November 2024

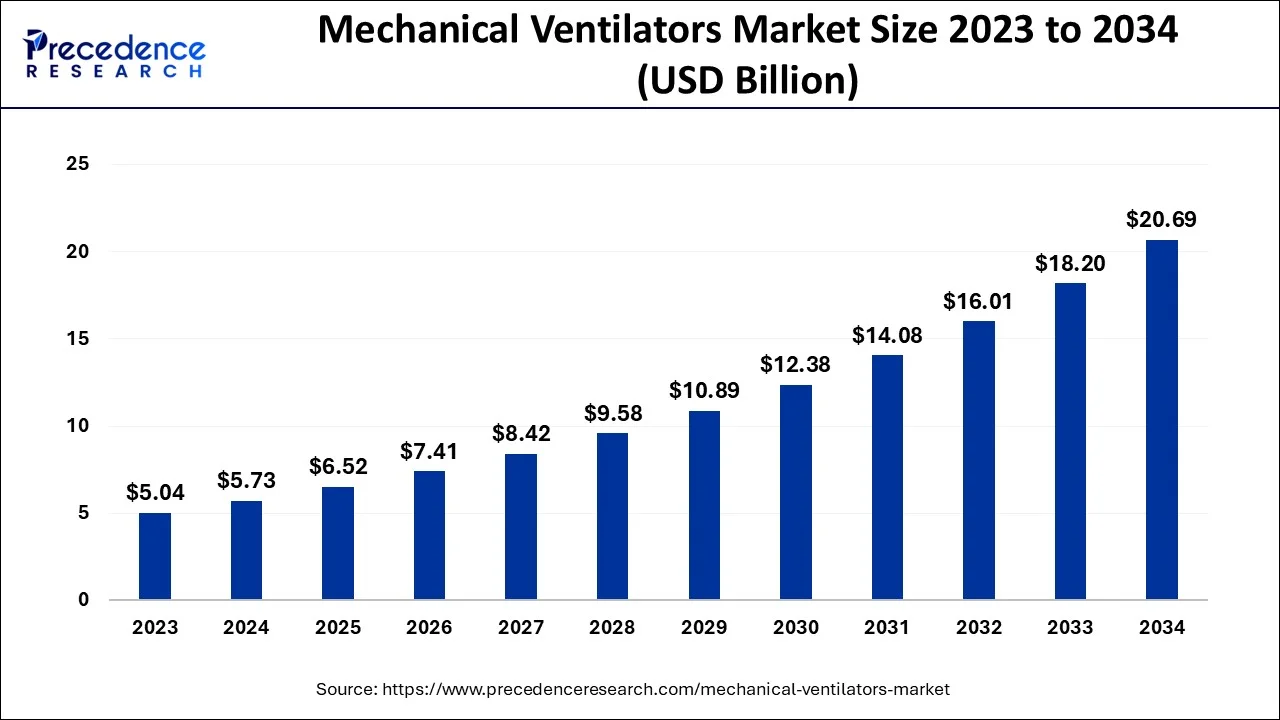

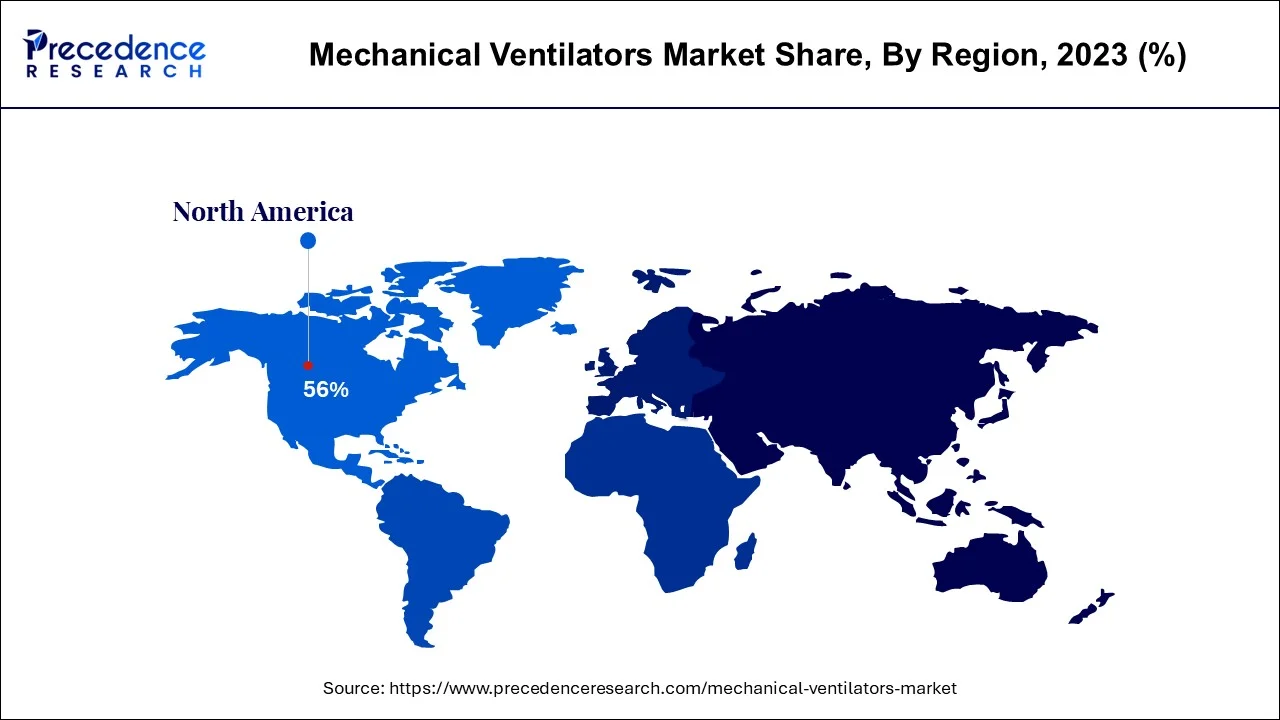

The global mechanical ventilators market size accounted for USD 5.73 billion in 2024, grew to USD 6.52 billion in 2025 and is predicted to surpass around USD 20.69 billion by 2034, representing a healthy CAGR of 13.70% between 2024 and 2034. The North America mechanical ventilators market size is calculated at USD 3.21 billion in 2024 and is expected to grow at a fastest CAGR of 13.80% during the forecast year.

The global mechanical ventilators market size is estimated at USD 5.73 billion in 2024 and is anticipated to reach around USD 20.69 billion by 2034, expanding at a CAGR of 13.70% from 2024 to 2034.

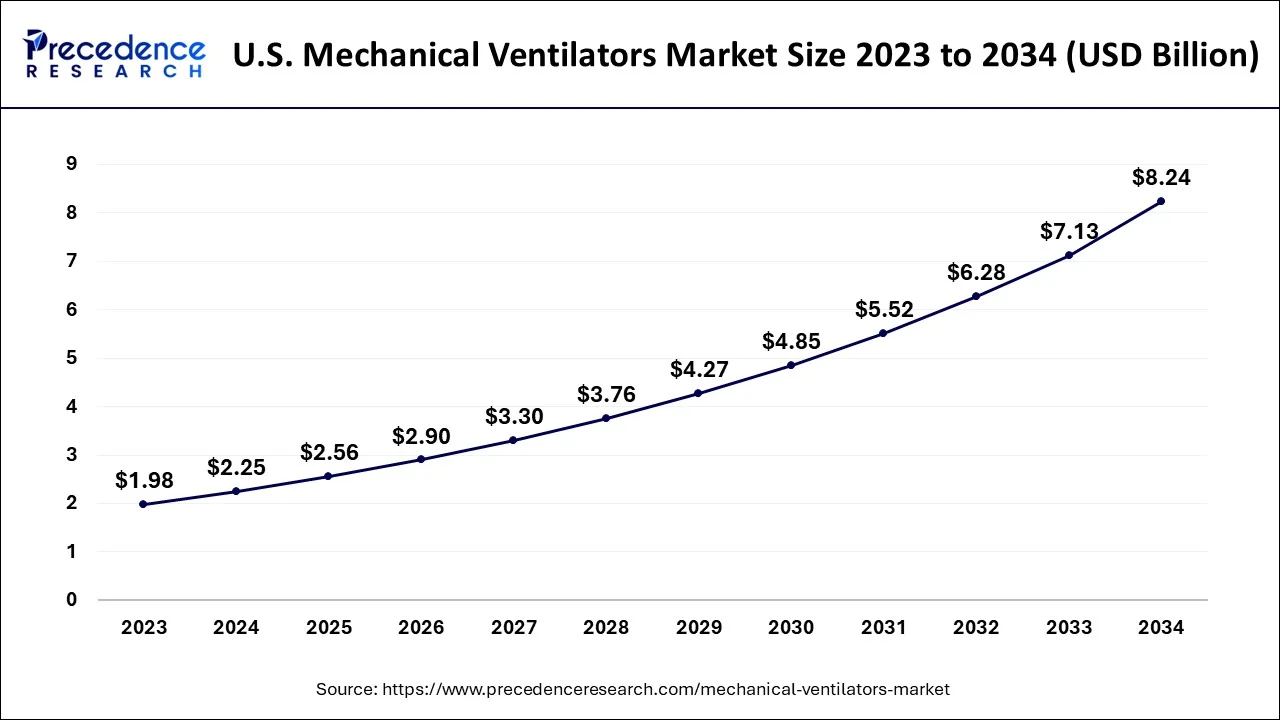

The U.S. mechanical ventilators market size is evaluated at USD 2.25 billion in 2024 and is predicted to be worth around USD 8.24 billion by 2034, rising at a CAGR of 13.84% from 2024 to 2034.

The North America region dominated the market till the year 2023. The US had the largest market share in this region. The increasing prevalence of chronic respiratory diseases and also the presence of major market players in these countries which provide good accessibility to various advanced technologies are boosting the market in this region. The use of technically advanced ventilators and good services provided in this region are helping in the growth of the market. The availability of various treatment procedures shall drive the market during the forecast. Chronic obstructive pulmonary disease is a leading cause of death in the United States. This disease causes serious long-term disability and also early deaths which are creating a great demand for ventilators and helping in generating revenue for this market. The demand for mechanical ventilators is also expected to rise in Canada in the coming years. The use of noninvasive ventilators which help in avoiding lung injury is being used in this region which drives the growth of the mechanical ventilators market during the forecast period.

The Asia Pacific is expected to be the most lucrative market during the study period. The frequency of respiratory disorders in the region is expected to grow due to increasing pollution as a result of increased urbanization and industry. Furthermore, increased government investments in the development of advanced healthcare infrastructure are likely to boost ventilator usage across the region's hospital facilities that supplement the market growth.

A mechanical ventilator is a machine that helps a patient breathe (ventilate) when they are having surgery or cannot breathe on their own due to critical disease. The patient is connected to the ventilator with a hollow tube (artificial airway) that goes in their mouth and down into their main airway or trachea. The two most common methods of mechanical ventilation are positive pressure ventilation, in which air is forced into the lungs, and negative pressure ventilation, in which air is sucked into the lungs by the stimulating movement of the chest. Mechanical ventilators are most commonly used to treat respiratory problems, strokes, chronic obstructive pulmonary disease, and other conditions. Mechanical ventilation is a life-supporting technique that helps patients with serious diseases breathe just to stay alive.

An increase in the geriatric population and the prevailing chronic respiratory disorders are expected to boost the demand for ventilators. Growing awareness regarding lung cancer the symptoms of lung cancer and an increase in the number of patients in middle hospitals swelling create a great demand for the growth of the ventilators market. The use of mechanical ventilation could also hurt the industry growth because there is an increased risk of infection due to the entry of germs through the airway. There could also be chances of collapsing of the small air sacs of the lungs or there could be some probable damage to the lung because of repetitive opening or inflation. These are the risks that are associated with the use of mechanical ventilators and these could hamper the growth of the market.

Unlike other industries, the pandemic has proven extremely beneficial for the mechanical ventilators market and it has had a positive impact on the growth of the market. Ventilation facilities were extensively used during the COVID outbreak. There was an increasing demand for ventilation facilities across all the hospitals during the pandemic. The demand for ventilators had led to the production of these ventilators during the pandemic major industry players increased their production capabilities to meet the demand. To make sure that the patients have timely availability of mechanical ventilators during the pandemic, various government initiatives were taken to provide the same. Government organization supply chain networks and the industry players were working together to meet the rising global demand for ventilators across the globe.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.73 Billion |

| Market Size by 2034 | USD 20.69 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Ventilation Mode, Type, Component, Application, End-User, and Geography |

Due to the increasing number of COVID-19 cases, there was a demand for mechanical ventilators which helped in the growth of the market across many developed and developing nations and the increasing prevalence of chronic respiratory diseases which could be associated with pollution or any other factors has led to a growth in the market. There is a rise in healthcare expenditure in many nations and the general awareness regarding the existence of respiratory disorders has led to a growth in the market. Many hospitals are increasing the number of ICU beds or critical care beds post-pandemic to meet the demands of the future generation in case there is another pandemic. Growing research and development in this field and technological advancements are the reasons for the adoption of these mechanical ventilators across many hospitals or clinics.

The market is contributed by the increased frequency of respiratory disorders. Over the projection period, the use of long-term Home Mechanical Ventilation (HMV) for chronic respiratory failure caused by disorders such as thoracic disease, chronic obstructive pulmonary disease (COPD), and neuromuscular disease is expected to grow market. According to a World Health Organization report, COPD affects roughly 65 million people globally, making it the third biggest cause of mortality in 2020. The growing aging population, increased cigarette smoke exposure, and indoor as well as outdoor pollution, are driving the market growth.

Using ventilators comes with several risks because they need proper guidance to use them. In addition to this dearth of skilled technical people is found in the market. Mechanical ventilators are expensive and require special care while handling. Difficulties observed during mechanical ventilators as the inappropriate working of alarm, ventilation sequence, etc. These are the challenges that could restrict the growth of the mechanical ventilator market.

COVID-19 Impact

The COVID-19 pandemic has increased sales of mechanical ventilators across hospitals and clinics. Respiratory failure is a complication of the COVID-19 infection, demanding critical care and ventilator support. For critically unwell COVID-19 patients, mechanical breathing has frequently been used for external oxygen supply. Furthermore, new COVID-19 delta and omicron variants with rapid spread rates discovered in mid-November 2021 have raised the danger of the third wave globally. In addition, major producers in the mechanical ventilators market as well as the government have made steps to increase production to meet the increased demand for ventilators during the pandemic.

Thus, the existence of several producers and efforts made by the government to boost market supply has fueled the industry's progress. Nevertheless, over the projected period, market development is constrained by the high price of mechanical ventilators and the risk of ventilator-associated infections such as nosocomial pneumonia.

Based on the product, the intensive care ventilator segment is expected to have significant market growth during the forecast period. The segment is expected to see growth due to various factors like the clinical benefits provided by the ventilator in acute respiratory failure, compromised lung functions, or any complications related to breathing. To maintain correct ventilation and provide support in health care facilities, these mechanical ventilators are widely used. Various functions like advanced monitoring and visual decision support are the driving factors of these mechanical ventilators and they will positively affect the mechanical ventilator’s market share during the forecast period.

Based on the ventilation mode, the segment is divided into Invasive Ventilation and Non-Invasive Ventilation. The non-invasive ventilation segment is expected to grow well during the forecast. The benefits provided by these noninvasive mechanical ventilators are a higher concentration of oxygen and precision, these factors are driving the market.

The noninvasive ventilation method provides better oxygen and decreases diaphragmatic work. Owing to all of these factors the mechanical ventilator segment with the noninvasive interface is expected to grow during the forecast period.

Based on the type, the adult ventilators segment shall have a larger market share during the forecast period owing to the increasing geriatric population and growing pollution across the globe. Moreover, the growth in this segment is also driving due to the people suffering from chronic obstructive pulmonary disease, asthma, and other breathing issues. Chronic obstructive pulmonary disease is extremely common among the adult population across the globe. Due to all of these reasons, the market for the adult ventilator shall grow during the forecast period.

Based on the component, the market is categorized into devices and services. The device segment was the major contributor in 2022 and is expected to maintain its lead during the forecast period, owing to an increase in demand for the mechanical ventilators market. However, the services segment is expected to witness considerable growth during the forecast period, due to an increase in sales in the market.

Based on the end-user segment, the hospital segment dominated the market till the year 2023. Increased availability of trained health care providers for operating and functioning these ventilators, there is enhanced productivity of hospitals in stimulating the revenue of this business and there is a growing emphasis on providing quality care services to the customers. These are the factors that help in the growth of the market and they shall drive the market during the forecast period.

Major players are expanding their hospital chains to offer better diagnoses and good treatment, these hospitals are developing their infrastructure services to provide a range of services that help in combating respiratory diseases. Owing to these reasons the market shall grow. There is a growing preference amongst customers to visit the hospital for the treatment of chronic respiratory diseases. As the hospitals can provide a range of novel technologies for treating these disorders and as they are easily accessible the health care facilities segment shall see growth.

Mechanical ventilation is a quite competitive market. The market is growing because some of the leading companies are producing and introducing new goods, while others are distributing ventilators. Manufacturers are preparing to increase production capacity to fulfill increased worldwide demand and combat the COVID-19 outbreak. The British government placed an order for 10,000 ventilators with the German firm Drägerwerk AG & Co., which is equal to its yearly production capacity. Hamilton Medical has increased its yearly output of 15,000 mechanical ventilators by 30.0% to 40.0%, and now produces roughly 80 ventilators per day. In March 2020, this company sent approximately 400 ventilators to Italy.

The market is close to saturation, as several manufacturers have increased their manufacturing facilities to suit the demand during the COVID-19 peak, and ventilators will be abundant following the Covid-19 situation. However, as the prevalence of chronic diseases is predicted to rise, critical care units such as ventilators will continue to be in high demand in the coming years. Furthermore, technological advances are expected to boost demand for low-cost and advanced feature ventilators over the forecast period.

By Product

By Ventilation Mode

By Type

By Component

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

July 2024

March 2024