January 2025

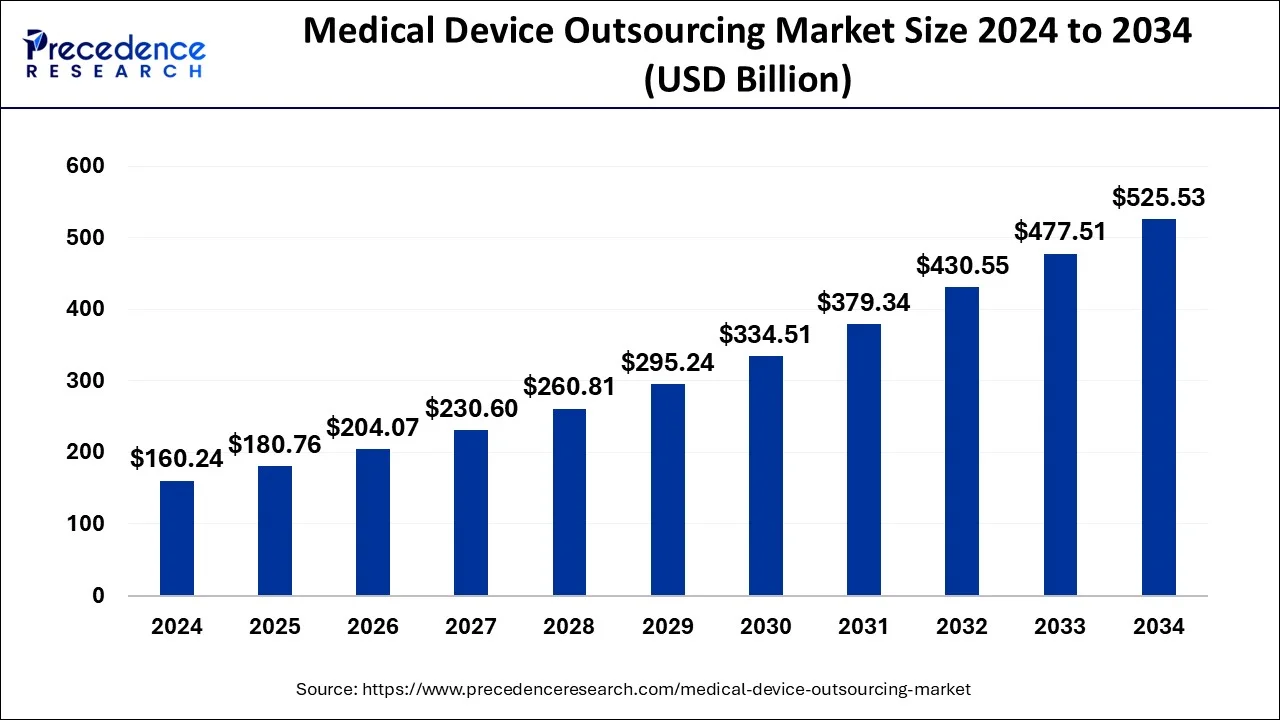

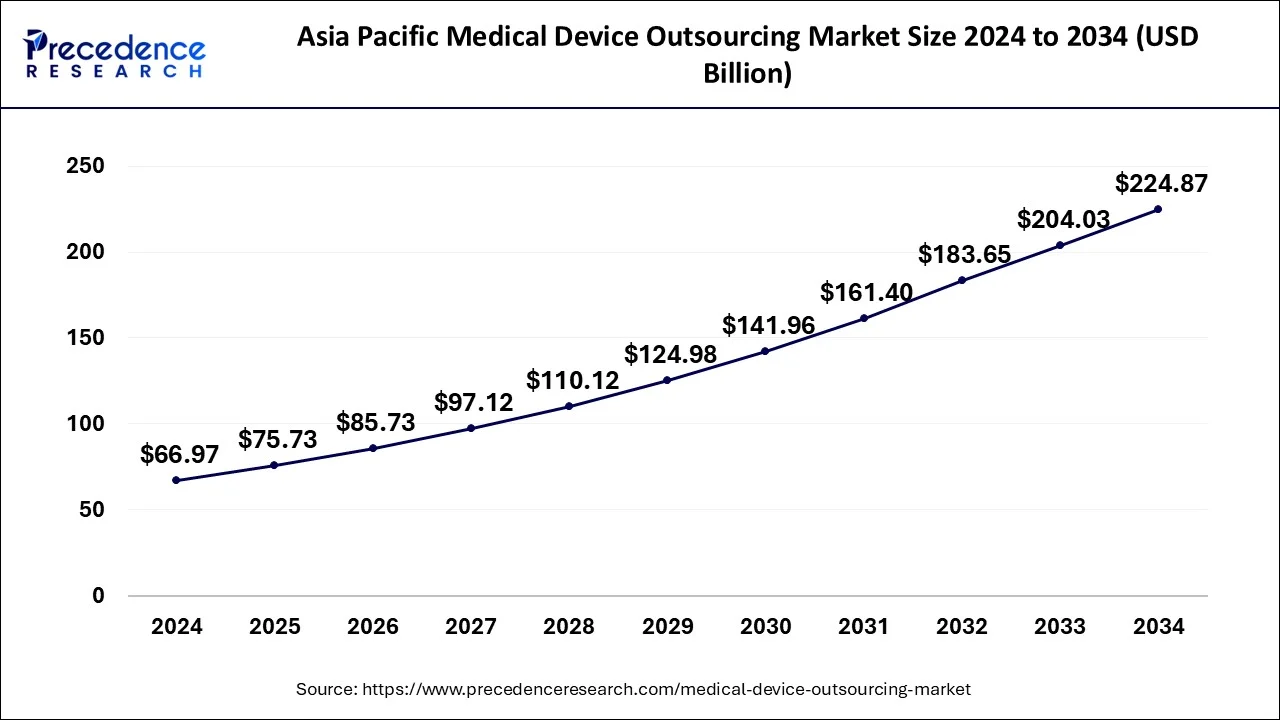

The global medical device outsourcing market size is calculated at USD 180.76 billion in 2025 and is forecasted to reach around USD 525.53 billion by 2034, accelerating at a CAGR of 12.61% from 2025 to 2034. The Asia Pacific medical device outsourcing market size surpassed USD 75.73 billion in 2025 and is expanding at a CAGR of 12.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical device outsourcing market size was estimated at USD 160.24 billion in 2024 and is anticipated to reach around USD 525.53 billion by 2034, expanding at a CAGR of 12.61% from 2025 to 2034. The increased demand for non-invasive medical devices is driving the growth of the global medical device outsourcing market. The growing need to reduce product costs and complexity enhances the adoption rate of outsourcing. Additionally, rising demand for affordable devices is fueling the market growth.

The increased production need for medical devices is the primary factor responsible for the iteration of AI in manufacturing. AI is able to improve manufacturing efficiency, capability, product development, and personalization. The rising demand for personalized medicines and customized medical devices is playing a favorable role in the adoption of automation in pharmaceutical manufacturing industries.

AI is not only beneficial for production sites but also helpful in improving cost savings and the quality of medical device productions. AI is being applied spectacularly in medical device outsourcing due to advancing healthcare and technology sectors. The expanding healthcare infrastructure and demand for advanced medical devices require cutting-edge technologies to comply with manufacturing, maintenance, and supply chain management services, for which AI integration is playing a game-changing role.

The Asia Pacific medical device outsourcing market size was evaluated at USD 66.97 billion in 2024 and is predicted to be worth around USD 224.87 billion by 2034, rising at a CAGR of 12.87% from 2025 to 2034.

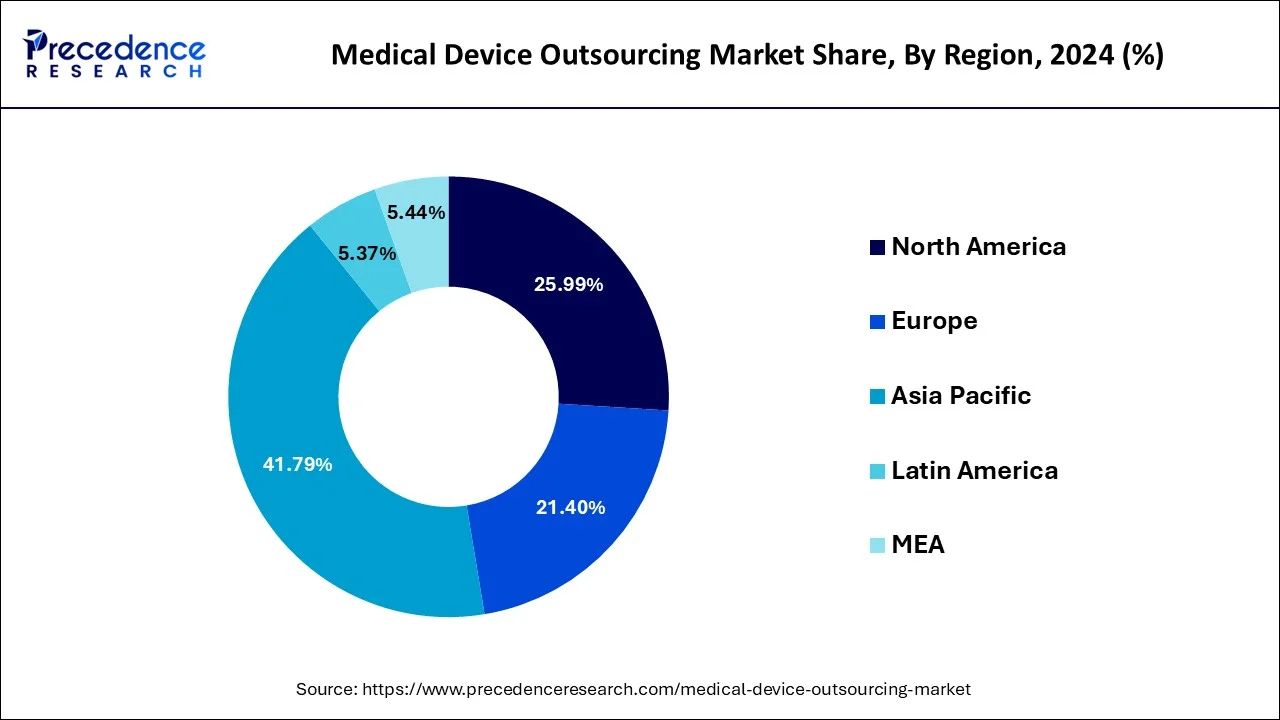

Asia Pacific dominated the medical device outsourcing market with the largest market share of 41.79% in 2024.

For instance, In November 2024, the Indian government invested in a Rs 500 crore scheme aimed at strengthening key areas such as manufacturing, skill development, clinical studies, infrastructure, and industry promotion. The investment is expected to boost India's medical device industry.

North America s expected to expand at the fastest CAGR of 12.5% during the forecast period.

North America is expected to witness significant growth in the medical device outsourcing market due to the availability of advanced healthcare infrastructure, which supports the innovations and developments of advanced outsourcing medical devices. The expanding healthcare infrastructure in North America is contributing to the market growth. Additionally, government and regulatory initiatives and investments in the research & development sector are shaping the market in North America.

Though the total medical device industry in the U.S. is estimated to continue growing at a robust rate, the outsourced manufacturing market is anticipated to perceive even faster growth. As medical device producers attempt to recover margins and time to market, outsourced manufacturing will continue to grow in approval.

The escalating trend toward outsourcing manufacturing operations has become essential as it helps to decrease direct expenses and modernize supply chains while balancing rising operating expenses. At present, a variety of influences are motivating growth in the contract manufacturing segment. Extreme competition has forced device producers to emphasize their core proficiencies of research and development, marketing, clinical education, and sales. Medical device outsourcing bids cost savings and better-quality service delivery. According to a present-day KPMG survey, out of 94 respondents in the medical service and device supplier industries, upgraded service delivery and cost drop are two of the primary influencers for outsourcing. IT outsourcing was recognized by 38% of respondents as the topmost way for cost reduction, whereas 26% of respondents observed it as a good technique to recover service delivery. In contrast, business process outsourcing (BPO) was regarded by 30% of respondents as an uppermost means for cost drop, whereas 19% of respondents thought it was a good method for developing service delivery.

The significance of regulatory compliance is anticipated to lift the growth of consulting services, including quality management systems, remediation, and compliance, thus backing the market growth. However, pricing pressure, budget scrutiny in established countries, and changes in repayment schemes are certain major features expected to upsurge the implementation of cost suppression procedures by the original equipment manufacturers (OEM). These factors are also anticipated to lift medical device outsourcing to emergent nations, including India and China.

| Report Highlights | Details |

| Market Size in 2024 | USD 142.19 Billion |

| Market Size in 2025 | USD 142.19 Billion |

| Market Size by 2034 | USD 430.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.10% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing complexity and cost

The rising complexity and cost of medical device development and production are the key drivers of the global medical device outsourcing market. The rising prevalence of chronic disease and the number of surgeries is driving demand for advanced, safe, and more effective medical devices; however, the complexity and expensive production of medical devices occurring due to regulatory compliance, clinical trials, quality control, and quality assurance are driving the need for outsourcing. The rising need for specialized expertise to develop and maintain medical devices is fueling the market growth. Additionally, the need for increasing scalability, flexibility, cost-effectiveness, quality, and reliability of medical devices is driving the need for outsourcing, leading to a positive influence on the market.

Data security

The medical devices outsourcing market significantly faces challenges in managing access to sensitive information such as patient data and product designs. The critical medical device development process is likely to be attacked by unauthorized aspects due to outsourcing. Additionally, the connection of medical device outsourcing can cause challenges such as cyber threats. The implementation of data security measures and risk assessment of outsourcing partners with data security practices can help to overcome such a restraint.

Rising demand for cost-effective medical device

The rising prevalence of chronic disease and the number of surgeries requiring cutting-edge medical devices. However, the high costs of medical devices are hampering the healthcare expenditure. The rising demand for affordable medical devices by healthcare professionals and patients is holding market potential. Outsourcing is beneficial for low-cost manufacturing as it helps to reduce cost-related regulatory compliance, clinical trials, waste management, and complexity. Large-scale outsourcing helps to reduce overall medical device production and maintenance costs. Additionally, access to specialized expertise further helps to reduce risk and complexity, making more cost-effective production and manufacturing. The ability of outsourcing to reduce product development downtime is increasing their adoption in medical device manufacturing practice.

By application, the cardiology segment accounted for the largest share of the market in 2024. The segment growth is attributed to the rising prevalence of cardiovascular disease worldwide, driving demand for cardiology devices. Cardiology devices are complex in nature and require specialized manufacturing and testing expertise. Additionally, the rising demand for non- and minimally invasive cardiology devices is driving the need for outsourcing.

General and plastic surgery device segments are expected to generate spectacular growth in the forecast period. The rising number of cosmetic surgeries is the key factor driving the growth of the segment. The increased number of surgeries, minimally invasive and non-invasive, are driving the need for specialized devices. Furthermore, the need to comply with regulatory-compliant outsourcing services is contributing to the segment expansion.

In 2024, The quality assurance segment generated the biggest market share of 9.56% in 2024. and is anticipated to lead the market for medical device outsourcing throughout the forecast duration. While cumulative focus on plummeting the cost of medical devices is also improving segment growth. On the other hand, the regulatory affairs services is projected to grow at a double digit of CAGR of 13.5% during the forecast period.

Outsourcing gives OEMs the prospect to take benefit of resources such as labor, machinery or materials. It proves cost-efficient to outsource production particularly if maneuvers and expertise of machinery can be handled from outside than to fetch an expert in the headquarters and then train individuals. Due to outsourcing despite of escalating operating expenses, the medical device manufacturing has exhibited significant growth during the last few years. For example, Medtech company have accomplished to sustain industry productivity by supporting an extremely high level of assurance to product innovation and by implementing a variety of creative cutbacks measures such as progressively popular approach of outsourced manufacturing.

By Service

By Application

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025