July 2023

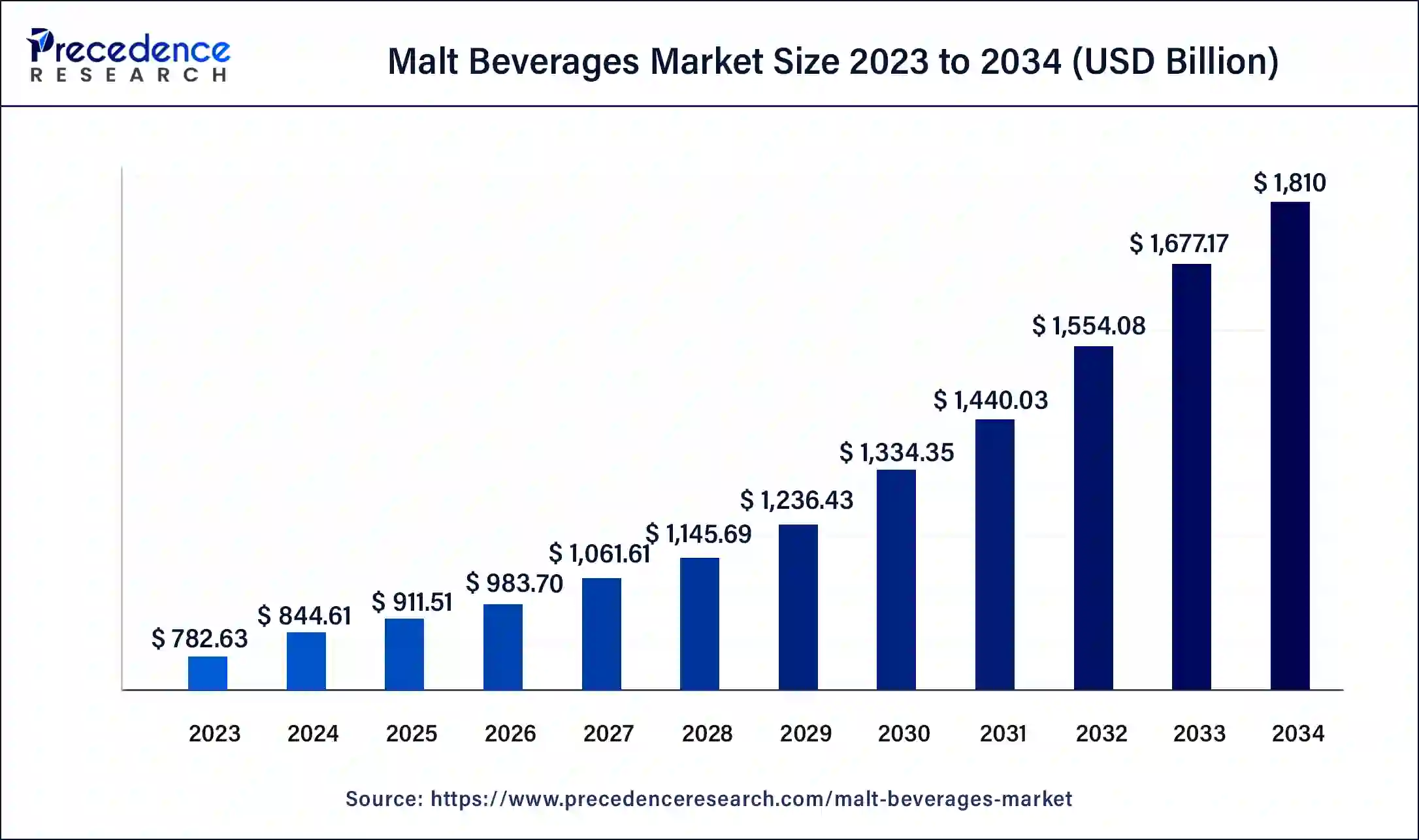

The global malt beverages market size was USD 782.63 billion in 2023, calculated at USD 844.61 billion in 2024 and is expected to be worth around USD 1,810 billion by 2034. The market is slated to expand at 7.92% CAGR from 2024 to 2034.

The global malt beverages market size is projected to be worth around USD 1,810 billion by 2034 from USD 844.61 billion in 2024, at a CAGR of 7.92% from 2024 to 2034. Consumers' preference for more diverse and innovative flavors is the key factor driving market growth. Innovative product launches such as flavored malt beverages (FMBs) and hard seltzers can fuel market growth further. Rising health consciousness among consumers is expected to boost the malt beverages market growth soon.

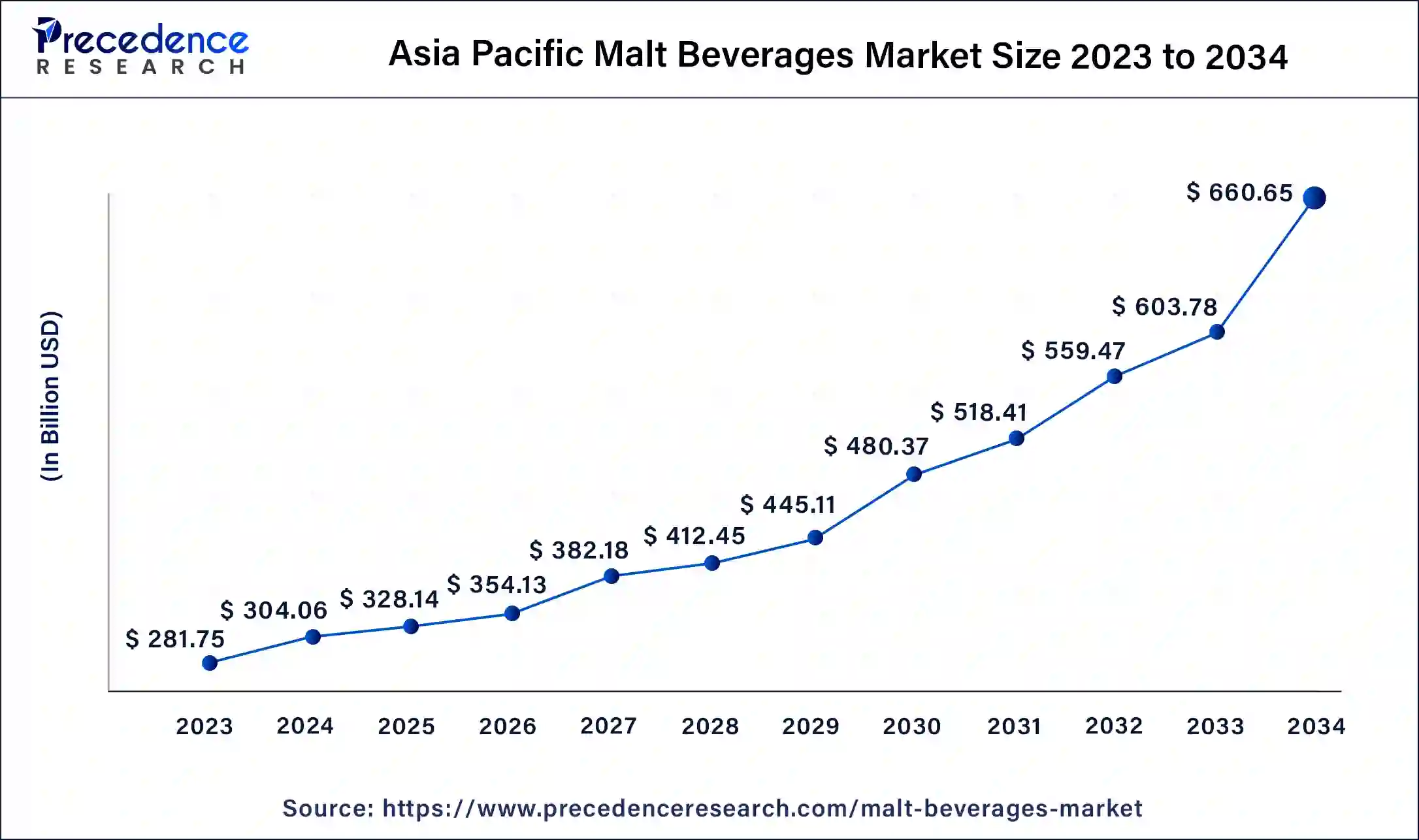

The U.S. malt beverages market size was exhibited at USD 281.75 billion in 2023 and is projected to be worth around USD 660.65 billion by 2034, poised to grow at a CAGR of 8.05% from 2024 to 2034.

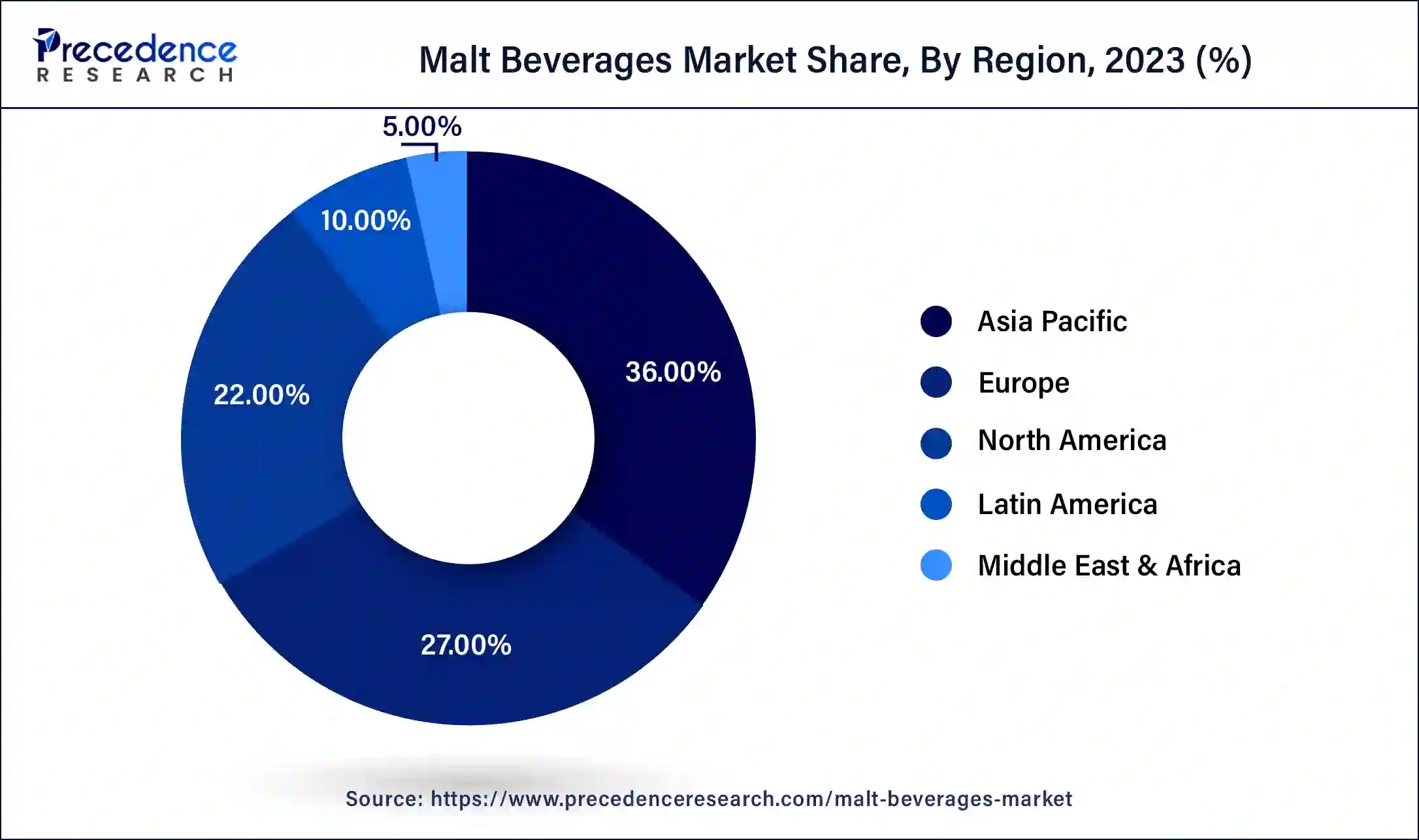

Asia Pacific led the malt beverages market in 2023. This is due to the rising adoption of flavored drinks and growing preference for organic drinks, which is anticipated to present lucrative opportunities in the market during the projected period. Moreover, the increasing number of bars, pubs, and craft beer events in the region also contributes to the growth of the market.

The dollar shares for each RTD category in September 2022 and the change over the previous year

| Category | Dollar share 2022 | Change 2022 vs. the previous year |

| Hard seltzer | 42.8% | -10.3% |

| Flavored malt beverages (e.g., hard teas/coffees/soda) | 37.0% | 12.0% |

| Spirits-based (e.g., cocktails, seltzers, frozen novelties) | 11.6% | 7.6% |

| Wine-based (excluding sake, dessert, and vermouth) in any container type that is 355 ml or smaller, 375 ml non-glass containers, or 500 ml tetra pack wine cocktails | 8.6% | -2.1% |

North America is observed to grow at a significant rate in the malt beverages market during the forecast period. The growth of the region can be attributed to the increasing consumer preference for vibrant beer culture and growing interest in craft beers. Furthermore, strategic initiatives by major industry players like Carlsberg and Anheuser Busch are driving market expansion further in the future. Also, the region's affection for popular beer brands like Corona and Budweiser strengthens the market presence of these brands.

A malt beverage is a fermented drink made from malted seeds and grains such as barley, along with ingredients like yeast, hops, and water. The process of malting involves germinating and drying the grains, which activates enzymes that convert starches into sugars. Yeast fermentation can then be used to produce alcohol. It's important to note that not all malt beverages contain alcohol. Some are non-alcoholic and can be marketed as substitutes for alcoholic beverages.

How is AI Changing the Malt Beverages Market?

AI can help in analyzing personalizing customer experiences, and consumer trends and automating regulatory processes. This gives more time for creativity from drinks brands and supports efficiency across processes to enhance price points. Furthermore, AI can help drink brands plan and forecast. AI’s ability to process many data sets and identify patterns along with anomalies can be used to analyze key trends in the malt beverages market with the competitor’s activity.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,810 Billion |

| Market Size in 2023 | USD 782.63 Billion |

| Market Size in 2024 | USD 844.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.92% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Distribution, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growth of craft beer market

The malt beverages market has seen exponential growth during the last couple of years. This is because the consumers seek something extremely tasty and special to drink. Additionally, smaller breweries are also experimenting with and producing new tastes and types of beer, which can drive market growth for malt beverages over the forecast period. Also, developing economies are witnessing growth and continued development in the production of malt beverages.

Rising health consciousness regarding alcohol

The majority of the population is becoming more aware of the adverse effects of alcohol on health. This can hinder the growth of the malt beverages market. Consumption of alcohol causes different types of diseases like heart disease, strokes, cancer, and high blood pressure. Moreover, alcoholic beverages can strengthen the risk of certain types of cancer.

Rising adoption of online sales

Growing adoption of online sales is the key trend shaping the dynamics of the malt beverages market. This is because e-commerce has become a reliable and popular tool for marketing and selling alcoholic beverages. It has also been seen as the fastest-pacing distribution channel for malted beverage sales. Furthermore, e-commerce sales have helped many small enterprises that produce craft cocktails, craft spirits, and craft beers to sell their brands and products to a large pool of consumers.

The alcoholic malt beverages segment dominated the malt beverages market in 2023. The growth of the segment can be attributed to the increasing advancements in brewing technology, rising demand for malt flavors and types, and well-established marketing and distribution infrastructure for beverages. Additionally, alcoholic malt beverages have a strong cultural and social presence across the globe which makes it an important drink at social gatherings and events. driving segment growth over the forecast period.

The non-alcoholic malt beverages segment is expected to grow at a significant rate in the malt beverages market during the forecast period. The growth of the segment can be credited to the evolving cultural and social attitudes toward inclusivity in social gatherings. Furthermore, Health-conscious consumers, including older adults and youngsters, are increasingly seeking new ways to provide the social experience of beer without alcohol. These shifts in consumer interests, along with seasonal trends like Dry January, are fueling the segment's growth in the upcoming years.

The on-trade channel segment led the malt beverages market in 2023. The trade channel includes restaurants, bars, and pubs and is anticipated to experience steady growth due to the rising popularity of craft beers and increasing demand for premium malt beverages in social gatherings. Moreover, sales through food pubs and community pubs have increased exponentially in the last couple of years, which can also propel segment growth.

The off-trade channel is anticipated to grow rapidly in the malt beverages market over the projected period. The growth of the segment can be attributed to the rising shift of consumers towards e-commerce, which has boosted convenience and access and appealed to a wide range of audiences. Additionally, the increasing trend of purchasing alcohol alongside other groceries has made it more convenient for consumers to incorporate malt beverages into their regular shopping lists.

Segments Covered in the Report

By Product

By Distribution

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2023

April 2025

October 2024

November 2024