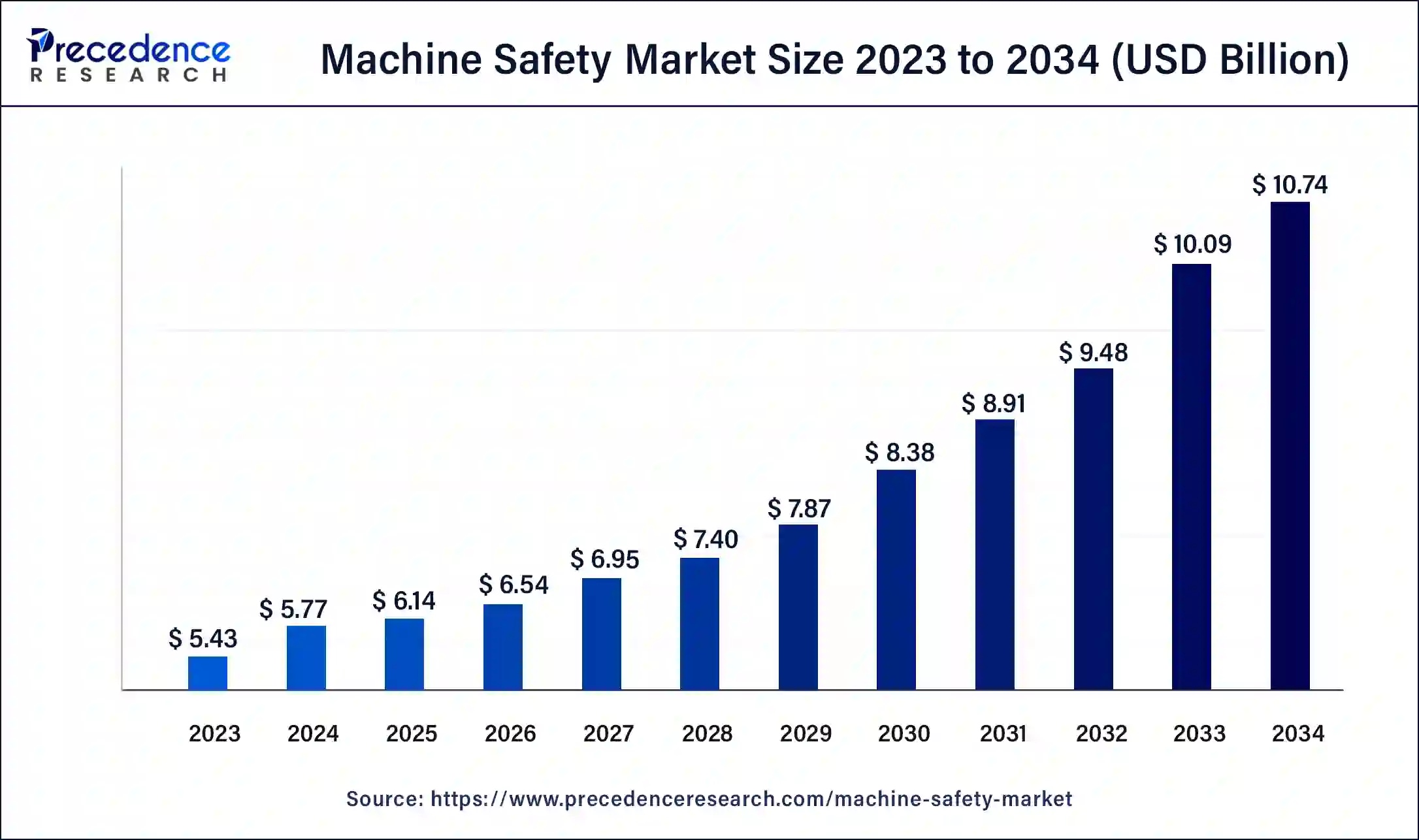

The global machine safety market size was USD 5.43 billion in 2023, accounted for USD 5.77 billion in 2024, and is expected to reach around USD 10.74 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034. The North America machine safety market size reached USD 2.06 billion in 2023.

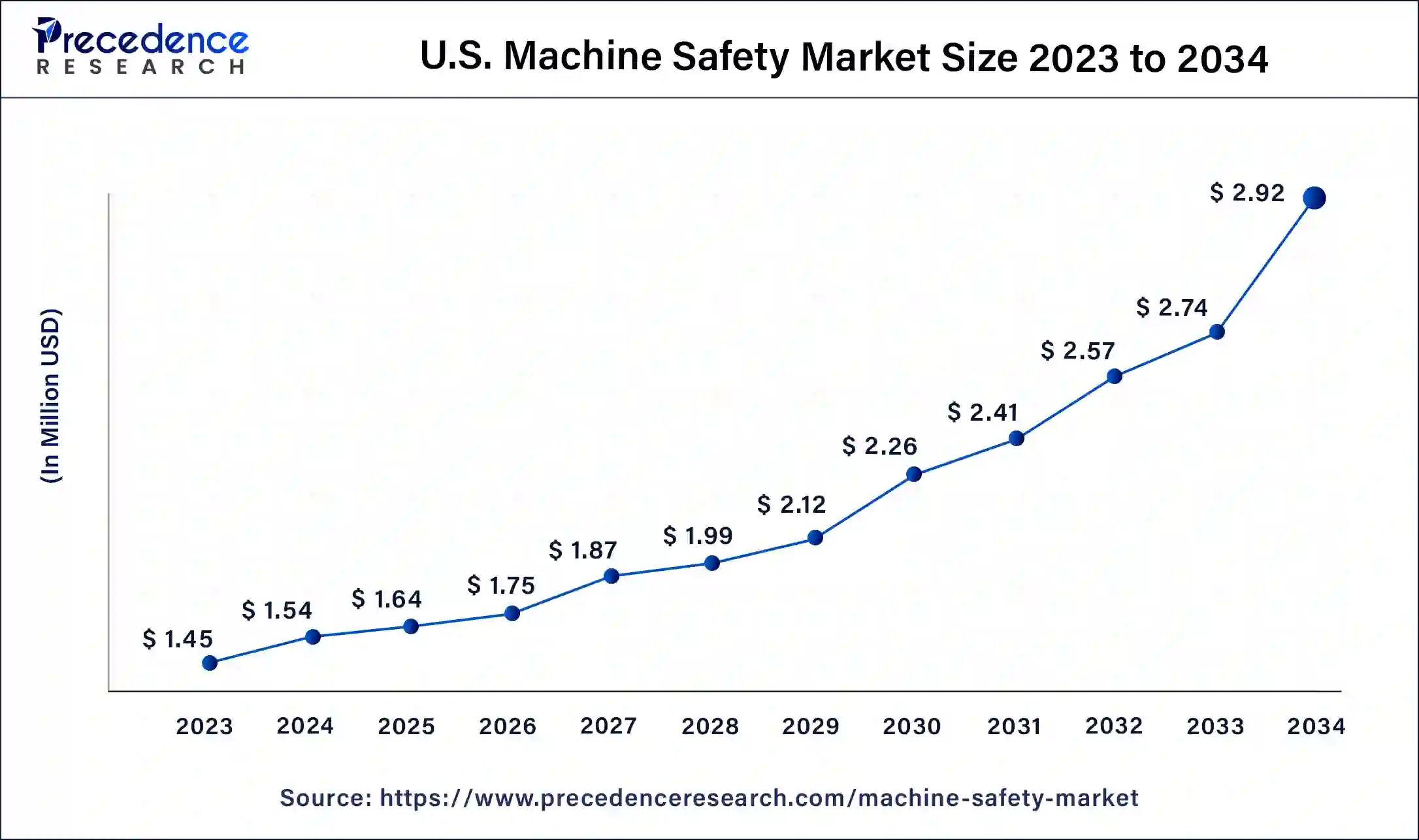

The U.S. machine safety market size was estimated at USD 1.45 billion in 2023 and is predicted to be worth around USD 2.92 billion by 2034, at a CAGR of 5.9% from 2024 to 2034.

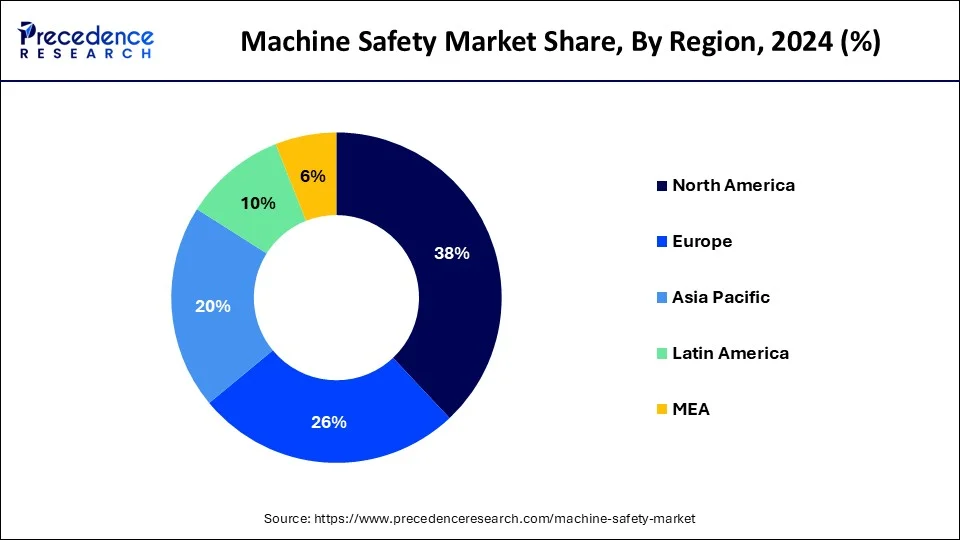

North America has held the largest revenue share of 38% in 2023. North America has well-established safety standards and regulations that mandate the implementation of machine safety measures in various industries. Compliance with these standards, such as those set by OSHA (Occupational Safety and Health Administration) in the United States and similar regulatory bodies in Canada, is a key driver for the adoption of machine safety solutions. The market is driven by the region's industrialization, technological advancements, and a strong focus on workplace safety. The market encompasses a wide range of industries, including manufacturing, automotive, healthcare, oil and gas, and other factors.

Asia-Pacific is estimated to observe the fastest expansion. With a diverse range of industries and increasing industrialization in several countries, the demand for machine safety measures has been on the rise across the region. APAC includes key economies such as China, Japan, India, South Korea, and others, each contributing to the growth of the machine safety market in its own way. Several countries in the Asia-Pacific region are undergoing rapid industrialization, leading to an increased deployment of machinery and automation. This industrial growth creates a demand for effective machine safety solutions to protect workers and assets.

The Europe machine safety market has been experiencing growth in response to the strong focus on industrial safety standards and regulations. The region includes major economies such as Germany, France, the United Kingdom, Italy, and others, each contributing significantly to the growth and development of the machine safety sector. Europe has a robust regulatory framework for workplace safety, with organizations such as the European Agency for Safety and Health at Work (EU-OSHA) setting guidelines. Stringent safety standards and regulations drive the adoption of machine safety solutions across industries.

Machine safety refers to the implementation of measures, practices, and technologies designed to minimize or eliminate risks associated with the operation of machinery and equipment in industrial settings. The primary goal of machine safety is to protect individuals, property, and the environment from harm or damage that may result from the use of machines. It is crucial in various industries, including manufacturing, construction, agriculture, and more, where the use of heavy machinery and automated systems is common. It not only protects workers and assets but also contributes to the overall efficiency and reliability of industrial processes.

Machine safety market provides solutions and systems designed to ensure the safety of machinery and equipment in various industrial settings. It encompasses a range of technologies, devices, and practices that are implemented to mitigate risks associated with the operation of machinery. The machine safety market is driven by the increasing emphasis on workplace safety, regulatory requirements, and the growing adoption of automation in various industries. It serves a wide range of sectors, including manufacturing, automotive, oil and gas, food and beverage, pharmaceuticals, and more.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.20% |

| Market Size in 2023 | USD 5.43 Billion |

| Market Size in 2024 | USD 5.77 Billion |

| Market Size by 2034 | USD 10.74 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Implementation, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing incidence of workplace accidents

The escalating incidence of workplace accidents is a compelling driver propelling the demand for the machine safety market. As industries grapple with a surge in accidents and occupational hazards, the imperative to prioritize and enhance workplace safety becomes increasingly pronounced. The tangible consequences of these accidents, ranging from injuries to fatalities and equipment damage, underscore the pressing need for effective safety measures. This surge in workplace incidents serves as a catalyst for organizations to reevaluate their safety protocols and invest in advanced machine safety solutions.

The machine safety market offers a strategic response to this growing challenge, providing technologies such as safety sensors, controllers, and comprehensive safety systems. By adopting these solutions, industries aim to mitigate risks, ensure compliance with stringent regulations, and ultimately safeguard the well-being of their workforce. The increasing recognition that a proactive approach to safety not only mitigates human suffering but also enhances operational efficiency and protects against financial liabilities is a pivotal factor driving the sustained demand for machine safety technologies in the contemporary industrial landscape.

High initial costs

The machine safety market faces a significant restraint in the form of high initial costs associated with the adoption of advanced safety solutions. The substantial upfront investment required for acquiring and implementing machine safety technologies, including safety sensors, controllers, and integrated systems, poses a considerable financial challenge for organizations. This financial barrier is particularly pronounced for small and medium-sized enterprises (SMEs) with limited budgets, hindering their ability to embrace comprehensive safety measures. The perceived high cost of entry may lead some businesses to prioritize immediate production goals over long-term safety benefits, especially when the return on investment (ROI) is not immediately apparent. Additionally, the integration of these safety systems into existing machinery can involve complex processes, necessitating specialized knowledge and potentially causing disruptions to regular operations during implementation.

As a result, the reluctance to incur substantial initial expenses may impede the widespread adoption of machine safety measures, despite their potential to mitigate workplace accidents and enhance overall safety standards. Addressing this challenge may involve strategies such as cost-effective solutions, financial incentives, and educational efforts to emphasize the long-term benefits and ROI of investing in machine safety technologies.

The integration of machine safety solutions with Industry 4.0 initiatives

The integration of machine safety solutions with Industry 4.0 initiatives represents a pivotal opportunity, positioning the machine safety market at the forefront of industrial innovation. As Industry 4.0 transforms manufacturing into smart, interconnected systems, machine safety plays a crucial role in enhancing overall operational efficiency and safety standards. By seamlessly incorporating machine safety into the broader framework of Industry 4.0, organizations can leverage real-time data analytics, predictive maintenance, and collaborative human-robot interactions. Smart sensors and advanced connectivity enable continuous monitoring of safety parameters, allowing for proactive identification and mitigation of potential hazards. This integration not only enhances worker safety but also contributes to the optimization of production processes.

Furthermore, Industry 4.0's emphasis on data-driven decision-making aligns with the goals of machine safety, offering opportunities for the development of intelligent safety systems. These systems can dynamically adapt to changing operational conditions, ensuring a responsive and adaptive safety environment. The convergence of machine safety with Industry 4.0 not only future-proofs industrial operations but also opens avenues for innovation, creating safer and more efficient workplaces. As industries increasingly recognize the synergies between safety and smart manufacturing, the integration of machine safety solutions with Industry 4.0 initiatives is poised to drive significant advancements and opportunities within the machine safety market.

In 2023, the safety sensors segment had the highest market share of 47% on the basis of the component. Safety sensors are fundamental components that detect changes in the environment, such as the presence of objects or personnel in hazardous zones. These sensors utilize various technologies, including light curtains, laser scanners, and proximity sensors, to trigger safety responses when predefined conditions are met.

The safety interlock switches segment is anticipated to expand fastest CAGR of 8.2% over the projected period. Safety interlock switches are designed to restrict access to hazardous areas by employing mechanical or electronic locking mechanisms. These switches ensure that certain conditions, such as the closure of machine guards or doors, are met before machinery can operate, preventing potential accidents caused by unauthorized access.

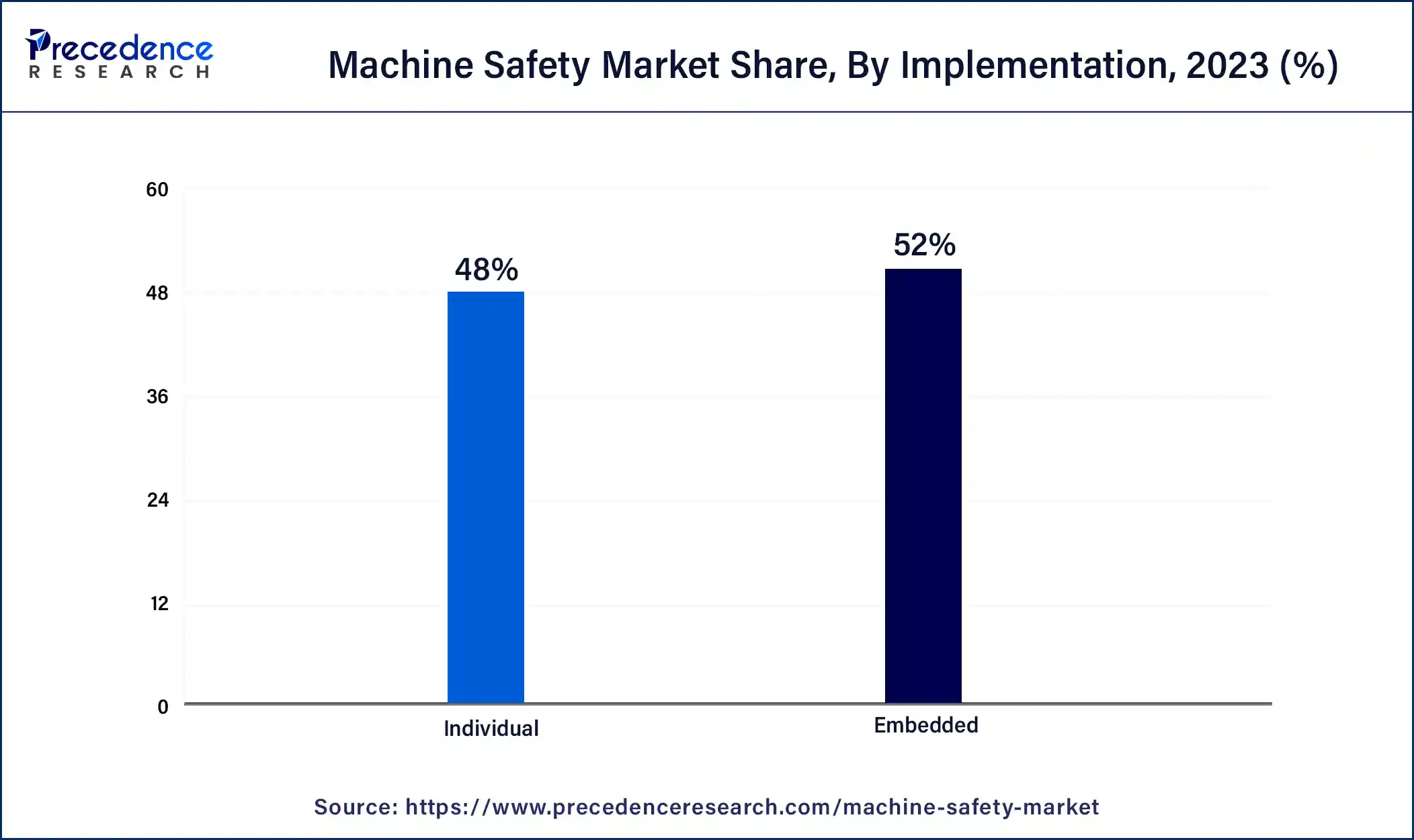

In 2023, the embedded segment had the highest market share of 52% on the basis of implementation. Embedded implementation involves the integration of safety features directly into the design and control systems of industrial machinery. Safety functions are inherently embedded within the overall automation and control architecture. It offers a streamlined and cohesive safety solution, reducing the complexity associated with standalone safety components. It provides a more integrated and automated response to safety hazards.

The individual segment is anticipated to expand fastest over the projected period. Individual implementation refers to the standalone integration of machine safety solutions into existing industrial setups. In this approach, safety components, such as sensors, controllers, and switches, are added as separate entities dedicated to safety functions. This method allows for a modular and flexible implementation where safety features are independently added to specific machines or processes. It is often chosen when retrofitting existing machinery or when a specific machine requires additional safety measures. It provides a targeted and customizable approach, allowing organizations to enhance safety selectively where needed without affecting the entire system.

In 2023, the automotive segment had the highest market share of 45% on the basis of the industry vertical. The automotive industry faces safety challenges related to the operation of heavy machinery, robotic assembly lines, and automated manufacturing processes. Emphasis is on preventing collisions, injuries, and ensuring worker safety. Safety sensors, light curtains, and emergency stop systems are crucial in automotive manufacturing to halt machinery when safety parameters are breached.

The metal & mining segment is anticipated to expand at the fastest CAGR of 8.3% over the projected period. The metals and mining sector involves heavy machinery, conveyor systems, and material handling equipment, presenting risks such as equipment entanglement, falling objects, and cave-ins. Machine safety measures include safety controllers, interlock switches, and proximity sensors to enhance worker safety during mining, processing, and transportation activities.

Segments Covered in the Report

By Component

By Implementation

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

October 2024

December 2024