August 2024

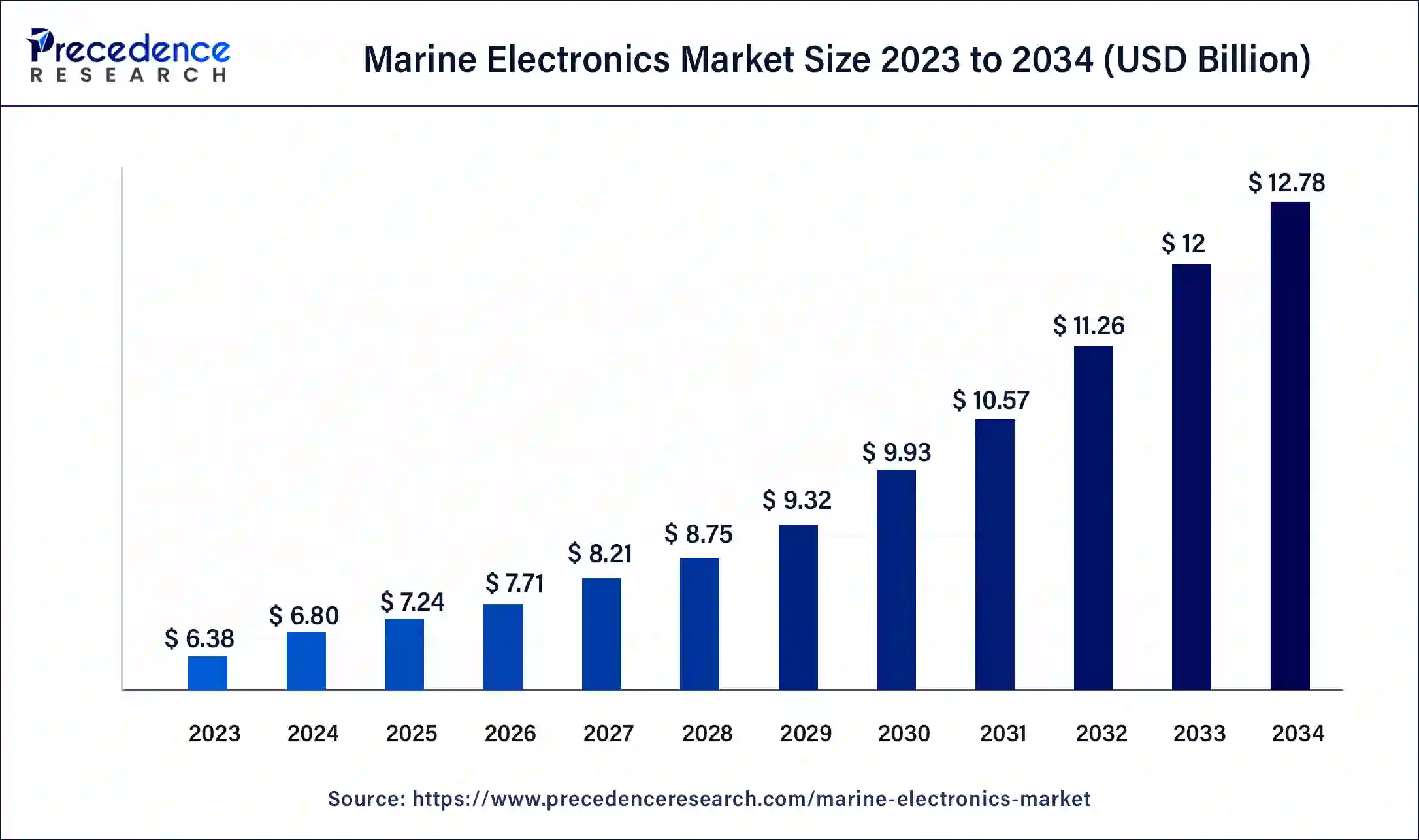

The global marine electronics market size was USD 6.38 billion in 2023, calculated at USD 6.80 billion in 2024 and is expected to be worth around USD 12.78 billion by 2034. The market is slated to expand at 6.52% CAGR from 2024 to 2034.

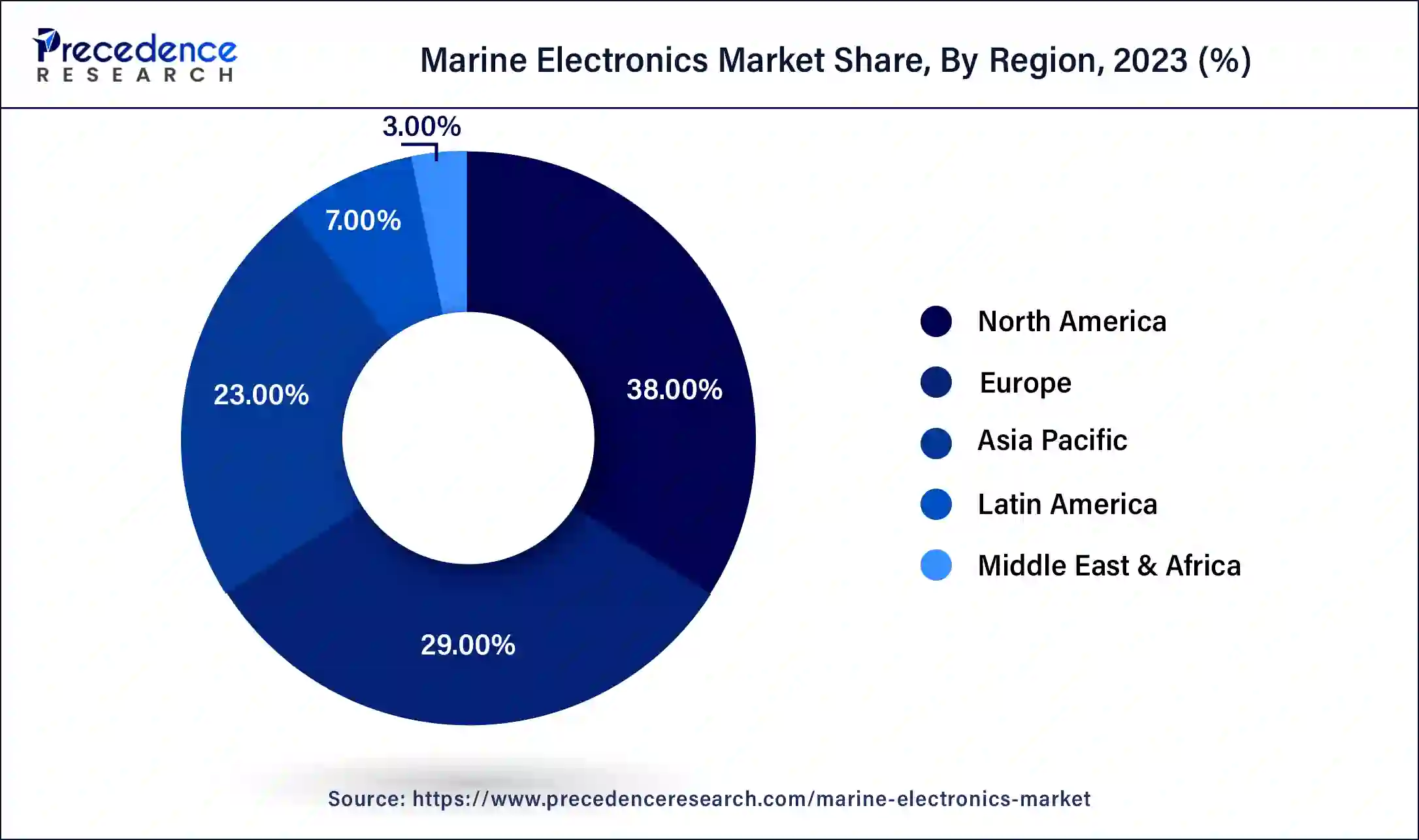

The global marine electronics market size is projected to be worth around USD 12.78 billion by 2034 from USD 6.80 billion in 2024, at a CAGR of 6.52% from 2024 to 2034. The North America marine electronics market size reached USD 2.42 billion in 2023. The increasing maritime activities globally are driving the growth of the market. A lot of goods/products are imported and exported via marine routes, which is why marine electronics are required.

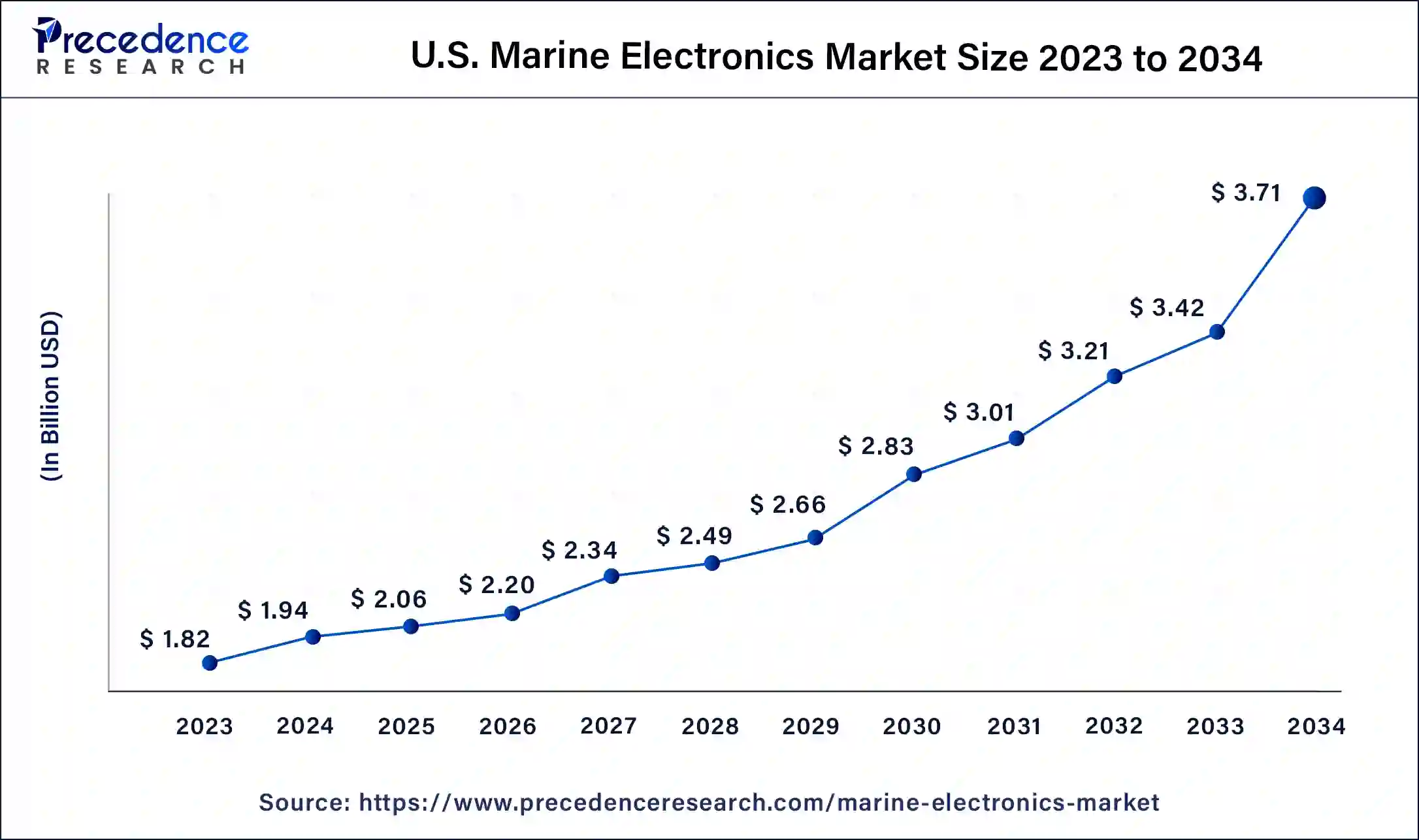

The U.S. marine electronics market size was exhibited at USD 1.82 billion in 2023 and is projected to be worth around USD 3.71 billion by 2034, poised to grow at a CAGR of 6.68% from 2024 to 2034.

North America dominated the marine electronics market in 2023. The growth of the market is attributed to the rising development of marine infrastructure in terms of logistics and transportation, passenger segment, and other recreational areas. The rising disposable income and the shifting lifestyle standards are driving marine activities in rental, buying, or leasing passenger vessels for vacation, and the increasing number of marine passengers are driving the passenger vessels and the developed industrial infrastructure in regional countries like the United States, and Canada is boosting the intercontinental logistics and transportation of goods are driving the growth of the marine shipping activities that further fuel the growth of the marine electronics market across the region.

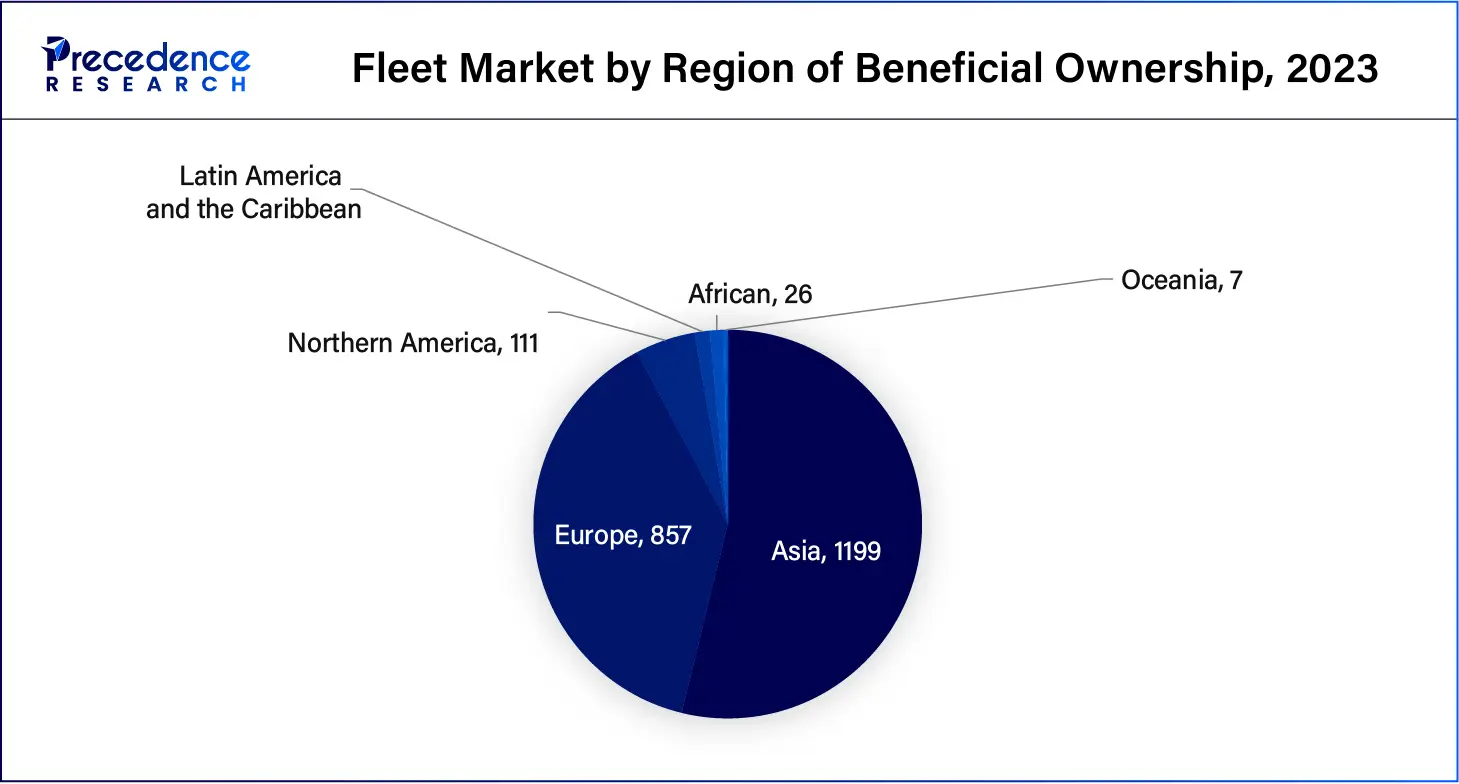

Asia Pacific is expected to have the fastest growth during the forecast period. The growth of the market is owing to the higher availability of ports in the regional countries, and the increasing import and export activities by the seaways are driving the growth of marine electronics. Additionally, the rising maritime activities for fishing and other commercial activities are driving the growth of the marine electronics market in the region.

Marine electronics are the specialized electronic devices that are made for use in marine activities or marine vehicles such as yachts, boats, and ships; they are generally water-resistive and waterproof and do not destroy the saline water of oceans or seas. The marine electronic generally includes the marine VHF radio, chart plotter, fishfinder, self-steering gear, marine radar, sonar, satellite navigation devices, satellite television, fiber optic gyrocompass, and marine fuel management. The increasing maritime activities such as shipping and transportation, passenger vessels, and the generation of energy from offshore are driving the growth of the marine electronics market.

How Can AI Impact the Marine Electronics Market?

The adoption of AI in the maritime industry is driving transportation in its several essential applications, such as predictive maintenance, fleet management, cargo optimization, risk management, and supply chain management. The adoption of artificial intelligence (AI) in the maritime has improved profitability and efficiency and reduced errors and environmental impacts of shipping. AI is an efficient technology that helps automate and digitize operations.

The AI could further help in navigation and route optimization, equipment and vessel maintenance, fuel consumption, port density, and traffic. AI could navigate and optimize the routes for the ships without human intervention, which drives the opportunities for the development of autonomous ships with limited crew members. It provides accurate decision-making in maritime activities. AI could improve the effectiveness of marine electronics with longer lifecycles and improved efficiency.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.78 Billion |

| Market Size in 2023 | USD 6.38 Billion |

| Market Size in 2024 | USD 6.8 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Vessel Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increasing maritime activities driving the growth of the market

The rising maritime activities, such as transportation and shipment of goods and products, as well as the rise in import and export activities via water bodies, are driving the growth of the maritime industry and are anticipated to drive the demand for marine electronics.

The rise in maritime activities drives the demand for efficient and effective electronic systems such as navigation, real-time communication, entertainment, and others, and the advancements in some marine electronics are autopilot or self-steering systems, compass, chart plotter, GPS systems, radar, and others. Additionally, the rising research and development activities in the launch of marine equipment and vessels with improved performance are driving the growth of the marine electronics market.

High cost of technology

The increased cost of the development of marine electronics due to the higher cost of raw materials and technologies associated with the electronics are limiting the production of marine electronics and restraining the growth of the marine electronics market.

Rising development of offshore energy plants

The rising use and development of offshore or marine energy are driving the opportunity for growth in the marine electronics market. There is an increasing inclination towards natural resources for energy generation, such as oil and gas and electric energy. Marine electronics are designed for water-resistive properties and are not impacted by the ocean's saline water. The rising demand for a clean source of energy is driving the number of offshore energy or marine energy plants across various regions.

The hardware segment held the largest share of the marine electronics market in 2023. The rising prevalence of marine activities for security, defense, commercial activities, shipping, and entertainment. The rising demand for efficient navigation and technologies in marine activities is driving the demand for a number of hardware equipment such as VHF radios, marine cameras, chart plotters, beacons, navigation equipment, compass, fish finders, fuel monitoring and management, fuse, GPS, marine publications, sensors, and switches, and switches panel. Additionally, ongoing investment in the development of new hardware components is driving the demand for the hardware segment.

The software segment is expected to have the fastest growth in the marine electronics market during the predicted period. The rising implementation of artificial intelligence, IoT, and sensors in the software for improving accuracy and advances maritime analytics and predictive maintenance solutions. The increasing demand for efficient and improved safety is driving the advanced technologies in the software segment. The rising digitization and automation in marine software are enhancing the efficiency and safety of marine equipment and electronics.

The merchant vessel segment dominated the marine electronics market in 2023. The increasing demand for the advancement in the navigation, safety, and communication system that drives the growth of the merchant vessel segment. The merchant vessel is also known as the merchant ship. Merchant vessel or merchant ship is a type of national commercial shipping. There are seven types of merchant vessels identified in the port, including bulk cargo ships, general cargo ships, chemical tanker ships, crude oil tanker ships, container ships, passenger/roro ships, and LNG tanker ships. The rising transportation and shipping activities via water bodies or marine are driving the demand for the merchant vessel segment.

The recreational boats segment is projected to grow at the fastest CAGR in the market during the forecast period. The recreation boats are also known as passenger vessels and small passenger vessels. The recreational boats are manufactured for rental, leased, and chartered and are majorly used for pleasure or entertainment. There are different types of recreational boats: airboats, bow rider boats, cabin cruisers, canoes, catamarans, dolls, personal watercraft, deck boats, fishing boats, and pontoon boats. The increasing demand for recreational boats for entertainment, luxury, and fishing purposes drives the growth of the recreational boats segment.

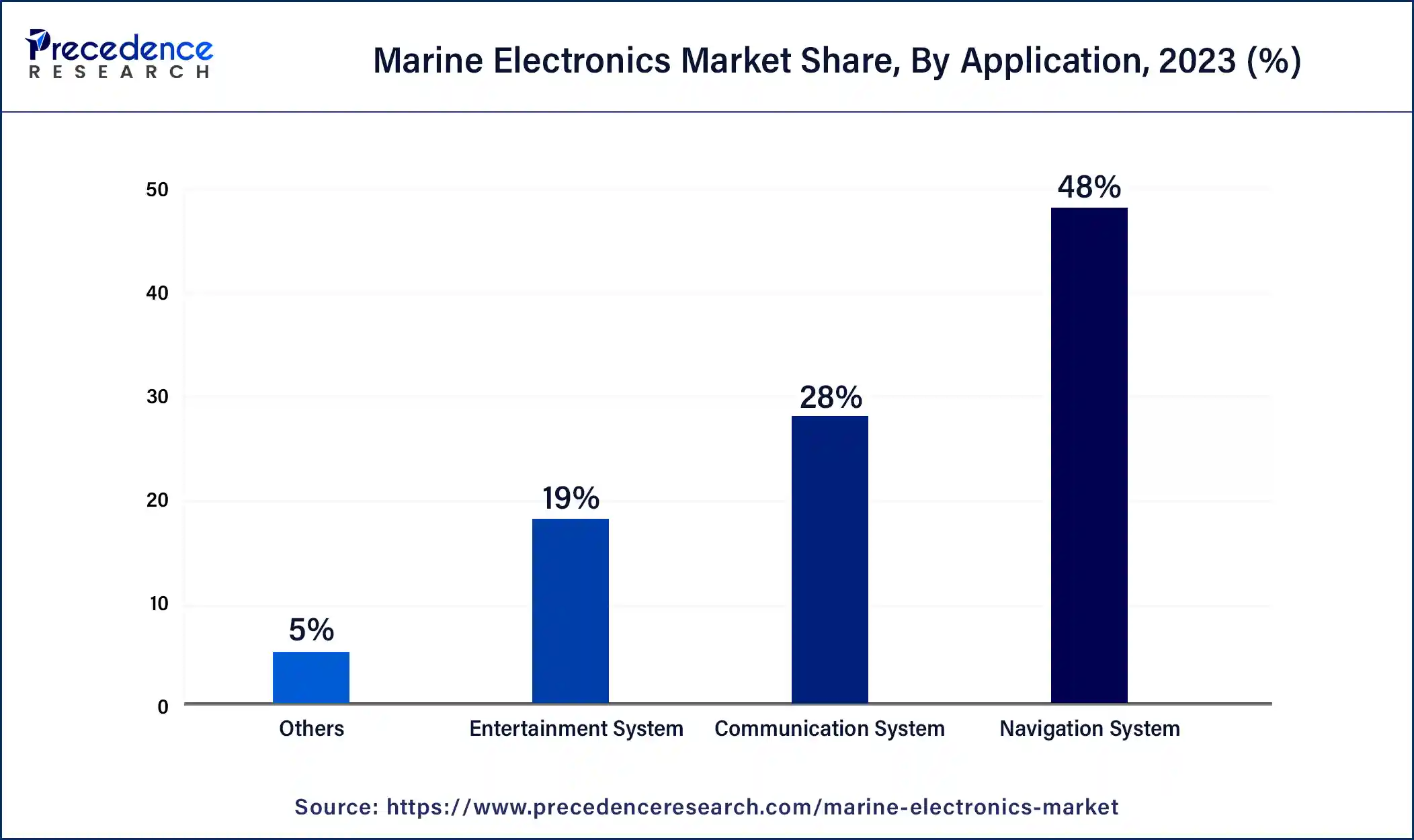

The navigation system segment captured the largest share of the marine electronics market in 2023. Marine navigation is one of the important applications in marine electronics, such as ships, boats, and others. Marine navigation is the efficient combination of software, equipment, and tools that provide the precise and accurate determination of location, chart courses, and safer navigation through the water. Marine navigation is an effective system for reducing latency and collision and ensures efficient voyages. There are some of the leading marine navigation systems currently operated by major marine shipments are as follows:

The entertainment system segment is expected to grow at the fastest rate in the marine electronics market during the forecast period. The rising passenger traffic in marine ships is due to the rising disposable income and the rising adoption of the luxurious lifestyle. The rising demand for technological advances and luxurious entertainment options in the ships, such as audio, video, and other connectivity solutions with enhanced performance, is driving demand for the entertainment systems in the vessels or ships that contributed to the growing demand for the entertainment system segment.

Segments Covered in the Report

By Component

By Vessel Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

March 2025

January 2025

January 2025