January 2025

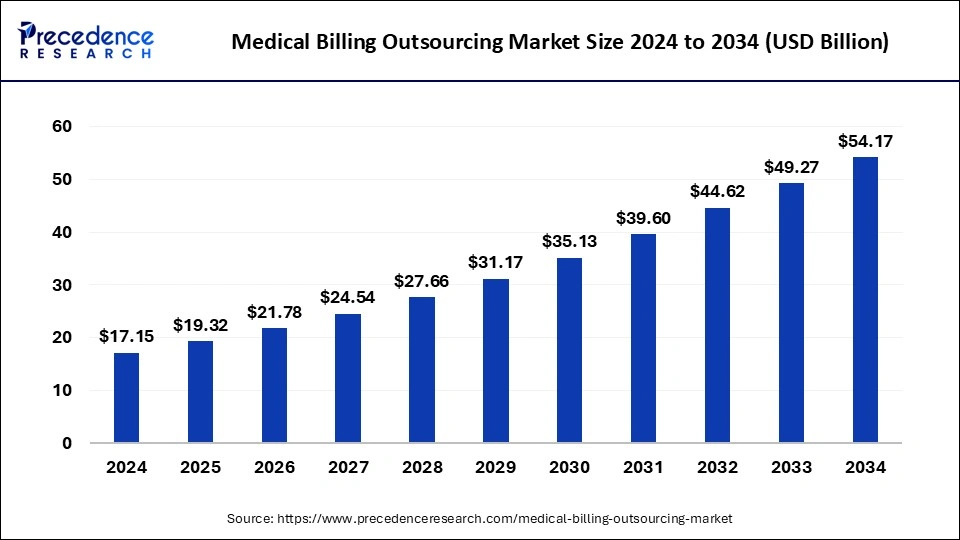

The global medical billing outsourcing market size calculated at USD 19.32 billion in 2025 and is forecasted to reach around USD 54.17 billion by 2034, accelerating at a CAGR of 12.00% from 2025 to 2034. The North America market size surpassed USD 8.23 billion in 2024 and is expanding at a CAGR of 12.19% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical billing outsourcing market accounted for USD 17.15 billion in 2024 and is predicted to reach around USD 54.17 billion by 2034, poised to grow at a CAGR of 12.00% from 2025 to 2034. The growth of the medical billing outsourcing market is driven by the increasing focus on care while ensuring that billing processes are handled efficiently.

Artificial intelligence (AI) technologies revolutionize the medical billing processes. AI can streamline and automate various tasks, such as data entry, reduce manual errors, and improve efficiency. It accelerates claims processing, accurate coding, and identifying potential issues. These capabilities can lead to quicker reimbursements for healthcare providers. Additionally, AI can analyze large volumes of data to identify trends and patterns, enabling better decision-making and resource allocation. This can make medical billing outsourcing more cost-effective.

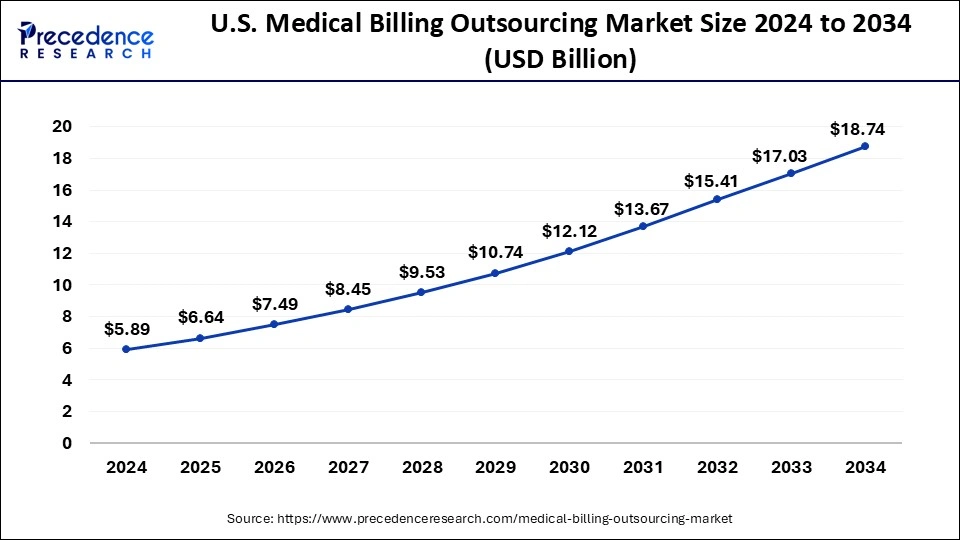

The U.S. medical billing outsourcing market size was exhibited at USD 5.89 billion in 2024 and is projected to be worth around USD 18.74 billion by 2034, growing at a CAGR of 12.27% from 2025 to 2034.

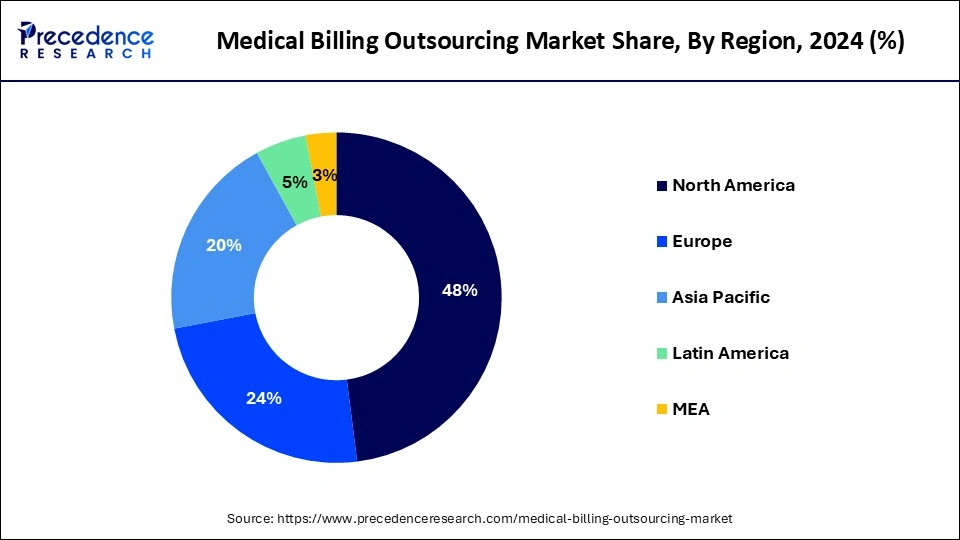

North America led the global market for medical billing outsourcing in the year 2024 and has garnered revenue 48%. Numerous healthcare service providers in the United States have shifted their focus towards end-to-end outsourcing firms for effectively managing their billing processes. In addition, increasing awareness related to the benefits provided by the outsourcing firms, healthcare service providers rely more on the third-party companies to manage high-volume transactions and enhance their operating margins.

The U.S. is leading the medical billing outsourcing market. The healthcare system in the U.S. has been undergoing rapid changes with new government policies and a shift toward electronic health record management systems. The lack of a skilled workforce to handle repetitive and tedious tasks like billing increases the risk of errors. This, in turn, provokes healthcare facilities to outsource billing processes to third parties.

On the other hand, Asia Pacific is projected to witness fastest growth in the market during the forecast year owing to standardization of outsourcing practices across the globe. In addition, improper medical facility has triggered the governments to prominently invest in the development of healthcare and hospital infrastructure that again propel the market growth in the regions.

Countries like China, Japan, and India are expected to play a major role in the growth of the Asia Pacific medical billing outsourcing market. With the growing patient pool in these countries, there is a significant increase in hospital admissions. This creates burden on healthcare facilities to handle billing processes while simultaneously managing other key tasks, encouraging them to outsource billing services. In addition, the growing focus on streamlining workflows to improve operational efficiency contributes to regional market expansion.

Medical billing outsourcing refers to a process where healthcare organizations assign their billing process to third parties. This third-party company manages the billing processes of different healthcare facilities like hospitals, radiology departments, specialty clinics, and private clinics. Outsourcing billing processes has become a necessity to accommodate the changing and complex nature of healthcare services. This has become a common trend around the world with the increasing regulatory compliance and the growing need to manage risks associated with data. Outsourcing billing processes helps reduce the burden on healthcare facilities and practitioners. There are plenty of positives to outsourcing billing services, as it helps professionals focus on patient care, improve cost-effectiveness and operational efficiency, and minimize errors in billings. The market is witnessing significant growth due to the advent of new technological solutions, bad debt & uncollectible accounts, and changing regulatory guidelines.

| Report Coverage | Details |

| Market Size in 2025 | USD 19.32 Billion |

| Market Size in 2034 | USD 54.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.00% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Service, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased demand for managing revenue cycles

Outsourcing medical billing tasks to specialized companies can lead to reduced operational costs along with improved efficiency for faster revenue cycles. By offloading billing responsibilities, healthcare providers can focus more on patient care and medical services, while the outsourcing companies handle billing, coding and reimbursement processes. This trend can lead to a growing demand for outsourcing services in the medical industry. While focusing on the public health concerns, multiple government administrations are also focusing on improving healthcare infrastructure. This element also brings multiple opportunities for medical billing outsourcing services in the upcoming years. Thus, the increased demand for managing revenue cycles is observed to be the driver for the medical billing outsourcing market.

Managing complex billing processes

Managing or handling complicated or complex billing processes for hospitals/clinics can be a major challenge for the service provider. This obstacle is created by multiple factors, such as fluctuating billing codes, handling large volumes of patient data, ensuring data security and the need for skilled professionals. In addition to this, lack of coordination between healthcare providers and billing service providers can create a major error or delay in service. All these factors contribute to the intricacies involved in medical billing outsourcing, making it a challenging task for service providers. Thus, managing complex billing processes is observed to be a major restraint for the market.

Emerging regions

The rapid development of healthcare facilities in emerging countries offers a lucrative opportunity for the medical billing outsourcing market. The rising population and growing disposable income have led to increased healthcare spending, significantly boosting the demand for healthcare services and hospital admissions. This, in turn, boosts the need for medical billing outsourcing. In addition, governments of various emerging countries are investing to expand and modernize healthcare facilities, contributing to market expansion. The need for improved efficiency in operations encourages healthcare facilities to opt for outsourcing services for medical billing processes.

Data privacy concerns

The medica billing outsourcing includes data sharing. The data shared with the third party of service provider may include personal or confidential data, such as patient’s information, billing related data, patient’s financial information or hospital’s financial data. Sharing such data or information with a service provider for billing outsourcing has a slightest risk of data leakages or breaching. Many service providers often use cloud-based services, which is prone to get attacked by cyberhackers. In such cases, healthcare providers can lose confidential data which limits them from adopting medical billing outsourcing services. Thus, the data privacy concerns are observed to pose a challenge for the market.

Medical billing outsourcing market is segregated primarily into in-house and outsourced segments. Among them, outsourced segment held the largest market value share 53% in the year 2024; in addition to this, the segment exhibits lucrative growth over the forecast period. Outsourcing of medical billing service prominently reduces costs in combination to this it proves as a good fit for medium and small healthcare institutes.

In the recent past, physician practices that includes clinics/ physician and acute care hospitals were facing numerous challenges as cost were increasing and reimbursements have declined; additionally, new regulations introduced by the government had transformed business more complex. The above mentioned factors expected to trigger the demand for medical billing outsourcing services prominently in the coming years.

Front end service comprises of the main function of medical billing outsourcing along with this accounted for the largest market value share 39% in the year 2024. On the contrary, the front end services are likely to face market devaluation owing to increased competition and saturation in the market. Front-end services include processes such as preregistration, insurance verification, scheduling, eligibility, registration, and pre-authorization.

On the other side, middle end services are likely project lucrative growth over the coming years because of new market entrants in the sector as well as rising awareness for the middle end service among practitioners.

Hospital segment dominated the global medical billing outsourcing market with revenue share 47% in 2024 and analyzed to maintain its dominance during the forecast period. This is mainly attributed to prime uses of such services in hospitals due to high claim of volume. Furthermore, the consolidation of hospitals increases complexity in reimbursement and billing procedures. Hence, the aforementioned factors trigger the demand for medical billing outsourcing services in the hospital sector.

Moreover, physician offices and private clinics are also adopting outsourcing services in various fields, thus experience the fastest growth in the global medical billing outsourcing market over the forecast period. Further, rise in the total services offered by the physician along with changes in the government regulations are contributing significantly for the increase in the adoption of Revenue Cycle Management (RCM) services by physicians at their medical facilities.

The global medical billing outsourcing market seeks high competition among the market players. Mergers & acquisitions, partnerships, and technological advancement are some of the prime business strategies adopted by these industry participants to expand their regional presence along with the services offered. For example, in July 2019, Cerner Corporation signed a partnership agreement with Amazon Web Services (AWS) to access its global infrastructure and cloud space for driving healthcare IT innovations. The partnership anticipated to enhance the lower operational budgets and clinical efficiency for healthcare organizations. Similarly, in February 2019, Veritas Capital announced to acquire athenahealth, Inc. in collaboration with the Evergreen Coast Capital, as a minority investor.

This research study comprises complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers classification of marketplace into impending and niche sectors. Further, this research study calculates market size and its development drift at global, regional, and country from 2025 to 2034. This report contains market breakdown and its revenue estimation by classifying it on the basis of component, service, end-use, and region:

By Component

By Service

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025