October 2024

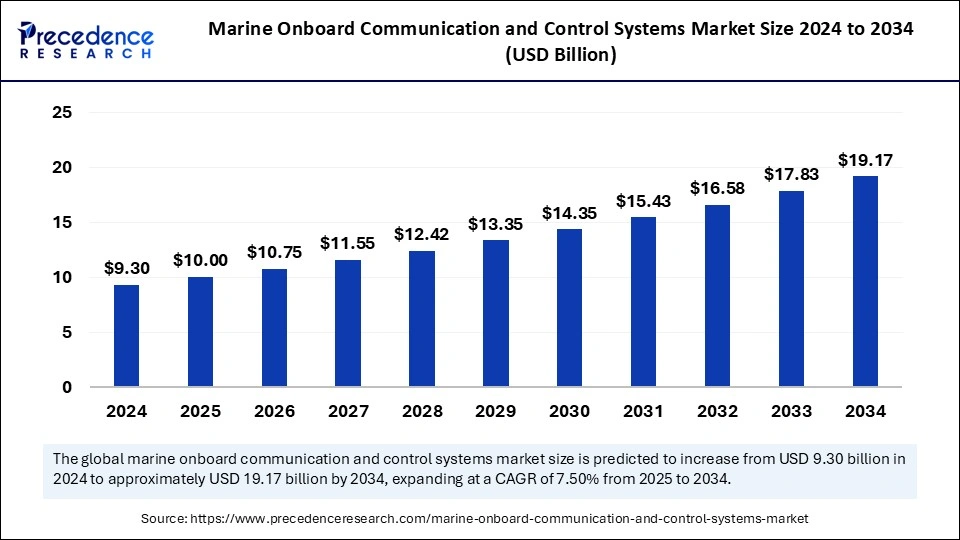

The global marine onboard communication and control systems market size is calculated at USD 10 billion in 2025 and is forecasted to reach around USD 19.17 billion by 2034, accelerating at a CAGR of 7.50% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global marine onboard communication and control systems market size accounted for USD 9.30 billion in 2024 and is predicted to increase from USD 10 billion in 2025 to approximately USD 19.17 billion by 2034, expanding at a CAGR of 7.50% from 2025 to 2034.. Incorporating advanced tools related to navigation control, seamless communication, and operational efficiency into maritime communication and navigation systems drives the growth of the marine onboard communication and control systems market.

Artificial intelligence contributes to improving maritime operations and transportation. AI enhances risk management and maritime safety. AI also offers solutions to improve risk assessment, resource management, and predictive maintenance. AI technology assists in reducing fuel consumption and managing the ship’s energy by eliminating harmful gas emissions. It plays a major role in real-time monitoring by evaluating the existing risk management measures and detecting risks that may come in the future. Moreover, AI and machine learning technologies help to address issues in sustainability, efficiency, and regulatory compliance. AI algorithms are significant in maritime systems and play major roles in navigation systems, hazardous material handling, and case studies.

The marine onboard communication and control systems market revolves around incorporating smart advanced technologies and computerized tools into shipboard communication and control systems. The maritime industry encompasses automatic identification system (AIS), VHF radios, internal telephone system, voice pipes, and the ship’s telegraph. These systems ideally assist in collision avoidance, ship tracking, ship communication, and engine control, which enhance real-time performance monitoring. Moreover, the global maritime distress and safety system (GMDSS) assists in emergencies by allowing secure communications within the ship.

The expansion of military areas and naval forces accelerates the importance of integrated equipment and technologies in maritime industries. The onboard system assistance to the military officers in executing successful operations drives a significant growth of the vessel communication and control systems. Furthermore, fishing practices and fishing industries can achieve efficient performance through real-time data analytics and advanced connectivity.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.17 Billion |

| Market Size in 2025 | USD 10 Billion |

| Market Size by 2024 | USD 9.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.50% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Demand for Advanced Systems and Increasing Maritime Trade

The rising need for smart tools and technologies in all commercial sectors allows researchers to put efforts into the research and development of novel products and services. The recommendable efforts of scientists in production, manufacturing, product approvals, and product expansion favor the market’s growth significantly. The maritime industrial trade has increased due to the adoption of new tools and technical systems like voyage data recorder, maritime mobile service identity, navigational telex, etc.

Furthermore, the marine onboard communication and control systems market is experiencing a remarkable growth due to the developments made by the International Maritime Organization (IMO) towards ship safety and preventing maritime pollution. The cooperative collaborations between different entities like the International Telecommunication Union (ITU), the World Meteorological Organization (WMO), the International Hydrographic Organization (IHO), etc., also promote international trade in the maritime industry.

High cost associated with integrated communication systems

The maritime industrial infrastructure needs to be equipped with seamless connectivity solutions, which require high costs to achieve this purpose. The uncertainty related to the return on investment plans may present challenges in front of the investor companies. The vast networking with ship operators and manufacturers is required to achieve the upgradation and digitalization of advanced systems. The incorporation of efficiently operative hardware and software into seamless connectivity solutions must comply with regulatory standards. The high operative costs for AI technologies can create limitations for the companies to proceed further in innovations.

Introduction of Novel Technology Solutions

Advancements in onboard internal communication systems have been made, which include dynamic tools and technologies. These are the electronic chart display and information system (ECDIS), automatic radar plotting aid (ARPA), anemometer, echo sounder and doppler log, etc. It is possible to measure the speed of wind by using an anemometer, determine the depth of water through echo sounding, and measure the relative speed of a ship with water by using doppler or speed log. These innovations are creating better opportunities for achieving successful missions in several commercial areas. The integration of the internet of things , smart sensors, AI, big data analytics, and other digital platforms allows real-time data analytics, remote performance monitoring, etc.

By type, the communication systems segment dominated the marine onboard communication and control systems market in 2024 due to the rising demand for advanced communication systems in maritime industries. The increased focus on achieving enhanced navigation, connectivity, and safety drives the adoption of integrated communication systems. The huge adoption of advanced marine navigation and real-time communication systems accelerates improved ship performance. The significant investments by government agencies, defense sectors, and commercial sectors into these systems enable efficient operations and coordination.

By type, the control systems segment is expected to grow at a significant rate in the marine onboard communication and control systems market during the forecast period. The extensive use of systems related to navigation control, risk management, risk assessment, resource management, etc., drives the growth of the control systems segment. The integration of AI and ML tools and techniques into the production of seamless connectivity solutions boosts the demand for control systems. The high preference for real-time control and communication systems for industrial and commercial purposes accelerates the demand and need for interconnected data analytics platforms.

By platform, the commercial segment dominated the marine onboard communication and control systems market in 2024 due to the wide use of commercial marine vessels across the globe. The expansion of seaborne trade and tourism allows the incorporation of various transport systems, including ships, cargo vessels, container vessels, bulk carriers, gas tankers, etc. The integration of smart technologies like real-time performance monitoring, advanced sensors, satellite communication, and real-time data analytics enables the optimization of vessel performance. The regulatory compliance of newly invented products and services allows efficient commercialization.

By platform, the defense segment is anticipated to be the fastest-growing in the marine onboard communication and control systems market over the forecast period. The improved efforts for security at national and international levels enhanced the preference for advanced systems and mediums by defense sectors. The interrelated communication platforms offered under ships allow successive operations of defense or military crews. The defense segment is growing due to the promising assistance of onboard systems in ships in emergencies and complex situations.

By end user, the OEM segment dominated the marine onboard communication and control systems market in 2024 due to the crucial role of OEMs in the design and manufacturing of specialized equipment or systems. The widespread production of various advanced systems like propulsion systems, communication systems, navigation equipment, and automation solutions drives the growth of the OEM segment in the market. The collaborations of OEMs with shipbuilders and other companies favor the commercialization of original products and components. The implementation of stringent regulatory standards, quality control measures, and rigorous testing parameters by OEMs boost their expansive reach in the market.

By end user, the aftermarket segment is observed to grow rapidly in the marine onboard communication and control systems market in the coming years. The ideal options of customization and personalization of products and services allow to meet the requirements of consumers. The cost affordability with an extended life span of products offered by aftermarket services boosts this segmental growth in the market. The increased accessibility of products and services by aftermarket accelerates this segmental growth significantly.

North America is observed to grow at the fastest rate in the marine onboard communication and control systems market during the forecast period, due to the incorporation of artificial intelligence (AI) and automation into marine transport systems. The significant efforts to automate control systems raise the maritime trade across the globe. The North American region holds several decarbonization strategies. The North American Emission Control Area applied strict gas emission standards in these regional areas. The various initiatives focused on identifying and evaluating alternative fuel and propulsion technologies to reduce greenhouse gas emissions in shipping. Moreover, there was an action plan on climate and energy released by the Pacific Coast Collaborative, which was the strategic collaboration between cities and states along the Pacific coast.

U.S. Marine Onboard Communication and Control Systems Market Trends:

The U.S. companies are dedicated to introducing automation into advanced communication and control systems. The U.S. companies are also committed to optimizing their services by integrating satellite communications and low earth orbit satellites. These efforts contribute to the expansion of services and products up to the remote ocean regions with increased accessibility. In December 2024, the Maritime Energy and Emissions Innovation action plan was launched in the U.S. to reduce and eliminate the greenhouse gas emissions in the U.S. maritime sector by 2050. This action plan supports marine industries, communities, civil society, subnational governments, etc., to decarbonize the maritime sector across the U.S. government.

Asia Pacific held the largest sahre of the marine onboard communication and control systems market during the predicted timeframe. This regional growth is attributed to the increased maritime trade and the increased marine fleet size in this region. The high number of investments in advanced technologies like artificial intelligence (AI) and cybersecurity for the development of onboard communication and control systems in maritime industries drive the regional market’s growth significantly.

The huge efforts to modernize the technical fleet in marine transport systems also raise the market’s portfolio remarkably. In July 2024, the transport division of the Economic and Social Commission for Asia and the Pacific (ESCAP) organized the program on Sustainable Maritime Connectivity. This action plan aims to establish long-term national maritime transport policies by considering developments in digital technology, decarbonization trends, and climate change.

China Marine Onboard Communication and Control Systems Market Trends:

The industrial firms in China also make efforts for the expansion of onboard communication and control systems through automation, satellite communication, AI, IoT, and digitalization. These major rationales behind the success of this market contribute to enhancing the operational efficiency of various systems and industrial performance. Moreover, Chinese research vessels go through oceanographic surveys where they measure the various parameters of the ocean, such as salinity, pressure, and water temperature. China’s operations in the Indian Ocean Region (IOR) ideally present a specialized fleet including the Yuan Wang 01 and Yuan Wang 02 which focus on oceanographic research.

Japan Marine Onboard Communication and Control Systems Market Trends:

There are huge efforts taking place in Japan to enhance maritime safety and technological improvements. The government of Japan is making investments in green onboard marine systems. The government is moving towards global green energy goals to reduce carbon dioxide gas emissions and increase energy efficiency. Furthermore, Japan holds a successive market for maritime autonomous surface ships (MASS). The MASS market creates opportunities for U.S. companies that are developing smart marine technology solutions. Japan is dedicated to fully autonomous vessel operations and autonomous ship technologies to control onboard operations and make final navigation decisions. The Nippon Foundation launched a project entitled ‘MEGURI2040’ through which Japanese companies are trying to develop and test new maritime technologies to achieve autonomous navigation and operation.

Europe is observed to grow at a considerable growth rate in the marine onboard communication and control systems market in the upcoming period. In Europe, the CapTech Maritime supports European Naives on existing and future challenges within the naval areas of research and technology. It also promotes the European Defense Cooperation. The maritime transport plays a significant role in the European Union economy, and the EU takes efforts on reducing greenhouse gas emissions from the shipping sector. The EU action plan aims to achieve climate neutrality in Europe by 2050. The European Economic Area (EEA) is responsible for monitoring and reporting greenhouse gas emissions in compliance with the monitoring, reporting, and verification (MRV) Maritime Regulation.

Integration of Automation and Digitalization in Germany

The German companies are committed to introducing advanced fleet management tools that enable real-time data analytics through the implementation of the internet of things (IoT), automation, and artificial intelligence (AI) technologies. These advanced tools and technologies help industries improve their operational efficiency and productivity. The German Aerospace Center conducts maritime research by investigating oceans, lakes, and rivers and provides its findings on aeronautics, energy, spaceflight, transport, and security. Deutsches Zentrum für Luft- und Raumfahrt is the German Aerospace Center, which plays a major role in improving maritime and coastal security in Germany and internationally.

In June 2024, Juha Koskela, Division President of ABB Marine & Ports, reported that the new software and services upsurge the company’s portfolio and strengthen the company’s commitment to support the marine industry’s digitalization.

In February 2025, Phil Siveter, CEO of Thales Group in the United Kingdom, announced that the company is dedicated to continuing its support to the Royal Navy to accomplish their missions through world-class communication capabilities.

By Type

By Platform

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2024

February 2025

February 2025