January 2025

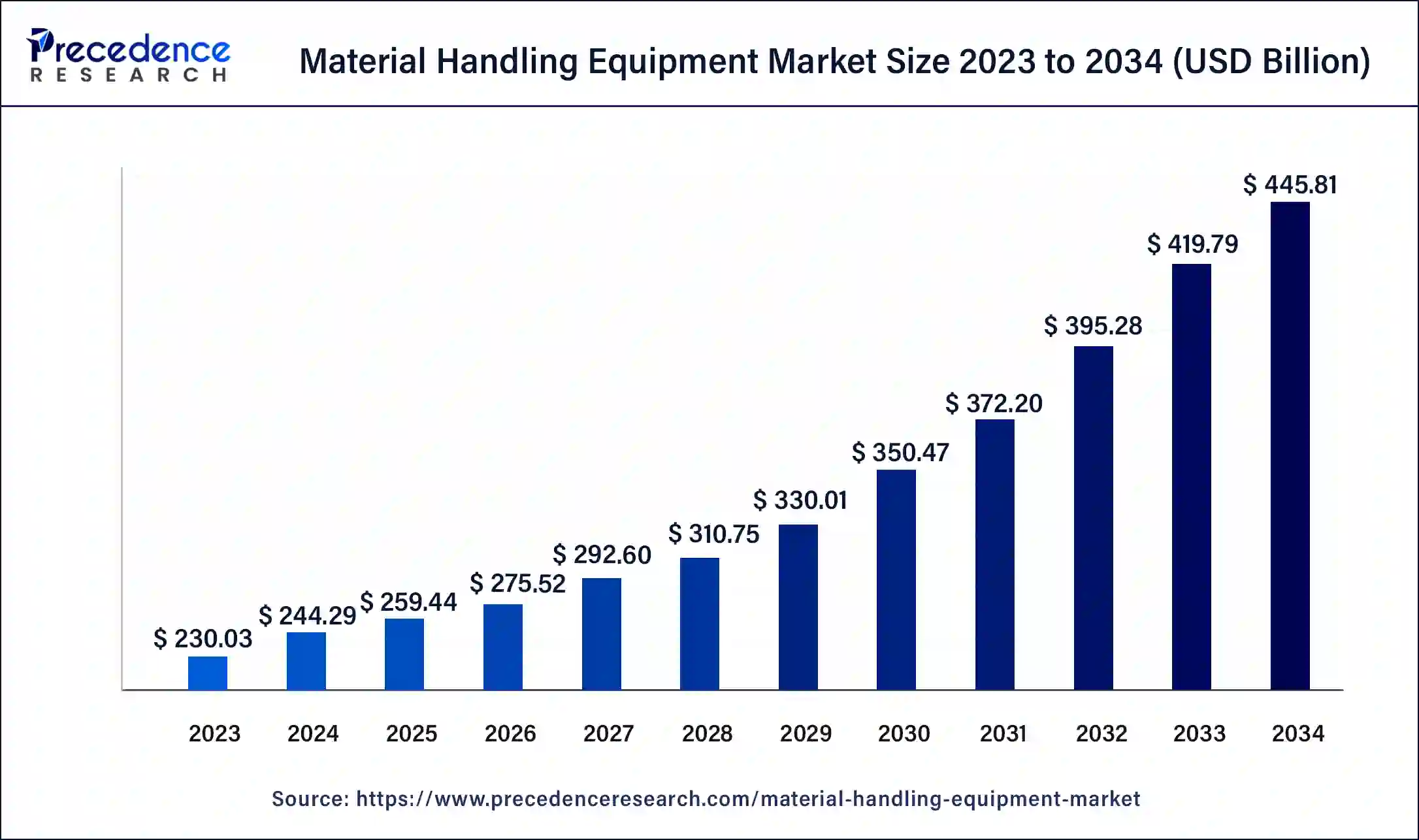

The global material handling equipment market size was USD 230.03 billion in 2023, calculated at USD 244.29 billion in 2024 and is expected to reach around USD 445.81 billion by 2034, expanding at a CAGR of 6.2% from 2024 to 2034.

The global material handling equipment market size accounted for USD 244.29 billion in 2024 and is expected to reach around USD 445.81 billion by 2034, expanding at a CAGR of 6.2% from 2024 to 2034.

The Asia Pacific material handling equipment market size was estimated at USD 101.21 billion in 2023 and is predicted to be worth around USD 196.16 billion by 2034, at a CAGR of 6.4% from 2024 to 2034.

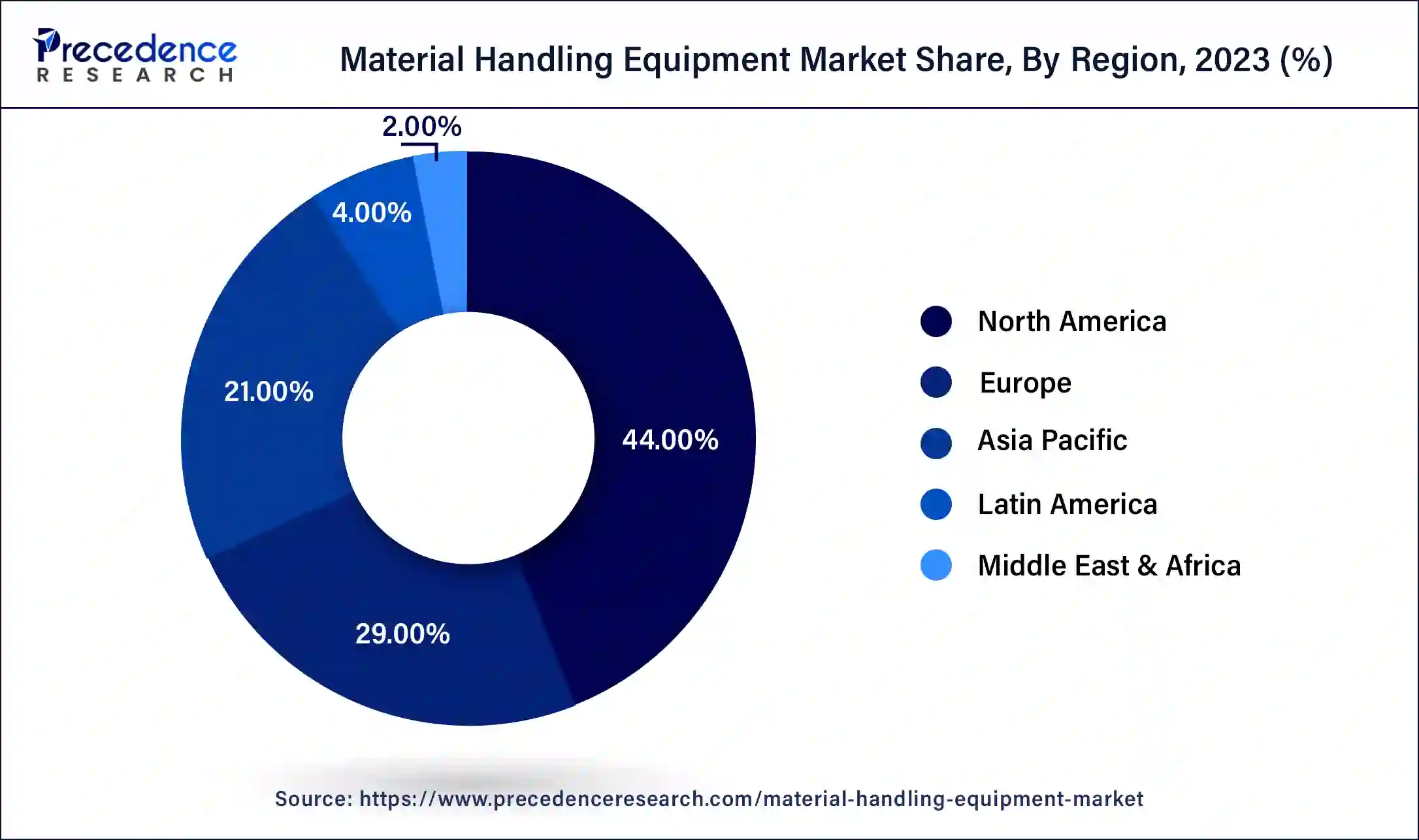

Asia Pacific region generated over 44% of revenue share in 2023. It is because the developing economies have provided ample opportunities, subsequently helping OEMs reach broader end-user markets. Moreover, the rapid growth of the e-commerce industry in this region is anticipated to boost the market growth.

Europe is expected grow significantly over the forecast period. It's due to the employment of innovative products to support the region's large-scale industrial presence. Europe has a diverse range of industries, from food and beverage to electronics manufacturing, all of which offer sales opportunities. Furthermore, the e-commerce sector led by same-day delivery models has contributed remarkably towards market growth. For instance, On 14th October 2021, LogsticaCarosan, a Spanish storage and transportation company, has stated that it has rebuilt its Talavera de la Reina (Spain) facility in order to improve customer service. The company will adopt Mecalux's Easy WMS warehouse management system to streamline all of its logistical procedures. The technology will allow LogsticaCarosan to keep a close eye on its clients’ entire inventory.

The surge in investments for the development of power and battery technology will foster the market growth. Apart from that, favorable government initiatives worldwide encourage new infrastructure development, resulting in growth prospects in the material handling equipment market over the forecast period.

The developing economies such as India and China attract foreign investments promoting infrastructure and industrial development; this is expected to drive the market growth. Also, the development of public infrastructure such as rail networks, airports, seaports and power plants, and others are estimated to foster the market growth.

The development of Belt and Road Initiative (BRI) by China is anticipated to create lucrative opportunities that will fuel the growth of the materials handling equipment market. This initiative focuses on connecting a network of rail and road routes from China to Europe via the Middle East.

The material Handling Equipment Market has benefited greatly from the rapid rise of the ecommerce industry. Furthermore, in reaction to the COVID-19 epidemic, the imposition of social distance rules, lockdowns, and other measures has prompted consumers to turn to internet shopping, which has helped market growth.

The increase in labor cost and safety concerns has led many industries to choose the equipment’s in order to improve work efficiency and time reduction and this factor will foster the market growth. Also, with the enhancement of technology there will be demand for automation and productivity and this will trigger the market growth. Furthermore, the increasing requirement for efficient material movement necessitates automated processes, which is expected to fuel market growth.

| Report Highlights | Details |

| Market Size in 2023 | USD 230.03 Billion |

| Market Size in 2024 | USD 244.29 Billion |

| Market Size by 2034 | USD 445.81 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.2% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End User, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Based on the product, the industrial trucks product segment is expected to lead the market with largest market share of over 30.5% in 2023. These trucks are a desirable choice due to their wide area of application in an industrial setting. The transportation of heavy containers or crates in several end use markets is undertaken using industrial trucks and this attribute accelerates the market growth. As the logistics industries are shifting towards sustainable products, the demand for battery-operated trucks will be surged over the forecast period. For instance, On 8th July 2021, KION Group AG has announced that manufacture of forklift trucks would begin near the German-Polish border in order to balance equipment for all KION Industrial Trucks &Services brand firms. The goal of this initiative is to increase the level of automation and digitization at these locations.

The automated storage and retrieval system segment accounted for a remarkable revenue share of 28.4% in 2023 and is expected to grow at a CAGR of 8.1% during the forecast periodowing to the COVID-19 pandemic's implementation of social distancing standards During this time, these systems were preferred because they emphasized efficiency and corresponded with social distancing norms. Also, during the projection period, the investments in automated equipment will surge which is anticipated to create lucrative opportunities that will drive the growth of the material handling equipment market.

Based on the End use, the Material Handling Equipment Market is divided into Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, E-commerce, Aviation, Pharmaceutical and Others. The e-commerce sector will dominate the market with a revenue share of 23.4% in 2023 and is estimated to grow significantly during the forecast period. During the lockdown limitations, an unforeseen need for distribution and transportation of basic supplies, particularly groceries, fueled market expansion. The impact of the coronavirus will not be a short-term boost to the market; rather, it will have a long-term impact on industrial demand, offering enormous prospects for material handling equipment vendors. It is also estimated the revenue share of the ecommerce sector will cross USD 10.5 billion by 2034.

The retail sector has always offered massive profit opportunities, and this trend is expected to continue in the future. The convenience of online shopping has encouraged retailers to build micro-fulfillment centres that allow for quick product deliveries, and this attribute will boost the growth of material handling equipment market. For instance, On 28th September 2021, The Italian Calzedonia Group, a prominent player in worldwide fashion retail marketplaces, has chosen BEUMER Group, a leading global producer of automated material handling systems. to put its pouch-making technology to work Calzedonia Group has seen a rapid expansion in its Direct to Consumer (DTC) business as a result of the boom in e-commerce, and it needed to improve its dispatch operations to account for this growth while improving efficiency and customer service.

Segments Covered in the Report

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024