January 2025

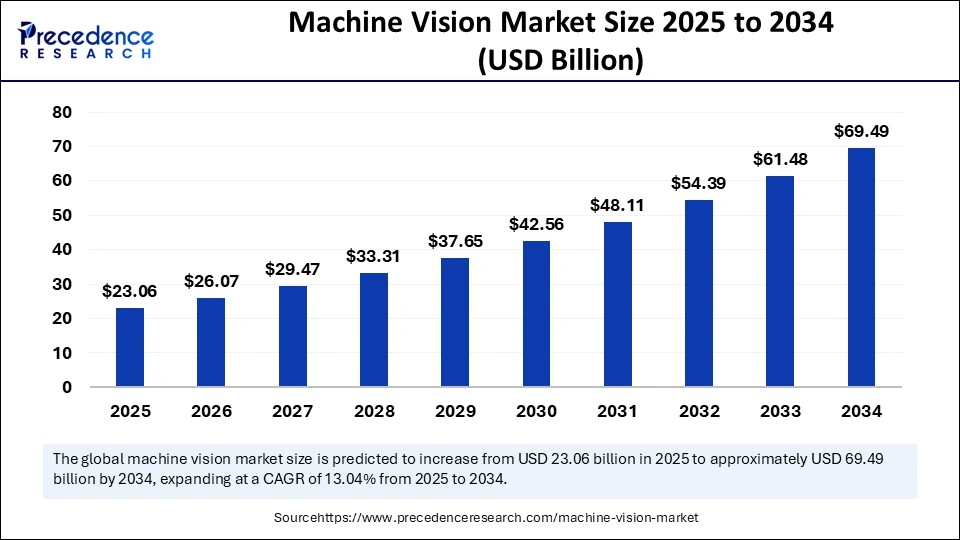

The global machine vision market size is calculated at USD 23.06 billion in 2025 and is forecasted to reach around USD 69.49 billion by 2034, accelerating at a CAGR of 13.04% from 2025 to 2034. The Asia pacific market size surpassed USD 8.98 billion in 2024 and is expanding at a CAGR of 13.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global machine vision market size accounted for USD 20.4 billion in 2024 and is predicted to increase from USD 23.06 billion in 2025 to approximately USD 69.49 billion by 2034, expanding at a CAGR of 13.04% from 2025 to 2034. The growing need for productivity and quality inspection is the key factor driving market growth. Also, the rise in implementation of innovative technologies by major players, coupled with the rising need for machine vision systems, can fuel market growth further.

Artificial intelligence is extensively revolutionizing the machine vision system market by improving its abilities in pattern recognition, adaptive learning, and image processing. AI-powered machine systems can perform tasks such as object recognition, defect detection, and visual inspection with higher efficiency and accuracy.

Furthermore, AI algorithms can adapt to changes in object shape, lighting, and surface texture, which makes them more robust and flexible in various environments.

In February 2025, Focoos AI, an Italian spin-off of Politecnico di Torino, incubated by I3P and part of the ESA BIC Turin incubation program, announced the closing of a seed investment round of € 2.65 million. The funding is led by Galaxia, the Italian National Technology Transfer Hub of CDP Venture Capital dedicated to aerospace, which participates with a follow-on compared to the previous pre-seed investment, as well as PiemonteNext.

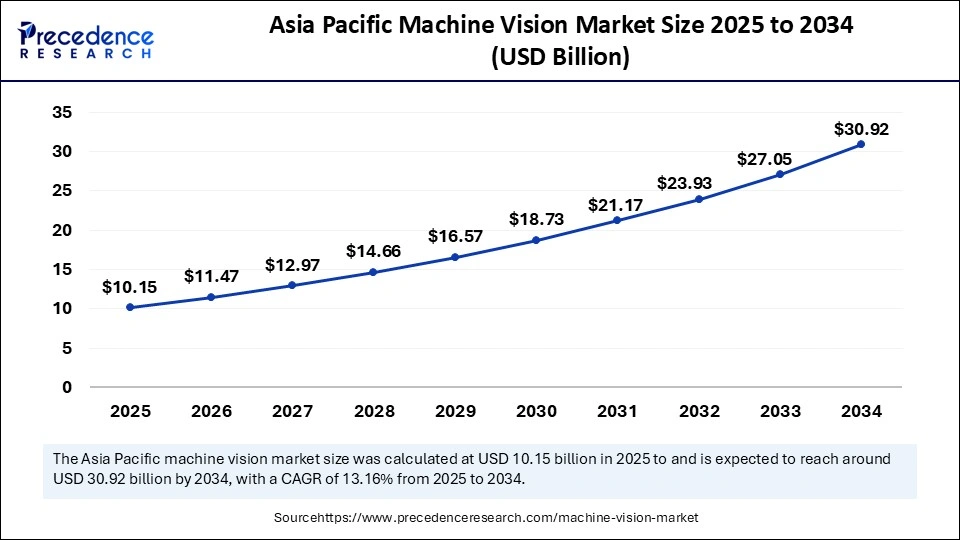

The Asia pacific machine vision market size was exhibited at USD 8.98 billion in 2024 and is projected to be worth around USD 30.92 billion by 2034, growing at a CAGR of 13.16% from 2025 to 2034.

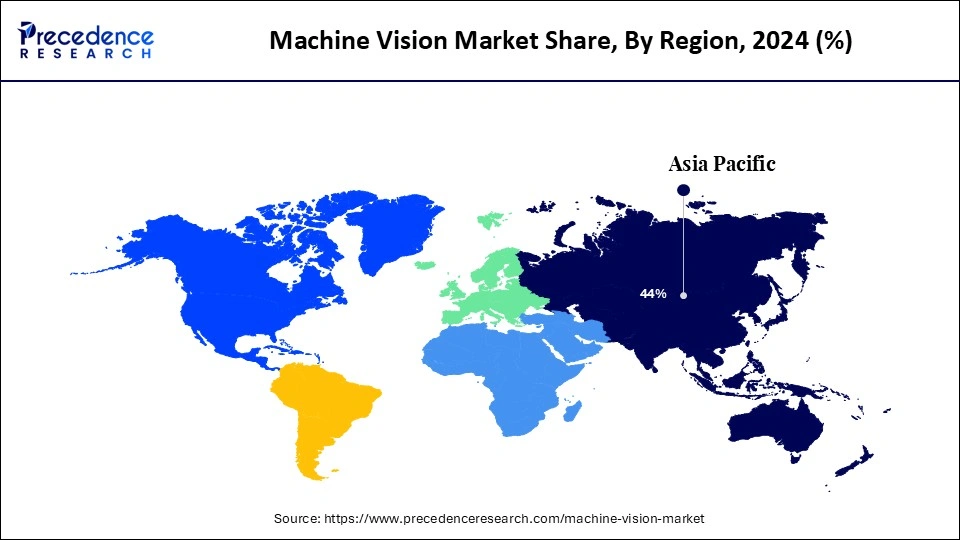

Asia Pacific dominated the machine vision market in 2024. The dominance of the region can be attributed to the ongoing industrialization and production expansion, especially in emerging economies like China, Japan, India, and Taiwan. Moreover, the market will likely experience growth opportunities in pharmaceutical, packaging, automotive, and other industrial applications. The growing emphasis on smart manufacturing practices and industry 4.0 initiatives is impacting positive regional growth soon.

In Asia Pacific, Japan led the machine vision market owing to the increasing elderly population and labor shortage, which creates hurdles for conventional manufacturing processes. Also, the growing adoption of machine vision technology is fueled by the need to keep high product standards and decrease costs.

North America is expected to grow at the fastest rate in the machine vision market over the forecast period. The growth of the region can be credited to the strong presence of major manufacturers in the region. The growth of the semiconductor industry for innovative semiconductor chipsets in MV systems is impacting positive regional growth. Furthermore, ongoing advancements in 3D technology-based systems are creating lucrative opportunities in the market shortly.

In North America, the U.S. dominated the market. The dominance of the country can be linked to the ongoing evolution of CMOS image sensors coupled with the growth in demand for automation. The key vendors are also working towards creating a 3D technology-based system, which will likely contribute to the market expansion further.

Machine vision systems are built to automate direct manufacturing and production, such as go/no-go assessments and quality control, by analyzing and examining digital images. This system integrates hardware (cameras, sensors) with software algorithms, allowing machines to make decisions based on visual data. The machine vision market is utilized in different sectors such as electronics, food and beverage, automotive, electronics, and more.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.49 Billion |

| Market Size in 2025 | USD 23.06 Billion |

| Market Size in 2024 | USD 20.4 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.04% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expansion of industry verticals

Machine vision's diversity has facilitated its extensive adoption in emerging industry verticals and other applications. Beyond its conventional use in manufacturing, this system now has applications in various sectors like healthcare, retail, agriculture, and entertainment. In addition, machine vision is rapidly being deployed in gaming and entertainment for augmented reality experiences and gesture recognition.

Lack of experienced professionals

Companies in the machine vision market are increasingly developing and deploying new applications; hence, the demand for professionals has risen substantially with the democratization of deep learning and artificial intelligence applications. This is the major challenge, affecting market growth negatively. In addition, to tackle this problem, companies such as Google and Amazon are investing internationally to grow their talent pool.

Growing demand for automation and quality inspection

The machine vision market is going to be propelled by the growing demand for automation and quality inspection across different industrial sectors. Vision system in the sector enables inspection and robotics devices to capture real-time images at stringent and complete places, which enhances overall productivity. Furthermore, the automation system, such as a logic computer, processes this data after it is collected and produces the desired output.

The hardware segment dominated the machine vision market in 2024. The dominance of the segment can be attributed to the ongoing launches of cutting-edge and innovative hardware systems. The segment includes hardware components such as image sensors, lighting systems, cameras, lenses, frame grabbers, processing units, and communication interfaces. Additionally, these components form the base of machine vision systems, optimizing the acquisition of visual data from the environment.

The software segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the growing demand for consistent and precise quality inspection, process automation, and defect detection in different industries. Also, the integration of ML and AI into vision software solutions is a key driver, allowing more simplistic image analysis and processing.

The PC-based segment led the machine vision market in 2024. The dominance of the segment can be linked to the high speed, processing power, and adaptability of PC-based systems in handling complicated machine vision tasks. PC-based systems can analyze vast amounts of data and control complex algorithms, making sophisticated analysis and inspection tasks possible. These systems are versatile and can be easily customized and upgraded to fulfill specific application requirements.

The smart camera-based segment is projected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by its automation efficiency, built-in processing abilities, and better design. The capabilities of smart cameras allow them to optimize inspection processes and enhance accuracy. Also, the growing adoption of AI-driven vision inspection systems and technological advancements in camera technology can impact positive segment growth further.

The quality assurance and inspection segment dominated the machine vision market in 2024. The dominance of the segment can be attributed to the increasing adoption of machine vision for strict quality control. Machine vision systems, using sensors, cameras, and algorithms, allow businesses to efficiently analyze products, maintain high-quality grades, and ensure compliance, which then leads to improving customer satisfaction. Machine vision helps identify contamination, defects, and production flaws for improved product quality and minimal waste.

The identification segment is estimated to show the fastest growth during the forecast period. The growth of the segment is due to the growing use of machine vision for pattern recognition, barcode scanning, and object identification. However, automation is increasingly becoming part of the business to enhance efficiency and overall machine vision-driven identification, which is changing operational workflows and supply chains across industries.

In 2024, the automotive segment led the machine vision market 2024 by holding the largest market share. The dominance of the segment is linked to the increasing need for machine vision and automated inspection in the automotive industry. The automotive sector uses machine vision to improve driver assistance systems, vehicle perception, and safety. Furthermore, the integration of machine vision algorithms for lane tracking and object detection boosts the development of autonomous vehicles.

The pharmaceuticals and chemicals segment is expected to grow at the fastest rate over the period studied. The growth of the segment can be driven by growing quality control requirements and stringent regulatory compliance. This industry is anticipated to witness a significant rise in machine vision adoption, fueled by the need for precision, automation, and efficiency in processes including label verification, defect detection, and packaging integrity.

By Offering

By Product

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024